Nuveen Senior Loan CEFs To Merge

Summary

- Nuveen announced the merger of its senior loan funds: NSL, JRO, JSD and JFR.

- The merger is slated to close July 31, 2023.

- Currently, arbitrage opportunities are slim.

- I do much more than just articles at CEF/ETF Income Laboratory: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Jun

On June 23, 2023, Nuveen announced the approval by shareholders of the merger of its senior loan funds: Nuveen Senior Income Fund (NYSE:NSL), Nuveen Floating Rate Income Opportunity Fund (NYSE:JRO), Nuveen Short Duration Credit Opportunities Fund (NYSE:JSD), and Nuveen Floating Rate Income Fund (NYSE:JFR). From the press release:

June 23, 2023 | Nuveen Senior Loan Closed-End Funds Announce Shareholder Approval of Proposed Mergers. Common and preferred shareholders of NSL, JRO, and JSD into JFR have approved a proposal to merge the funds. The mergers will combine each of NSL, JRO, and JSD into JFR. Subject to the satisfaction of certain customary closing conditions, the mergers are expected to become effective before the market opens on July 31, 2023. Leading up to the mergers, NSL, JRO, JSD, and JFR are expected to follow their normal distribution schedules. Following the mergers, JFR is expected to declare its regular August distribution on July 31, 2023, with a record date of August 15, 2023, payable September 1, 2023. (initial merger proposal)

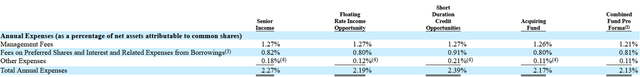

In their proxy materials, Nuveen presented a number of factors to support their argument for a merger, including greater liquidity, potential for narrower discount, increased portfolio size, and lower expense ratio:

Q. Why has each Fund's Board recommended the Merger proposals?

A. Nuveen Fund Advisors, LLC ("Nuveen Fund Advisors"), a subsidiary of Nuveen, LLC ("Nuveen") and the Funds' investment adviser, recommended the Merger proposals as part of an ongoing initiative to streamline Nuveen's closed-end funds line-up and eliminate overlapping products. Each Fund's Board considered its Fund's Merger(s) and determined that the Merger(s) would be in the best interests of its Fund. Based on information provided by Nuveen Fund Advisors, each Target Fund's Board believes that its Fund's proposed Merger may benefit the common shareholders of its Fund in a number of ways, including, among other things:

- Greater secondary market liquidity and improved secondary market trading for common shares as a result of the combined fund's greater share volume, which may lead to narrower bid-ask spreads and smaller trade-to-trade price movements;

- The potential for a narrower trading discount as a result of the larger size of the combined fund and the Acquiring Fund's common shares trading at a discount that historically has been approximately equal to or lower than that of the Target Funds' common shares;

- Increased portfolio and leverage management flexibility due to the significantly larger asset base of the combined fund; and

- Assuming that each merger is completed, lower net operating expenses (excluding the cost of leverage), as certain fixed costs are spread over the combined fund's larger asset base which may also help to achieve fund-level management fee breakpoints (please see "Proposal No. 1-A. Synopsis-Comparative Expense Information" for more information).

The proxy documents indicate that the management fees of the combined fund would be estimated to be 1.21%, which is around 5-6 bps lower than the management fees for the individual funds. Although this is a benefit to investors, it is an extremely slim difference.

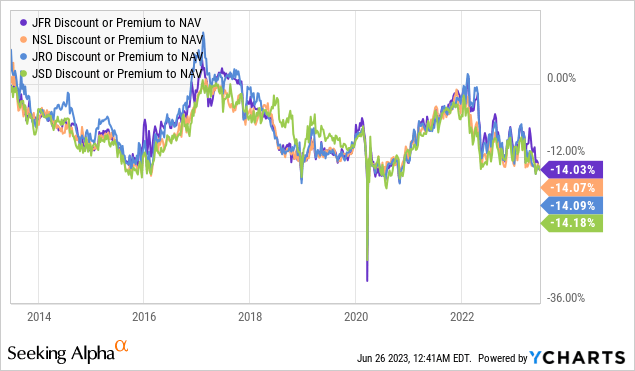

Another of Nuveen's claims was that the combined fund would potentially exhibit a narrower discount because the acquiring fund's discount was historically equal or narrower than those of the acquired funds. We can also see that this is a rather generous interpretation as the funds' discounts have moved nearly in lockstep over the last 10 years.

YCharts

It's true however that the fund's do have highly overlapping investment mandates, with their total returns over 10 years differing by under 5% cumulatively with very similar NAV profiles. Thanks to the positive effects of leverage, the funds have also outperformed the benchmark ETF Invesco Senior Loan ETF (BKLN) over this time frame.

YCharts

Could the merger have been an attempt to ward off activist activity? As shown in our handy Corporate Actions Tracker tool for members, the combined fund would reach more than $1 billion in assets, making it more difficult for activists to accumulate a significant stake in the combined fund.

Income Lab

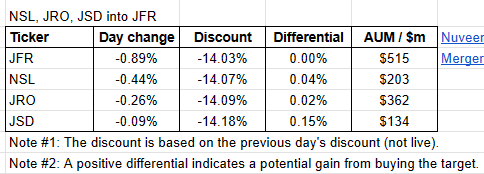

However, it doesn't look like any of the four funds are currently under attack by activist right now. The smallest fund, JSD at $134 million AUM, does count Bulldog and Saba Capital as its top 5 institutional holders, but they each own relatively small (~3%) stakes in the fund. Nevertheless, the merger could still be a prophylactic attempt by Nuveen to preemptively ward of activist activity.

Going forward

The merger is expected to close on July 31, 2023. For those already holding NSL, JFR, JRO or JSD, and who are happy to continue receiving exposure to a Nuveen managed preferred CEF, no action is required, and you will end up holding shares of JFR after the merger.

Depending on the discounts of the funds, there may be arbitrage opportunities available as well. As shown in the table above, the discounts of the funds are very close, differing by under 0.20%. This means that there's not a significant arbitrage potential available from buying and selling any of these funds. However, should one of the fund's discounts deviate significantly (>2%) from the others, that would be an opportunity to rotate from the most expensive CEF to the cheapest CEF, as we would expect the valuation difference to revert back as the merger date approaches.

This article was written by

CEF/ETF Income Laboratory is a premium newsletter on Seeking Alpha that is focused on researching profitable income and arbitrage ideas with closed-end funds (CEFs) and exchange-traded funds (ETFs). We manage model safe and reliable 8%-yielding fund portfolios that have beaten the market in order to make income investing easy for you. Check us out to see why one subscriber calls us a "one-stop shop for CEF research.”

Click here to learn more about how we can help your income investing!

The CEF/ETF Income Laboratory is a top-ranked newsletter service that boasts a community of over 1000 serious income investors dedicated to sharing the best CEF and ETF ideas and strategies.

Our team includes:

1) Stanford Chemist: I am a scientific researcher by training who has taken up a passionate interest in investing. I provide fresh, agenda-free insight and analysis that you won't find on Wall Street! My ultimate goal is to provide analysis, research and evidence-based ways of generating profitable investing outcomes with CEFs and ETFs. My guiding philosophy is to help teach members not "what to think", but "how to think".

2) Nick Ackerman: Nick is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. Since then he has continued with his passion for investing through writing for Seeking Alpha, providing his knowledge, opinions, and insights of the investing world. His specific focus is on closed-end funds as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long term financial goals.

3) Juan de la Hoz: Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He is the "ETF Expert" of the CEF/ETF Income Laboratory, and enjoys researching strategies for income investors to increase their returns while lowering risk.

4) Dividend Seeker: Dividend Seeker began investing, as well as his career in Financial Services, in 2008, at the height of the market crash. This experience gave him a lot of perspective in a short period of time, and has helped shape his investment strategy today. He follows the markets passionately, investing mostly in sector ETFs, fixed-income CEFs, gold, and municipal bonds. He has worked in the Insurance industry in Funds Management, helping to direct conservative investments for claims reserves. After a few years, he moved in to the Banking industry, where he worked as a junior equity and currency analyst. Most recently, he took on an Audit role, supervising BSA/AML Compliance teams for one of the largest banks in the world. He has both a Bachelors and MBA in Finance. He is the "Macro Expert" of the CEF/ETF Income Laboratory.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)