Realty Income: A Potential Inflection Point Has Surfaced (Rating Upgrade)

Summary

- Our outlook on Realty Income Corporation has improved amid a positive shift in numerous of its influencing variables.

- A cyclical pivot within the retail space is likely as consumer sentiment in the U.S. and the United Kingdom has started recovering.

- Additional acquisitions and pipeline developments provide promise, given the REIT's occupancy track record.

- Receding market risk premiums could lend the REIT the necessary latitude to gain value.

- Although we are more positive about Realty Income Corporation than before, risks remain, which is why we upgrade the asset to a Hold instead of a Buy.

- Looking for a helping hand in the market? Members of The Factor Investing Hub get exclusive ideas and guidance to navigate any climate. Learn More »

tupungato

Today we turn our attention to Realty Income Corporation (NYSE:O), a retail-centric Real Estate Investment Trust ("REIT") known to many as the "monthly dividend company."

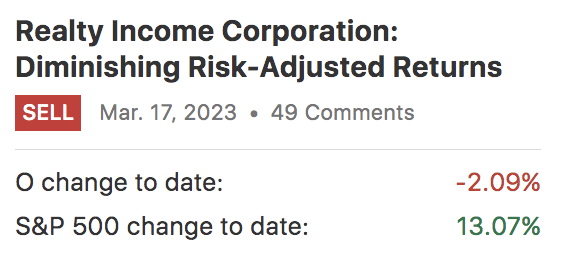

We last assessed the REIT in March, correctly forecasting that it would underperform the broader financial markets. However, plenty of Realty Income Corporation's influencing variables have shifted since our latest analysis, driven by newly completed acquisitions, altered market-based risk premiums, and more. As such, we decided to re-assess the asset's circumstances and discovered an improved outlook; here is why.

Pearl Gray's Historical Ratings (Seeking Alpha)

Operations Reviewed

Realty Income Corporation released its first-quarter earnings report in May for the period ending March 31. Although the fund missed its revenue estimate by $17.37 million, we noticed a few inflection points that could provide idiosyncratic support to the REIT.

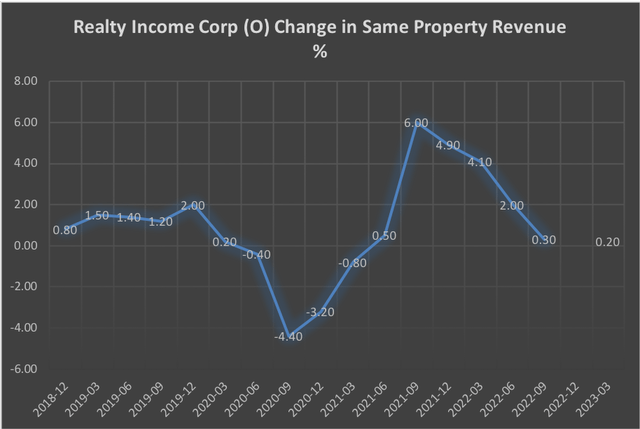

Realty Income generated approximately $4.1 million in sales-pegged rental income during Q1 2023 and $3.7 million in Q1 2022, which adds up to less than 1% of its revenue mix. This illustrates that its business model relies on base rent from high-quality tenants instead of royalties, meaning it is probably less cyclical than most other retail REITs. Nevertheless, as illustrated by the diagram below, the REIT is subject to moderate base rent cyclicality, which we attribute to: 1) Inflation levels; and 2) the cyclical nature of its tenants, which sometimes leads to uncollectibles and vacancies.

Revenue Per Property Growth - Ending Q1 (Author's Work with Data from GuruFocus)

During its first quarter, Realty Income Corporation expanded its same-store rent by 0.2%, led by a 1.5% increase in industrial property rent. In our opinion, Realty Income Corporation will shortly experience renewed support from its retail properties (which span approximately 82% of its portfolio). Our premise for the claim is that consumer sentiment within the United States has ticked up in recent months, which could soon reflect in Realty Income Corporation's profit & loss statement as it hosts some of the U.S.'s leading retailers as tenants whose operating results are most likely inextricably linked to the mainstream consumer's behavior.

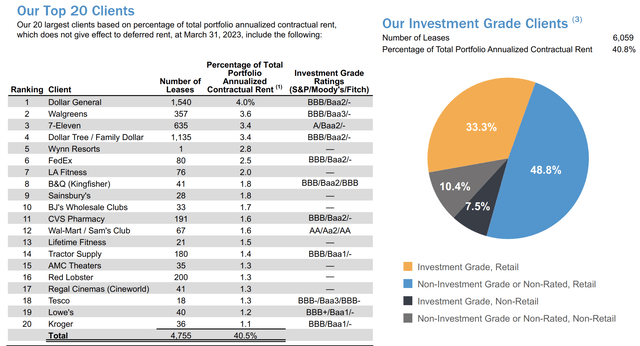

Moreover, Realty Income Corporation's portfolio is 48.8% exposed to non-investment-grade tenants, which could come into play amid higher consumer sentiment as lower-grade tenants typically behave more cyclically than investment-grade tenants (which is usually a good thing during a bullish economic pivot).

Furthermore, Realty Income Corporation's 10.3% United Kingdom exposure could also come into play soon. The REIT hosts companies such as Sainsbury's (OTCQX:JSNSF) and Tesco (OTCPK:TSCDF), and the recent uptick in U.K. sales coupled with sustained inflation might add significant value to the REIT's U.K. portfolio. Keep in mind that strong underlying company fundamentals coupled with high inflation are advantageous to retail real estate investors.

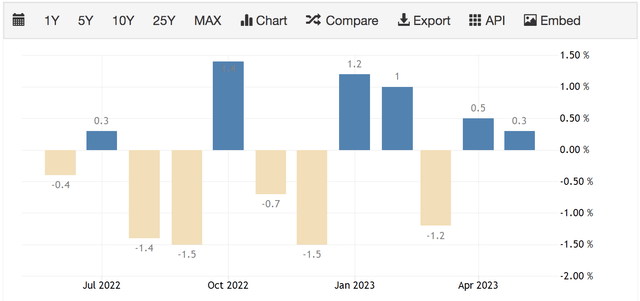

U.K Retail Sales (Trading Economics)

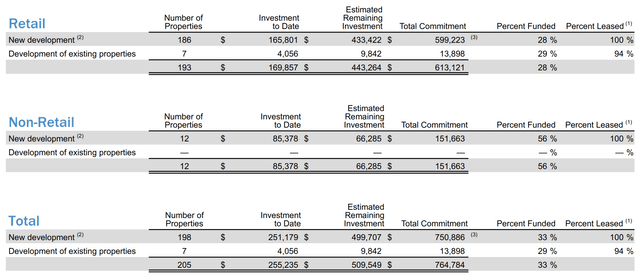

Realty Income Corporation has expanded its asset base since our latest discussion, adding 339 properties at a cost of $1.7 billion in Q1 and another $2.6 billion worth in May/June. The first batch of properties have an estimated capitalization rate of 7%, which is level with the REIT's current cap rate, while the latter has a going-in cap rate of 6.8%, which is slightly below Realty Income Corporation's ongoing cap rate.

The fund's portfolio has a 99% occupancy rate with a mix of 95% existing and 5% new tenants; moreover, it has numerous pre-leased pipeline projects. As such, we think it's safe to say that any incoming acquisitions should raise enthusiasm, as they are almost guaranteed to run at high occupancy rates with reasonably good cap rates.

New Developments (Realty Income Corporation)

Let's take a look at a few recent developments within Realty Income Corporation's capital structure.

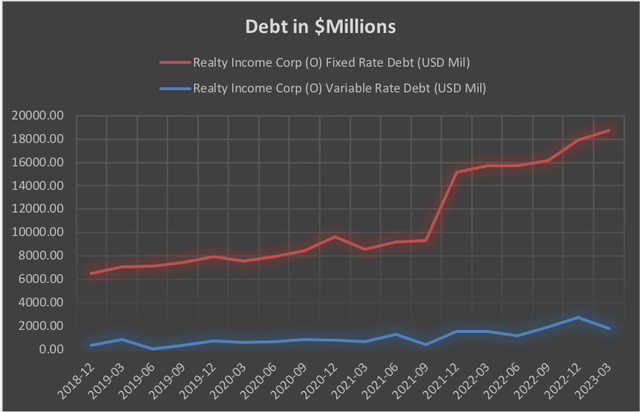

In April, the REIT issued $1 billion worth of debt in the form of senior unsecured notes, altering its capital structure to 69.5% common stock equity and 30.5% mixed debt.

As illustrated in the diagram below, Realty Income Corporation's debt is primarily fixed (90% of its debt), with an average interest rate of 3.74% (for all debt combined) and maturity of 5.9 years. In our view, the company's aggressive addition of fixed-rate debt during a period of elevated interest rates is slightly undesirable. Nevertheless, its cost of debt is much lower than its capitalization rate of around 7%, lending it the latitude to realize arbitrage profits that it will hopefully pass through to its shareholders.

Debt Levels - Ending Q1 (Author's Work with Data from GuruFocus)

Market Risk Premiums

Remember that Realty Income Corporation is a traded asset, and traded assets do not always reflect the performance of the entities they're secured by. Instead, they often reflect investors' risk-return preferences. As such, assessing the financial market risk premiums inherent to the REIT's performance is critical.

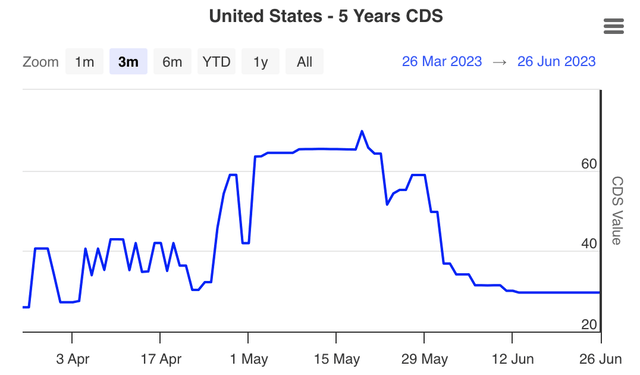

The salient features of today's economy and the financial markets imply that it is a good time to invest in cyclical Real Estate Investment Trusts like Realty Income Corporation. Firstly, CDS Values have fallen abruptly in the past two months, concurrently decreasing the market's credit risk outlook, in turn, lending cyclical assets such as retail stocks and real estate funds the necessary scope to prosper.

We believe CDS values (and credit risk) will continue to compress as inflation stabilizes. Additionally, the Federal Reserve has hinted at an early-2024 interest rate pivot. These two factors combined suggest that investors have a more transparent view of future risk, which could provide continued support to cyclical assets.

U.S. 5-year CDS Values (worldgovernmentbonds.com)

Valuation - A Noteworthy Risk

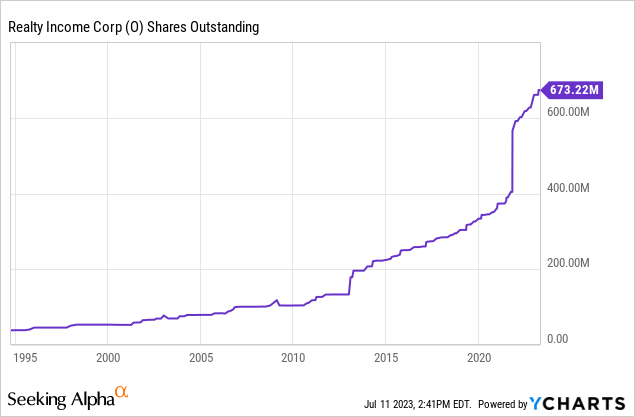

Based on our analysis, Realty Income Corporation possesses a few risks, one of which is its valuation. Realty Income Corporation, like most REITs, regularly issues equity and debt to facilitate further acquisitions, as most of its internal profits must, by law, be distributed as dividends.

In addition to the debt issuance mentioned earlier, Realty Income Corporation sold $804.4 million worth of common stock in its first quarter with a volume-weighted average price of $63.31. The REIT's continuous issuance of new shares often dilutes its investors base, which we deem undesirable.

Let's drift away from the share issuance debacle and have a look at the REIT's cash flow-based valuation metrics.

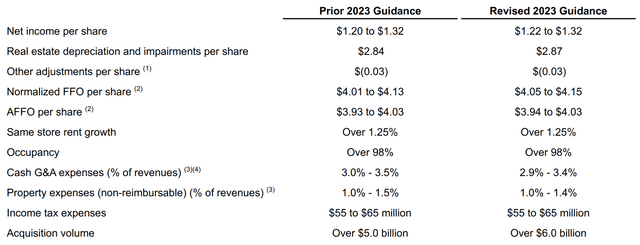

The Price-to-Funds From Operations metric is the most commercially accepted valuation ratio among financial analysts. In contrast, the Price-to-Adjusted Funds From Operations metric conveys the most economic information. I used the firm's full-year revised guidance to construct the ratios and discovered the following.

Realty Income Corporation's implied P/FFO ratio of 14.58 stretches beyond its cyclical midpoint of 12.58, and its implied P/AFFO ratio of 15 reveals the same as it exceeds its cyclical midpoint of 13.99. As such, a relative valuation of the REIT's cash flows implies that it is theoretically overvalued. Unfortunately, this adds to the aforementioned stock issuance concerns, handing us the necessary data to conclude that the stock is theoretically overvalued.

Dividends

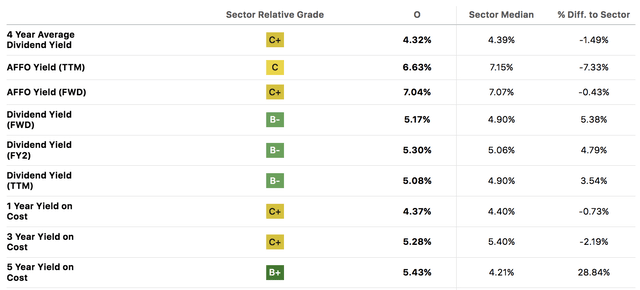

Unlike its valuation, Realty Income Corporation's dividend profile is robust. For those unaware, the REIT has a monthly dividend policy and raised its June dividend to $0.255 per share.

In our view, Realty Income Corporation's long-term dividend trend growth of 4.4% per year since 1994 suggests its dividend is safe and reliable, especially as no structural breaks have occurred that might initiate an alternative trajectory.

Final Word

Realty Income Corporation is well-placed to benefit from a potential cyclical pivot within the retail REIT space amid its market-leading position. Furthermore, the REIT has acquired aggressively since the turn of the year, adding to its asset base, which is 99% leased out.

Another factor to consider is the U.S.'s receding credit risk, which will likely free up cyclical assets like Realty Income Corporation. Moreover, the REIT's dividend policy remains highly lucrative to income-seeking investors.

We hereby upgrade Realty Income Corporation to Hold from our previous Sell Rating. Although we consider its prospects brighter than they were at the turn of the year, risks like an unconvincing valuation and underwhelming going-in cap rates on new acquisitions remain of concern to us.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>

This article was written by

Quantitative Fund & Research Firm with a Qualitative Overlay.

Coverage: Global Equities, Fixed Income, ETFs, and REITs.

Methods: Factor Analysis, Fundamental, Valuation, Street Gossip, and Common Sense.

Our work on Seeking Alpha consists of independent research and not financial advice.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)

Although we are more positive about Realty Income Corporation than before, risks remain, which is why we upgrade the asset to a Hold instead of a Buy.