General Motors Is Not Attractive Compared To Its Peers At $40

Summary

- GM stock price increased by 25% in the past two months as its results in 1Q 2023 were better than expected, and its U.S. 2Q 2023 vehicle sales were strong.

- However, General Motors' global market share decreased in the past few quarters and I expect it to decrease further in 2023.

- Despite recent developments and partnerships, GM's EVs have a low market share in Europe and China and face strong competition in the US.

- Compared to Toyota, Ford, and Stellantis, General Motors' vehicle sales results and its EV outlook are representing an interesting investment opportunity at its current price.

- Using the CCA method and some adjustments, I evaluate GM's stock at $40-$42.

Mario Tama

Investment Thesis

During the past two months, General Motors (NYSE:GM) stock price increased by about 25%. The company’s 1Q 2023 results were better than expectation, and GM updated its full-year 2023 earnings guidance. GM is expected to announce it 2Q 2023 results in 25 July 2023. The company has already reported its U.S. second quarter sales, which was 19% higher than the same period last year, as all four GM’s brands delivered double-digit YoY increases. However, be careful and don’t get too excited about GM’s increased U.S. sales. GM’s U.S. vehicle sales accounts about 45% of its total sales, and its international sales growth in 2Q 2023 might not be as high as the U.S. sales growth is.

Many people love GM’s cars and to be honest, I love them too. GMC Hummer EV SUV is my favorite one in the company’s portfolio. However, at prices around $40, GM stock is not attractive for me and its news about increased U.S. second quarter sales, and increased earnings 2023 guidance, are not convincing enough to make me put a buy rating on the stock.

GM is investing more and more on its EVs, and tries to get more competitive in the market. The company’s recent announcement can support this statement: On 30 June 2023, GM acquired the battery software startup ALGOLiOn, that can help GM deliver better performing EVs. On 26 June 2023, General Motors announced an agreement for Element 25 to supply up to 32500 metric tons of manganese sulfate annually to support the annual production of more than 1 million GM EVs in north America. On 8 June 2023, GM announced its customers will be able to access 12000 Tesla (TSLA) Superchargers in early 2024. However, the company’s electric vehicles sales may not be able enough to increase the company’s earnings in a significant way.

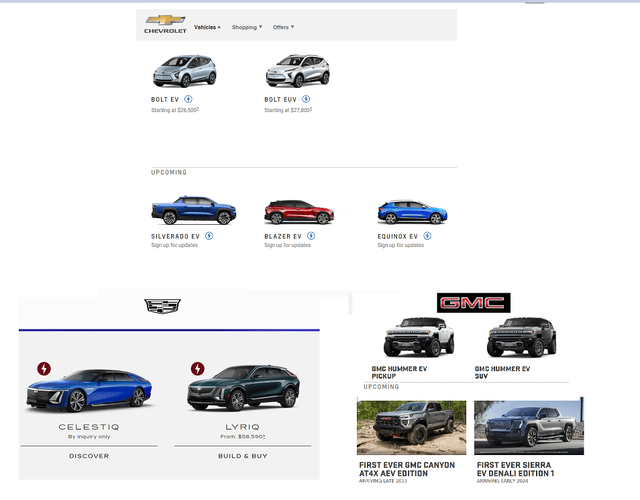

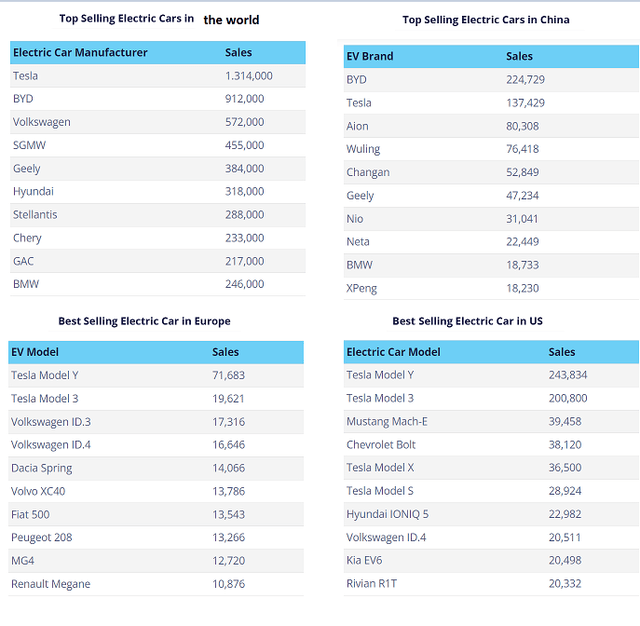

According to Figure 1, Chevrolet has two EVs: Bolt EV and Bolt EUV, and three more are expected. GMC has two EVs: GMC Hummer EV Pickup and GMC Hummer EV SUV, and two more are expected. Cadillac has two EVs: Celestiq and Lyriq. In 2022, electric vehicles accounted for 14.2% of total vehicle sales. In 2022, in the United States, Chevrolet Bolt EV was the fourth best-selling EV, after Ford Mach-E, Tesla Model 3, and Tesla Model Y (see Figure 2). However, in Europe and China, GM’s electric vehicles were not among the top 10 best-selling EV’s in 2022. It is worth noting that SGMW’s is the fourth top selling EV in China (SGMW, or SAIC-GM-Wuling, is a China joint venture, and GM has a 44% direct ownership interest in it). In 1Q 2023, SGMW sales accounts for about 20% of GM’s total vehicle sales (SGMW EV sales accounted for 36% of its total vehicle sales in 2022).

Based on GM’s current EV models, and the various growing competitors, it seems that in Europe and China, GM’ electric cars do not have significant place. Electric cars are expected to account for 60% of total car sales China, the EU, and the US by 2030. However, I don’t expect GM’s EVs low market share in Europe and China to increase, or even remain flat. Thus, I expect U.S. to remain the only significant market for GM’s EVs in the following years. In the United States, GM’s electric vehicles have to compete with electric cars of Tesla, Ford, Volkswagen, Kia, Hyundai, Rivian, and etc. GM’s 2Q 2023 U.S. EV deliveries of 15652 units (representing 2.26% of total U.S. sales) were lower than 1Q 2023 U.S. EV deliveries of about 20000 units (representing more than 3% of GM’s total U.S. sales).

In 2Q 2023, Chevy Bolt EV and EVU accounted for 90% of GM’s U.S sales. On average, based on the charging times and using different chargers, Tesla Model S and 3 are the fastest EVs to fill up. Also, with a Tesla Model S that is fully charged, you can drive up to 333 miles, and with a fast charger, you can recharge (to 80%) it in about 30 minutes. With a fully charged Chevy Bolt you can ride about 259 miles and you can recharge (to 80%) it with a fast charger in about 1 hour. Overall, Chevy Bolt battery is not as good the battery of Tesla cars. However, it is important to know that Chevy Bolt is cheaper than Tesla S (the cheapest Tesla car). In fact, Chevy Bolt’s cheaper price is its only advantage against Tesla S. Thus, I am not saying that GM’s EV sales are not going to increase in the United States. The EV market is growing, and GM can benefit from it. However, the company’s EV sales may not be able to boost its earnings in a significant way to make GM stock a buy at its current prices.

Figure 1 – GM’s EVs

GM

Figure 2 – Top selling EVs in 2022

tridenstechnology.com

Comparison with the peers

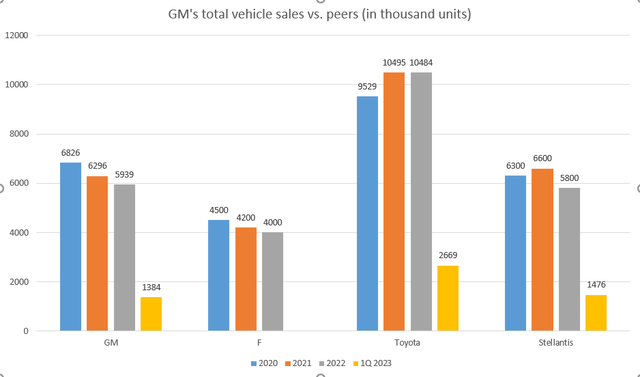

According to the company’s full-year 2023 guidance, GM expects its 2023 net income attributable to stockholders to be between $8.4 billion to $9.9 billion, which its mid-point is 8% lower than 2022 net income of $9.9 billion. In 2022, GM’s total vehicle sales were lower than in the previous years (see Figure 3). In the first quarter of 2023, the company reported total vehicle sales of 1384 thousand units, 7% lower than the quarterly average in 2022, and 13% lower than the quarterly average of the previous 12 quarters.

One might argue that GM’s lower sales can be attributed to the lower economic growth, higher interest rates, the severe financial tightness, and overall, the economic headwinds that the world experienced in the past few quarters. Yes, it is true that the unfavorable economic conditions in the past few quarters hurt the demand for cars. Thus, the financial results of car manufacturers got hurt. However, compared with Ford (F) and Toyota (TM), GM’s total vehicle sales decreased more significantly in 2022. While GM’s 2022 total vehicle sales decreased by 5.7%, F, and TM’s total vehicle sales decreased by 4.8% and 0.1%, respectively. Stellantis (STLA) total vehicle sales decreased by 12% in 2022. But, the company’s total vehicle sales in 1Q 2023 was 1476 thousand units, which is higher than the quarterly average in 2022. Also, TM’s 1Q 2023 total vehicle sales of 2669 thousand units was higher than the quarterly average in 2022, 2021, and 2020. Thus, while I expect GM’s full year 2023 total vehicle sales to be lower than in 2022, I estimate TM and STLA’s total vehicle sales in 2023 to be higher than in 2022. Ford hasn’t reported its total vehicle sales in 1Q 2023. However, the company’s wholesale in the first quarter of 2023 was not lower than its 2022 wholesale quarterly average.

Figure 3 - GM's total vehicle sales vs. peers (in thousand units)

Author (based on the companies' results)

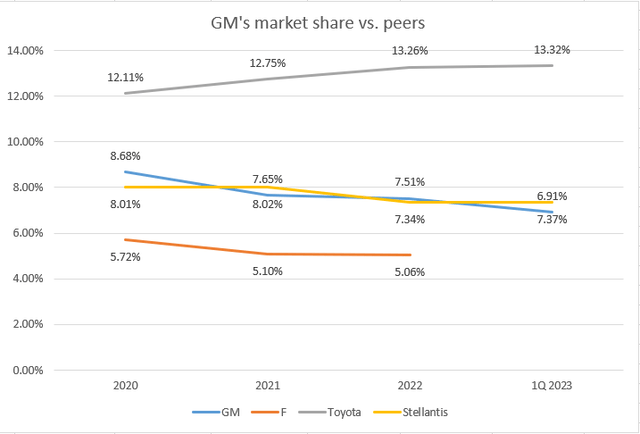

GM’s market share that decreased in the past three years, and might decrease further in the following quarters. According to Figure 4, GM’s market share decreased from 8.68% in 2020 to 7.65% in 2021 and 7.51% in 2022. The company’s market share in 1Q 2023 was 6.91% (the market shares are calculated by dividing the total vehicle sales of the company to the total vehicle sales of all car makers in a specific period). We can see that F and STLA’s market shares in 2022 were lower than in 2021. However, STLA’s market share in 1Q 2023 was higher than in 2022.

It is worth noting that STLA’s market share in 2022 was lower than GM’s market share in 2022; however, in the first quarter of 2023, STLA’s market share was higher than GM’s. When it comes to Toyota, we can see that the company’s market share increased continuously in the past years, implying that the company has been able to take over the market share of other companies as economic headwinds especially in the western countries caused GM, F, and STLA’s vehicle sales to decrease in 2022. I expect GM’s market share in 2023 to be lower than in 2022, while F, TM, and STLA’s market share in 2023 are likely to be higher than in 2022.

Figure 4 – GM's market share vs. peers

Author (based on the companies' results)

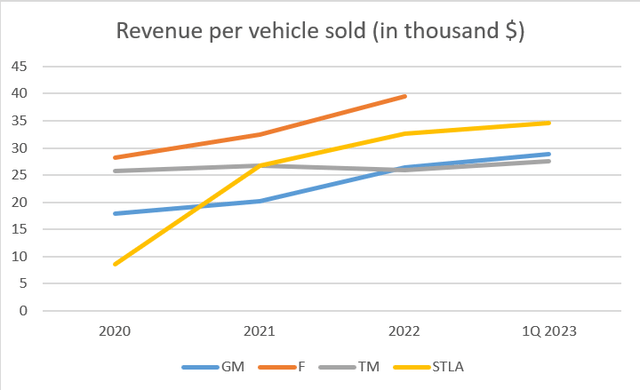

In 2020, GM’s revenue per vehicle sold was $17940 (see Figure 5). It increased to $20172 in 2021, $26390 in 2022, and 28890 in 1Q 2023. As automakers commonly receive a great part of the price for their cars in monthly installments, their revenue per vehicle sold is not representing the average price of GM’s cars. But it can be very useful in comparing automakers revenue generation potential with each other. Thus, I calculate revenue per vehicle to compare how GM is doing compared with its peers. In 2022, GM’s revenue per vehicle sold was $26390, higher than TM’s revenue per vehicle sold of $25903, and lower than F and STLA’s revenue per vehicle sold of $39525 and $32636, respectively. Assuming that 1Q 2023 revenue per vehicle sold can represent the whole year’s revenue per vehicle sold (which is not an irrational assumption), GM’s revenue per vehicle sold growth rate in 2023 can be higher than Toyota and Stellantis’. However, its revenue per vehicle sold is expected to remain significantly lower than F and STLA’s.

Figure 5 – Revenue per vehicle sold (in thousand $)

Author (based on the companies' results)

Valuation

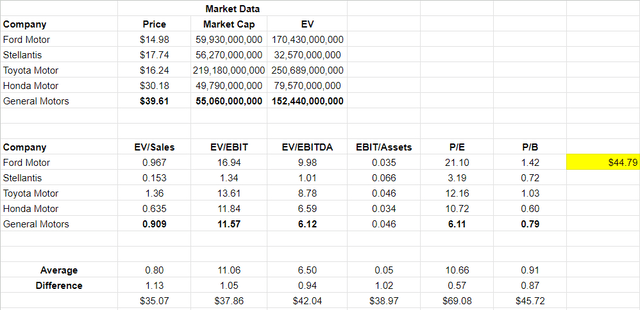

According to Comparable Company Analysis (CCA) method, and using the GM’s EV/sales, EV/EBIT, EV/EBITDA, EBIT/assets, P/E, and P/B, and its peers corresponding multiples, I evaluate that based on its past results, GM is worth $44.79 per share. However, some adjustments must be included. The calculations that you see in Figure 6 are based on TTM metrics, representing what has already happened for the included companies in the table. In another word, if the financial results of GM and its peers were supposed to remain flat in the following year, a price target of $45 per share would have been rational for GM. However, GM’s financial results in 2023 are not expected to be as strong as in 2022. According to GM’s guidance, its net income is expected to be between $8400 to $9900 million, which its midpoint is $9100 million, lower than in 2022. Also, the company expects its adjusted EBIT to be between $11000 million to $13000 million, which even its upper level is 10% lower than in 2022. On the other hand, its peers’ financial results may improve. For example, Toyota expects its FY 2024 (from April 2023 to March 2024) revenue, operating income, and net income to be higher than in FY 2023. Ford expects its adjusted EBIT in 2023 to be between $9000 million and $11000 million, compared to $10415 million in 2022. While Ford’s adjusted EBIT in 1Q 2023 was 34% of the mid-point of its full-year 2023 guidance, GM’s 1Q 2023 adjusted EBIT was 32% of its full-year 2023 guidance, implying that Ford’s results in 1Q 2023 was stronger than GM’s. As a result, considering GM’s future financial results, a price target of close to $40 to $42 is probably a more realistic one. Thus, as GM is currently trading at around $40 per share, I put a hold rating on the stock.

Figure 6 – GM stock valuation

Author (based on SA data and companies' results)

End note

General Motors’ market share in 2023 can be lower than in 2022, while its biggest competitors’ market shares can improve. Also, the company’s investments in electric vehicles may not be able to boost its earnings in a significant way at least for now. As I evaluate the stock to be worth between $40 and $42, which is close to its current price; GM is a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.