Boyd Gaming: Undervalued And Ready To Take Off

Summary

- Boyd Gaming has shown mixed financial performance, with a 22.83% growth in revenue over the past decade and a 450.04% growth in free cash flow. However, its balance sheet raises concerns due to a high debt-to-equity ratio and a low current ratio.

- BYD is set to benefit from strong tourism trends in Las Vegas and significant growth in its online segment. The company expects its online operations to generate approximately $50 million in EBITDAR for the year 2023.

- BYD is undervalued, potentially offering investors a gain of 62.17% compared to the company's current market price based on a DCF analysis.

SolStock

Intro

Boyd Gaming Corporation (NYSE:BYD), along with its subsidiary companies, functions as a gaming company operating across multiple jurisdictions. The company operates through three distinct segments: Las Vegas Locals, Downtown Las Vegas, and Midwest & South.

Boyd Gaming Corporation managed a portfolio of 28 gaming entertainment properties situated in 10 states. In addition to its gaming operations, the company is also involved in the ownership and operation of a travel agency.

The goal of this article is to provide a thorough assessment of BYD's financial performance and growth potential. We will conduct an in-depth analysis of BYD's revenue and profitability patterns, its ability to generate free cash flow, and evaluate the overall financial stability depicted in its balance sheet. Additionally, we will utilize a discounted cash flow analysis to estimate the intrinsic value of BYD, offering valuable insights to investors considering BYD as a potential investment opportunity in the current market context.

Track Record

BYD is a prominent player in the gaming industry, offering a wide range of entertainment experiences. In this section, we will delve into Boyd Gaming's financial performance, focusing on revenue growth, free cash flow, balance sheet strength, and profitability. Additionally, we will compare the company's return on equity (ROE) to the sector median and analyze its total return relative to the S&P 500. Through this analysis, investors can gain valuable insights into Boyd Gaming's potential as an investment opportunity.

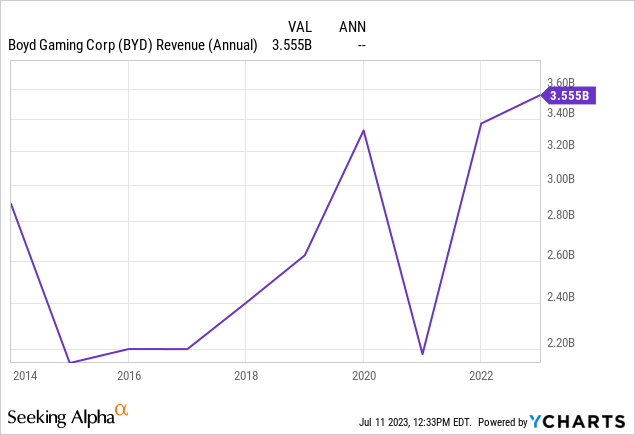

BYD has experienced mixed growth in revenue over the past ten years. While the company demonstrated fluctuations in revenue during this period, the overall growth stands at 22.83% while the compounded annual growth rate (CAGR) for the period is 2.08%. A high growth rate is important as it indicates the company's capacity to expand its market share, invest in strategic initiatives, and generate sustainable long-term returns.

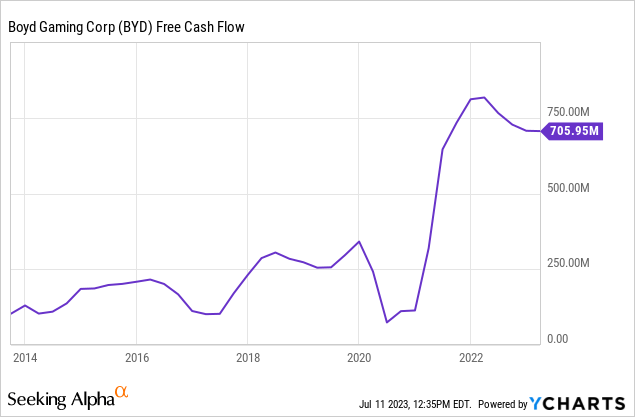

The company's free cash flow is a different story. BYD has displayed both positive and negative growth over the years. The total growth during the period amounts to 450.04%, highlighting significant improvement. The CAGR for free cash flow stands at 18.59%. Positive free cash flow growth reflects the company's ability to generate surplus cash after meeting operational expenses and capital investments. This provides flexibility for strategic initiatives, such as acquisitions and returning value to shareholders.

It's worth highlighting the significant improvement in BYD's free cash flow from 2020 to 2021. This notable increase can be attributed to several factors. Firstly, the negative impact of casino closures during the pandemic heavily affected 2020's top and bottom line. As the industry rebounded in 2021, BYD experienced a $721 million surge in operating cash flow, reflecting the recovery in casino operations.

Furthermore, BYD implemented a strategic shift in its operating model during 2021. This new approach prioritizes the cultivation of loyalty among core customers while adopting a more efficient business strategy. By focusing on maximizing gaming revenues, optimizing cost structures, targeted marketing investments, and reducing lower-margin offerings, BYD has successfully streamlined its operations. As a result, the company is now able to allocate a higher percentage of its revenues to the bottom line, enhancing its overall profitability.

Boyd Gaming's balance sheet raises concerns, particularly in terms of the debt-to-equity (D/E) ratio and current ratio. The D/E ratio of 2.24 indicates a relatively higher level of debt compared to equity, potentially increasing financial risk. Additionally the company's current ratio of 0.77 raises red flags as it shows that the company may not have enough capital to meet its short-term obligations. A strong balance sheet is essential as it enhances a company's ability to weather economic downturns, access capital at favorable rates, and invest in growth initiatives.

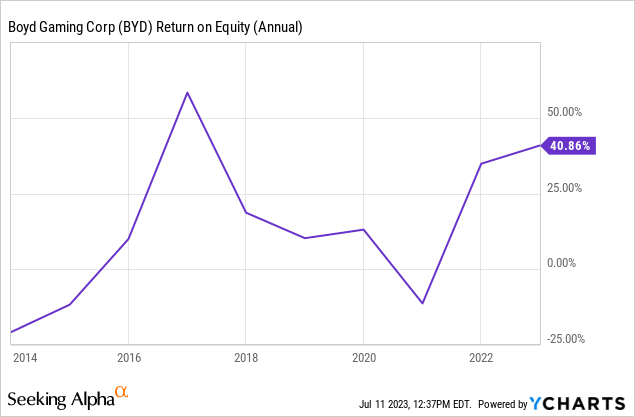

The company's profitability, measured through return on equity (ROE), has shown mixed performance. While the company achieved impressive ROE figures in certain years, such as 2016 with 56.50%, it also experienced negative ROE in others. The average 10-year ROE stands at 13.74%, indicating a decent return on shareholder investments. Comparing BYD's average ROE to the sector median of 9.90% demonstrates the company's superior performance within its industry. A high ROE is desirable as it signifies efficient utilization of capital and the ability to generate profits for shareholders.

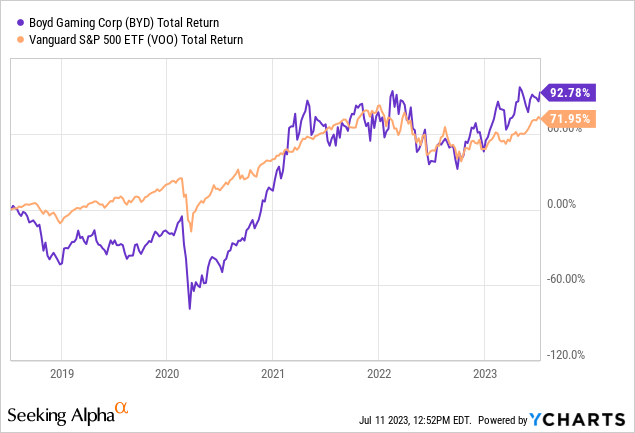

BYD's 5-year total return of 92% surpasses the S&P 500's 5-year total return of 72%. This strong performance highlights BYD's ability to deliver long-term value to its investors. The company's ability to outperform the broader market demonstrates the strength of its business model, effective execution of strategies, and investor confidence in its growth potential.

Outlook

Despite a mixed financial track record in the past, BYD has made a strong start to 2023. The company's first-quarter earnings report exceeded analyst expectations, showcasing robust performance in both the top and bottom lines. BYD reported earnings per share (EPS) of $1.71, surpassing estimates by $0.17. Moreover, the company generated revenue of $963.97 million, representing a significant year-over-year growth of 11.99%, surpassing estimates by $74.38 million.

This impressive performance can be attributed to several factors, including the favorable tourism trends in the Las Vegas Valley, the continued growth of BYD's Online segment, and strategic investments in expansion projects. These positive developments bode well for BYD's future prospects and reflect the company's ability to capitalize on market opportunities.

Looking ahead, BYD is poised to capitalize on the strong tourism trends in the Las Vegas Valley, which have been consistently on the rise. Over the trailing 12 months, visitor numbers to Las Vegas increased by 16%, reaching over 40 million people. This growth, coupled with an all-time high annual visitor spend of approximately $45 billion, creates a favorable market environment for BYD's operations in the area. Furthermore, Las Vegas visitors are spending more during their trips, with average spend per visit showing a significant increase of nearly 35% compared to 2019 levels. These positive trends set the stage for continued success in BYD's Las Vegas ventures.

Las Vegas is a key market for BYD, and the company is well-positioned to capitalize on the growth opportunities in the area. The company's Vegas Locals properties are well-positioned to attract local customers, and three of its properties are located in the growing downtown Las Vegas market. Additionally, BYD markets to Hawaiian customers, a unique niche market.

In addition to the robust tourism trends, BYD's Online segment has demonstrated remarkable growth. The first quarter witnessed a nearly doubling of EBITDAR compared to the previous year. This growth can be attributed to the successful launch of online gaming in Ohio and Kansas, expansion in existing markets, and the addition of Boyd Interactive.

Building on this momentum, BYD expects their online operations to generate approximately $50 million in EBITDAR for the year 2023. As part of their online gaming strategy, BYD plans to transition their online casinos in Pennsylvania and New Jersey to the Boyd Interactive platform, pending final regulatory approvals in May. This strategic move positions BYD for further success in the online gaming market.

However, there are some risks associated with investing in the company. BYD is subject to stringent government regulations, and any changes in the laws can potentially have a negative impact on its operations. BYD engages in various activities such as live and historical wagering, online wagering, casino gaming, online gaming, and sports betting, all of which are heavily regulated by state and local authorities.

These regulatory bodies possess the authority to impose restrictions, suspend or revoke licenses, or prohibit ownership stakes based on the prevailing laws and regulations. The decisions made by these regulatory bodies hold significant influence over BYD's ability to conduct its business effectively.

Despite these risks, the company is focused on growth. BYD's $100 million expansion of Treasure Chest Casino is set to open next spring. This expansion project aims to significantly enhance the product offering with a new land-based single-level casino facility, expanded non-gaming amenities, and improved parking. By investing in these improvements, BYD seeks to improve the overall customer experience, attract new customers, and enhance operational efficiency at Treasure Chest Casino. This expansion project represents BYD's commitment to continuously enhancing their properties and staying ahead in a competitive market.

Maintaining a strong balance between investments and capital return programs, BYD remains committed to maximizing shareholder value. They plan to continue their $100 million per quarter share repurchase program, supplemented by dividend distributions. This approach demonstrates BYD's dedication to rewarding shareholders while efficiently allocating capital.

With the positive market conditions, continued growth in their Online segment, strategic investments in expansion projects, our view is that BYD is well-positioned for a promising Q2 earnings report which is expected July 26th. It's worth noting that BYD has beat on the top and bottom line of each earnings report since the June 2020 quarter and experienced 11 upward EPS revisions in the last 90 days. Upward earnings revisions often reflect increased confidence in the company's financial performance and future prospects.

Additionally their ability to capitalize on the strong tourism trends in Las Vegas, combined with their focus on innovation, positions them for sustained success in the gaming and hospitality industry far beyond 2023. Investors can look forward to the potential benefits of BYD's growth initiatives and ongoing commitment to delivering long-term value.

Valuation

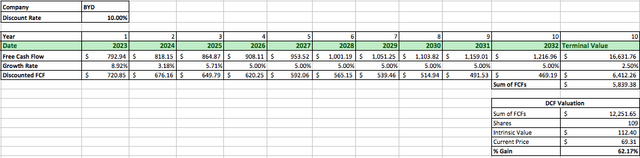

We will utilize the discounted cash flow (DCF) analysis, our preferred method for assessing a company's value, to evaluate BYD's true worth. This approach involves determining the present value of BYD's projected future cash flows in order to derive its intrinsic value.

To initiate the analysis, we will start with BYD's starting free cash flow of $728 million. Based on average analyst estimates, we will apply an initial growth rate of 8.92% for 2023, followed by 3.18% for 2024 and 5.71% for 2025. It is important to note that predicting future free cash flows for BYD beyond the next few years can present challenges due to uncertainty and limited visibility. However, we will use a second growth rate of 5.00% for subsequent seven years based on the company's mixed track record of revenue and free cash flow growth over the past decade.

Using a discount rate of 10%, which accounts for the long-term return rate of the S&P 500 with dividends reinvested, and a conservative terminal growth rate of 2.5%, we calculate BYD's intrinsic value to be $112.40. This suggests that BYD may currently be undervalued, potentially offering investors a potential gain of 62.17% compared to the company's current market price.

Author's Work

Takeaway

Despite its mixed track record, BYD shows promising growth potential and favorable market conditions. The company is well-positioned to benefit from the strong tourism trends in the Las Vegas Valley and annual visitor spend reaching an all-time high. BYD's operations in Las Vegas Locals and Downtown Las Vegas have delivered record performances, showcasing revenue growth and improved margins.

The Online segment of BYD has experienced significant growth, driven by successful launches, expansion into new markets, and the addition of Boyd Interactive. With a robust start to the year, the segment is expected to generate approximately $50 million in EBITDAR in 2023. Moreover, BYD's strategic investment in the $100 million expansion of Treasure Chest Casino demonstrates its commitment to enhancing customer experiences and operational efficiency.

Although there are risks associated with government regulations and changes in laws, BYD remains focused on capitalizing on growth opportunities. The company also maintains a balance between investments and capital return programs.

Considering BYD's potential for sustained success, attractive growth prospects, and current share price, the stock presents an appealing opportunity for investors. Despite its mixed track record, the positive market conditions, strong performance in key segments, and commitment to shareholder value warrant a buy rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.