NXG: Interesting Play On Traditional And Renewable Energy While Earning Income

Summary

- Midstream companies have long been good ways to earn an income, but some people believe that they will soon become obsolete.

- That is unlikely to be the case, but there is probably going to be more growth in renewable energy than in the fossil fuel sector.

- NXG NextGen Infrastructure Income Fund invests in a portfolio of both traditional and renewable energy infrastructure companies and applies a layer of leverage to boost the effective yield.

- The NXG closed-end fund boasts an 8.45% yield at the current price, and it appears that this yield is sustainable.

- The fund is currently trading at an incredibly large discount to the net asset value, so the price appears to be reasonable.

- This idea was discussed in more depth with members of my private investing community, Energy Profits in Dividends. Learn More »

Eloi_Omella

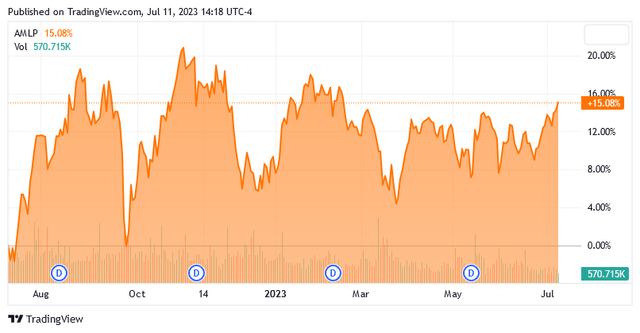

For many years now, master limited partnerships, or MLPs, have been some of the best options available in the market for investors that are seeking income. This may have given them new popularity recently as these entities have been surging over the past year. As we can see here, the Alerian MLP Index (AMLP) is up 15.08% over the past year:

In numerous previous articles, I have pointed out that investors are desperate for additional sources of income today to help them overcome the ravages of inflation and maintain their standard of living. This strong performance serves as evidence of that fact considering that crude oil and natural gas prices are both down significantly over the same period. This is a departure from the past trend of midstream companies typically correlating with energy prices.

With that said midstream master limited partnerships may prove problematic for some investors. In particular, these companies are all connected to the fossil fuel sector and we have all been hearing about how fossil fuels will become obsolete before too long. While that is highly unlikely, as I have pointed out in several previous articles, it is certainly true that fossil fuel usage will not grow at nearly the same rate as renewable energy. There are some renewable master limited partnerships in the market, but their yields are substantially lower than midstream partnerships. For example, Brookfield Renewable Partners (BEP) yields 4.66% and NextEra Energy Partners (NEP) yields 5.82% today. This is nowhere close to the 8.65% yield of the Alerian MLP Index, nor is it as high as several of the midstream partnerships that we regularly discuss here at Energy Profits in Dividends.

There is a way to gain exposure to renewable energy companies, and traditional midstream companies, and still receive a very high yield that can provide for your income needs. This is to purchase shares of a closed-end fund that specializes in investing its assets with the intent of profiting from the energy transition. These funds normally contain both traditional and renewable master limited partnerships and are capable of employing certain strategies that effectively boost the yields of their portfolios. In addition, these funds are structured as corporations, which allows them to be easily included in a retirement account without any adverse consequences at tax time.

In this article, we will discuss the NXG NextGen Infrastructure Income Fund (NYSE:NXG), which is one closed-end fund that falls into this category. As of the time of writing, this fund boasts an impressive 8.45% yield, which is much higher than can be obtained from any renewable energy company and is easily in line with the best midstream companies in the sector. I have discussed this fund before, but that was a few months ago so naturally a great many things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund's financial condition. Let us investigate and see if this fund could be a good addition to your portfolio today.

About The Fund

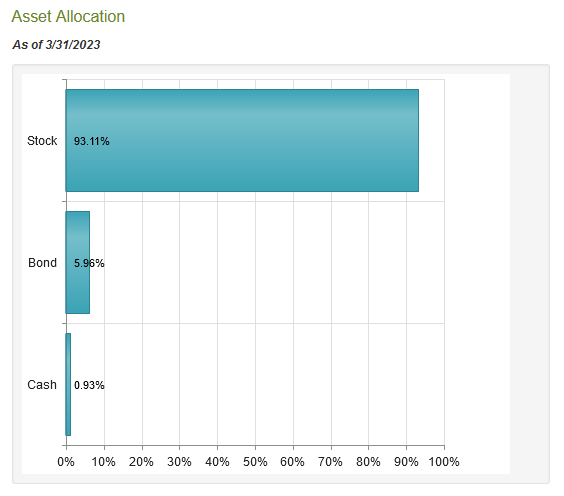

According to the fund's webpage, the NXG NextGen Infrastructure Income Fund has the stated objective of providing a high level of total return. This is not surprising considering that this is an equity closed-end fund. As we can see here, 93.11% of the fund is invested in common equity, with the remainder in bonds and cash:

CEFConnect

Although this fund does have some bonds, it is still an equity closed-end fund, as 5.96% exposure to bonds is not really enough to affect the characteristics or the performance of the portfolio. It might be enough to provide the fund with a bit of extra income, but in truth, most bonds are going to have a lower yield than master limited partnerships. Overall, this should be considered a common equity fund.

By its very nature, common equity is a total return vehicle so the fund's objective should not be especially surprising. After all, investors typically purchase common equity to receive an income in the form of dividends and distributions paid by the issuing company. They also want to benefit from capital gains as the issuing company grows and prospers with the passage of time. In the case of master limited partnerships, the majority of the returns will be in the form of distributions paid to the investors. This is because these companies are generally low-growth entities that pay out the majority of their cash flows to the investors in order to provide a competitive return with other things in the market. This fund recognizes that fact and specifically states that it is aiming to deliver the majority of its total return in the form of current income. The webpage describes the fund's strategy thusly,

The fund's objective is to seek high total return with an emphasis on current income. There can be no assurance that the fund's objective will be achieved. Under normal market conditions, the fund will invest at least 80% of its net assets, plus any borrowings for investment purposes, in a portfolio of equity and debt securities of infrastructure companies, including: (i) energy infrastructure companies, (ii) industrial infrastructure companies, (iii) sustainable infrastructure companies, and (iv) technology and communication infrastructure companies.

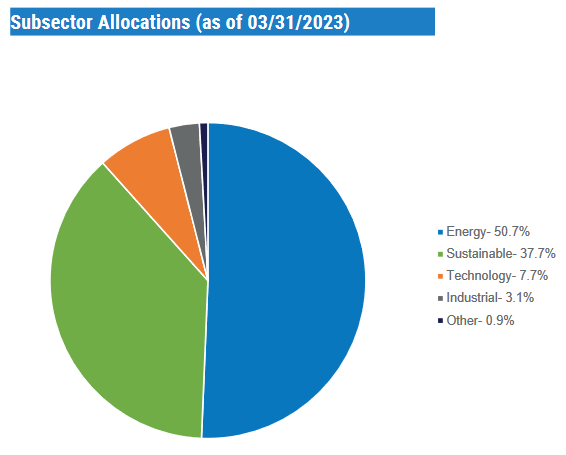

Despite this definition, the fund is mostly invested in traditional energy and renewable energy companies. We can see this quite clearly by looking at the fund's fact sheet that is downloadable from its webpage. This document includes this handy chart:

Fund Fact Sheet

As is clearly visible, energy infrastructure companies and sustainable infrastructure companies account for 88.4% of the fund's total assets. Thus, while the fund claims that it invests in several different types of infrastructure companies, we can clearly see that the thesis about this being a midstream and renewable play is valid.

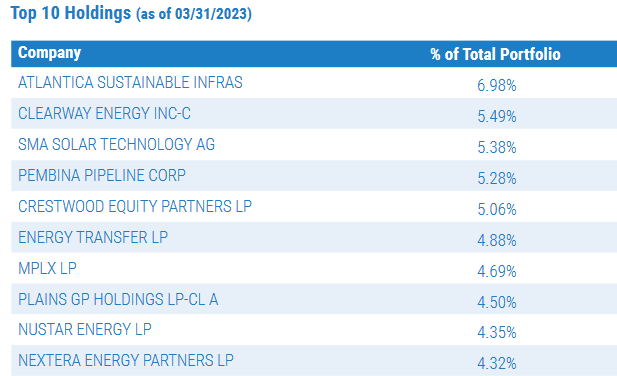

As my regular readers are no doubt well aware, I have devoted a considerable amount of time and effort to discussing midstream partnerships, corporations, and renewable master limited partnerships here at Energy Profits in Dividends and on Seeking Alpha. As such, most of the largest positions in the fund will be familiar to many readers. Here they are:

Fund Fact Sheet

I have discussed several of these companies before, but admittedly not all of them. The three that I have never discussed are Atlantica Sustainable Infrastructure (AY), Clearway Energy (CWEN), and SMA Solar Technology (OTCPK:SMTGF). I have discussed all the rest of these companies numerous times, with the exception of Plains GP Holdings (PAGP). However, Plains GP Holdings is just the general partner of Plains All American Pipeline (PAA), which I have discussed quite frequently. As such, most of these companies will be relatively familiar.

One curious thing that we note above is that the fund's website states that no more than 25% of the fund's assets will be invested in master limited partnerships. However, six of the ten companies shown in the chart above are structured as master limited partnerships:

- Crestwood Equity Partners (CEQP).

- Energy Transfer (ET).

- MPLX (MPLX).

- Plains GP Holdings.

- NuStar Energy (NS).

- NextEra Energy Partners.

These six companies alone account for 27.8% of the fund's assets, according to the fact sheet. Thus, even if the fund had no other master limited partnerships in its portfolio, it would still exceed the 25% of assets limit stated on the webpage. I am not exactly sure what this means, particularly as the fund's most recent fact sheet makes no similar statement about the proportion of assets that will be invested in master limited partnerships. Usually, funds like this simply structure themselves as corporations so that they can invest however they wish. This one does not specifically state that it is a corporation, but its annual report says that 38.7% of the fund was invested in master limited partnerships at the start of the year. Thus, it is fair to assume that the fund does indeed have a corporate structure and that its webpage is wrong about the percentage of assets that can be invested in master limited partnerships.

There have been two major changes since the last time that we discussed this fund. They are that Enbridge (ENB) and New Fortress Energy (NFE) were removed from the largest positions in the fund. The two companies that replaced them are SMA Solar Technology and NextEra Energy Partners. There were also numerous weighting changes, but these can be at least partially explained by one company outperforming another in the market. This is not necessarily a sign that the fund is actively trading securities to change its investments, but that does not mean that it is not doing this.

The reason that this is important is that it costs money to trade stocks or other assets and these expenses are billed directly to the shareholders of the fund. This creates a drag on the fund's performance and makes the job of the fund's managers much more difficult. This is because management needs to earn sufficiently high returns to cover these expenses and still have enough left over the satisfy the shareholders.

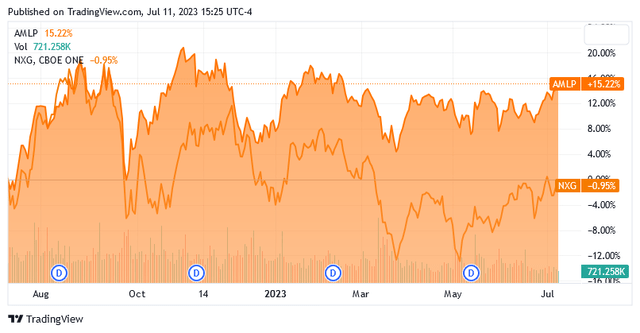

This is a task that very few management teams are able to achieve on a consistent basis. As such, most actively managed funds end up underperforming their benchmark indices over time. This one admittedly does not have a perfect benchmark index, but it has substantially underperformed the Alerian MLP Index over the past twelve months:

As each of these assets has a very similar yield, we cannot count on that to close the gap. Investors would have clearly been better off with the index fund. However, the Alerian MLP Index does not include renewable energy companies nor does it include midstream corporations. The NXG NextGen Infrastructure Income Fund has both so it enjoys substantial diversification benefits. However, the vast performance differential here will almost certainly cause some people to question if the renewables exposure is worth the underperformance, including myself.

As I have pointed out before, the global demand for both crude oil and natural gas is likely to grow over the coming years due to various emerging markets experiencing rapid economic growth and the need for natural gas as a supplement to unreliable and intermittent wind and solar power. Thus, the traditional midstream sector can probably deliver some growth and we do not desperately need renewable exposure to get a respectable total return. The NXG fund did manage to deliver a positive total return over the period when we take its distribution into account though, so it is not a total loss.

Leverage

In the introduction to this article, I stated that closed-end funds such as the NXG NextGen Infrastructure Income Fund have the ability to employ certain strategies that allow them to boost their yields over those of the underlying assets. One of these strategies is the use of leverage. Basically, the fund borrows money and then uses that borrowed money to purchase the common equity of master limited partnerships and infrastructure corporations. As long as the purchased assets have higher total returns than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case. It is important to note though that this strategy is not nearly as effective today with the federal funds rate at 5% as it was eighteen months ago when the federal funds rate was 0%.

The use of debt in this fashion is a double-edged sword, however, because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since this would expose us to too much risk. I generally do not like to see a fund's leverage exceed a third as a percentage of its total assets for this reason. Fortunately, the NXG NextGen Infrastructure Income Fund currently satisfies this requirement. As of the time of writing, the fund's levered assets comprise 24.68% of its portfolio. This is a reasonable level that represents a fairly nice balance between risk and reward. Overall, we should not have to worry too much here.

Distribution Analysis

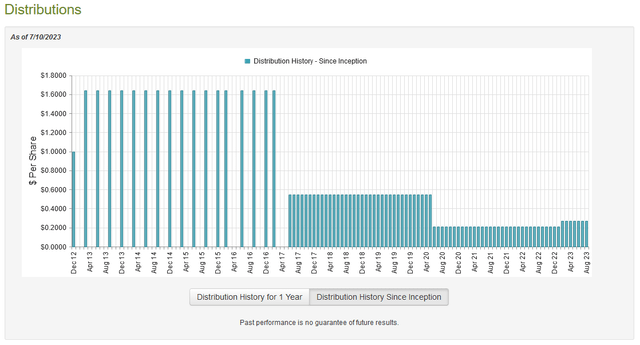

As stated earlier in this article, the primary objective of the NXG NextGen Infrastructure Income Fund is to provide its investors with a high level of total return. However, the fund has an emphasis on providing its total returns through direct payments to its investors and it invests primarily in master limited partnerships and infrastructure companies. One of the characteristics of these companies is that they typically have very high yields due to a combination of relatively low growth rates and paying out most of their cash flows to their investors. This fund also applies a layer of leverage on top of these securities to artificially boost their yields beyond that of the underlying assets. Thus, we can assume that the fund itself will have a very high yield. This is certainly the case as the fund pays a monthly distribution of $0.27 per share ($3.24 per share annually), which gives it an 8.45% yield at the current price. Unfortunately, the fund has not been especially consistent with its distribution over the years, as it slashed the payout fairly dramatically back in 2020:

It is not surprising to see a distribution cut in 2020, however. This was a period of great turmoil for the traditional energy industry as crude oil prices hit the lowest level that we have seen in over a generation. This prompted many upstream companies to cut back on their production plans. While the cash flows of most midstream companies held up just fine, we still saw them shelve their own growth projects and some even reduced their distributions to focus on reducing debt and strengthening their balance sheets. The market prices of many of these companies fell, too, which would have caused realized or unrealized losses for the fund.

The fund was naturally forced to cut its distribution since it had to preserve capital and had less money coming in. It is nice to see that the fund has been making an effort to restore its distribution to the prior levels, although it obviously still has a long way to go.

However, the fund's history is not especially important for anyone buying today. After all, someone purchasing the fund today will receive the current distribution at the current yield and is not especially hurt by the events of the past. The important thing for anyone buying the fund today is its ability to maintain the current distribution. Let us investigate its ability to do that.

Unfortunately, we do not have an especially recent document to use for the purposes of our analysis. The fund's most recent financial report corresponds to the full-year period that ended on November 30, 2022. As such, this document will not provide us with any insight into the fund's performance over the first half of this year. That is a shame because this was a period during which natural gas prices fell severely but the overall market exhibited some strength. However, most of 2022 was something of a rollercoaster ride for the entire energy sector so it is nice to at least see how the fund handled that situation.

During the full-year period, the NXG NextGen Infrastructure Income Fund received $8,843,371 in dividends and distributions (net of foreign withholding taxes) along with $1,046,561 in interest from the assets in its portfolio. However, a substantial proportion of this came from master limited partnerships so it is not considered to be income for tax purposes. The fund reported a total investment income of $3,767,962 during the period. It paid its expenses out of this amount, which left it with a $160,138 net investment loss.

That is obviously not enough to cover any distributions, but the fund still paid out $6,656,226 in distributions to its shareholders. At first glance, this could be concerning as the fund clearly had insufficient net investment income to cover its distributions.

However, the fund does have other ways through which it can obtain the money that it needs to cover the distributions. As already mentioned, it received a significant amount of money from the various master limited partnerships in its portfolio that are not considered to be income for tax purposes, but it can obviously pay this money out to its shareholders. It also might have had capital gains during the period, as most energy infrastructure funds did. Fortunately, this was all the case as the fund reported net realized gains of $11,907,876 during the period, which was partially offset by $1,194,557 net unrealized losses. The fund's assets went up by $3,896,955 after accounting for all inflows and outflows though, so it clearly covered its distributions during the period. It also had some money left over that could be carried forward. Thus, it appears as though the fund is probably fine financially and should be able to sustain its distributions going forward.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the NXG NextGen Infrastructure Income Fund, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of all the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can obtain them at a price that is less than the net asset value. This is because such a scenario implies that we are acquiring the fund's assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of July 10, 2023 (the most recent date for which data is available as of the time of writing), the NXG NextGen Infrastructure Income Fund had a net asset value of $48.57 per share but the assets currently trade for $38.52 per share.

This gives the fund a 20.69% discount on net asset value. That is an incredibly large discount to net asset value, but it is not as good as the 21.58% discount that the shares have had on average over the past month. Still, this is a large enough discount that a purchase is certainly reasonable today.

Conclusion

In conclusion, the NXG NextGen Infrastructure Income Fund offers an interesting way to gain exposure to both the emerging renewable and traditional energy sectors, while earning a very high yield. The fund's attractive 8.45% yield appears to be sustainable but unfortunately, it has underperformed the Alerian MLP Index over the past twelve months. The index delivers a comparable yield but lacks the renewable energy sector. The fund's website also appears to be wrong about the fund's exposure to master limited partnerships. Regardless, the combination of old and new energy sources, a high yield, and an attractive valuation may be appealing to some investors.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPLX, CEQP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was originally published to Energy Profits in Dividends on July 11, 2023. Subscribers to the service have had since that time to act on it.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

NXG in share price.

Thank you, my friend.