The 2 Main Reasons Why We're Skeptical About Block

Summary

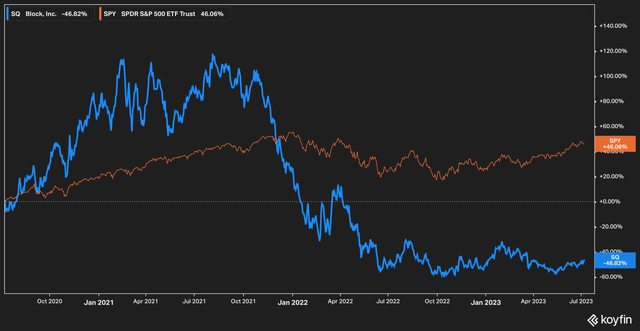

- Block, formerly Square, has seen its shares plunge 46% in the past three years due to inflation and interest rate hikes by the Fed.

- Casual investors in Block may not be aware of the extent of the company's involvement with Bitcoin.

- Block's relatively generous stock-based compensation poses a concern for us.

Thinkhubstudio

Price Appreciation: Blocked

The tech-wreck of 2022, brought on by ripping inflation and a corresponding hiking of interest rates by the Fed, spared very few companies which only months before were market darlings. Block (NYSE:SQ), formerly known as Square, was no exception.

In the past three years shares of the company have plunged 46% after surging over 100% from mid-2020 to 2021. While it is true that during this time total revenues remained relatively stable, overall profitability has proved elusive for the company. While we think that the market will likely view Block unfavorably until it consistently turns a profit, there are two things under the company's financial hood that give us pause on whether the company can easily make such a turn.

Let's dive in.

1. Bitcoin

Those new to Block or those with only a passing knowledge of the company's financial statements might be surprised to learn just how much Bitcoin revenue adds to the company's top line revenue.

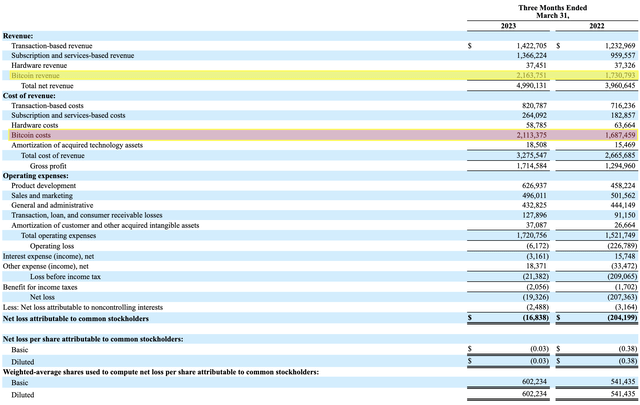

Company Filings, Author Highlights

For the quarter ended March 31, 2023, Block recorded just over $4.9 billion in revenue. Of this, $2.16 billion (43% of total revenue, highlighted above in yellow) was attributable to Bitcoin related revenue. Most of Block's Bitcoin revenue appears to come from providing customers with Bitcoin--buying Bitcoin on the market for customers who want to hold it and providing it to them at a markup.

This would explain why the total costs associated with Bitcoin for Block were so high. In the same quarter Bitcoin costs (highlighted in red above) came in at $2.11 billion--a whopping 65% of the company's total cost of revenue.

At first glance, this all may seem innocent enough. Sure, the volatility of Bitcoin could make revenue difficult to model over time, and if the company is simply marking up the Bitcoin it buys for customers, then there seems to be little risk of the company losing money on the activity.

We do not think the reality is so cut and dry, however. Management has in the not-so-distant past discussed the build out of a large scale Bitcoin mining operation for the company. At Block's investor day presentation on May 18, 2022 (company-presented transcripts can be found here), Block's Bitcoin Hardware Lead Jesse Dorogusker stated that "[w]e anticipate billions of dollars of mining-related capital expenditure as Bitcoin network demand increases. We are confident that Block can apply its hardware product expertise and design ethos to have substantial impact in this space."

Since the investor day, the company has provided little detail on its plans to expand into the Bitcoin mining space, but we believe that this venture adds a heightened degree of risk for investors who may otherwise believe that they are investing primarily in a payment-processing company.

Further, the subsequent risk to the company's overall revenue and gross margin posed by the volatility of Bitcoin gives us pause. Providing Bitcoin at a markup to clients is also no guarantee of profit--general market risk and the ability of clients to pay up could pose a risk as well. This risk, we think, is a bit different than the risks inherent in Block's legacy business of payment processing.

2. Stock-Based Compensation

Tech companies are known to be generous with stock-based compensation. The argument in favor of this practice is that compensating employees in stock reduces the cash outlay needed for higher salaries and helps to retain talent. Also, the argument goes, it's a non-cash expense, so it doesn't really impact the bottom line.

We take the opposite view. While we believe stock based compensation has a rightful place in the markets, we also think that it can run counter to the interest of shareholders if it goes too far.

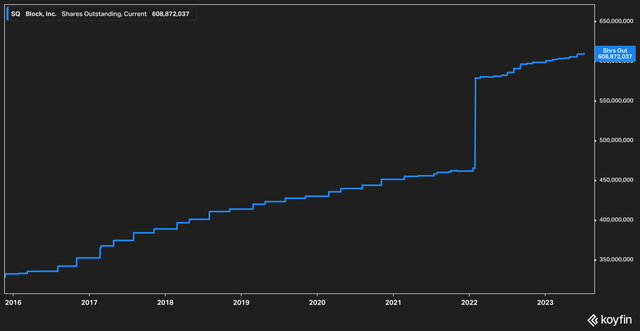

Consider the current outstanding shares for Block. Today there are more than 600 million shares outstanding, up from 327 million in November 2015--an 85% increase.

For some additional context, according to Block's 10Q for the quarter ending March 31, 2023, share-based compensation expenses totaled $279 million--slightly more than 5% of overall revenue. Consider now that the company posted a $16.8 million quarterly loss. Even a small pullback on share-based compensation could have a significant impact on the company.

Of course, these are non-cash charges, but we caution investors about the peril of not taking non-cash charges seriously. As more shares are introduced into the market, the dilutive effect combined with the ever-increasing amount of revenue needed to generate a per-share profit can pose a problem in a long run if not carefully monitored.

The Bottom Line

While there is no denying that Block is an innovative company with a suite of useful and user-friendly products, we think that problems under the hood may pose headwinds for growth and profitability for shareholders. The unpredictability of the Bitcoin market, in our view, injects a new style of risk that is relatively non-existent in the company's legacy payment processing business. The amount of share-based compensation at the company is also concerning in our view. While some may believe that a new rally is around the corner, we remain skeptical at this time.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)