Elastic: Upside Not Attractive Enough To Invest At This Price

Summary

- The global enterprise search market is projected to reach $8.85 billion by 2030, and I expect ESTC to grow faster than the industry due to its generative AI-related offerings.

- Despite a difficult macro environment, ESTC reported healthy revenues in 4Q23, with strong RPO performance due to increased multi-year customer commitments.

- I recommend a hold rating as the current share price upside is unattractive.

Suphachai Panyacharoen

Overview

My recommendation for Elastic (NYSE:ESTC) is a hold rating as I see the upside to current share price as unattractive. Although I might get more positive on the stock if the market reacts well to ESTC turning profitable, thereby closing the valuation gap.

Note that I previously rated hold rating for ESTC due to my expectation that the stock would be rangebound until the company reports earnings or there is other major news to drive the stock, and I am reiterating it.

Business

The services of ESTC include data analysis and information technology. The firm provides services in the areas of application performance monitoring, security analysis, enterprise search, cloud computing, and cloud storage.

Industry

According to Grand View Research, the value of the global enterprise search market is projected to reach $8.85 billion by 2030, growing at a CAGR of 8.9% from 2023 to 2030. The need for effective management of massive data sets by businesses looking to improve their operational prowess is, in my opinion, largely responsible for this expansion. Enterprise search solutions are becoming increasingly popular due to rising demand for tools that simplify the search of large amounts of data and increase safety. Value-added services, like search, are becoming increasingly important in the business world, which is accelerating their widespread adoption.

Some of the key players in the Enterprise Search Market are Google (GOOG), Lucidworks, Oracle (ORCL), IBM, SAP, etc.

Investment highlights

Despite the difficult macro environment, ESTC had a successful final quarter of FY23, reporting slightly higher revenues as well as increases in gross margin, operating margin, and free cash flow. While the slowdown in self-managed subscriptions and cloud revenue was expected, it was still a bit discouraging to see the decline in subscription revenue persist. The ongoing efforts of customers to optimize Elastic Cloud had a continued impact, which was largely similar to what the company observed in the previous quarter.

However, I am encouraged by ESTC's strong RPO performance (RPO accelerated modestly from the previous year), which can be attributed to the company's increased number of multi-year customer contractual commitments. As I come to appreciate the immense potential presented by generative AI, my outlook on ESTC's long-term growth prospects improves. To take advantage of the emerging market for generative artificial intelligence, I believe ESTC's Elasticsearch Relevance Engine [ESRE] will set the company up favorably. With its ESRE capabilities, I believe ESTC has a chance to become a foundational component powering Gen AI applications as businesses around the world seek to do so using proprietary enterprise data sets. Management has noted strong customer interest despite the company's early stage and indicated that they are developing their own Gen AI copilots for Observability and Security applications.

Overall, I'm heartened by the consistent execution, and I'm looking forward to the opportunity presented by the new ESRE product in the area of AI in the medium term, where it will likely serve as another growth vector to drive sustainable profitable growth beyond FY24.

Financial highlights

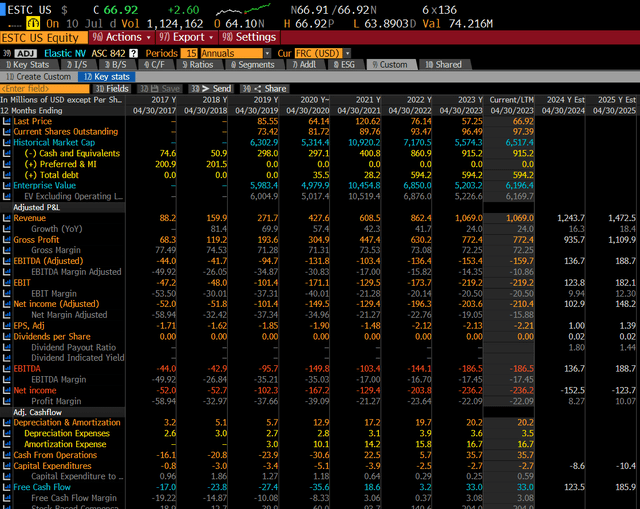

Bloomberg

Over the next decade, I expect ESTC to grow faster than the industry as it rides the generative AI wave to secure more long-term commitment contracts. However, given that the revenue base is significantly larger today (two to three times larger than in the past), it is unlikely that ESTC will repeat its historical 40+% growth rates. Based on management guidance, I expect ESTC to grow in the high teens.

I expect management to continue focusing on growth rather than profits as the industry grows and becomes more relevant in today's work, particularly with the emphasis on deploying. Having said that, at the rate that ESTC is growing, I believe the company will be profitable in the coming quarters, as 4Q23 EBITDA is already close to breakeven (-$30 million).

ESTC has $915 million in cash and $594 million in debt as of 4Q23, indicating that the company is in a net cash position. This, in my opinion, gives ESTC more leeway to invest more aggressively for growth, even in today's uncertain macroeconomic conditions environment.

Valuation

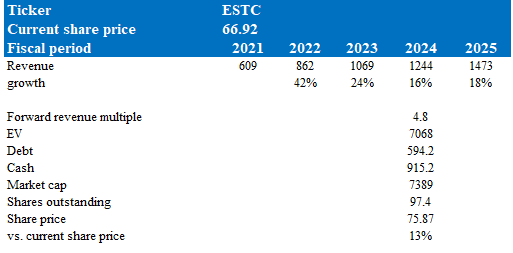

Author's valuation model

According to my model, ESTC is worth $75.87 in FY24, a 13% increase. This target price is based on my growth forecast for the next two years, which is in line with management guidance.

ESTC stock is now trading at 4.8x forward revenue, which I believe will remain at this level until ESTC shows a significant shift in profitability or growth - which should close the gap with peers. I don't think it's fair to compare ESTC to its key competitors in the same industry because they have other businesses. Instead, I compare ESTC to other rapidly growing software industries in similar industries. Given its loss-making profile and growth profile (which ranks in the middle of the pack), ESTC should trade at a discount.

Bloomberg

Bloomberg

Risk

As one of the key players in the search industry, ESTC has established a dominant position due to the limited presence of strong competitors. If ESTC were to decide to update their technology and add Elastic-like features, however, they would be up against stiff competition from the likes of Microsoft (with their FAST search), Oracle (with their Endeca), and Micro Focus (with their Autonomy). By bundling them with other customer engagement solutions, these mega-vendors can afford to offer steep discounts or even give these tools away for free.

Conclusion

I recommend a hold rating for ESTC as the current upside to the share price is not attractive enough for investment. However, the company's strong RPO performance and the potential of its Elasticsearch Relevance Engine [ESRE] for generative AI applications offer long-term growth prospects. That said, until ESTC demonstrates significant profitability or growth, it is likely to trade at a discount compared to peers.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.