'They Never Lose': J.P. Morgan Is Victorious In The 2023 Bank Crisis

Summary

- Q2 earnings season begins this week with reports from large banks like Citi, Wells Fargo, and J.P. Morgan Chase.

- This is the first full quarter of results since a series of high-profile US bank failures in the spring.

- Q2 earnings are likely to show that J.P. Morgan benefitted by picking up low-cost deposits fleeing regional banks, and from acquiring the remnants of First Republic in May.

- A look into the preferred vs. common shares of J.P. Morgan.

winhorse

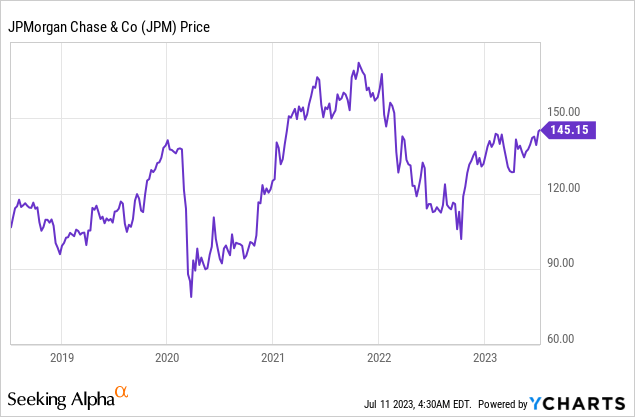

Q2 earnings season kicks off this week with reports from megabanks like Citi (C), Wells Fargo (WFC), and J.P. Morgan Chase (NYSE:JPM). After the high-profile failures of banks like Silicon Valley Bank (OTCPK:SIVBQ) and First Republic (OTCPK:FRCB), Q2 earnings will be closely watched by investors to assess the health of banks and the economy at large. Of these, J.P. Morgan is likely to emerge as a clear winner, having bought the carcass of First Republic from the FDIC in May and earning a solid grade on the Fed's stress tests in June. J.P. Morgan is up roughly 7.4% for the year as of my writing this, in contrast to many banks that are down. While it's not quite as exciting as Elon Musk and Mark Zuckerberg fighting in the Octagon, this week we get a battle of the banks. There are several good options among large banks, including some beat-up banks like Bank of America (BAC) and Truist (TFC). However, for this article, we'll focus on JPM.

J.P. Morgan Got A Great Deal On First Republic

Formerly among the most high-flying banks in America, First Republic grew massively by offering below-market-rate loans to wealthy customers in California, Florida, and the New York metro area. Their payroll was equally insane, with dozens of employees making $1,000,000 per month or more. However, they flew too close to the sun and made a series of wrong-way bets that culminated in 1930s-style bank runs that were widely circulated on the internet. First Republic was not immediately closed like Silicon Valley Bank or Signature Bank (OTCPK:SBNY), rather FRC was stabilized while the FDIC searched for a buyer. And as has happened many times in American history, J.P. Morgan was really the only bank large enough to take over First Republic.

Being the only credible buyer for FRC, J.P. Morgan was able to get a great deal. How great was the deal? Seeking Alpha author Growth At A Good Price, linked to an analysis showing J.P. Morgan earns a book profit of ~$7.4 billion and an IRR of 20% annually. Bloomberg's Matt Levine did a back-of-the-envelope analysis on the deal and highlighted how J.P Morgan gets excellent upside and regulatory treatment, while the FDIC shares much of the potential losses if the loans go sour. J.P. Morgan thinks they'll earn $500 million per year in net income for the deal, which isn't a ton compared to the $40 billion or so they earn already, but it shows that the crisis can be an opportunity for a bank like JPM.

Quirks In Fed Data Mean Traders May Be Underestimating Deposits And Income

However, the broader picture is that billions in deposits left regional banks in Q2, and much of these deposits were transferred to banks like Chase. This means that the bank crisis had a powerful indirect effect on J.P. Morgan's bottom line as well. Much has been made about falling bank deposits, but it's actually much better than it looks for banks like Chase because First Republic and Silicon Valley Bank were counted in the "large commercial bank category." In fact, J.P. Morgan gained roughly $50 billion in deposits in a matter of days after the March crisis. The implication here is that J.P. Morgan's deposits and net interest income are likely to be up and stay up as well. Rising interest rates are thought to be good for banks (as long as everyone doesn't yank their money), and for J.P. Morgan they likely will be. New deposits + risk-free returns in Treasuries and low-risk investments = higher net interest income.

Moreover, something traders need to watch more than deposit market share is the rate that banks are paying to attract and retain deposits. If a regional bank with deposit issues sees all its 0% checking accounts leave and replaces them with CDs paying 6%, then their problems haven't gone away. In fact, when some of these troubled regional banks report quarterly results, investors are likely to be surprised by how much money they're losing each quarter.

As for JPM, things look pretty good. JPM trades for 10x current year earnings and is in good shape to make more small or midsized acquisitions as necessary. While JPM is not a recession-proof stock, the low valuation means that you're getting an excellent price for the company's earning power over the full cycle. When a company is cheap but somewhat likely to get cheaper due to the business cycle, the play is often to start buying with an eye towards buying more if the price falls. There are cheaper banks than JPM, but no other bank quite has the same long-term potential to benefit from the chaos.

What About Commercial Real Estate Risks?

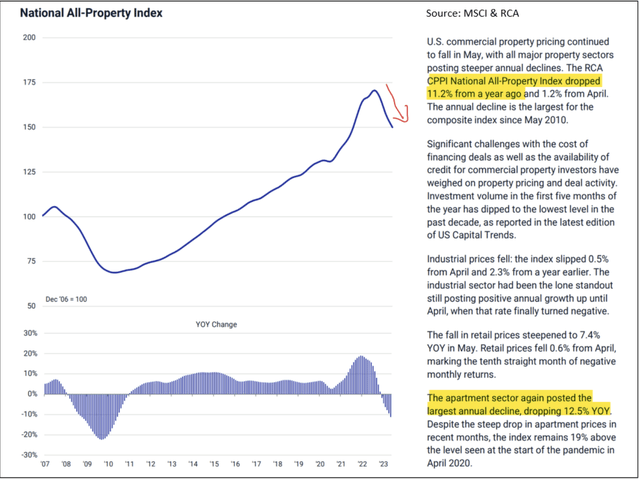

Finally, I think it's worth discussing commercial real estate loans and what banks are likely to see trouble. Commercial real estate loans have been regarded by many as a slow-motion time bomb, and I think the comparison is reasonable. Here we see commercial real estate prices dropping roughly 1% per month, with losses steepening. Barely a week goes by without one major borrower or another handing the keys back to lenders.

Us Commercial Real Estate Prices (Reventure Consulting)

Commercial real estate is like an aircraft carrier, it tends to move slowly but powerfully. With the Fed indicating they'd like to hike two more times, this is going to get worse.

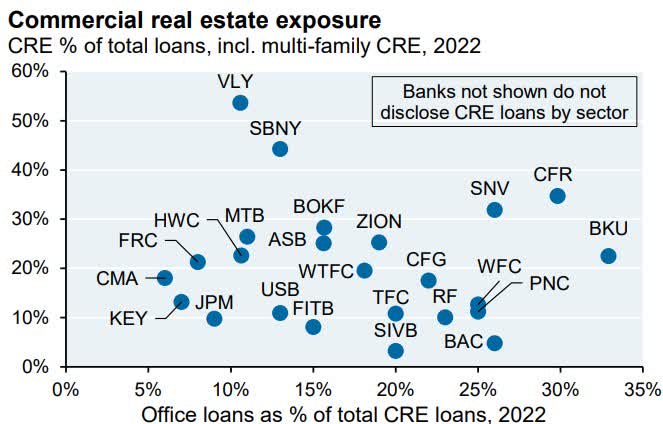

Here again, Chase did it right, with Jamie Dimon warning about risky commercial real estate loans, most of which are made by small/regional banks. J.P. Morgan is not heavily exposed to CRE, but many smaller banks are, with a typical exposure of 4-5x higher than large banks.

Bank Commercial Real Estate Exposure (Goldman Sachs Via Bloomberg)

This chart only includes large-ish banks. Some banks have better underwriting than others and some geography is better than others, but commercial real estate loans are highly likely to cause existential problems down the road for regional banks. This is particularly true for those that have already seen deposit outflows. Here again, I think J.P. Morgan Chase will be able to pick up the pieces and buy the assets of failed banks cheaply.

Are J.P. Morgan Preferred Shares A Good Buy Instead?

With bank stocks, investors always have a choice between investing in preferred stock or common stock. For J.P. Morgan, the preferred issue most searched by our readers is the company's 6% noncumulative EE issue (NYSE:JPM.PC). The par value is $25, and it trades for a slight premium at roughly $25.25, meaning the yield is a bit below 6%.

So are you better off earning about 6% in the preferred or buying the common? Ballparking the earnings yield here and assuming the cycle turns down a bit, investors can expect about a 10-11% long-run return in the common stock but a 6% return in the preferred. 10-11% may sound boring, but the value in the broader S&P 500 (SPY) is incredibly thin after running up on air this year. The preferred stock is obviously a rock-solid income investment, but I find the preferred shares in other banks are a bit juicier, such as the preferred shares for Morgan Stanley (MS.PA), and Goldman Sachs (GS.PA). You certainly won't go broke buying J.P. Morgan's preferred stock, but if you're not in a hurry, consider watching it and/or placing a 60-day buy limit order under par value at $25. Investors have some concerns that the Fed's plans to raise capital requirements for banks will suppress profitability. I'm in the camp that more Fed supervision is not necessarily bad for bank profits - banks overall historically take too much risk rather than too little. However, if implemented, these changes are somewhat likely to benefit preferred shareholders at the expense of common shareholders.

Bottom Line

Q2 earnings season kicks into gear this week with large banks reporting earnings. I'd expect solid numbers from J.P. Morgan, having likely emerged as the big winner from the 2023 spring bank panic. At 10x earnings, JPM common stock is attractively priced for its earnings potential across the business cycle. Should more turmoil emerge from regional banks with shaky deposits and risky commercial real estate loans, I'd expect J.P. Morgan to be there again to take over struggling competitors- for a rock-bottom price. There are other large bank stocks likely to do well going into earnings season, but J.P. Morgan looks like the best bet at this time going into Q2 earnings.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM, BAC, TFC, MS.PA, GS.PA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)

I would rather put money into the best bank, with a PE of ~9-10, then settle for a lesser quality bank with a PE of 8-9.