NICE: Capturing Growth In AI-Driven Customer Experience

Summary

- NICE Ltd. has shown consistent revenue growth and positive free cash flow, demonstrating financial strength and stability.

- The company's focus on AI-driven customer experience solutions and cloud market expansion positions it for future growth.

- Despite its growth, NICE faces risks associated with the industry's shift towards cloud-based solutions, which could impact demand for its on-premises software products and related services.

- Based on a discounted cash flow analysis, NICE's intrinsic value is estimated to be $197.35, suggesting that the stock may currently be fairly priced in the market.

Vertigo3d/E+ via Getty Images

Intro

NICE Ltd. is a global provider of cloud platforms for AI-driven digital business solutions. They offer CXone, a cloud-native open platform for contact centers, supporting a range of organizations. Their solutions include Enlighten for automation opportunities, digital-entry points for customer needs, and journey orchestration for real-time routing.

NICE also provides smart self-service solutions, agent tools for real-time support, and performance solutions for analyzing customer interactions. In the financial sector, they offer the X-Sight platform for financial crime and compliance, along with data intelligence solutions and AI technologies for real-time detection and prevention.

This article aims to conduct a comprehensive analysis of NICE's financial performance and growth prospects. We will delve into the company's revenue patterns, profitability metrics, and its capacity to generate free cash flow. Furthermore, we will assess NICE's strategic position within the insurance industry and provide an outlook for its future. By evaluating these crucial factors, investors can obtain valuable insights into the company's potential and ascertain its appeal as an investment opportunity in the present market context.

Performance

NICE, a prominent player in the industry, has witnessed remarkable growth over the years. The company's revenue and free cash flow have consistently shown an upward trajectory, emphasizing its financial strength and stability. Let's delve into the details and understand why NICE's positive growth numbers matter.

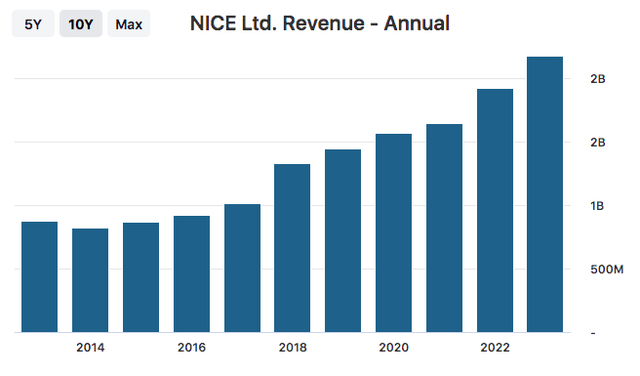

NICE has experienced consistent revenue growth over the past decade. From 2013 to 2022, the company's revenue increased by an impressive 165.52%. This equates to a compounded annual growth rate (CAGR) of 10.26%, signifying sustained expansion and market penetration. This remarkable growth is a testament to NICE's ability to deliver innovative solutions that meet the evolving needs of its customers. Such continuous revenue growth is crucial for any company as it demonstrates the ability to generate consistent income streams, invest in research and development, and fuel further expansion.

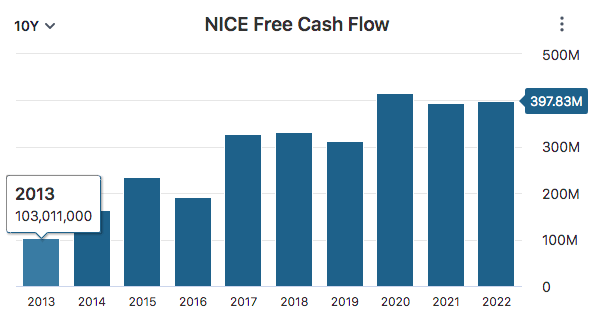

NICE's free cash flow has also exhibited a positive trend, growing by 286.21% over the past decade. This growth, equivalent to a CAGR of 14.47%, indicates the company's ability to generate ample cash after meeting its operating expenses and capital investments. Positive free cash flow is essential for a company as it provides flexibility for strategic initiatives, such as acquisitions, capital expenditures, and returning value to shareholders.

Data by Stock Analysis

A high growth rate in free cash flow reflects NICE's effective management of its resources, operational efficiency, and the creation of value for its stakeholders. By consistently growing its free cash flow, NICE has established a solid financial foundation that allows it to invest in future growth opportunities and weather economic uncertainties.

NICE's balance sheet is a source of strength and stability for the company. The current ratio, which measures its ability to meet short-term obligations, stands at an impressive 2.11. This indicates that NICE has more than enough current assets to cover its short-term liabilities. A high current ratio instills confidence in investors, suppliers, and creditors, as it suggests that the company has sufficient liquidity to manage its day-to-day operations and financial obligations.

Furthermore, NICE boasts a healthy debt-to-equity (D/E) ratio of 0.26, indicating a conservative capital structure. The company has a low level of debt relative to its equity, which reduces financial risk and enhances its ability to navigate challenging economic conditions. Maintaining a strong balance sheet enables NICE to access capital at favorable rates, invest in growth initiatives, and withstand market downturns more effectively.

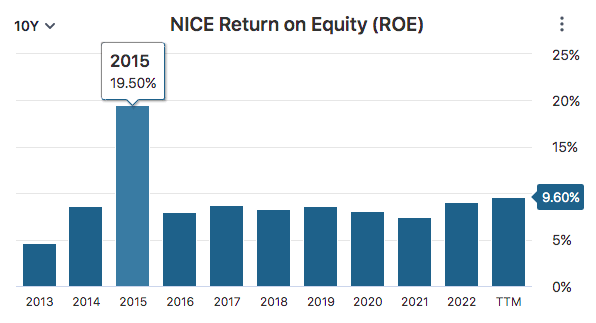

NICE has consistently demonstrated profitability, reflected in its return on equity (ROE) figures. Although the ROE has varied over the years, the company has maintained a solid average 10-year ROE of 9.59%. This consistent profitability showcases NICE's ability to generate returns for its shareholders and efficiently allocate capital.

Data by Stock Analysis

Comparing NICE's average ROE to the sector median ROE, which stands at a mere 0.23%, highlights the company's superior performance within the industry. A high ROE is desirable as it indicates that NICE effectively utilizes shareholder investments to generate profits. By consistently outperforming its peers in this aspect, NICE demonstrates its competitive advantage and ability to create value for its shareholders.

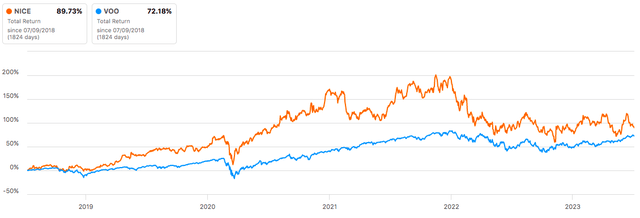

NICE's 5-year total return of 89% stands out when compared to the S&P 500's 5-year total return of 72%. This robust performance underscores the company's ability to deliver long-term value to its investors. NICE's ability to consistently outperform the broader market demonstrates the strength of its business model, effective execution of its strategies, and the trust investors place in the company.

Outlook

NICE's future outlook is poised for significant growth, driven by its focus on leveraging AI-driven CX (customer experience) solutions and expanding its presence in the cloud market. With a track record of strong performance and strategic initiatives, the company is well-positioned for continued success. Let's delve deeper into the future outlook for NICE, highlighting key growth areas and anticipated market expansion:

To begin with, NICE recognizes the tremendous potential of AI-driven CX solutions. With an estimated EPS of 8.46 for the fiscal period ending in December 2023, representing a robust year-over-year growth of 11.00%, the company is set to revolutionize customer experiences using AI technology. By addressing critical operational challenges such as skilled labor, business decision velocity, and mass personalization at scale, NICE aims to drive further growth and solidify its leadership position in the industry. NICE's CEO, Barak Eilam, had the following comments regarding AI during the company's 2023 Q1 earnings call.

AI driven CX has the potential to be a force multiplier for these (CX) employees, empowering them to become three times more effective, and as a result, spend towards the CX technology will grow threefold.

In parallel, NICE's cloud business is on an upward trajectory, surpassing industry norms. The company has achieved an impressive milestone with $1.5 billion in cloud ARR (Annual Recurring Revenue), showcasing its ability to attract a growing number of customers to its cloud solutions. This success underscores NICE's strong reputation and the immense growth potential within the cloud market. As NICE's cloud ARR continues to rise, the company is well-positioned to capture a larger market share and capitalize on the ongoing industry shift towards cloud-based solutions.

However, it's important to recognize that NICE is not immune to certain risks associated with the industry's shift towards cloud-based solutions. One significant risk is the increasing prevalence of Software-as-a-Service (SaaS) delivery models offered not only by NICE but also by its competitors. As more customers adopt cloud offerings, there is a possibility that pricing and overall demand for NICE's on-premises software products and related services could be unfavorably impacted. This scenario could potentially lead to a decrease in revenues and profitability for the company.

It's crucial to acknowledge that while NICE is experiencing growth in its cloud business, there is no guarantee that the revenues generated from this segment will fully offset any potential decline in its on-premises enterprise software business. The ongoing industry shift towards cloud-based solutions presents a risk that NICE needs to navigate and adapt to effectively.

Despite these risks, the CX market offers significant untapped potential for NICE's growth. Anticipated revenue of $2.37 billion for the fiscal period ending in December 2023 reflects an impressive year-over-year growth of 8.48%. NICE aims to seize a larger portion of this market by strategically directing budgets towards technology-driven solutions, particularly in AI-driven CX. Leveraging its broad market reach and purpose-built AI platform, NICE is well-equipped to expand its total addressable market (TAM) and harness the substantial growth potential within the industry.

Moreover, NICE's expansion efforts extend beyond the contact center, enabling the company to provide comprehensive solutions throughout the entire customer journey. By catering to digital and nondigital interactions, as well as human-assisted and consumer-led experiences, NICE is unlocking remarkable growth opportunities. The company's aim is to enhance customer experiences and pursue new avenues for growth, presenting a compelling value proposition to clients.

It is our position that by leveraging AI technology, NICE is well-positioned to address industry challenges, seize new market prospects, and deliver enhanced value to its customers. With a strong foundation for growth and innovation, NICE presents an exciting investment opportunity with the potential for sustained success and shareholder value creation.

Valuation

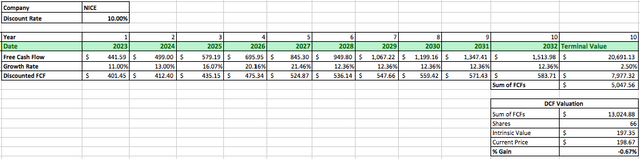

While the future prospects for NICE appear promising, it is crucial for value investors to maintain discipline when considering the price of a stock. Therefore, we will employ the discounted cash flow (DCF) analysis, our preferred method of evaluating a company's value, to determine NICE's true worth. This approach involves calculating the present value of NICE's projected future cash flows to derive its intrinsic value.

Starting with NICE's current free cash flow of $397.83 million, we will apply the following growth rates: an initial growth rate of 11.00% for 2023, 13.00% for 2024, 16.07% for 2025, 20.16% for 2026, and 21.46% for 2027, based on average analyst estimates.

Additionally, we will use a second growth rate of 12.36%. The second growth rate, which applies to years 6 through 10, represents the projected growth beyond the initial five-year period. In this case, we will calculate it based on the average of NICE's 10-year compounded revenue and free cash flow growth rate.

Using a discount rate of 10%, which reflects the long-term return rate of the S&P 500 with dividends reinvested, and a conservative terminal growth rate of 2.5%, we calculate NICE's intrinsic value to be $197.35. Considering the intrinsic value of $197.35, compared to NICE's current market price, the total return is estimated to be -0.67%. This indicates that NICE may currently be priced fairly in the market, offering investors a potential gain.

Takeaway

NICE has demonstrated strong financial performance, with consistent revenue growth and positive free cash flow. The company's strategic focus on AI-driven CX solutions and expansion in the cloud market positions it for future growth. Anticipated growth figures in EPS and revenue reflect its potential to capitalize on the CX market's significant opportunities.

However, the increasing prevalence of SaaS delivery models presents a risk to its on-premises software products. It is important for the company to navigate the industry shift effectively and ensure that revenues generated from its cloud business can compensate for any potential decline in the on-premises enterprise software segment.

Considering NICE's growth opportunities and current valuation, a hold rating on the stock seems appropriate. While the company shows potential for sustained success, it is crucial for value investors to maintain discipline when considering the stock's price.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.