Investing In Brookline Bancorp: Balancing Caution And Opportunity

Summary

- Brookline Bank's acquisition of PCSB at the start of the year led to a drop in net income by $22.1 million from the prior quarter due to substantial expenses.

- Despite challenges, Brookline maintains a strong financial footing with a well-capitalized status, a $240 million capital buffer above required standards, and consistent dividend payouts.

- Brookline's stock is potentially undervalued with a P/E ratio well below its historical average; however, its growth and momentum are underperforming compared to the rest of the financial sector.

Hero Images Inc

Thesis

This article analyzes Brookline Bancorp, Inc. (NASDAQ:BRKL) an American bank holding company with diverse banking offerings. After an eventful first quarter marked by acquisitions and financial challenges, Brookline remains strong capital-wise while continuing its tradition of consistent dividend payouts. Unfortunately, however, an underperforming share price and growth, rising credit loss provisions, and decreasing deposit base present significant challenges moving forward; even though its stock seems undervalued based on historical P/E ratio alone; such challenges and potential risks call for a cautious investment approach to be taken.

Company Overview

Brookline Bancorp, Inc., is an American bank holding entity for Brookline Bank offering a multi-dimensional approach to banking, spanning commercial, business, and retail sectors. Its diversified customer base encompasses corporate clients, municipalities, and individual consumers.

A key component of their financial architecture is their deposit products, which embody demand checking, NOW, money market, and savings accounts. Examining their loan portfolio reveals a primary focus on first mortgage loans, secured by a mix of commercial, multi-family, and residential real estate properties. They further extend their reach by granting loans to business entities through commercial lines of credit and servicing condominium associations.

Brookline's Financial Canvas

When we look back at Brookline's first quarter of the year, it painted a financial tableau both intricate and intense, featuring an assortment of standout events, ongoing trends, and the fallout from the end-of-quarter failures of SVB and Signature Bank.

The acquisition of PCSB Financial at the beginning of the year was a major game-changer. It brought in a substantial $21.4 million in singular expenses (see data below), contributing to an overall drop in net income by $22.1 million from the prior quarter.

Brookline Bancorp's Q1 Investor Presentation

The impact of this event was compounded by a decrease in net interest margins and a rise in the provision for credit losses. Even though revenues saw an uptick of $6 million from Q4, the cost of funding put a squeeze on net interest margin, consequently restricting the overall contribution from asset growth. The PCSB acquisition also played a significant part in the increase of costs by $11.7 million, including a non-cash charge of $1.8 million for core deposit intangible amortization.

Nevertheless, if we put aside the one-time items linked to the PCSB acquisition, operating income holds strong at $23.3 million. And although the net interest margin slipped 45 basis points to 3.36%, interest-earning assets did manage to grow a bit over $2 billion in the quarter as yields ticked up by 15 basis points. A glance at the balance sheet reveals a growth story primarily driven by the PCSB deal, resulting in total deposits surging by $1.9 billion and loans by $1.6 billion.

The company also rose to the challenge of heightened concerns about FDIC insurance following the collapses of SVB and Signature Banks. While these incidents didn't significantly tilt Brookline's balance, they did prompt a proactive communication strategy to soothe existing and potential customers regarding the safety of their deposits.

Despite the hurdles, Brookline's financial footing seems firm. The company boasts a well-capitalized status, outpacing regulatory benchmarks, and comfortably maintains a $240 million capital buffer above these required standards. Even with a negative mark-to-market hit of $52.7 million on the investment portfolio, Brookline would still possess close to $200 million in excess capital over the well-capitalized thresholds.

Lastly, the board stayed the course on the quarterly dividend, maintaining it at $0.135 per share, with an estimated annualized yield of 5.5%. So, despite an eventful quarter filled with unique incidents and challenges, Brookline stands steadfast, balancing its robust capital position with customer communication and growth initiatives.

Performance

Brookline's medium-term (past seven-and-a-half year) ride has not been smooth sailing. To begin with, its stock price has plummeted since 2016 from USD 11.50 to USD 8.65 (at time of analysis), representing an almost 25% decline - certainly not ideal conditions for any investor. This has resulted in an annualized return on rate (ROR) without dividends of -3.72%, markedly underperforming the S&P 500 which has generated a robust 10.78% return(see data below).

Fast Graphs

Brookline currently boasts an annual compound growth rate of just 0.50% when measured against the S&P's impressive 12.05%, making this investment option far from attractive to me. But all isn't lost: Brookline does offer diversification through dividends as an asset class that may help buffer some losses and provide opportunities.

And that appears to be the silver lining: dividends. Despite the challenging circumstances, BRKL has demonstrated an impressive commitment to its shareholders by maintaining consistent dividend payouts. Their average growth rate over the past seven years stands at 5.68%, and the compound growth rate is a comparable 5.60%.

Valuation

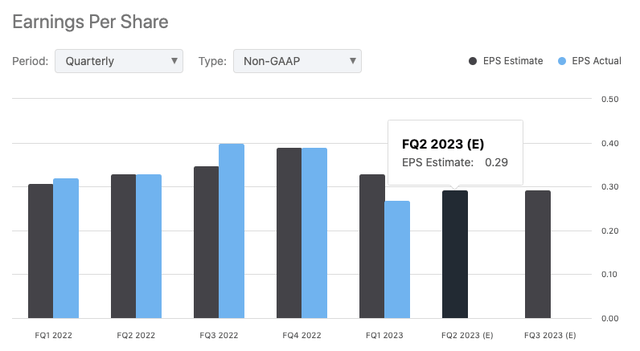

Brookline's Blended Price to Earnings (P/E) ratio, at 7.24x, is trading well below its historical average P/E of 15.85x. That's quite the divergence, which implies that the market may be undervaluing this banking stock (see chart below).

Fast Graphs

Now, let's move on to the growth rate with Adjusted (operating) earnings are growing at a rate of 6.34%. It's not going to blow anyone out of the water, but it's respectable for a bank, which tend to be more conservative with their growth strategies (more on BRKL's growth story relative to its peers below in "Risks & Headwinds").

The significant disparity between BRKL's current P/E and its normal P/E, the strong dividend yield, and the respectable earnings growth rate, all seem to point to one direction. The market seems to be missing something here. We're looking at a potentially undervalued financial powerhouse that could deliver strong returns for the discerning investor. However, given the high yield and low P/E, I'd suggest a cautious approach.

Risks & Headwinds

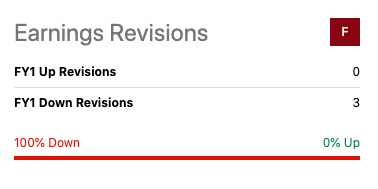

Currently, and to put it bluntly, BRKL's momentum and growth are not only underperforming but actively declining compared to the rest of the financial sector (see data below). Digging deeper, BRKL's 1-year price performance is down a staggering 44.36%, more than twice the sector median decline of 17.61%. As we move to growth, the story only gets more disconcerting. BRKL's EPS Diluted Growth Year-over-Year (YoY) is down by a jaw-dropping 20.21% compared to the sector median of -2.08%.

Seeking Alpha

Moreover, their Return on Equity (ROE) figures aren't any more encouraging. They are declining YoY and are predicted to continue falling. It's hard to overstate how troubling this is; the company isn't generating the returns one would typically expect from their equity investments. Again, the D+ grades are relative to the financial sector, and frankly, they're well below par.

When looking at the credit loss provisions, the bank is setting aside a larger pool of funds to cover potential loan defaults, a move that could be symptomatic of an anticipated rise in non-performing loans. In simple terms, which we'll hopefully get more color on in their upcoming Q2, Brookline may be bracing for more customers failing to meet their repayment obligations.

Next, the bank's net interest margin, a vital measure of lending profitability, has experienced a contraction, down 45 basis points to 3.36%. Rising funding costs and the decision to maintain higher on-balance sheet liquidity are the chief contributors to this decline. In a scenario where interest rates are ascending, this could exert additional pressure on the bank's margins.

On the deposit front, Brookline seems to be grappling with a shrinkage, a development that can pose challenges for its liquidity status and its capacity to underwrite new loans. The recent unfortunate incidents at SVB and Signature Banks might have sparked apprehensions among depositors, although there's no significant fallout so far. But in the volatile world of banking, perceptions matter.

Finally, turning our attention to the investment portfolio, Brookline's market-linked investments show a negative mark-to-market. Though this doesn't currently impinge on regulatory capital calculations, it's not a scenario to ignore. Market volatility could potentially exacerbate this negative mark, posing risk to the bank's investments. Even though the direct impact on regulatory capital may not be apparent now, significant market fluctuations can affect the overall financial health of the bank.

Final Takeaway

Brookline will be reporting its Q2 2023 towards the end of this month (July 26) so we'll be able to get more insight on how things have been going. With that said, if management sentiment is any indication, I wouldn't expect anything that'll wow us. For example, in their Q1 meeting concerning the outlook on fees, CFO Carlson bluntly stated:

It’s a volatile number is the best I can say. And right now, I don’t think we have a lot in the pipeline.

To which CEO Perrault quickly added:

....And with activity down the way that it is, it’s not likely to be as impressive as it’s been the past few quarters."

Seeking Alpha

Seeking Alpha

Moreover, if the previous quarter's EPS miss is any indication, we'll be lucky to get a result that's in line with expectations. Therefore, given the evidence, I would rate Brookline Bancorp as a "hold." While the bank is currently dealing with challenges, such as declining share price, underperformance in growth, and potential risks in the form of higher credit loss provisions and shrinking deposit base, it maintains a robust capital position and consistent dividend payout, which signal resilience. The stock is also trading below its historical P/E ratio, suggesting possible undervaluation, yet the company's lackluster performance and potential headwinds urge a cautious approach. So, I suggest holding onto BRKL stock while monitoring the bank's actions to mitigate current and future risks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.