KONE: Market Expectations Are Tempered, And Valuations Appear Fair

Summary

- KONE, a Finnish elevator manufacturer, is facing challenges due to its significant exposure to the China market, which is currently experiencing low demand for new equipment. This is impacting the company's overall earnings growth.

- Current growth opportunities are limited to winning maintenance contracts. Although this provides a stable and recurring revenue stream which is positive, its growth impact has its limitations.

- Valuations are not stretched but with no positive catalyst in the short to medium-term, we rate the shares as neutral.

Teka77

Investment thesis

KONE's (OTCPK:KNYJF) outsized exposure to China will mean overall earnings growth will experience limitations until demand returns in that region. Current valuations are not stretched, and market expectations are muted which may provide a buying opportunity. However, with no hurry to buy we rate the shares as neutral.

Quick primer

KONE is a Finnish elevator manufacturer with global operations, competing against the market leader Otis Worldwide (OTIS), and other peers such as Schindler (OTC:SHLRF), TK Elevator (unlisted), and local manufacturers in China and Asia such as Hyundai Elevator (OTCPK:HYEVF) and Fujitec (OTCPK:FJTCY). A singular characteristic of KONE's is its significant exposure to the China market, which comprised 31% of the total (page 50) FY12/2022 sales (the US was the second largest market at 17%).

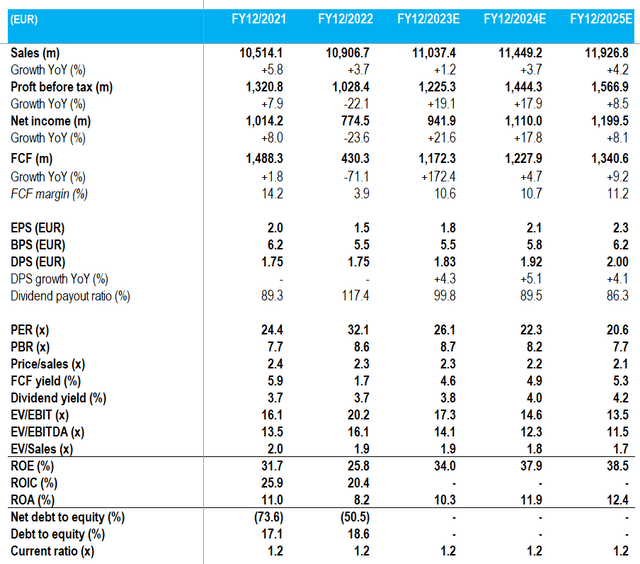

Key financials with consensus forecasts

Key financials with consensus forecasts (Refinitiv)

The objectives of this report

With a slowing global economy and rising financing costs that act as headwinds to the construction industry, derivative businesses such as elevator OEMs are finding it increasingly difficult to generate earnings growth in a highly competitive industry. Options appear to be 1) low-balling prices to sell new equipment, 2) aiming to win modernization work for old installations, and 3) winning maintenance contracts of old stock from independent maintenance service companies. We will assess how well KONE is doing regarding these opportunities.

A mixed picture in the short-term

Q1 FY12/2023 results confirmed that on a global basis, the appetite for new equipment remains low with sales growth driven by maintenance and modernization demand (page 12), registering total sales growth at 4.7% YoY. On a regional basis, there is clear weakness in the APAC (Asia Pacific) market with sales declining 4.2% YoY under comparable FX rates - China continues to see negative growth YoY. Although this is a very simplified view, it is difficult to foresee a scenario where KONE can drive earnings without China being a key recovery component - the outlook for earnings is negative as Q1 FY12/2023 orders fell 6.6% YoY (page 11), with the APAC region again being highlighted as a key weakness.

Demand for maintenance and modernization appears to be healthy in EMEA and the Americas, and this improves the sales mix and boosts profitability (page 13) with adjusted EBIT margins rising from 8.0% to 9.5% YoY. Although this is positive, we have some concerns over its sustainability as independent service operators are retaliating with more cost-efficient offerings to maintain their market share. In tough economic times, building owners may opt for the cheaper option to keep down running costs and postpone any premium OEM services. However, KONE has been able to raise pricing overall, and customer retention does not appear to be a major concern.

An area that remains a positive secular driver for all OEMs is elevator modernization, as old stock will need to be renewed or replaced (usually around after 20 years) providing a runway for long-term earnings. Whilst it is usually best suited for the original manufacturer to conduct modernization, there are growing instances where cheaper substitute services are being offered by non-OEM players with non-proprietary equipment which will have to be managed.

Whilst some of these market themes are general and not KONE-specific, we feel that the OEM business model is ultimately based on increasing its installed base and then benefiting from high-margin maintenance business in the medium term. The current business environment is clearly not conducive to this. KONE management believes that China's demand for new equipment will recover from FY12/2024 - the market seems to have hit bottom in Q4 FY12/2022, but we do not see any evidence of a V-shaped recovery in the making.

Valuation

The elevator OEM business is attractive in its predictability of earnings. Global urbanization continues driving the need for multi-story housing for both residential and commercial use. The growing aging stock of elevators will need to be continually modernized, and maintenance services are lawfully mandated in most key markets. Operating in an oligopoly that comprises four key global players, companies such as KONE deserve to trade at a premium.

On current consensus forecasts (please see the Key financials table above), we see that the market expects high teen earnings growth for FY12/2023 and FY12/2024, driven primarily by maintenance demand. The shares are trading on PER FY12/2024 22.3x, which is not a hugely demanding multiple and in line with key peers Otis Worldwide at 24.0x and Schindler at 24.8x. The free cash flow yield for FY12/2024 is 4.9% - we would view it as a suitable yield for a business with predictable recurring earnings and stable operating cash flows.

The dividend yield for FY12/2023 is 3.8%, which is higher than its peers Otis at 1.6% and Schindler at 2.2%. However, on an absolute basis, we do not see this as a standalone reason to buy the shares.

Risks

We believe that the key risk for KONE is continued negative growth for new equipment sales in China. As its key geographic market, the lack of demand will be difficult to offset with growth in EMEA and America, dampening any earnings recovery profile. Recent data points continue to point to a weak real estate sector, with figures disclosed in May 2023 highlighting continued weakness in the sector, particularly in lower-tier cities and private developer financing projects. The consensus view appears to be that the property sector could be a multi-year growth drag for China.

Conversely, if the company experiences a demand recovery YoY in the latter stages of H2 FY12/2023, this raises earnings expectations significantly for the medium term with KONE's core market showing signs of renewed demand. Continued urbanization and increasing high-rise single-person properties will remain positive themes in China for elevator demand, and there is also scope for major demand for maintenance - back in 2016 it was said that only a quarter of Chinese elevators are serviced by the large OEMs, so there is a large addressable market to target.

Conclusion

Q1 FY12/2023 results confirmed continued difficulties in China, and the business model continues to pivot toward winning maintenance and modernization contracts. Whilst growth prospects are limited, we believe current valuations have priced in low growth expectations, and downside risk is limited. KONE remains a high-quality business with predictable earnings and stable free cash flow generation, but with no positive catalyst in the short to medium-term, we rate the shares as neutral.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.