Note To Landstar Investors: There Is An Alternative

Summary

- Landstar System, Inc. shares have advanced 20% in the past eight months, outperforming the S&P 500's gain of 11.8%. The company's financial performance has been strong and the balance sheet is robust.

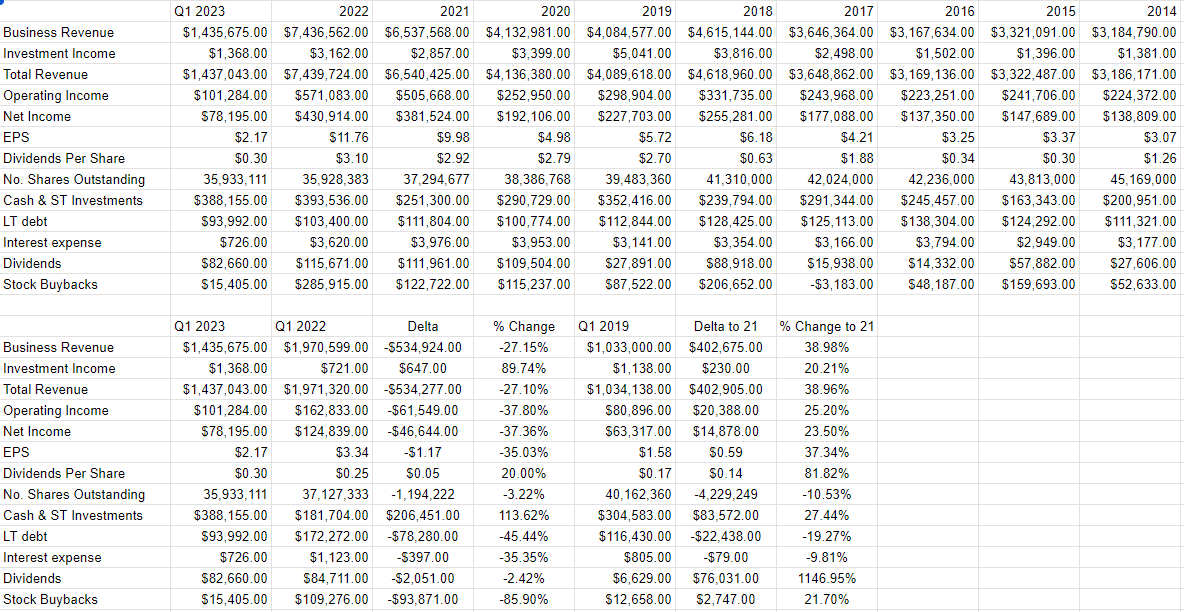

- Despite a 27% drop in total revenue compared to the same period last year, revenue and net income have increased by 39% and 23.5% respectively compared to pre-pandemic levels. The company's capital structure has also improved significantly.

- I don't think the stock is offering adequate risk-adjusted returns, and as a result, I prefer to avoid it for now.

ablokhin

It's been just shy of eight months since I sold my Landstar System, Inc. (NASDAQ:LSTR) shares, and in that time, they have advanced another 20% against a gain of about 11.8% for the S&P 500. I don't feel too bad about this, because I did earn a nice 18% return on my investment, but I'll admit that I would have preferred to be sitting on the 38% I could have enjoyed had I not abandoned the name prematurely. It's time to review the name yet again to see if it makes sense to buy back in or not. I'll make that determination by looking at the most recent financial performance and by looking at the valuation.

I write a "thesis statement" at the beginning of each of my articles because I understand that not everyone has the time to read an article, and even fewer people have the time to read one of my bad joke infested articles. For that reason, I put up a "thesis statement" paragraph near the beginning of each of my pieces to give readers the opportunity to get in, get the "gist" of my thinking, and then get out before too much psychic damage is done. You're welcome. I'm of the view that the financial performance has been quite decent recently, and I'm particularly impressed by the strength of the balance sheet. In the current environment, that's a rare positive. Additionally, the shares are, by some measures, quite cheap. The problem, from my perspective, is that I'm not seeking "returns"; I'm seeking "risk adjusted returns." In a world where I can earn over 340 basis points more on a risk free 10-year government note, why would I take on the risk of owning a stock like this? Stocks come with risk that should be compensated, and the investor isn't being adequately compensated in my view. Put another way, TINA is very much over, and there very much is an alternative to stocks. Since I can earn a superior risk adjusted return in bonds, I'm sticking with bonds. I may miss out on future upside and capital gains, but I may also earn a nice capital gain on the bonds if rates fall as I suspect they will. Whatever the outcome, I'll be able to sleep better with bonds, and I really, really like my sleep.

Financial Snapshot

I think the most recent financial performance has been, on balance, quite good with only a few blemishes. Let's start with the blemishes. Relative to the same period last year, total revenue is down about 27%, in spite of an uptick of 90% from investment income. Operating income, too, was down about 61.5% from the same time last year.

At the same time, revenue and net income were up by 39% and 23.5% respectively compared to the pre-pandemic era. Investors have been rewarded for this great performance with a 20% uptick in dividends per share over the same time last year. Additionally, the capital structure has been cleaned up massively over the past year, and long term debt is now the lowest it's been since at least 2014. At the same time, the cash level has jumped by $206 million, or 114% over the past year. I'd write that this is one of the most rock solid capital structures I've seen, especially when compared to the companies I've looked at over the past few years. Although the payout ratio is currently over 100%, I think the large cash hoard guarantees that the dividend won't be cut anytime soon. Given the above, I'd be very comfortable buying the stock at the right price.

Landstar Financials (Landstar investor relations)

The Stock

Unless you have the means to take a public company private with resources that you can personally scrape together, you access the future cash flows of a given business via the stock, and the stock is sometimes a very poor proxy for what's going on in the underlying business. The business sells transportation management solutions, and the stock is a piece of virtual paper that represents a fractional share ownership in this business. It gets traded around based on the crowd's ever changing views about the future. The stock price movements are affected by the crowd's changing views about Landstar's future, interest rate policy, the appetite for "stocks" as an asset class etc. This is why I like to consider the stock as a thing distinct from the underlying business. If you still disbelieve me, consider the recent price action at Landstar itself. If an investor bought these future cash flows in the public market on June 21, they're up about 7.3% since then. If that investor's twin brother bought virtually identical shares six days later, their return is only 2.4%. Nothing happened over those six days to warrant a 5% variance in price. The message is plain enough in my view: if you don't pay attention to stock price, you'll have a hard go of it, even if you buy wonderful businesses like this.

In my experience, the only way to generate profits in stock trading involves spotting discrepancies between expectations about the future and reality. If the market is currently too optimistic or pessimistic, and you place a trade accordingly, sooner or later you'll be rewarded. Additionally, I like to buy shares that are cheap because they offer the greatest potential upside. This is because all of the bad news is already "priced in", so any positive news can send shares skyward. They're also less risky, because they generally have less far to fall.

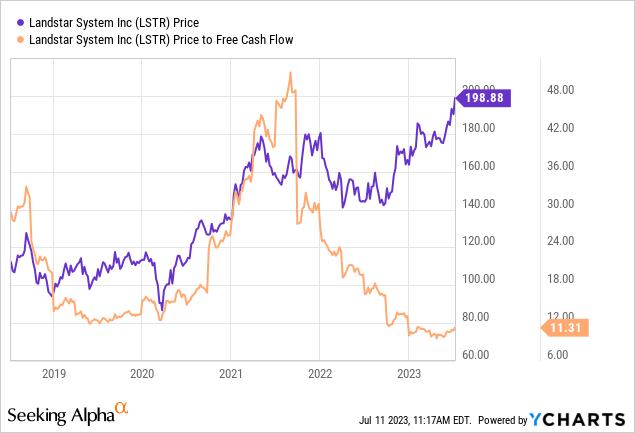

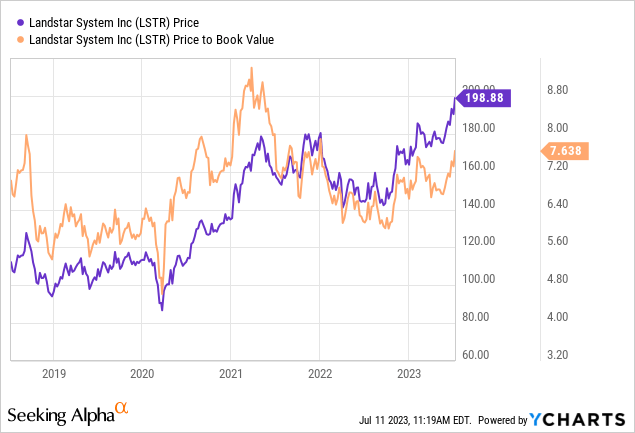

I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at ratios of price to some measure of economic value like sales, earnings, book value, and the like. When I last reviewed Landstar, the valuation was somewhat unclear to me. On the one hand, their price to free cash flow was about 19% cheaper than they were when I had previously piled into the stock. The problem for me was the fact that the shares were trading at a price to book of about 6.8, very near a decade high. I thought it's better to be prudent, and took my winnings off the table. I've earned my nickname "granny Doyle." Anyway, fast forward to the present, and here's how things look. The shares are even cheaper on a price to free cash flow basis, in spite of the run-up in the stock price. Price to book is even more expensive, though.

Source: YCharts

Source: YCharts

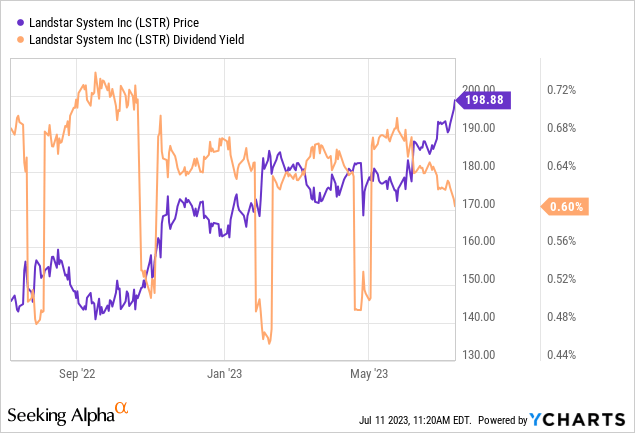

Source: YCharts

The most difficult thing for me here is the dividend. Although I think it's very well covered in spite of the very high payout ratio, the stock is only yielding about 0.6% at the moment. This is fully 340 basis points lower than what an investor can receive on a 10-year risk free investment at the moment. Since we're always seeking risk adjusted returns and not simply "returns" this is a problem for me. I don't like the notion of receiving less for taking on more risk.

Additionally, as my regulars know, I don't just look at ratios. I also want to try to quantify the market's current "thinking" about a given stock. In order to do this, I turn to books like "Accounting for Value" by Penman, and "Expectations Investing" by Mauboussin and Rappaport. Both of these books introduce the idea that stock price itself is a great source of information that can tell you about the crowd's current view of the future. The more rosy those assumptions, the more risky the stock. Applying this approach to Landstar at the moment suggests the market is assuming that this company will grow earnings at about 6.5% in perpetuity. I consider that to be a very rosy forecast because I'm of the view that over the long term, a company like this can only grow at the rate of the overall economy.

Given the above, I'm going to remain on the sidelines here. I may miss out on some further gains, but I'd rather that than lose capital. I'm happy to collect my yield, and may enjoy a capital gain on my bonds if rates come back down over the next decade.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)