RSF: Share Repurchases Trying To Dent The Discount

Summary

- RiverNorth Capital and Income Fund is a small fixed income closed-end fund with $60 million in assets, a high leverage ratio of 40%, and a diverse portfolio.

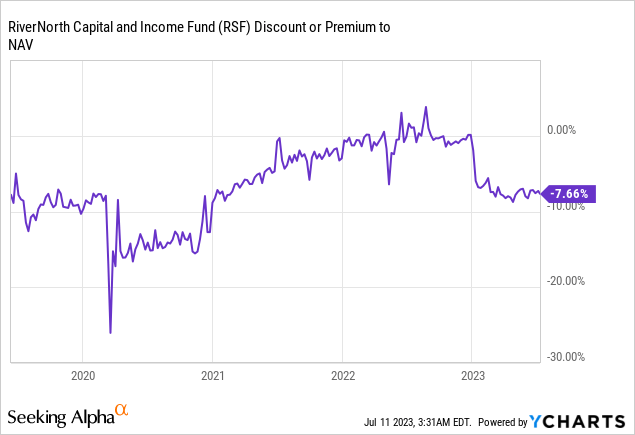

- The fund is pro-cyclical and has been trading at a wide discount to NAV due to increasing odds of a recession and bankruptcy rates.

- Despite efforts to address the discount through share repurchases, the fund's leverage and pro-cyclical nature could lead to further widenings.

Phiromya Intawongpan

Thesis

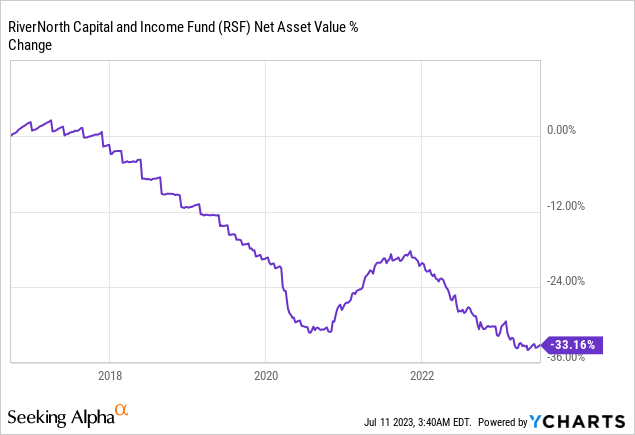

RiverNorth Capital and Income Fund (RSF) is a small fixed income closed end fund with only $60 million in assets. The fund has an eclectic portfolio mix composed of other CEFs, whole loans, BDC notes and SPACs. On top of these securities the fund layers in a high leverage ratio of 40% in order to extract yield. Some of its underlying securities are more illiquid (whole loans), and the portfolio as a whole is very pro-cyclical. With the odds of a recession increasing, it is not surprising the CEF is now trading at a wide discount to NAV:

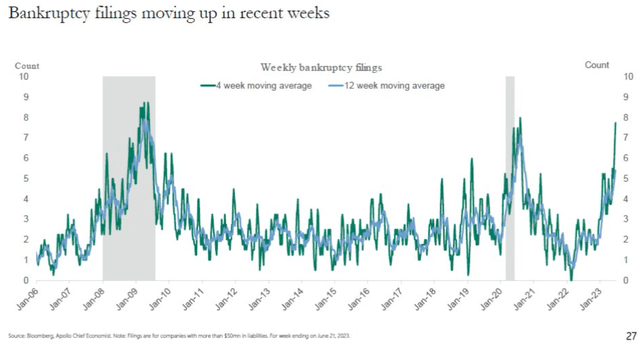

Consumer and business credit will suffer during a recession, with bankruptcy rates already creeping up:

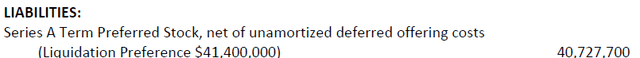

That translates into weaker credits and impairments in certain cases. As we saw during Covid, pro-cyclical portfolios like this one can experience deep distress, which translates into very large discounts to NAV. The leverage ratio here is very high, and unfortunately it was done via preferred securities, which leaves the fund with less flexibility than repo facilities:

Liabilities (Semi-Annual Report)

Given the current set-up, it is not surprising to see the fund continue to engage in share repurchases, because that is the only tool available to proactively address the discount:

Thursday, July 06, 2023 05:00 PM | Business Wire

RiverNorth Capital and Income Fund, Inc.* Announces Final Results of Repurchase Offer

RiverNorth Capital and Income Fund, Inc. (the “Fund”) (NYSE: RSF), a closed-end fund, announced the final results of its repurchase offer for up to 5% of its outstanding common shares. The repurchase offer expired at 5:00 P.M. Eastern Time on July 5, 2023.

Based on information provided by DST Systems, Inc., the depositary for the repurchase offer, a total of 1,886,944 shares were submitted for redemption and 203,976 shares were repurchased. In accordance with the terms and conditions of the repurchase offer, because the number of shares submitted for redemption exceeds the number of shares offered to purchase, the Fund will purchase shares from tendering shareholders on a pro-rata basis (disregarding fractional shares). The purchase price of repurchased shares is equal to the Fund's net asset value per share calculated as of the close of regular trading on the New York Stock Exchange (NYSE) on July 5, 2023, which is equal to $16.68 per share.

These actions are commendable, but we see a further widening of the discount here. The CEF is very leveraged and we are entering rough waters in terms of fundamental fixed income performance. Furthermore, we are surprised the fund did not try to call back some of its preferred shares or somehow adjust the leverage lower.

Also to note the fund's very small size in term of net assets (managed assets minus liabilities) which currently tallies out at roughly $60 million. The NAV has been decreasing throughout time here due to overdistribution and underperformance:

We would think that once the fund hits something like $40 million the manager will be looking to merge it into another larger fund. Very small CEFs do not usually survive long term due to scale issues.

Holdings

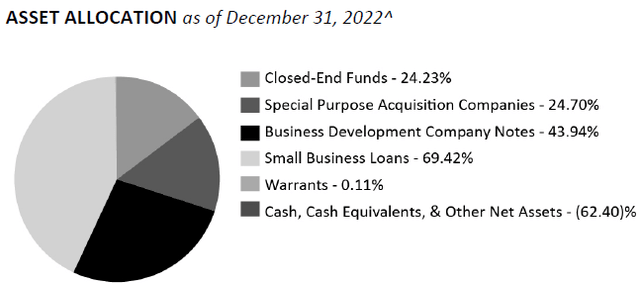

Let us have a look at the fund holdings via its latest Semi-Annual Report:

Asset Allocation (Semi-Annual Report)

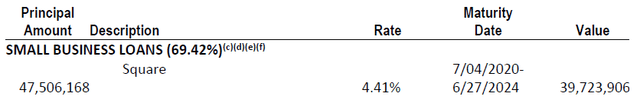

Other CEFs were the main holding here, followed by SPACs, BDC notes and Small Business Loans. The Small Business Loans category is actually a package of small loans from Square:

Square is a direct to consumer finance company that accelerates the lending process:

What is a Square loan? Square loans are business loans with no hidden fees or lengthy applications to fill out. Upon approval, funds are deposited as soon as the next business day — so you can invest in your business immediately to increase inventory, purchase equipment, hire employees, and more.

You get access here via this segment to classic commercial banking channels / risk exposure. But again, this is a very pro-cyclical asset class that can see severe impairments during a recession.

Conclusion

RiverNorth Capital and Income Fund is a small fixed income CEF. The fund has roughly $60 million in net assets, a high leverage ratio of 40%, and an eclectic portfolio mix of other CEFs, BDC notes and direct small business loans. The portfolio here is very pro-cyclical and a bit on the illiquid side in certain corners. During the Covid crisis the fund saw very wide discounts to NAV, correlated with a poor asset performance. We are seeing the story repeating itself here with the market gearing up for higher bankruptcies and impairments. The fund manager is doing the right thing, trying to dent the discount to NAV via share repurchases, however in the short term we see further widenings. We would not want to be long credit in this format via a 40% leverage ratio here, and would look for 15% type of discount to NAV in order to consider this CEF attractive.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.