Aalberts N.V.: A Fairly Valued Dutch Dividend Gem With Plenty Of Growth Ahead

Summary

- Aalberts N.V., a Dutch industrial technology company, is a high-quality business with a safe dividend yield of almost 3% and decent growth prospects, making it a good addition to a dividend investment portfolio.

- Despite a drop in share price, the company's long-term fundamentals remain strong and it is well-positioned to participate in relevant megatrends such as urbanisation, energy scarcity, and digitalisation.

- Aalberts has a disciplined capital allocation strategy and a track record of sustainable growth, investing in organic growth and M&A to strengthen its market position and portfolio.

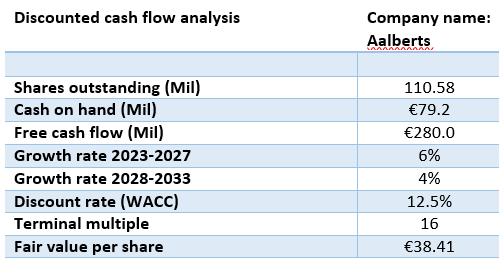

- Based on discounted cash flow analysis, the fair value of Aalberts is €38.41, which is 2.7% undervalued.

eyesfoto

Investment thesis

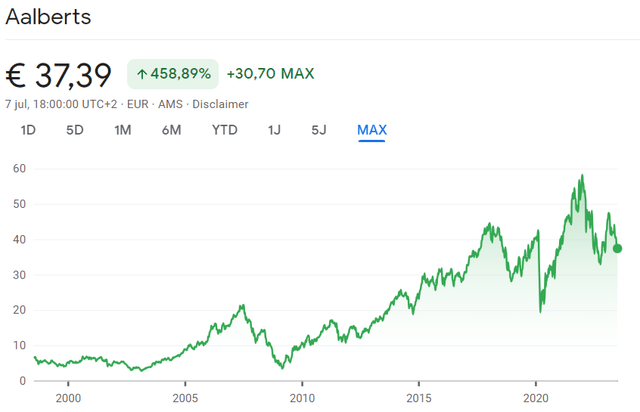

As a dividend growth investor I tend to look for high-quality companies. In my opinion these companies need to have a long-term mind-set and disciplined capital allocation. This is an effective way to create long-term value and the ability to sustainably raising the dividend. Sometimes I search for smaller, unknown businesses that are more under the radar. One of these businesses is Aalberts N.V. (OTCPK:AALBF). The company has been around for a long time and has created a lot of shareholder value, especially after the financial crisis of 2008.

On the 1st of December 2021, the stock was available at a price of €58.26 per share. Since then the stock price went down significantly to €37.39 per share. Despite the drop in share price, the long-term fundamentals of the company didn't change. On the contrary, Aalberts has set itself in a good position to participate in a couple of relevant megatrends. In this article I am going to explain why this could be a great moment to add Aalberts to your own dividend investment portfolio.

Company overview

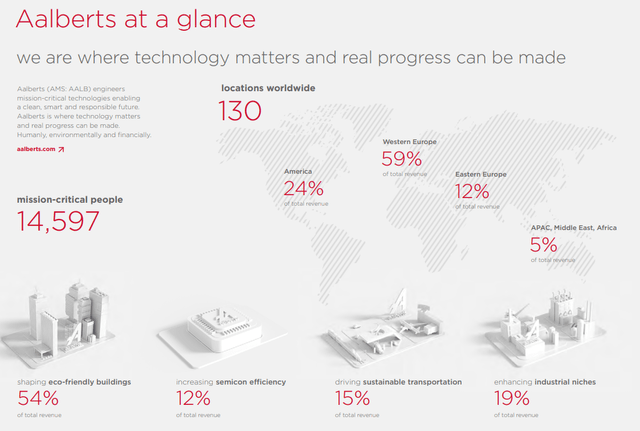

Aalberts (OTCPK:AALBF) is a Dutch industrial technology company with a market cap of €4.14 billion and is headquartered in Utrecht. The stock is trading at Euronext Amsterdam and on the OTC markets. I highly suggest to buy it at the Amsterdam stock exchange for liquidity reasons. The company has been founded in 1975 as Mifa, which turned into Aalberts N.V. in 1981.

In the Netherlands there is almost no house or building without products from Aalberts. The total revenue of Aalberts is distributed across different continents. At the moment Europe is by far their largest market, which accounts for 71% of their total revenue. Their business activities can be divided into four different segments:

- Eco-friendly buildings (54% of revenue)

- Semicon efficiency (12%)

- Sustainable transportation ( 15%)

- Industrial niches (19%)

Revenue distribution (Aalberts annual report 2022)

As this is a relatively unknown company I would like to take a bit of your time to tell about all the business activities of Aalberts.

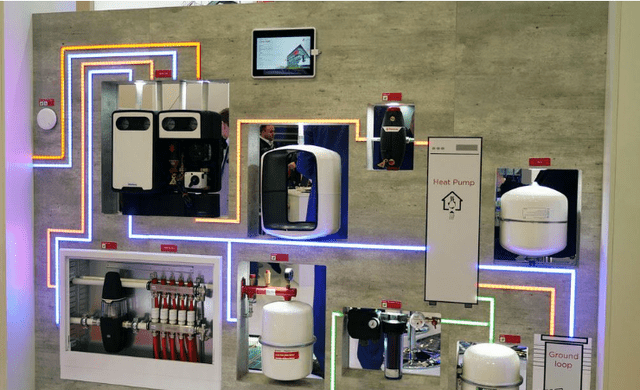

Hydronic flow control

This segment is effectively a collaboration between Comap and Flamco.

Comap has been involved in distribution and emitter technology. Their products help managing water and energy through its thermal and sanitary products, which will create more comfort in buildings. Think about:

- Surface heating & cooling control systems.

- Thermal & sanitary connection systems.

- Smart thermostats & radiator heads.

Flamco has been involved in the development, production and sale of high-quality components for use in HVAC (heating ventilation and airconditioning) systems.

Their largest end markets are large residential, domestic, commercial and industrial buildings. Aalberts Hydronic flow control is aiming to make their products more user-friendly and energy-efficient. This should lead to less energy consumption and more eco-friendly buildings.

Hydronic Flow Control technology (Aalberts annual report 2022)

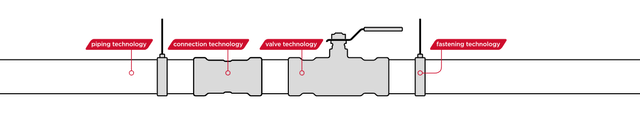

Integrated piping systems

This mainly involves piping systems to transport and control liquids and gas. Think of products like fittings, valves, pipes and fasteners.

Aalberts states that their products are easy to specify and install, which will safe preparation- and installation time. The company has won a BESA national award in 2022 for "product innovation of the year" for its ProFlow valve. The combine properties of the valve results in time savings up to 70% compared to other market alternatives.

End markets: Eco-friendly buildings and industrial niches.

Piping system (Aalberts investor relations)

Advanced mechatronics

Aalberts is also adding value in the high-tech sector. In this segment Aalberts helps their high-tech customers with manufacturing challenges. They offer a unique combination of different products, which gives Aalberts a competitive advantage. Think about:

- large- and accurate machining

- Environmental control

- Motion and fluid control

- Mechatronic subsystems

A good example is the semiconductor equipment market, were they have a partnership with some large international players such as ASML Holding N.V. (ASML). It is very important that the effect of the environment, for example vibration, is reduced to a minimal amount. The technology of Aalberts can improve functionality, performance and consistency of semiconductor equipment. They also offer vacuum chambers, machine frames and other related products.

End markets: semicon efficiency and industrial niches.

Surface technologies

Products in automotive and aerospace industry need to withstand wear, friction and corrosion. Aalberts is producing durable coatings and heat treatments in these segments.

End markets: industrial niches and sustainable transportation

Megatrends

Looking at the business of Aalberts it seems they are in a good position to participate in the following megatrends:

1. Urbanisation

There will be a high demand for more energy efficient products in new build and the renovation of buildings. In 2022, Aalberts contributed to the realization of approximately one million installations operated on renewable energy. I also think that growth can accelerate the next few years because of governmental support programmes.

2. Energy scarcity

Aalberts is offering a lot of products that improve energy efficiency when it comes to eco-friendly buildings and sustainable transportation. The company also makes materials more lightweight and durable. Aalberts provides surface treatments for electrical car parts and lightweight battery housing for e-bikes. They also enable ships to decrease fuel consumption with high-tech propeller sensors.

3. Digitalisation

Aalberts is part of the high-tech infrastructure with their advanced megatronic solutions segment, especially in the semiconductor space. In the long-term the demand for semiconductor equipment will be high based on growth in computer logic, e-mobility developments, internet of things, global investment in new semiconductor fabs and 5G.

Aalberts megatrends (Aalberts annual report 2022)

The Aalberts playbook and capital allocation

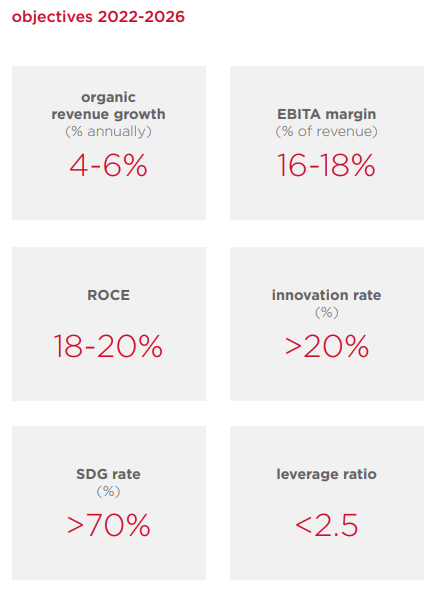

I really like the way how clear Aalberts is about their capital allocation strategy and their financial goals.

Financial objectives (Aalberts annual report 2022)

Their disciplined capital allocation should lead to a ROCE between the 18-20%. At the moment the ROCE is 16.1%, which is also decent.

Aalberts ROCE (Aalberts annual report 2022)

Investing in organic growth and M&A

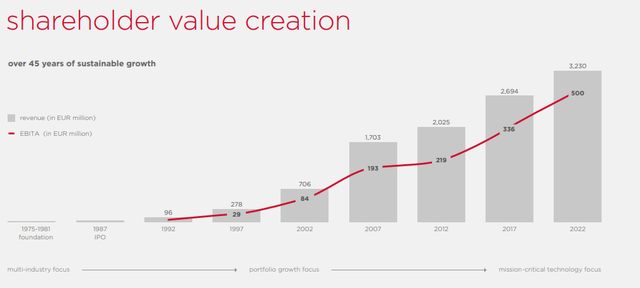

Aalberts has a fabulous track record of at least 45 years of sustainable growth and it doesn't look like that it's going to stop soon.

Shareholder creation value trend (Aalberts annual report 2022)

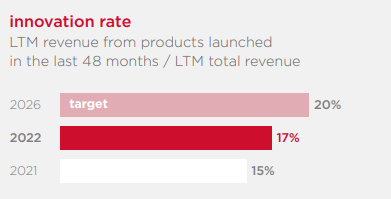

Aalberts uses a significant portion of their money to strengthening their market positions, innovation and portfolio optimization will be one of their top priorities. Aalberts is planning to spend at least 5% of total revenue into innovation and they're also going to measure if that particular investment will materialize into decent profits, which they call the innovation rate. In fiscal year 2022 the innovation rate was 17% and they have initiated a goal of 20% by the end of 2026. I really like that way of analyzing the success of an investment and I think this really fits the mindset of a durable business.

Innovation rate (Aalberts annual report 2022)

The company is also investing money in M&A and is normally doing a couple of acquisitions every year. Normally I am not a big fan of this , because research shows us that there is quite some risks involved and often leads to value destruction. Based on the numbers the failure rate of acquisitions is between the 70-90% range. Aalberts on the other hand has an amazing track-record and in the Netherlands the company is sometimes called "the king of acquisitions". In fiscal year 2022 they optimized their portfolio with the acquisitions of ISEL, KML (advanced megatronics segment) and UWS (hydronic flow control segment). The acquired companies are relatively small, for example, UWS had a total of 90 employees and a total of €25 million in annual revenue. Aalberts is really critical in their analysis for potential acquisitions and the main goal is always to strengthen their already existing portfolio. I like this way of thinking and it helps to company at staying focused on their qualities and prevents diworsification. They are also doing some divestments in order to achieve portfolio optimization and make the business more lean and mean.

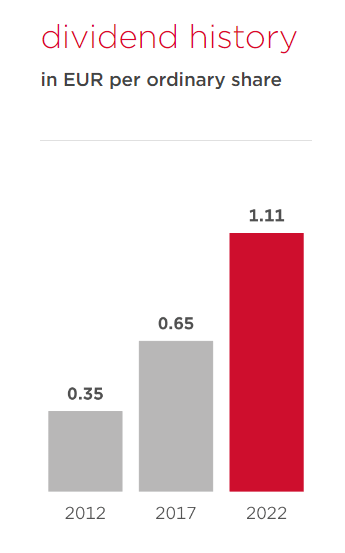

Dividend

Because of my dividend growth investment strategy, an analysis without mentioning the dividend would be incomplete.

Aalberts has a solid dividend history. At the moment Aalberts pays a dividend of €1.11 per share annually and with a share price of €37.39 this comes down to a dividend yield of 2.97%. The total amount has been paid on the 3rd of July this year. The current yield is higher than its 5-year average of 2.09%. The dividend growth for the last 10 years is quite impressive. The dividend grew from €0.35 in fiscal year 2012 to €1.11 in 2022. This comes down to a CAGR of 12% per year. Combining the current starting yield and the 10-year dividend growth Aalberts looks like a great compounder.

Aalberts dividend history (Aalberts annual report 2022)

Looking at the dividend growth year-by-year, Aalberts is not your typical dividend growth stock. In their reports they don't speak about a clear dividend growth policy, but the company was well on its way to achieve a dividend growth track record for almost 10 years. In 2021 Aalberts slashed its dividend by 25% from €0.80 to €0.60 per share. With this, the company did not deviate from their policy of paying out approximately 30% of the net profit to shareholders. In 2022 the company had a really good year and they increased the dividend again from €0.60 to €1.01 per share, which is an increase of 68%. On top of that Aalberts paid a special dividend of €0.64 per share due to a positive surprise in EBITA. So maybe it wasn't necessary to cut the dividend in the first place. It is likely that Aalberts will generate more profit so the long term dividend growth pattern will continue. Because of its dividend policy of paying 30% of their net profit and the cyclical nature of the business it wouldn't surprise me if there will be some dividend cuts during the way up.

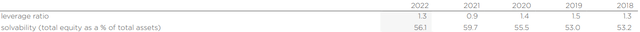

Balance sheet

At the moment the balance sheet of Aalberts looks healthy. The company has a net debt to EBITDA ratio of 1.3. This is in line with its own 5 year average and well under its benchmark of 2.5. This is a good sign, because this allows Aalberts to be financially flexible when good opportunities arise. There is also no need to bring further down debt.

Net debt to EBITDA ratio (Aalberts annual report 2022)

Trading update & short-term risk

The latest trading update was published on the 24th of May. In the first four months this year Aalberts has realized 6.4% organic revenue growth compared to their previous year. This is in line with their own financial goals. The order book was also 4% better than last year and they´re seeing the first results of their inventory reduction plans.

The eco-friendly buildings segment is facing some headwinds due to destocking of their wholesale customers. Also in new build projects they see postponements. This could be a short term earnings headwind for Aalberts, because this is by far the largest segment of the company. How big the impact this impact will be on the earnings is still unknown. However, the renovation activities of heating and cooling systems are continuing at a nice pace.

The semicon segment is the strongest growing segment of Aalberts and is continuing to do so. Aalberts is further increasing their manufacturing capacity and the acquisitions of ISEL and KML are doing well so far. Sustainable transportation is also doing well. The demand for precision manufactured parts is increasing due to new developments in e-mobility, lightweight materials, sustainability and reshoring. For example, the request for valve applications for hydrogen increased strongly. Aalberts has also stated that the results in the aerospace and marine segment were pretty good, because of new sustainable system innovations.

In the industrial niches they have a record order book in several industry niches. Their business in North America performed very well when it comes to industrial valves.

On the 27th of July before the start of trading at the Amsterdam stock exchange, Aalberts will present the numbers in detail.

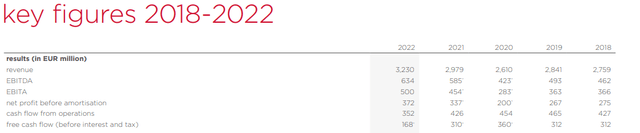

Valuation

To determine if the current share price is a good reflection of the company's fair value, discounted cash flow analysis has been used. Aalberts is a cyclical company, therefore it is always hard to put things in a linear perspective. In fiscal year 2022, Aalberts reported a free cash flow of €168 million, which is significantly lower compared to the free cash flow of previous years. This was due to an increase CAPEX cash out of €189 Million. In my opinion it would not be fair to take the €168 million for the analysis. For the calculations I used a free cash flow of €280 million.

Aalberts financial metrics (Aalberts annual report 2022)

I used a 5 year growth rate of 6%, which is in my opinion fairly conservative and for the 5 years thereafter I used a 4% because it's harder to make accurate assumptions over longer periods of time.

At the moment Aalberts is trading at a PE ratio of 13. For the analysis I use a terminal multiple of 16, because I think this is a high-quality business and Aalberts has some decent growth perspectives. The PE of 16 is also lower than its own median PE of 18. I used a discount rate of 12.5%, because I want this as an annual return on investment and to add some extra margin of safety.

This comes to a fair value of €38.41 per share. At the moment Aalberts is trading at a share price of €37.39, which means the stock is 2.7% undervalued.

Discounted cash flow analysis (Google spreadsheets)

For comparison, analysts are giving Aalberts an average price target of €53.79 per share.

Conclusion

Based on financial health, future growth prospects and disciplined capital allocation I think Aalberts can be called a high-quality business. The company has a safe dividend yield of almost 3%, combine this with some decent dividend growth and it should compound nicely. However, if you don't like irregular dividend payments this investment isn't one for you. From a risk reward perspective, I give Aalberts a "BUY" rating. From a valuation point of view the company is in my opinion slightly undervalued. Of course there is a possibility that the share price will be lower due to economic headwinds or a further slowdown in the eco-friendly building segment. If this is the case I would be more than happy to buy some more shares of Aalberts at lower prices.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AALBF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.