BJ's Wholesale Club: Business Seems To Be Turning Positive, But Stock Is Fair Valued

Summary

- I reiterate a holding rating for BJ's as the stock is currently fair valued, despite being positive about the business.

- BJ's has shown positive performance, gaining market share in the grocery and apparel sectors, and has a growing membership base with a stable renewal rate.

- Despite optimism about BJ's future prospects, I believe future growth may be limited to mid-single digits due to the end of COVID-19 tailwinds.

Portra

Overview

I recommend a holding rating for BJ's Wholesale Club (NYSE:BJ) as my DCF model suggest a share price that makes the stock fair valued at this point, although I am feeling positive about the business.

This is a reiteration of my hold rating for BJ stock previously which I believed consensus was likely to re-extrapolate their estimates from a lower base if BJ reports weaker-than expected growth, due to the headwind from the end of covid tailwinds.

What does the company do?

BJ operates retail warehouse clubs and gas stations. The company sells a wide range of consumer goods, including media devices, home furnishings, computers and tablets, kitchen appliances, and even food. According to FY23 numbers, sales of groceries account for 67%, sales of gasoline and other products account for 21%, and sales of other goods and services account for 12%. All of BJ's earnings come from the United States.

Industry overview and growth

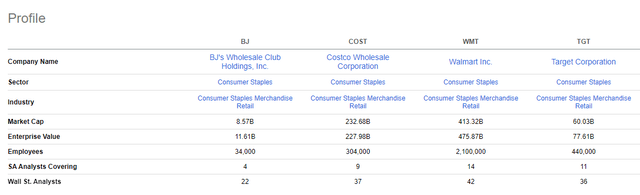

As of FY22, the market size that BJ operates in has a TAM of $645 billion, which grew 0.4% from FY21. On average, the industry has grown about 2.2% per year since 2017 to 2022. Key competitors in the industry include Costco Wholesale Corp (COST), Walmart (WMT) (Sam's Club), Target (TGT). My expectation for the industry is it will continue to stay relevant as the value proposition differs from a typical supermarket due to its vast number of SKUs. Furthermore, technological innovation and advancement will further optimize industry players ability to understand consumer preference so they can adjust SKU to fit demand. I believe the industry should grow in-line with GDP as it should mirror consumer spending growth.

My thoughts on the business

Despite the inflationary climate, BJ reported a first quarter SSS of 5.7%, excluding gasoline. This was evenly split between traffic and ticket sales, which I found to be satisfactory. In particular, BJ's grocery and perishables section grew by +8%, allowing the company to gain market share. Consumers' decision to cut back on spending was reflected in an 8% drop in BJ's general merchandise, which was affected in part by the slower and wetter start to spring. Despite consumers cutting back on discretionary spending, I believe BJ has done well and gained market share, especially in the apparel sector. Gains in the apparel category, spurred by better assortment and presentation thanks to recent changes in its merchandising team, are a clear indication of management's foresight and ability to put plans into action. BJ's new toy partnerships with Simbe (which should help optimize SKU) bode well for strong sequential growth in the coming quarters. Furthermore, I anticipate an uptick in 2H23 connected to the credit card transition due to the enhancement of associated rewards, which may stimulate wallet share gains.

Also, I was heartened to see that BJ's membership base grew by 5% to 6.8 million people, and that its renewal rate remained stable at 90%. The quality of BJ's members is high, with a 38% higher tier penetration being particularly noteworthy. This percentage of the market has grown by 200 basis points since last year. Overall, I've become much more optimistic about BJ's future prospects after witnessing its recent performance and learning about the company's plans to retain and grow members despite potential disruption from the credit card transition.

My thoughts on the financials

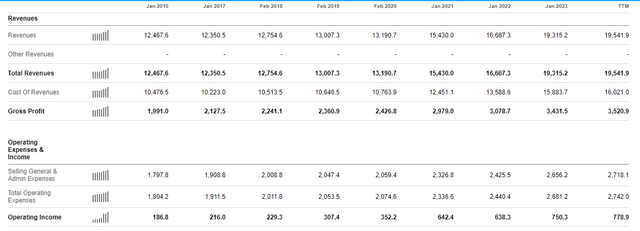

Inherently, given the nature of BJ business model, it is not a fast grower especially given the size of the business at ~$20 billion revenue. Historically, the business has grown at low single digits until covid where the surge in consumer spending and pantry-loading have driven growth to 10+% levels. This growth is unlikely to repeat again as the covid tailwinds are now over. I expect growth to stay at mid-single digits for the near-term, following inflation rates, and eventually normalize back to low single digits.

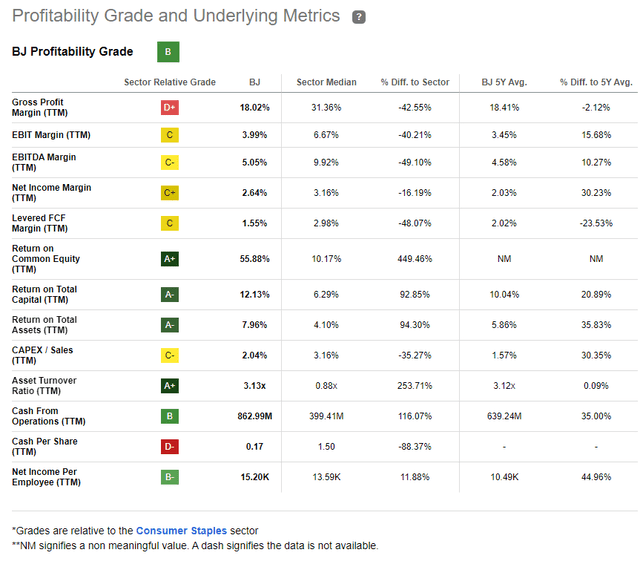

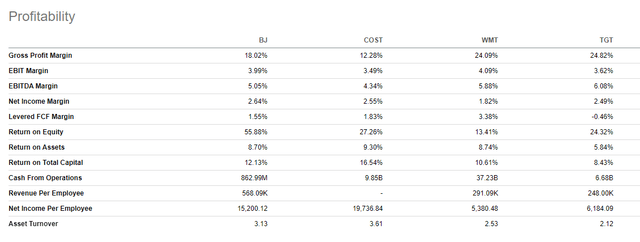

Similar to many other retail supermarkets player, BJ EBIT margin is low at low-single digits as the business thrives on volume (i.e. absolute profits, rather than discount). When compared to the industry, BJ profitability margins are lower than average, which I believe provides flexibility for BJ to adjust its cost structure and pricing to improve margins in the future.

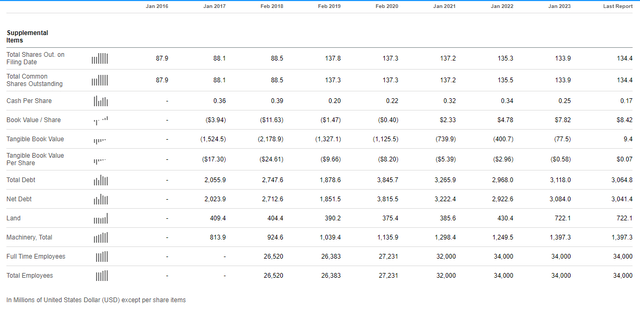

BJ ended the recent quarter with $23 million in cash and $3 billion in debt, of which $2.2 billion is operating lease. As such, actual net debt is only ~$780 million, which is less than 1x EBITDA. Based on this, BJ balance sheet has no issues or any red flags.

On working capital management, cash conversion cycle has come down by half since FY18 levels, which demonstrates management ability to management inventory and account payable days.

Valuation

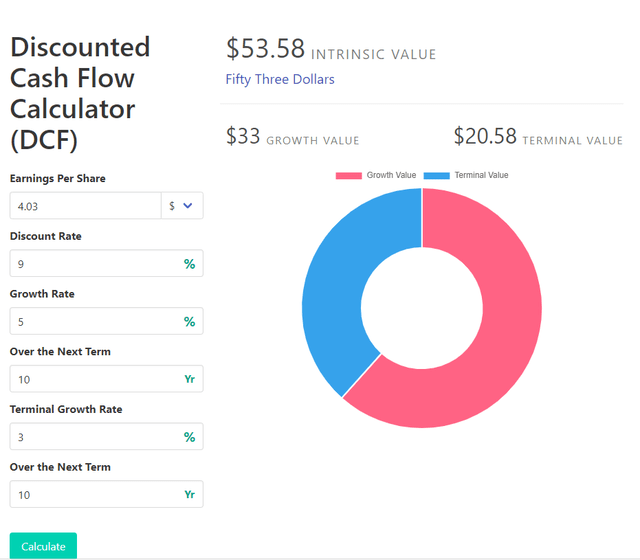

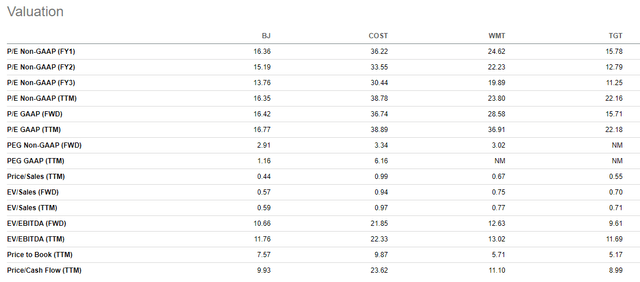

BJ valuation remains unattractive to me based on my DCF model which I have given a rather aggressive assumption, based on top-line growth and margin expansion I expect BJ to grow earnings at 8% a year for the next 10 years, accounting for its ability to close margin gap vs the industry and revenue to continue growing as it optimizes SKU offerings. At terminal year, BJ should grow at 3%, which is in line with GDP/inflation levels. Lastly, I assumed at 9% discount rate as the business is equity stable. My target price is $65.60 which makes the stock fair valued.

Looking at peers' valuation, BJ deserve to trade at a discount given it is much smaller in size and lower gross profit margin.

Seeking Alpha Seeking Alpha Seeking Alpha

Risk

Customer spending slows, and members become less loyal as a result of pressure from online retailers and other club models.

Conclusion

In conclusion, I recommend a holding rating for BJ. While the business seems to be turning positive, my valuation suggests that the stock is currently fair valued. BJ operates in a competitive industry, but its unique value proposition and technological advancements should help it stay relevant and grow in line with consumer spending. The company has shown positive performance, gaining market share in the grocery and apparel sectors. Additionally, the growth in BJ's membership base and stable renewal rate indicate strong customer loyalty. However, future growth may be limited to mid-single digits due to the end of COVID-19 tailwinds. BJ's financials appear stable, with manageable debt and effective working capital management. Overall, while optimistic about BJ's future prospects, I believe the stock is currently priced appropriately.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.