Duke Energy Is Still Worth Buying

Summary

- Duke Energy plans to achieve net-zero carbon emissions by 2050. They plan on investing $56B into renewable energy and grid infrastructure over the next decade.

- Since 2013 annual revenue has risen by 27.83%, while operating income has risen by 23.48%.

- When faced with the uncertainty of the future energy market, Duke Energy's increasingly diverse portfolio gives them an adaptability advantage.

- Although it's currently trading at a PEGY that marks the company as overvalued, it's also currently trading at a price to earnings ratio that is slightly below its historical average.

- I currently rate Duke Energy as a Buy.

Davis Turner

Thesis

When the Inflation Reduction Act passed, it began providing sustained tailwinds for utility providers. These are exactly the type of tailwinds I look for when searching for long-term investments. After looking over the sector, several players jumped out at me as being more forward looking than most of their competition.

Duke Energy Corporation (NYSE:DUK) stood out to me because they have pledged to achieve net-zero carbon emissions by 2050, and are in the middle of a major portfolio update. I went into much further detail into their culture of innovation in my last article, but the summary is that they are diversifying their energy production and selling off older fossil fuel-based assets while taking on newly constructed renewable ones. Over longer time frames this should lower their relative operational overhead and reduce their risk to fluctuations in fuel prices. The company is building itself additional resilience. After looking over their recent financials and present valuation, I still rate Duke Energy as a Buy.

Company Background

Duke Energy provides electricity to over 8 million customers across six states. They were established over a century ago and operate a significant network of power plants and transmission lines. The company produces electricity from a large variety of sources, including nuclear, coal, natural gas, and renewable energy sources, like wind and solar. They have set a goal that would have them achieve net-zero carbon emissions before 2050. The company is already taking action to meet their goals and plans to invest $56 billion in grid infrastructure and renewable energy over the next decade.

Long Term Trends

Oil & gas Market Size is expected to have a CAGR of 5.4% through 2028; for an already mature industry this is a healthy growth rate. The solar industry is expected to maintain a CAGR of 25.7% until 2028. Generating Hydrogen as a fuel has a projected CAGR of 39.6% through 2030. The long-term outlook for fossil fuels is dependent on the pace of adoption of renewables. While it is expected that overall demand for fossil fuels will eventually decline as we continue to adopt renewable energy, the rate of this transition remains uncertain.

Over shorter and medium time frames, fossil fuel prices will remain volatile and subject to a range of economic, political, and environmental factors. However, macro factors will determine long-term average prices. The diversity of energy sources that Duke incorporates into its portfolio has armed them with an adaptability advantage and will serve them well when faced with our uncertain future.

Annual Financials

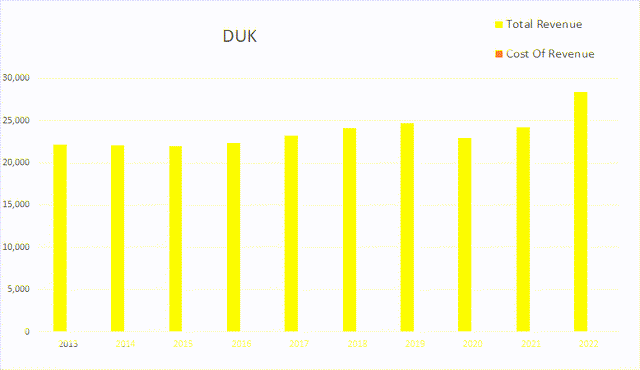

Revenue has risen over the last several years. It is also driving improvements to operating income and EBITDA. In 2013 they had an annual revenue of $22,154M; by 2022 that had risen to $28,319M. This represents a total increase of 27.83% and an average annual rate of 3.09%.

DUK Annual Revenue (By Author)

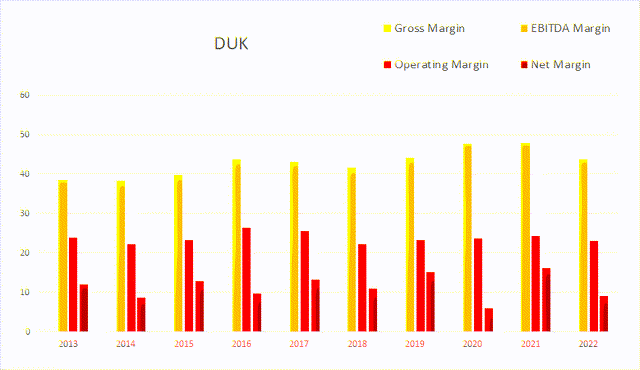

Their EBITDA margins have experienced a noticeable expansion while operating margins have remained relatively flat. As of the most recent annual report, EBITDA margins were 43.76%, operating margins were 23.12%, and net margins were at 9.00%.

DUK Annual Margins (By Author)

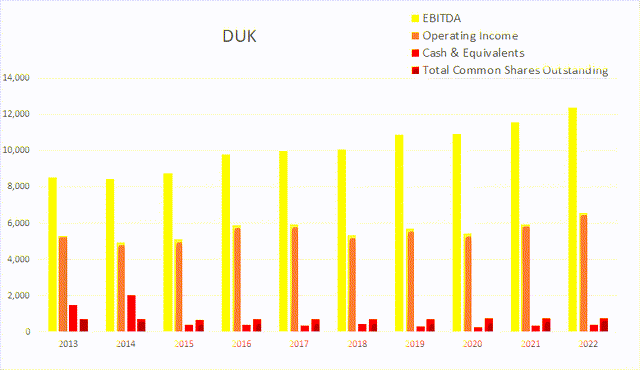

Their share count continues to slowly grow. However, considering their significant rises in income, this dilution is still quite accretive. Total common shares outstanding was at 706M in 2013; by the end of 2022 that rose to 770M. This represents a 9.07% rise in share count and comes out to an average annual rate of 1.01%. Over that same time period operating income rose from $5,303M to $6,548M. This represents a 23.48% total increase, or an average rate of 2.61%.

DUK Annual Share Count vs. Cash vs. Income (By Author)

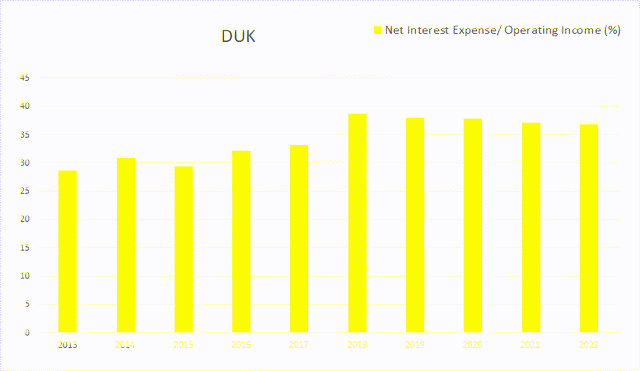

Utility companies typically carry eye-popping levels of debt. Much of this is unavoidable as it's due to things like the insurance requirements on their infrastructure. I would love to see energy providers like Duke begin diverting small portions of their income into investments with the goal of eventually producing enough cash flow to cancel out most of their regular debt maintenance. As of the 2022 annual report, the company spent $2,590M in annual interest expense and collected $27M in interest and investment income. In 2022, 36.8% of their operating income was consumed by their net interest expense.

DUK Annual Interest Expense vs. Income (By Author)

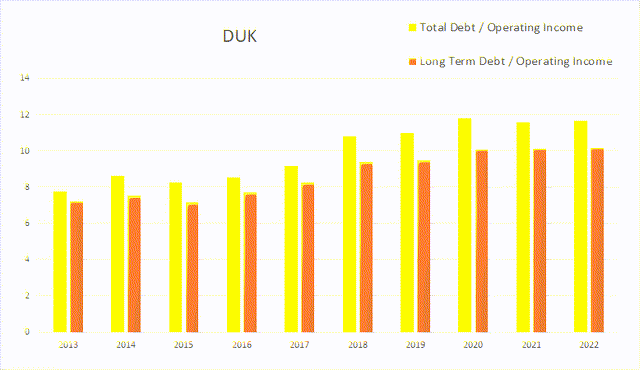

For most industries I consider annual debt to income ratios above 3x as unattractive, and ratios below 1x as attractive. The thresholds for utility providers are roughly ten times higher. This means anything below 10x is treated as appealing, and anything above 30x as unappealing. As of the most recent annual report, total debt to operating income was 11.64x, and long-term debt to operating income was 10.15x.

DUK Annual Debt vs. Income (By Author)

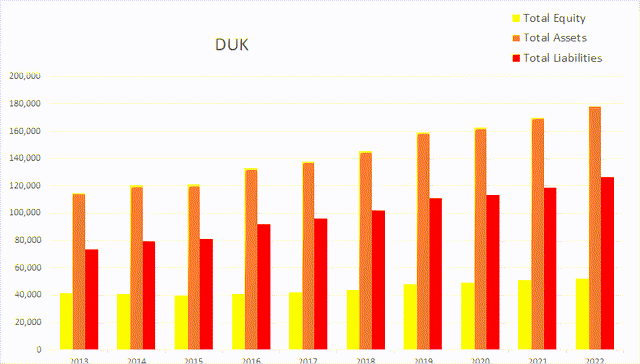

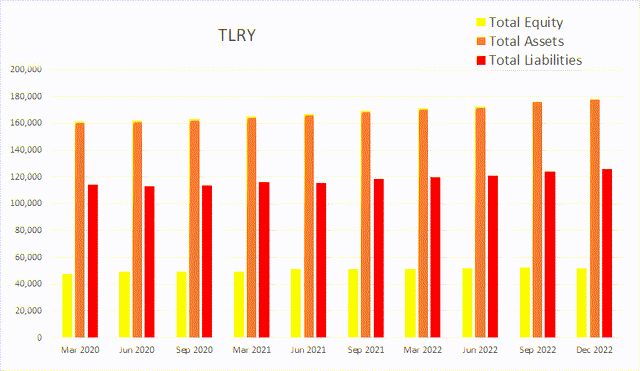

Their total equity has been relatively flat compared to the growth seen in both assets and liabilities. As the company is currently in a multi-decade portfolio restructure, they have more control over these values than a stagnant company would.

DUK Annual Total Equity (By Author)

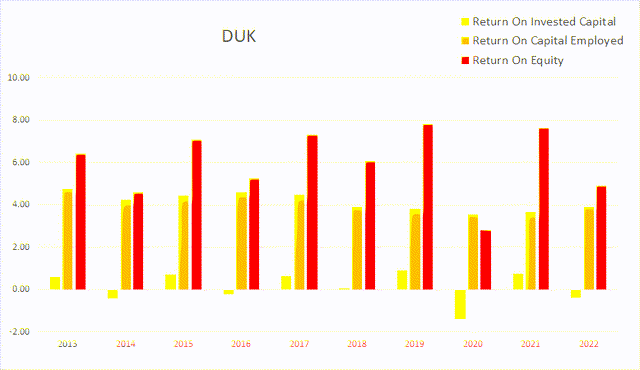

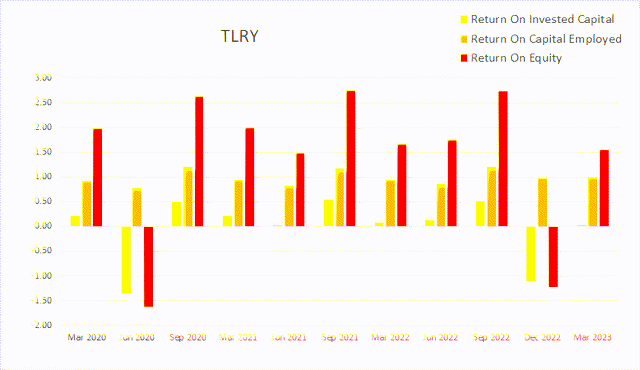

Their values for return on invested capital are low because of their large debt. Their return on capital employed appears to have experienced a contraction in recent years. As of the most recent annual report ROIC was -0.40%, ROCE was 3.89%, and ROE was at 4.92%.

DUK Annual Returns (By Author)

Quarterly Financials

Their quarterly financials show clear seasonality. Duke typically experiences lower than average revenue every Q2 and higher than average revenue every Q3. Eight quarters ago Duke had a quarterly revenue of $6,721M. Four quarters ago that had grown to $7,011M, by this most recent quarter that had grown again to $7,276M. This represents a total two-year increase of 9.83% and an average quarterly rate of 1.09%.

DUK Quarterly Revenue (By Author)

Their EBITDA margins appear to be slowly contracting. As of the most recent quarter, EBITDA margins were 41.49%, operating margins were 23.02%, and net margins were at 11.05%.

DUK Quarterly Margins (By Author)

Their cash situation is quite healthy. As of the most recent quarter, cash and equivalents was $451M, and quarterly operating income was $1,675M.

DUK Quarterly Share Count vs. Cash vs. Income (By Author)

This most recent quarter Duke spent $720M on net interest expense, and had $1,675M in operating income paired with $804M in net income.

DUK Quarterly Net Interest Expense vs. Income (By Author)

When viewing debt to income ratios on a quarterly basis, I shift my thresholds for utilities from 10x and 30x, to 40x and 120x. As of the most recent earnings report, total debt to quarterly operating income was 46.01x, while long-term was 41.28x.

DUK Quarterly Debt vs Income (By Author)

Total equity growth continues to be outpaced by both assets and liabilities.

DUK Quarterly Total Equity (By Author)

Seasonality also affects their returns. As of the most recent earnings report ROIC was 0.02%, ROCE was 0.98%, and ROE was at 1.55%.

DUK Quarterly Returns (By Author)

Valuation

As of July 8th, 2023, Duke had a market capitalization of $69.18B and traded for $89.77 per share. Using their forward P/E of 15.83x, their EPS Long-Term CAGR of 5.78%, and their forward Yield of 4.48%, I calculated a PEGY of 1.52x and an Inverted PEGY of 0.65x. These ratios imply the company is currently overvalued.

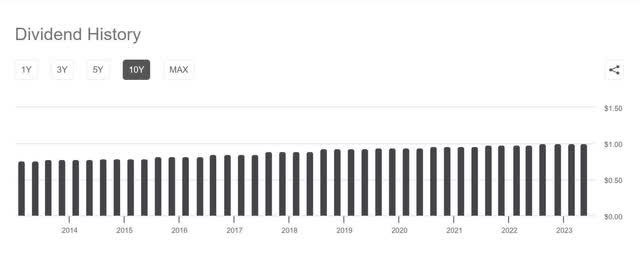

They are expected to maintain a long-term dividend CAGR of 2.77%.

DUK Dividend History (Seeking Alpha)

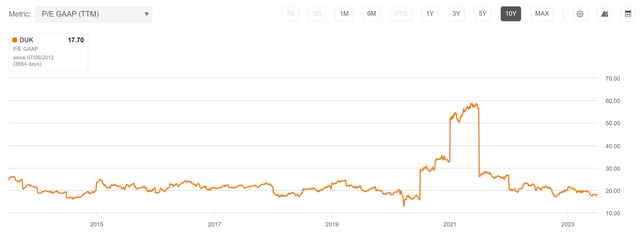

Duke typically trades at price to earnings ratios in the 15x to 25x range.

DUK Historical P/E (Seeking Alpha)

Because Duke has been steadily growing its dividend over many years, anytime price falls below fair value income investors will step in and aggressively buy dips. It is frequently seen as a resilient value play. The long-term behavior of value investors has formed a clear ascending zone of liquidity and price is currently trading near the bottom of the zone.

DUK Zone Of Liquidity (By Author)

Risks

As much as their demand is fairly stable, the cost of their fuel is not. Duke exists in a partially cyclical industry. This can impact the company's costs and earnings. Additionally, there is always the risk of operational issues, including things outside of the companies control like accidents or natural disasters.

While I am talking about risks I need to bring up their goal of reaching carbon neutral. Any energy company which does not set a similar goal, is likely to spend the next decade or more lobbying against the adoption of a carbon tax. Companies that have set similar goals to Duke will view such a tax as a mere inconvenience that will go away as they continue transitioning. Not only are they actively removing themselves from this risk, the onset of such a tax would only help make them more competitive than any of their less progressive peers.

Catalysts

There are several companies lobbying for federal grants for a Hydrogen hub in the southeastern United States. If the funding is approved, I won't expect a significant short-term reaction in their share price, but I do expect it to be a boon for long-term fundamentals. As this Hydrogen infrastructure is constructed, Duke will be able to open up new revenue streams.

Their industry is currently benefiting from the Inflation Reduction Act. Depending on who achieves political power, additional subsidies and government assistance might come forth, or the already existing subsidies and assistance might be revoked. Momentum is currently in favor of further subsidies, but this can always change.

Conclusion

Overall, Duke is a solid company. They are currently going through a long-term portfolio update. Their planned portfolio carries a large amount of renewables and will remove much of their exposure to changes in the price of fuel. This also means that as 2050 approaches, Duke will carry a large amount of relatively newer assets. I expect them to experience lower overhead from maintenance cost savings. Companies that do not stay adaptable risk losing their competitive edges and slowly slipping away into irrelevancy. I believe the diversity of energy sources that Duke is steadily incorporating into its portfolio, is incrementally granting them additional resilience.

Although it is currently trading at a PEGY that marks the company as overvalued, it's currently trading at a price to earnings ratio that is slightly below its historical average. Also, it is currently trading near the bottom of its ascending zone of liquidity. I believe price has reached a point where it has become attractive to value investors.

I typically avoid buying mature companies and prefer to hunt for alpha with companies that have significantly lower market cap than Duke. However, this is one of those companies that has both deep moats and the ability to pass on price increases to their customers. This means over the long-term, there are very few situations that would be able to force the company to stumble. For this reason, I keep it on a very short list of companies that I am willing to buy the dip on during black swan events.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Thanks for sharing