Aurora Cannabis: Fighting To Survive

Summary

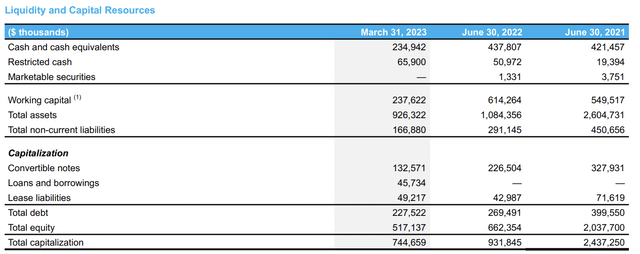

- Aurora's total cash position of C$300 million as of the end of its fiscal 2023 third quarter formed a material liquidity base that should help the company survive.

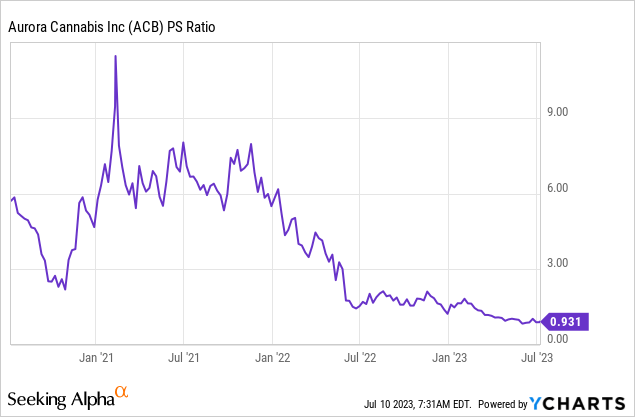

- A price to sales multiple of 0.93x highlights just how much investor sentiment has collapsed over the last year. A recovery of this presents possible upside to be captured.

- The company is now guiding for free cash outflows to improve further with another reverse stock split likely required this year.

Jasmina Stokic

The cannabis industry has seen back-to-back turbulent years that have sapped investor confidence and left companies reeling under the weight of heavy debt and cash burn. Aurora Cannabis (NASDAQ:ACB) would realize a cash burn from operations of C$15.1 million against this backdrop for its fiscal 2023 third quarter ending on March 31, 2023. The company's price-to-sales multiple has declined markedly as shareholder hopes for growth turn to dreams for survival. There's a lot at stake here with Aurora sporting cash and equivalents of C$235 million as of the end of its third quarter. This was down C$195 million from C$430 million in the year-ago quarter. However, Aurora is now guiding for positive free cash flow by the end of the calendar year 2024, identifying another C$40 million in annualized cost efficiencies to achieve this.

Bulls would be right to flag that the company's sales multiple has dropped further to new record lows at 0.93x and this presents a possible upside to be captured if sentiment improves. Whether Aurora will become a buy is dependent on to what extent the company's attempt to rebuild a lower cost base lower will drive what the market wants; survival. This is important as capital markets look set to remain disrupted on the back of the Fed's comments of a possible two more rate hikes this year. Critically, the market appetite for loss-making companies in what remains a broadly speculative industry will depend on the direction of the Fed funds rate.

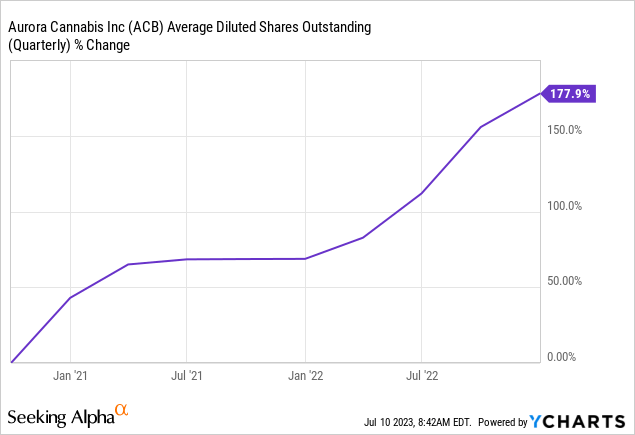

Dilution Is The Enemy Of Upside

Aurora Cannabis Fiscal 2023 Third Quarter MD&A

Aurora does have access to another C$65.9 million in restricted cash to expand its total liquidity position to C$300 million as of the end of its third quarter. Convertible notes at C$132.5 million formed 58% of its total debt as of the end of the third quarter and the company was very active with buying back the senior notes during the quarter. Aurora closed out roughly US$50.9 million of these senior notes during the third quarter for a US$46 million cash consideration and through the issue of 6,354,529 common shares to settle a further US$4 million principal of this debt. Aurora also issued another 4,650,088 common shares through its now ceased 2021 at-the-market offering program. This allowed the company to raise US$3.6 million, then another US$1.4 million post-period end through the issue of another 2,145,350 common shares.

Is A Recovery Possible This Year?

Dilution now forms a core barrier to the growth of the common's stock price with shares outstanding up a material 178% over the last three years. Further stock sales will be difficult against a stock price that has fallen by 40% since the start of 2023 and is currently trading hands at less than the Nasdaq's minimum listing standard. Aurora's current market cap at US$207 million now means any further stock sales will have a comparatively more dilutive impact against a total debt position of C$227.5 million. The upside here comes from Aurora's rebuilding of its cost base.

Aurora Cannabis Fiscal 2023 Third Quarter MD&A

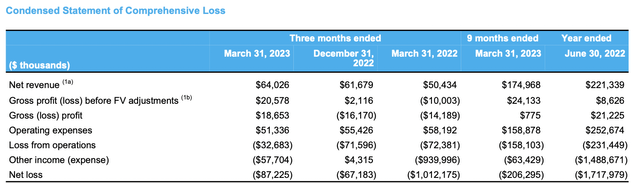

Aurora brought in net revenue of C$64 million, a growth of 27% year-over-year from $50.4 million. Critically, a gross profit of C$20.58 million during the quarter was a material improvement from a loss of C$14 million in the year-ago quarter. Management flagged that this was driven by the strength of their medical cannabis segment which brought in revenue of C$38 million during the quarter.

Operating expenses dipped by C$6.86 million to C$51.3 million during the quarter, with the decline being led by efforts to keep SG&A expenses below the company's target of C$30 million per quarter. However, this figure excluded C$11 million of restructuring costs. Further, Aurora bulls would also highlight that cash burn from operations of C$15.1 million can be adjusted down to C$13 million with C$2.1 million of nonrecurring termination costs being realized during the quarter. With capital expenditure of C$3.6 million during the third quarter, the company's future quarterly free cash outflows likely face an upper cap of C$16.6 million.

Management stated during their earnings call that they aim to reduce quarterly cash burn from operations by a further C$1 million through fiscal 2024 by holding quarterly maintenance CapEx roughly at $2 million per quarter. Crucially, assuming the company's future earnings reports simply reflect the recent third quarter, Aurora would have a cash runway of at least 18 quarters. This is their current C$300 million liquidity position divided by third-quarter free cash outflow. Further debt repayments would radically slim this runway but the risk of a near-term filing is low due to the significant liquidity position which works to be around 145% of Aurora's market cap. The company is a hold against this.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.