KeyCorp: An Undervalued Regional Bank With 8.5% Dividend Yield

Summary

- KeyCorp gets strong buy rating today.

- Positives are over 8% dividend yield, undervaluation, strong financial condition, price trading well below 200-day average, interest income benefits from high rate environment and macro effects of Fed decisions.

- Risk exposure to uninsured deposits and credit losses is under control and within manageable levels. Over two-thirds of deposits are insured or collateralized.

jetcityimage

Research Brief

Company earnings season is here, and to get ahead of the pack and find an under-covered dividend opportunity in the financial sector today I am covering regional bank KeyCorp (NYSE:KEY), whose Q2 earnings release is coming up in a few weeks on Thursday July 20th.

My prediction for its Q2 results is positive, and below will show why this stock is getting a strong buy rating.

From its company website, Cleveland-based KeyCorp is the parent company of KeyBank, known for its iconic "key" logo. Notable metrics include: $198B in assets, over a thousand branches across 15 states, and solutions in both the consumer & commercial banking segments.

Our Rating Methodology

Our goal is to find value buying opportunities for stocks in the financial & tech sectors, for companies that otherwise have strong financial fundamentals.

We individually rate 5 categories: share price trend, valuation, dividends, financial condition of company, macro factors affecting company.

If we recommend a stock on at least 4 of the 5 categories it gets a buy rating, 3 out of 5 is a hold rating, and less than that is a sell rating.

Share Price Trading Far Below 200 Day Average

At the market open on Monday July 10th, the stock was trading at around $9.55, as shown in the chart below:

KeyCorp - price on July 10 (StreetSmartEdge trading platform)

In the chart above, I am tracking the price vs both the 50 day simple moving average (blue line) and 200 day simple moving average (red line), to follow bullish or bearish price trends as shown by death cross & golden cross formations, with a goal of buying into significant dip opportunities.

I highlighted in yellow my target buying range of $9.50 to $11, so currently the stock is in a buying opportunity I think, while it remains well below its 200 day SMA and around or below the 50 day. In the above case, the 50 day and 200 day have mostly provided resistance since that huge dip in March during the selloff around the time of the Silicon Valley Bank (OTCPK:SIVBQ) failure, and another dip after the Q1 earnings call.

Since I think the Q2 call will be more positive, I want to say this price will turn at least somewhat bullish after that call.

My investing timeframe to hold this stock would be 1 year, looking to exit in July 2023 with a goal of a capital gain of at least 8%, which puts my target sell price range between $10.26 - $11.88. This period allows also for locking in the great dividend yield, which I discuss later. If my thesis on price growth is wrong, I am still getting the over 8% dividend yield in that timeframe just to hold the stock.

Therefore, I am recommending this stock based on current price range.

I welcome your discussion & approach to this topic in the comments section!

Undervalued vs 2 Peers

Based on Seeking Alpha's own valuation metrics, let's talk about this stock's GAAP-based forward price to earnings (P/E) and forward price to book (P/B) ratios, the two metrics I always use. The benchmarks I compare against are the sector averages, looking for stocks below these numbers ideally.

For KeyCorp, its forward P/E of 7.18 is over 21% less than the median for its sector, and over 28% less than its own 5 year average.

Its P/B of 0.72 is almost 25% less than the sector average, and over 37% less than its own 5 year average.

Although you may use other valuation methods as well, my approach to P/E ratios is also shared by CMC Markets, as shown in the following May 2023 discussion on this topic:

A good PE ratio should be lower than its industry peers and the overall market average. As such, investors should compare different stocks within the same sector or across other sectors to gauge whether the PE ratio is low enough to constitute a potential buying opportunity.

So, two regional banks I could use for comparison purposes are Regions Financial (RF), which has a forward P/E of 7.86, and a price to book of 1.05, while Ohio regional Fifth Third Bank (FITB) shows a P/E of 8.13 and P/B of 1.03. KeyCorp easily beats these two peers on these valuation metrics, then.

Hence, I recommend this stock in terms of being undervalued right now.

Dividend Yield Beats its Peers

Next, let's talk about dividends, which was the main metric that grabbed my attention initially. From dividend info on this stock, we see that it currently has a dividend yield of 8.55% as of July 10th.

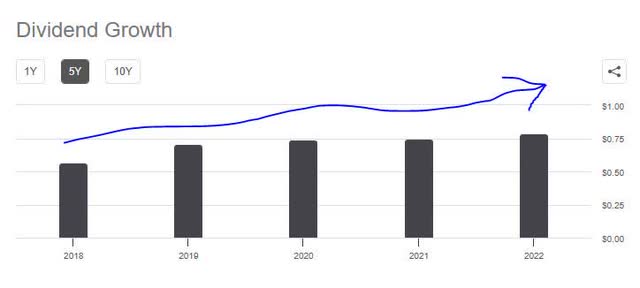

It's dividend of $0.21 per share does not have an ex-date coming up soon, but in looking at its 5 year dividend growth rate it shows positive dividend growth, going from an annual dividend of $0.57 in 2018 to $0.79 in 2022, an over 38% growth, as shown in the chart below:

KeyCorp - 5 year dividend growth (Seeking Alpha)

What about its dividend yield compared to the two peers mentioned earlier?

It beats the dividend yield of Regions which is 4.36%, and also beats the dividend yield of Fifth Third which is 4.95%.

Therefore, I recommend this stock in the category of dividends, and would add it to a portfolio of dividend stocks in the bank sector.

Financial Condition of Company is Healthy

For the purposes of this article, we will use data from the Q1 earnings release and balance sheet info.

Notable items I am looking at are:

A CET1 ratio of 9.1% which is well above Basel III minimum requirements and just slightly less than the 9.4% figure from Q12022.

The company commented that it continued to exceed all 'well-capitalized regulatory benchmarks at March 31, 2023. Key's capital position remained strong in the first quarter of 2023.

The positive sentiment from CEO Chris Gorman:

I remain confident in Key and the long-term outlook for our business. We have a relationship-based business model that will continue to serve our clients and our prospects and deliver value to our shareholders.

A balance sheet showing positive equity going back several years, and an income statement showing positive net income every quarter for the last several years.

I would recommend this stock based on solid company financial condition, taking into account the decline in net income both YoY and QoQ, which appear to be driven by one-time items.

My sentiment also seems to be shared by SA analyst Gen Alpha, who wrote in their April analysis :

KeyCorp's first-quarter results were impacted by one-time items and a more cautious economic outlook, but the underlying performance remains strong. Total loan growth continues to be encouraging and deposits have held up well considering the current banking landscape.

Positive Effect of Macro Factors on this Business

For KeyCorp's business model, which is heavily driven by interest income and interest margins, I will consider the larger macro factor of Fed rate increases over the last year and their impact, but also the forward looking sentiment on rates.

Here is a look at their YoY net interest income growth:

KeyCorp - interest income growth (Seeking Alpha)

As the table shows, both total interest income and net interest income grew significantly YoY, with just the NII figure decreasing QoQ most recently. However, in the first quarter their earnings release also mentioned a net interest margin of 2.47%, and the benefit of a higher rate environment.

According to their earnings release:

net interest income and the net interest margin benefited from higher earning asset balances and higher interest rates, partly offset by higher interest-bearing deposit costs and a shift in funding mix.

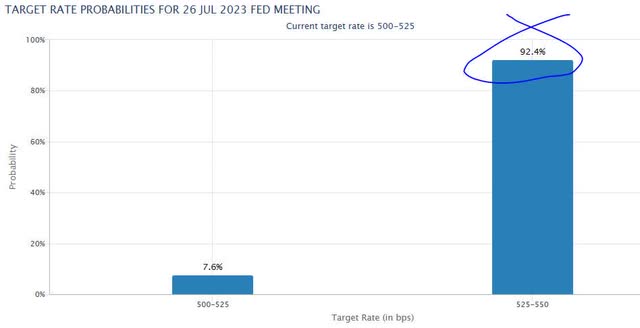

Looking forward, since they have already shown to benefit from rate hikes, and based on sentiment from rate traders surveyed by CME Fedwatch, I think it likely we see another rate hike, which could benefit this bank in Q3.

Consider that there is an over 92% probability sentiment that the Fed will hike again this month:

Rate hike probability (CME Fedwatch)

Because of this, I would recommend a stock like KeyCorp in the category of macro effect on its business being a positive one.

Rating Score

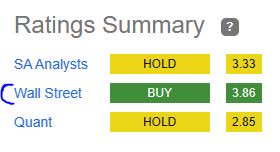

Winning in all 5 of my rating categories, this stock gets a strong buy today. Compared with the consensus from SA analysts, Wall Street, and the SA quant system, my rating is slightly more bullish than Wall Street but significantly more bullish than SA analysts and the quant system:

ratings consensus (Seeking Alpha)

Risks to our Rating Outlook

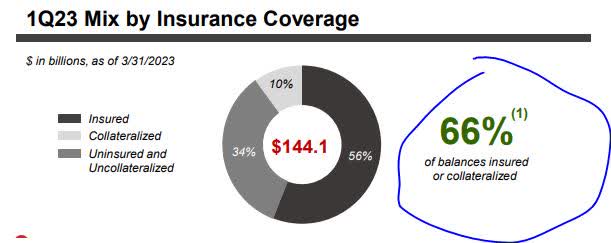

Two risks I identified on this company that could impact my bullish sentiment on its stock, because other investors will be asking the same questions, are exposure to commercial real estate and also exposure to non-FDIC insured deposits, which was a concern raised by the failure of Silicon Valley Bank. That bank, according to data from Axios, had over 93% of deposits uninsured.

Based on its Q1 presentation, KeyCorp has around 34% of deposits uninsured, with 66% FDIC insured or collateralized:

insured vs uninsured deposits (KeyCorp - Q1 presentation)

This tells me that about two-thirds of deposits are covered in some way. I think that is a safe number, especially now that the March bank panic seems to have calmed significantly by now, and rightfully so.

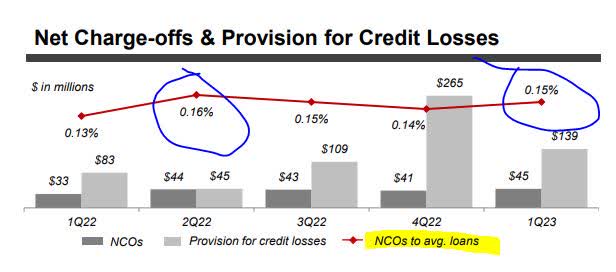

Next, when looking deeper into credit quality, I care about trends in net charge-offs and loan losses so I want to use the following metrics from their Q1 presentation which show that the percent of net charge-offs to avg. loans is only 0.15%, actually slightly lower than the same quarter a year ago:

KeyCorp - net chargeoffs (KeyCorp - q1 presentation)

Additionally, we can see that the provision for credit losses has gone down since the last quarter of 2022.

So, although credit risk is an important factor in analysis, I think this bank has it under control and I expect that to be the case looking forward to the next quarterly result as well.

Analysis Wrap-up

To reiterate, today I am giving KeyCorp a strong buy rating after analyzing its dividends, valuation, current price, financial condition of company, and macro effects that benefit the business. We also discussed the risk of exposure to credit losses and uninsured deposits.

As earnings season heats up on the Street in the next few weeks, this is one regional that I want to keep an eye on and I remain positive about their Q2 figures. I think they could be the "key" to restoring confidence in the regional banks once again, but for now it is an opportunity to buy into the cheap ones that have strong fundamentals & pragmatic risk management.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.