BlackSky Technology: Fundamentals Don't Support Recent Rally

Summary

- Earth observability company BlackSky Technology has surged over the past month.

- I believe this move is due to technical factors rather than underlying strength in the business.

- I expect BSKY shares to sell off in the coming months.

- Looking for a helping hand in the market? Members of Ian's Insider Corner get exclusive ideas and guidance to navigate any climate. Learn More »

da-kuk

BlackSky Technology (NYSE:BKSY) is a geospatial intelligence company which uses both hardware and software analytics to provide solutions to its customers. The company aims to provide services to governmental and commercial clients. It has had more uptake on the government side of the equation thus far.

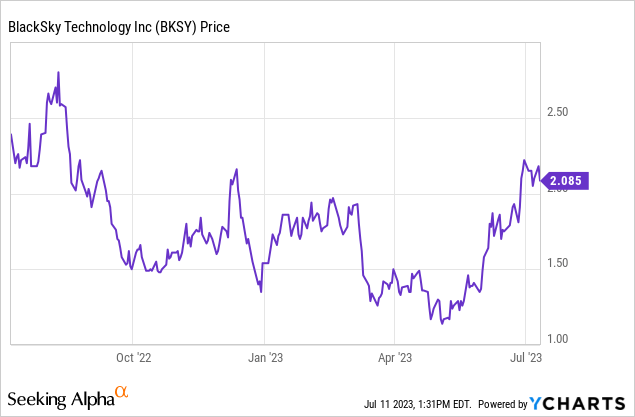

I wrote up BKSY stock last September, saying that shares were too expensive at the $2 mark. That seemed to indeed be the case, with shares subsequently dropping to a low of $1.12. However, amid the powerful rally we've seen in more speculative stocks this summer, BlackSky is now back up above the $2 level:

Has something fundamentally changed with BlackSky to justify the powerful rally over the last six weeks? Or is this another chance for traders to sell the pop and move to the sidelines?

BlackSky's Earnings Don't Show Much Acceleration

The first thing to check when seeing a sharp rally like this is if earnings have meaningfully inflected to the upside. In this case, however, there's not much indication of that.

In fact, BlackSky's Q1 earnings were a disappointment. An EPS loss of 14 cents was a penny worse than expected. Meanwhile, revenues of $18.4 million were well short of expectations; analysts were looking for $20.4 million.

A revenue whiff of that magnitude is generally bad news. But perhaps guidance was better? No, not really. The company guided to a midpoint of $93 million for full-year revenues, which is slightly short of the analyst consensus of $94.2 million. To sum up, this was an earnings miss, a revenue miss, and soft guidance.

The one bright spot is that the company is targeting adjusted EBITDA profitability in Q4 of this year. That would be a positive if achieved. However, adjusted EBITDA profitability is a fairly low bar, as far as metrics go. Particularly in a business with high capital costs (satellites aren't cheap and they depreciate quickly), merely breaking even on an adjusted EBITDA basis isn't all that impressive.

The analyst consensus is projecting that BlackSky will become GAAP EPS profitable in 2025. However, the same analyst consensus forecasts that BlackSky's revenue growth will accelerate from 41% this year to 44% next year and a shocking 52% in 2025. I believe it is highly unlikely that BlackSky's revenue growth will speed up like this off a far larger base. Assuming a more normal revenue growth trend, where deceleration occurs as the business gets larger, it is hard to see BlackSky reaching EPS profitability before 2026.

As a further reminder, BlackSky's revenues grew only 32% year-over-year last quarter, and their guidance was slightly below the prior analyst consensus. As such, consider me skeptical on the 41% full-year 2023 growth target as well. If the whole deck of projections is wrong and BlackSky's revenue growth is more in the high 20s-low 30s range going forward, profitability could still be as much as five years out from here.

To that point, BlackSky's net loss for the first quarter of 2023 was $17.3 million, compared to a net loss of $20.0 million for the same quarter last year. Despite a fairly impressive revenue growth rate, it barely moved the needle in terms of improving the business' underlying profitability. This isn't a total knock against the company; a firm generating 32% year-over-year revenue growth is doing something right. But it still has a long way to go to become sustainable, especially as the company has debt on the balance sheet, limiting its maneuverability going forward.

As mentioned, this is also a highly capital intensive business. The company is guiding to spending $42.5 million on capital expenditures this year. For a company that is currently only generating $75 million or so in annualized revenue, its CAPEX budget will require a great deal of financing compared to the firm's current market cap and revenue base.

Why BlackSky Shares Rallied Recently

So if it's not fundamentals that are driving the rally in BKSY stock, why have shares appreciated so much over the past two months?

I'd argue that it is likely a matter of fund flows. BlackSky was added to the Russell 2000 Index on June 26th. Presumably, some savvy traders did the math on which companies would likely be moving in and out of the index ahead of the scheduled rebalancing and picked up BlackSky shares ahead of the inclusion. This sort of frontrunning is a common and often profitable strategy with index rebalances.

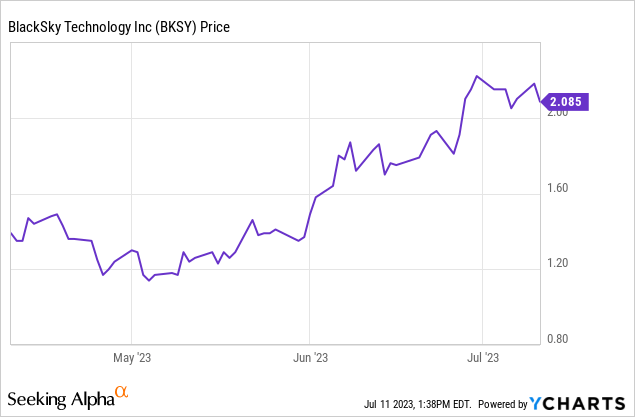

Zooming in on the chart, we can see that BlackSky started to lift off at the beginning of June, and shares hit their near-term top just a couple of days after the Russell 2000 addition had been completed:

For a company with a small market capitalization such as this one, getting added to a bunch of significant index funds can make a huge difference in a firm's short-term share price performance. On top of that, there is notable short interest in BlackSky, with shares as a percentage of float sold short currently topping 5%. A solid catalyst such as index inclusion combined with significant short interest can lead to the sort of dramatic run-up that we've just witnessed in BlackSky shares.

BlackSky Technology Stock Verdict

While short squeezes and passive index flows are great for near-term trading, they don't do much for a company's long-term outlook. Ultimately, BlackSky needs to grow its customer base -- by a large amount -- for the business to deliver attractive economics.

There has been some progress on this front, such as a recently announced $30 million multi-year contract with an unnamed defense sector customer. This is an incrementally positive, albeit modest, step in the right direction.

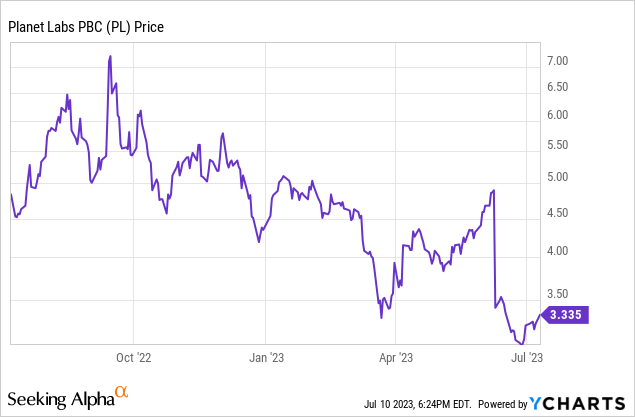

That said, I believe investors may demand more from the company to justify the current valuation once the Russell 2000 inclusion pop wears off. To that point, I'd note that rival Planet Labs (PL) shares collapsed to fresh 52-week lows last month after an earnings report that frankly wasn't all that bad:

As Planet has several positive features, including a strong balance sheet, going for it, I'd be awfully nervous chasing BlackSky shares after a large rally as opposed to looking at Planet near its lows.

I'd also note that in BlackSky's equity raise in March, they issued stock at $1.79 and an associated warrant exercisable at $2.20 per share. Holders can start exercising those warrants six months on from the offering point. It might not be a coincidence that BlackSky's recent rally slowed down as the stock neared that warrant level, as that could serve as a resistance level for the time being.

Ultimately, I believe the Earth observability industry holds a lot of promise, and I intend to have an investment in this area sooner or later. However, we're still in the early days. For a company like BlackSky, I fear that there are several more years of growing pains and potential dilution coming down the pike before the company reaches GAAP profitability and starts to become more stable and predictable.

If you enjoyed this, consider Ian's Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

This article was written by

Ian worked for Kerrisdale, a New York activist hedge fund, for three years, before moving to Latin America to pursue entrepreneurial opportunities there. His Ian's Insider Corner service provides live chat, model portfolios, full access and updates to his "IMF" portfolio, along with a weekly newsletter which expands on these topics.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.