UDR Looks Nice For Income Investors

Summary

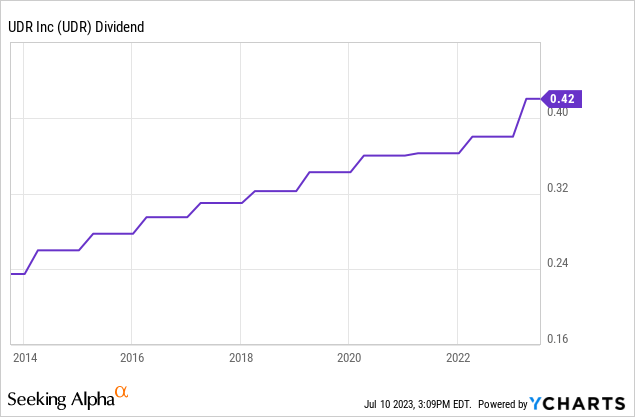

- UDR, a real estate company that manages, buys, sells, develops, and renovates apartments, has a strong history of dividend growth, making it an attractive option for income-oriented investors.

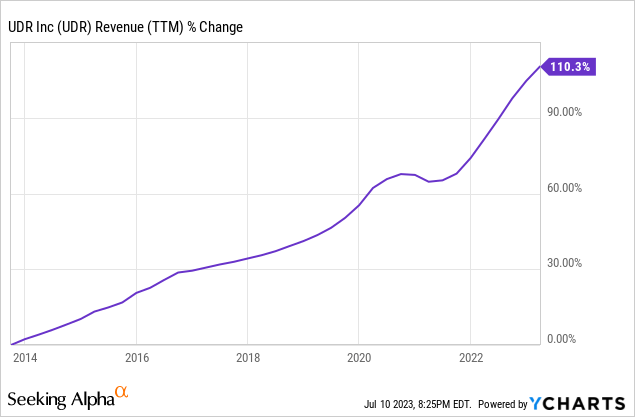

- The company has successfully taken advantage of market trends to grow its revenues and profits, with 55% to 110% revenue growth in the last 5-10 years, respectively.

- Despite a recent dip in performance due to rising interest rates, UDR's strong management, history of dividend hikes, and reasonable valuation make it a potential buying opportunity for the long term.

ewg3D/iStock via Getty Images

UDR (NYSE:UDR) is a real estate company that focuses on multi-family apartments. The company manages, buys, sells, develops or renovates apartments within the US and the company currently owns or manages close to 60k apartment units. The company is classified as a REIT, so it distributes almost all of its income in dividends. I believe this REIT is a great stock for income-oriented investors, especially those looking for dividend growth, given its history and track record of performance.

In the last decade, the company raised dividends every year with average compounded dividend growth of 6.5%. Also, it has been paying a dividend for 202 quarters which is a little over 50 years even though there have been some dividend cuts in the past, but the general direction of dividends has been mostly up over the years. UDR's management seems highly committed to raising dividends for the foreseeable future.

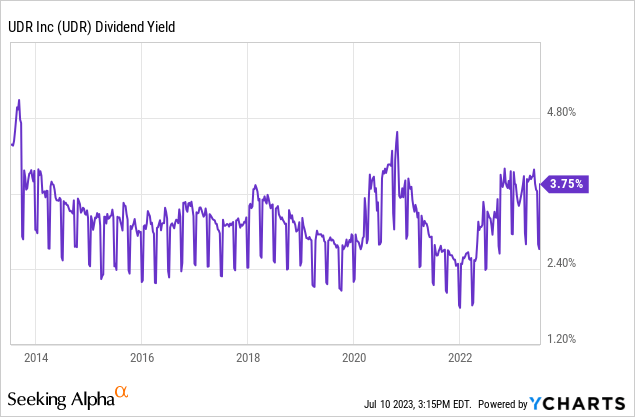

The stock's current dividend yield is close to 3.8% which is on the higher end of the range we've seen in the last decade. In the last 10 years, UDR's dividend yield mostly ranged between 2% and 4% with a few exceptions that fell out of this range for brief periods of time such as when the yield briefly touched 4.8% back in 2014 or in 2020 or when it dipped below 2% in early 2022, but those didn't last long. We can expect the stock's dividend yield to be around the 3-4% range in the long run. Since the current yield is on the higher end of this range, this could be a good opportunity to initiate a position in this stock.

Multi-family apartments are a unique business because they can thrive in different environments if they are well-managed. For example, when the housing market is strong, apartments that are well-managed can benefit from it because they can charge a higher rent. This is also true when inflation is elevated. On the other hand, apartments can also take advantage when housing markets are weak if they are well-managed and well-capitalized because they can buy out their competition for cheap and increase their portfolio size. Also, when the housing market is weak and people are reluctant to buy houses, they are more likely to rent while waiting for the housing market to improve. We must keep emphasizing the importance of management though because if a REIT has a bad management not only can they not take advantage of these trends, but they might actually put their company in trouble by making the wrong moves.

One good example is how UDR took advantage of the low rate environment a couple of years ago to upgrade a large number of its units and started developing new units, which are now contributing to the company's profit growth. It's very tricky for multi-family apartment companies to upgrade their apartments and turn it into additional profits. Many of them fail to do this because they either spend too much on updates and renovations or they fail to convert this into higher rent prices, but UDR seems to be good at this so far. The company's management is good at identifying those opportunities to be able to tell where they can get the most "bang" for their invested "buck".

Since REITs legally have to distribute at least 90% of their net income to investors in dividends, they can put very little money back into their business and this limits their growth rate. This is why they have to be very strategic and creative in order to find ways to grow their revenues and profits without investing too much money. This is particularly difficult to do because real estate is a capital-intensive business and buildings need a lot of maintenance and upgrades. Many REITs have to rely heavily on the prime location of their properties in order to boost their income. If a REIT has apartments in a highly desirable location, they can increase their rents at a healthy rate, which would provide growth for investors without spending too much capital. UDR is nicely positioned with most of its apartments being in desirable locations on the west coast, the east coast and the sun belt.

In the last 5 years, UDR saw its revenues grow by 55% and in the last 10 years the company's revenues grew by 110%. A significant portion of this growth came from rent increases. In the last few years, we've seen elevated inflation levels, which were partially caused by wage increases and also drove further wage increases since many industries found themselves suffering from worker shortages and competition for labor intensified. As many of UDR's apartments are located in or near major business locations with some of the biggest wage increases such as Seattle, Miami, Dallas, and San Diego, the company had a lot of flexibility to raise its prices in recent years.

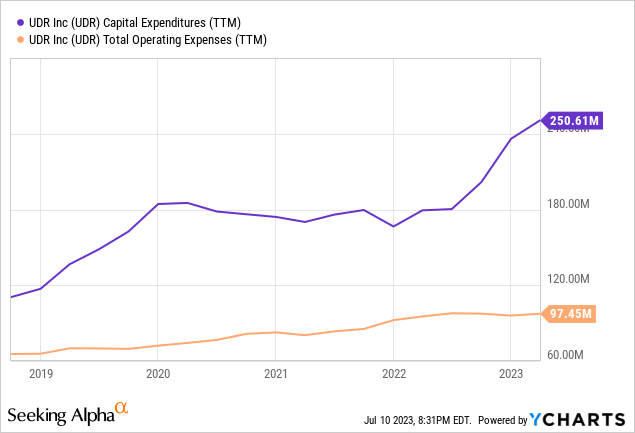

This inflation also resulted in the company spending more money on its expenses, though. In the last 5 years, UDR's capital expenditures rose by 120% and its operating expenses rose by 56%. The first might be partially due to inflation and partially due to the company's increased investments, but the rise in operating expenses is probably more due to the effects of inflation.

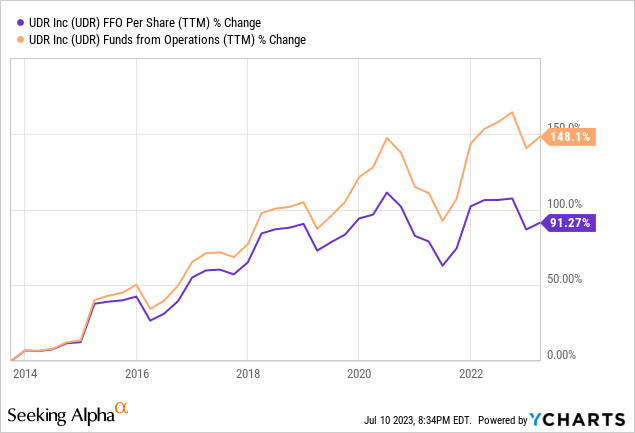

In the last 10 years we've seen UDR's fund from operations rise by 148%, but only a portion of this growth translated into FFO per share, more specifically 91%. This brings us to another reality about how REITs operate. Since REITs have to distribute virtually all of their profits to investors, they have to dilute their shareholders to fund growth from time to time.

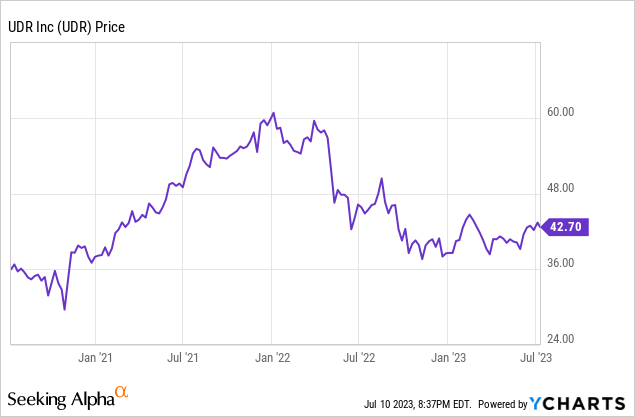

Since the beginning of 2022, many REITs have been underperforming because of rising interest rates, and UDR is no exception. The company's stock is down significantly since January 2022, but this could be seen as a buying opportunity for long-term investors, especially those focused on income and more specifically those focused on dividend growth.

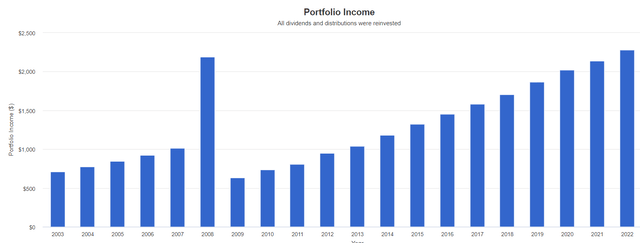

If you had bought $10k worth of UDR 20 years ago, held until now while reinvesting your dividends, your annual income would have grown to $2,300 by the end of last year, which represents a yield of 23% on your original investment. Keep in mind that this would keep growing in the future as well as long as the company continued its dividend growth policy. Your total compounded annual growth would have been 9.65% during this period, even with the sharp drop experienced by the stock since January 2022. The stock's 20-year long-term compounded average growth rate was actually an impressive 12.43% from 2002 to 2022 and $10k invested in 2002 would have turned into $106k in 2022 before last year's crash started.

UDR dividend growth history with reinvestments (Portfolio Visualizer)

Last year's bear market was a great buying opportunity to buy stocks in many sectors but REITs are still in a bear market which might mean that perhaps a few years later we will look at these days and say that it was a great buying opportunity.

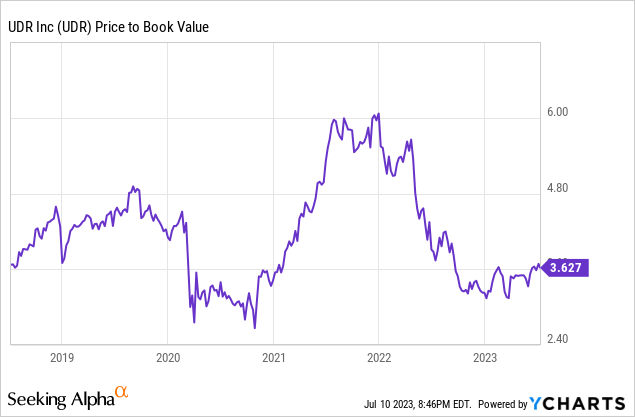

UDR is currently selling for 3.62 times its book value. This may look like premium pricing, but it's actually closer to the lower end of its P/B range for the last 5 years. In the last 5 years, UDR's price-to-book value ranged from 2.5 to 6 with the average being 4.2, so the current valuation is on the lower side.

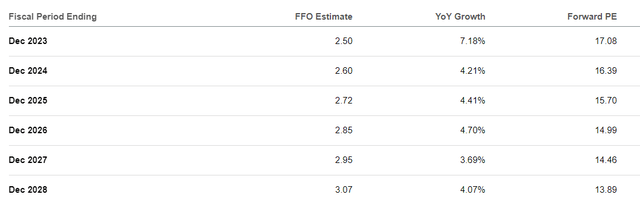

Analysts expect the company to generate $2.50 per share this year in FFO, followed by $2.60 next year, $2.72 in 2025 and so on. This would allow the company to not only easily cover its current annual dividend of $1.68, but also give it some room for potential future dividend hikes. The company's future growth rate should be averaging 4-5% assuming an inflation rate of 2-3% but possibly more if the inflation rate stays elevated for longer. The current earnings estimates also give the company a forward P/FFO ratio of 17 for this year, 16 for next year, and 15 for 2025. While it's not "dirt cheap" it is within a reasonable range considering how pricey some sectors of the market are right now.

UDR analyst estimates (Seeking Alpha)

The dip in REITs that started in January 2022 created some good buying opportunities for dividend-focused investors. While I don't know if this is the bottom and there are probably at least 2 more rate hikes coming, I'd like to think that we are much closer to the bottom than we are to the top. UDR has a good history of paying and hiking dividends, a strong management team, a decent dividend yield (though still below the 5.25% rate offered by treasuries), and a reasonable valuation. If not buying from here, I'd at least keep the stock on my watchlist because it's worth taking a look.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UDR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.