Pool Corporation Is An Impressive Dividend Compounder

Summary

- Pool Corporation, the world's largest wholesale distributor of swimming pool supplies, has seen its shares return nearly 680% over the past decade, despite a 35% sell-off from its all-time high.

- The company's strategic purchasing strategies and diverse customer base give it a competitive edge, with a large portion of its sales being non-discretionary, providing a steadily growing revenue stream.

- Despite short-term challenges due to economic factors and weather impacts, Pool Corporation maintains a positive long-term outlook, with solid financial performance, high-quality earnings, and a commitment to aggressive dividend growth.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Johnce/E+ via Getty Images

Introduction

It's time to discuss Pool Corporation (NASDAQ:POOL), a company I've ignored for way too long. While this dividend stock has a yield close to 1%, it has proven to be a terrific compounder, thanks to its large footprint in the (global) pool industry and its ability to generate strong revenue, resulting in a boost to earnings and free cash flow.

Right now, POOL shares are trading roughly 35% below their all-time high, as the pandemic caused the stock to fly. Now, the stock has come down as a result of consumer and housing weakness, which is hitting its core business.

However, this comes with opportunities.

In this article, we'll discuss what makes this Louisiana-based corporation so special and why I expect it to remain a long-term dividend wealth compounder.

So, let's get to it!

What Makes POOL So Special

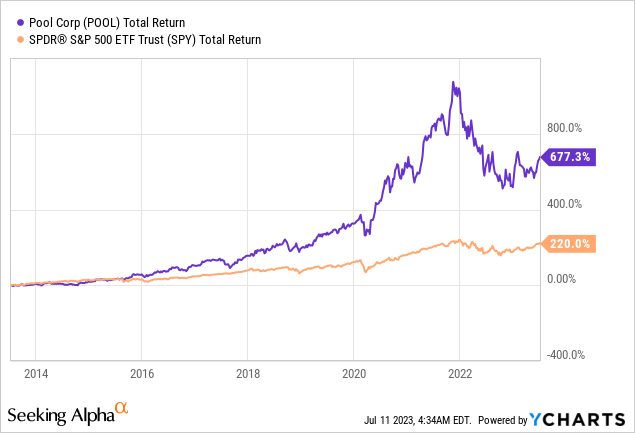

POOL is a wealth compounder. While its dividend yield is just 1.2%, the stock has been a total return star in the past.

Despite the 35% sell-off from its all-time high, POOL shares have returned close to 680% over the past ten years, beating the S&P 500 by a huge margin.

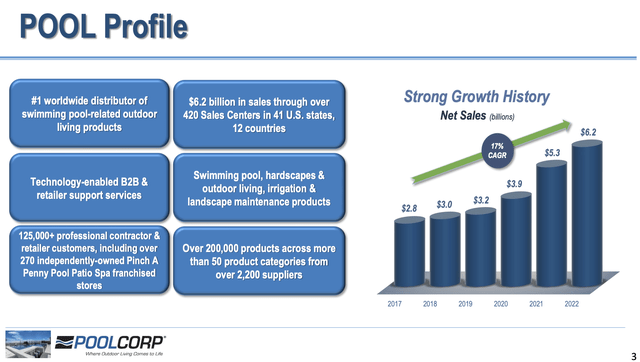

With a market cap of $15 billion, the company is the world's largest wholesale distributor of swimming pool supplies, equipment, and related leisure products. It is also a leading distributor of irrigation and landscape products in the United States.

The company serves roughly 125,000 customers, with no single customer accounting for 10% or more of sales in 2022, as most customers are small, family-owned businesses, including swimming pool remodelers, builders, specialty retailers, repair and service businesses, irrigation contractors, landscape maintenance contractors, and commercial pool operators.

Pool Corporation offers over 200,000 products from various manufacturers and their own Pool Corporation-branded products, including maintenance products, repair and replacement parts, building materials, pool equipment, and so much more.

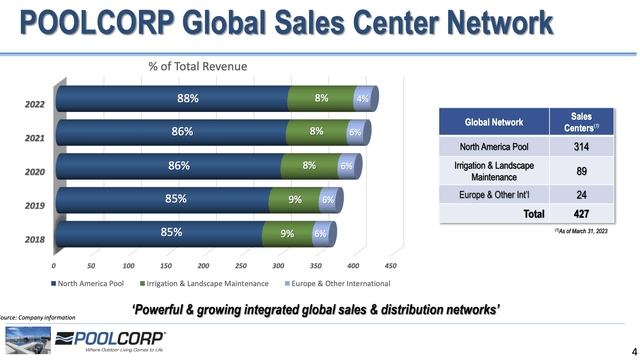

The company behind the POOL ticker operates 420 sales centers in North America, Europe, and Australia, with the highest concentration of swimming pools in California, Texas, Florida, and Arizona, which makes sense, given the weather conditions in these states.

Furthermore, 96% of its sales are generated in North America. Europe accounted for 4% of 2022 sales. This, too, makes sense, as having a pool is much more common in the US than in Europe.

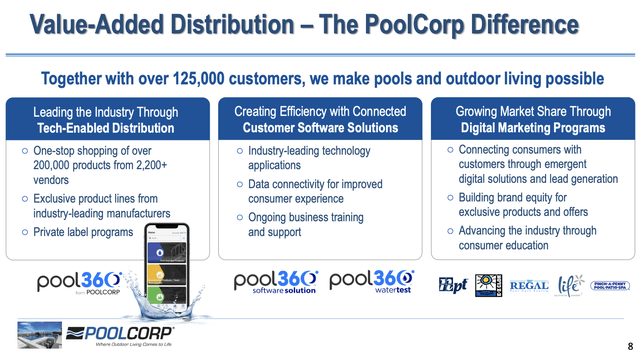

With regard to its purchasing strategies, it's interesting to note that Pool Corporation maintains good relationships with suppliers and participates in early buy programs that offer extended payment terms to qualified customers. The preferred vendor program focuses on stocking products from a smaller number of vendors offering the best terms and service.

What the company is doing here is textbook purchasing, as it creates good relationships with buyers. As obvious as it may sound, it's a difficult task to achieve. In its competitive industry, the company is catering to its sellers, not the other way around. Pool Corp. creates a situation where sellers are happy to sell to Pool Corp, which reduces long-term supply risks and gives the company an edge over its competitors, who may not get the preferred buyer benefits of Pool, which may include better pricing and certain services in case of supply bottlenecks.

Having said that, Pool operates in a cyclical industry. After all, people do not spend money on pool equipment if they are struggling financially.

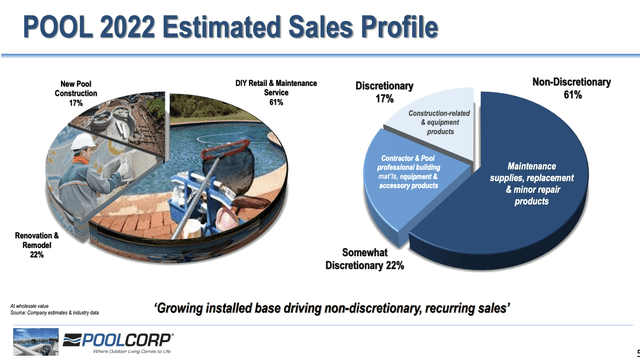

However, a large part of the company's sales are non-discretionary.

As the overview above shows (emphasis added):

- Roughly 60% of consumer spending in the pool industry goes toward maintenance and minor repair of existing swimming pools. Hence, the company benefits from the ongoing demand for pool chemicals, equipment, and related parts and supplies for sanitization balance and upkeep.

- The swimming pool remodeling, renovation, and upgrade market accounts for 21% to 23% of consumer spending. Aging pools and the availability of enhanced feature products drive activity in this market. While I would make the case that people will neglect these operations during recessions, I do agree with the Somewhat Discretionary label.

- New swimming pool construction accounts for 17% to 18% of consumer spending. In this case, new pools increase the need for certain supplies. However, they also increase the installed base. After all, new pools will need maintenance.

Based on that context, the company's selling strategy goes beyond the effective use of its sales network, connecting sellers to buyers.

The company also promotes industry growth involving advertising, digital marketing initiatives, and educational programs to raise consumer awareness of pool ownership benefits.

These support programs for customers include lead generation, personalized websites, marketing campaigns, and business development training.

The company also provides expertise and resources for all aspects of customers' businesses.

Having said all of this, let's dive into the results.

POOL's Shareholder Returns

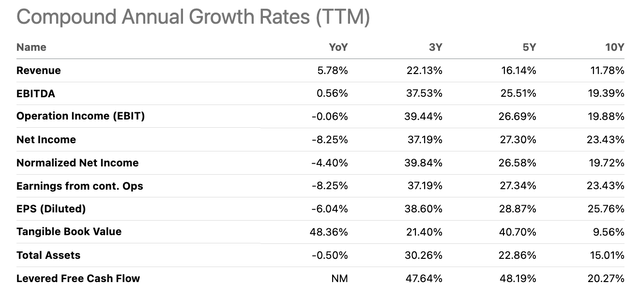

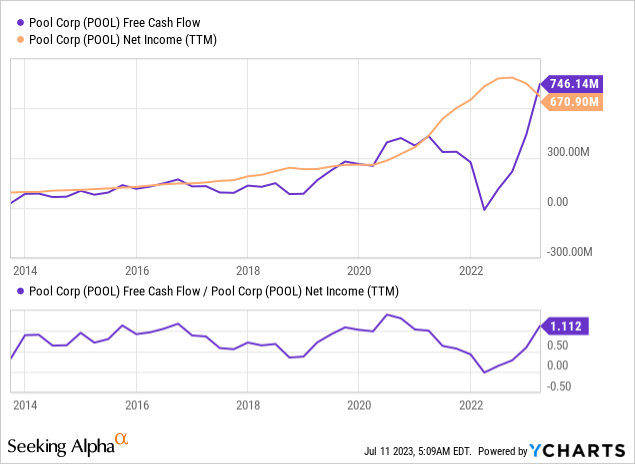

Using Seeking Alpha data, we see that the company has generated mindblowing compounding growth rates. Over the past ten years, the company has compounded its annual revenue by 11.8% per year. Thanks to higher margins, it grew net income by 23.4% per year.

Additionally, the company's earnings are high-quality earnings, as free cash flow generation is consistently close to 100%.

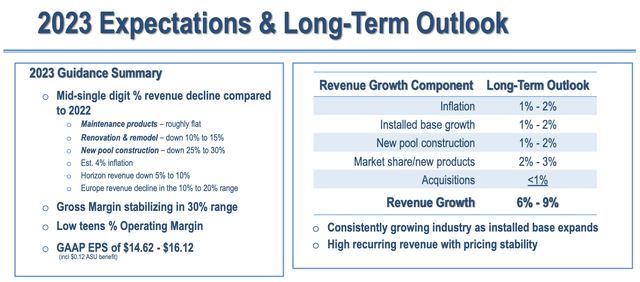

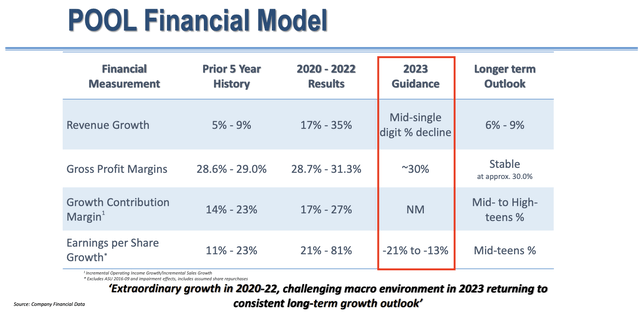

Furthermore, the company has strong long-term guidance.

Long-term revenue growth is expected to be between 6% and 9% per year, which is a very ambitious goal. If the company is able to achieve this, we will more than likely see long-term stock price outperformance.

This growth target is based on 1%-2% growth in inflation (prices), installed base growth, and new pool construction. A higher market share and new products are expected to be the biggest driver of growth.

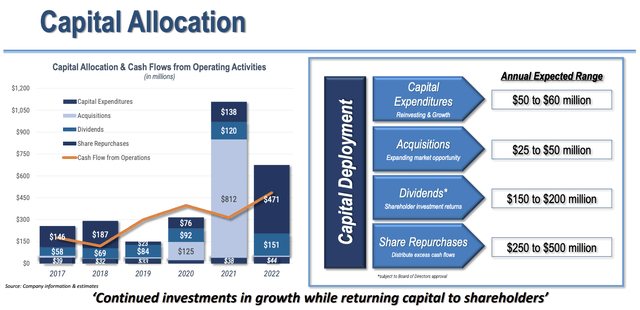

Speaking of free cash flow, the company's capital deployment plans are straightforward. Its main goal is to invest in its business. This includes organic growth and acquired growth. Once these things have been taken care of, money flows to dividends and share repurchases.

This brings me to the dividend.

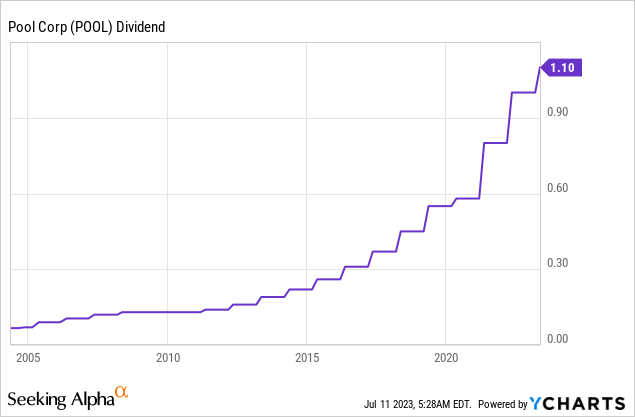

POOL currently yields 1.2%, which is a bit underwhelming and bad news for income-oriented investors.

However, that's also where the bad news ends.

This dividend has grown by 19.9% per year over the past ten years. Over the past five years, that number has risen to 21.3%.

The most recent hike was announced on May 4, when the company hiked by 10%.

But wait, the good news continues.

This dividend is backed by a 25% payout ratio.

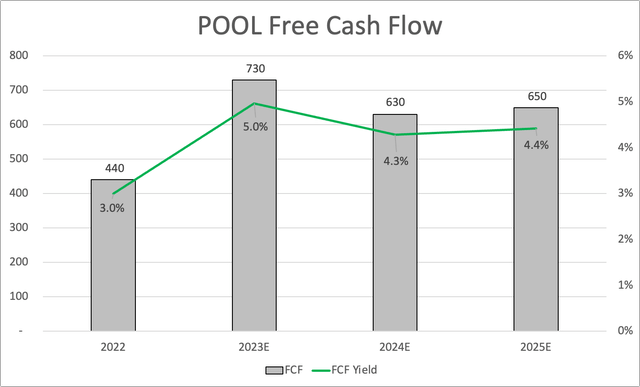

Furthermore, when looking at free cash flow estimates, we see that the company is expected to maintain a free cash flow yield close to 5%. This means that the cash payout ratio is expected to remain below 30%.

While dividend growth will depend on macroeconomic developments, the company has plenty of room to continue aggressive dividend growth, which adds to the favorable total return picture.

Recent Developments & Valuation

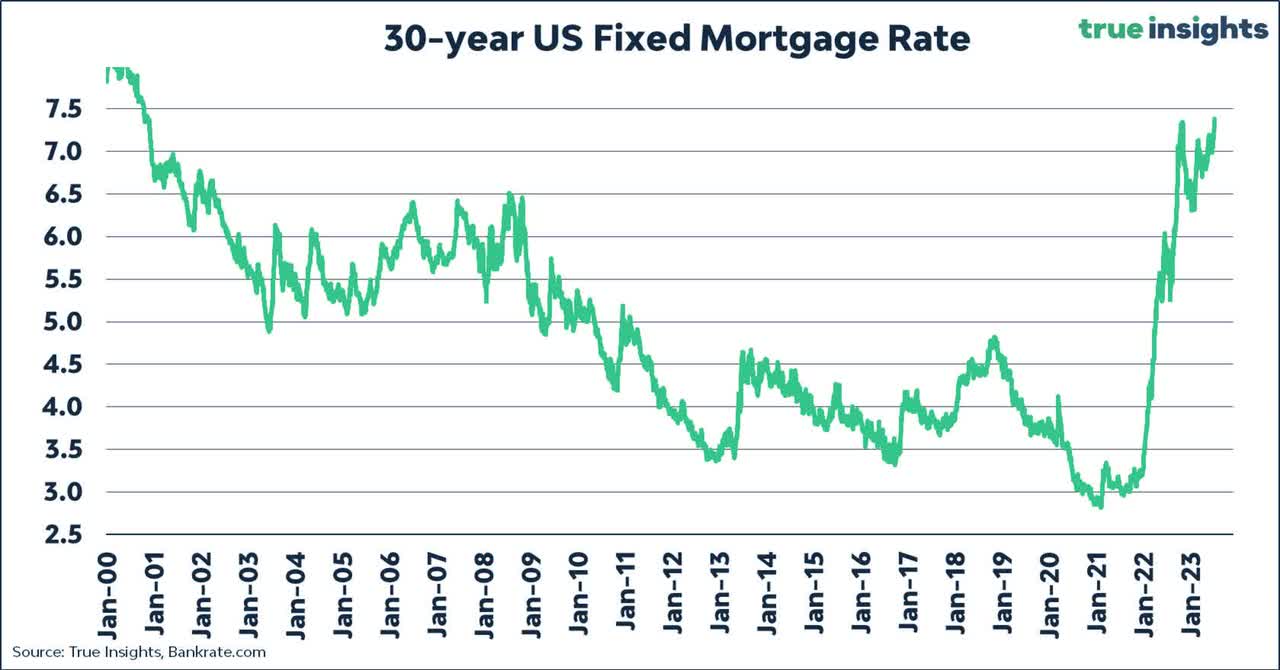

As most people are fully aware, the consumer isn't in a great spot. Neither is the housing market, given sky-high interest rates.

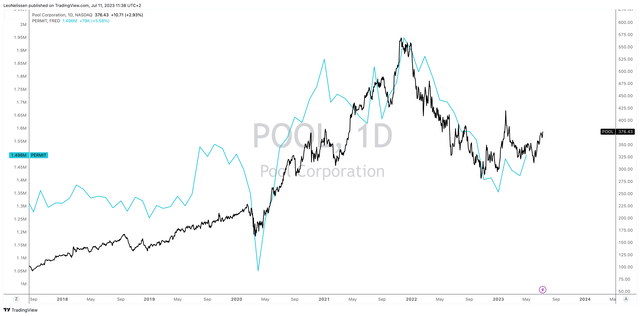

The chart below compares the POOL stock price to building permits in the United States. While new pools are just a small part of the company's revenue, it's a driver of investor sentiment. After all, stronger building permits usually suggest that the consumer is healthier, which also fuels maintenance demand.

TradingView (POOL, Building Permits)

Hence, in the first quarter:

- Equipment sales were down by 14%, which was attributed to construction unit volume declines, unfavorable weather, and delayed customer early buys.

- Chemical sales decreased by 11% due to cooler and wetter weather conditions, except for Florida, which saw a 12% increase in chemical sales.

- Building material sales declined by 7% due to lower new builds, partially offset by higher renovation and remodel numbers.

Furthermore:

- The demand in Europe remained soft, with sales declining by 25% in the first quarter. Economic factors and adverse weather conditions contributed to this decline.

Unfortunately, due to the significant weather impacts and the expiration of COVID tailwinds, the company decided to lower its guidance for 2023.

The weather-related challenges and economic factors are expected to have notable short-term impacts on financial results.

However, the long-term outlook for the business remains positive, with pools and outdoor living remaining highly desirable. The company believes in its ability to take market share based on its competitive profile and commits to being the best supplier in the industry.

This is also why the company sticks to long-term revenue growth of at least 6% per year.

I highlighted the 2023 outlook in the overview below.

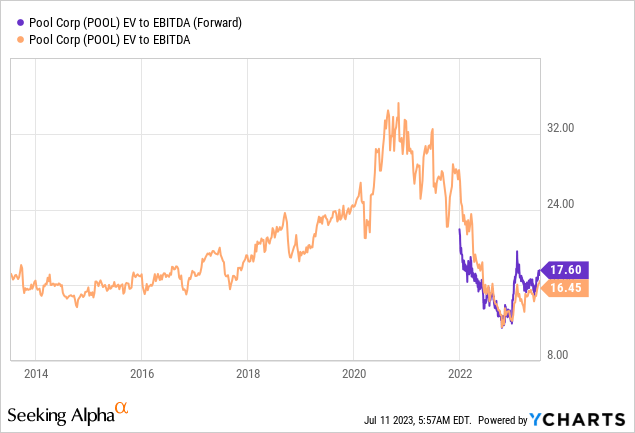

With this in mind, the company generated $1.1 billion in EBITDA last year. This year, that number is expected to be $910 million. The company is not expected to break its 2022 record until 2025.

While this may sound bad, the 2022 result was more than 100% above its 2020 result, which is remarkable.

So, seeing some slowing in the post-pandemic years is normal, especially considering the surge in rates.

With regard to its valuation, POOL is trading at 17.6x NTM EBITDA, which is a fair valuation.

This is confirmed by analyst estimates, which give the stock a consensus target of $383. That's 2% above the current price.

I believe that POOL is a fantastic long-term dividend growth compounder, and I'm definitely looking to make it a part of my portfolio.

However, the economy is tricky. Given sticky inflation, I do not believe that the Fed will soon start cutting rates. I only expect rapid rate cuts if the Fed is forced to cut. That wouldn't be bullish for POOL.

Also, I'm not sure how POOL fits in my portfolio, as I recently bought construction exposure through Carlisle (CSL). It's not pools, but it's also tied to building permits.

So, while I'm figuring out how POOL fits in my portfolio, I hope that Mr. Market provides us with another correction opportunity. I may not get another buying chance, but I'm willing to take my chances.

Takeaway

Pool Corporation is a remarkable long-term compounder with a proven track record of delivering substantial returns.

Despite its modest dividend yield, the stock has outperformed the market by a wide margin, offering investors significant value.

As the largest wholesale distributor of pool supplies and related products, POOL enjoys a strong market presence, serving a diverse customer base.

Its strategic purchasing strategies and preferred vendor program give the company a competitive edge.

While operating in a cyclical industry, POOL benefits from a considerable portion of non-discretionary sales, providing a steadily growing revenue stream.

With a focus on industry growth and customer support programs, POOL is well-positioned to capitalize on the ongoing demand for pools and related products.

While short-term challenges exist due to economic factors and weather impacts, the company maintains a positive long-term outlook.

POOL's solid financial performance, high-quality earnings, and commitment to aggressive dividend growth make it an attractive investment option for long-term investors seeking a satisfying total return.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.