Palantir: This Is No Bubble, AI Hype Should Accelerate Growth

Summary

- Palantir stock has been a clear beneficiary of enthusiasm for AI this year.

- The company has sustained robust revenue growth and is set to deliver GAAP profitability this year.

- I expect AI hype generated by OpenAI to help Palantir drive accelerating top-line growth.

- With a net cash balance sheet and reasonable valuation, I reiterate my buy rating for the stock.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

imaginima

Palantir (NYSE:PLTR) stock has been on fire. Not only has the company managed to offset decelerating revenue growth with a sudden push for GAAP profitability, but the surge in enthusiasm for artificial intelligence has helped to highlight the company’s dominant positioning in the field. PLTR is a leader in helping companies make use of AI and I expect the latest AI developments to prove to be the long-awaited catalyst to increase demand. The company maintains a net cash balance sheet and has shown an ability and willingness to drive operating leverage. While the stock has seen a somewhat parabolic move higher and the valuation is no longer dirt-cheap, PLTR stock remains highly buyable for long term growth investors.

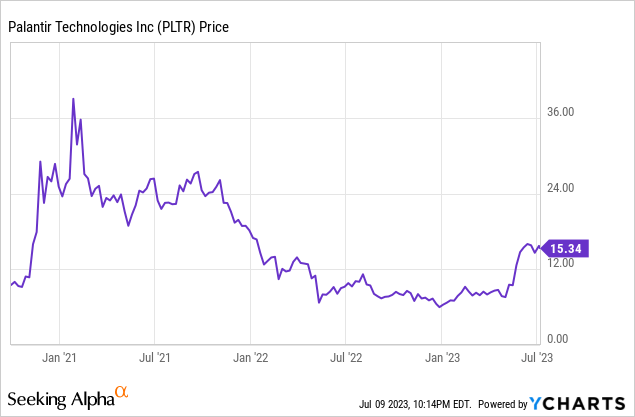

PLTR Stock Price

What a difference a couple of months can bring - after languishing amidst the valuation reset in the tech sector, PLTR has shot straight up.

I last covered PLTR in April where I discussed why the push for GAAP profitability paves the way for substantial upside. Even with the stock up 74% since then, I continue to see upside ahead.

PLTR Stock Key Metrics

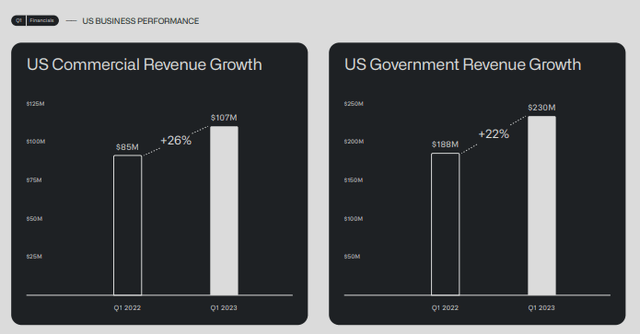

In its most recent quarter, PLTR grew revenue by 18% YOY to $525 million with the US being its strongest region of growth. That comfortably beat guidance which had called for only $504 million in revenue.

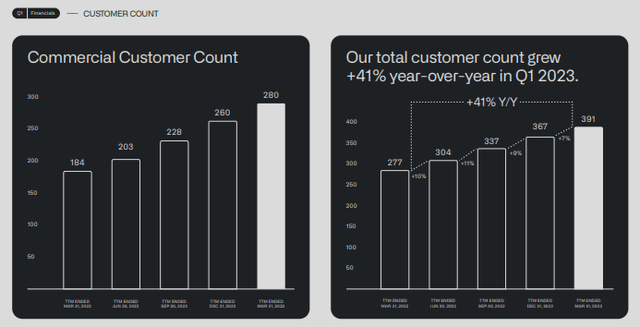

PLTR grew its customer count by 41% YOY though overall growth may continue to lag customer count growth due to it taking time for customers to fully embrace the solutions.

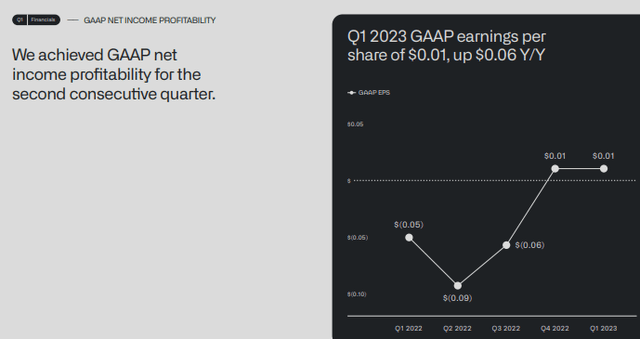

At this point, investors have likely come to terms that revenue growth will be depressed in the near term due to the tough macro environment. Yet investors have shifted their focus to the company’s aggressive profitability targets. PLTR achieved GAAP profitability for the second consecutive quarter.

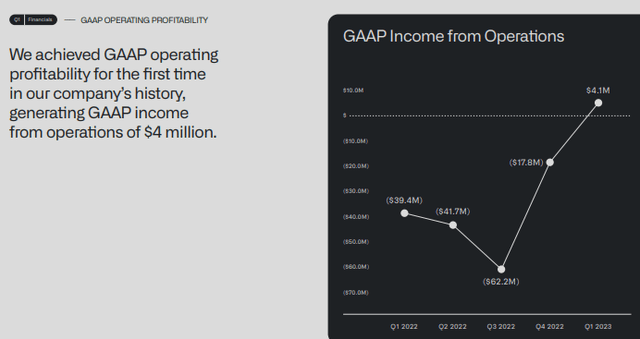

Unlike the first quarter, in which the GAAP profits were mainly due to non-cash realized gains on investments, this quarter saw PLTR generate GAAP operating income for the first time.

We can see below that the margin expansion was mainly driven by operating leverage, as the company managed to drive 18% top-line growth without materially increasing operating expenses.

Wall Street may have at some point assumed that these tech stocks were unable to show operating leverage, but these results (as well as the results of many other tech peers) have shown that these tech companies may have instead been intentionally aggressively investing in growth. Management continues to expect GAAP profitability for the full year with GAAP profits in each quarter.

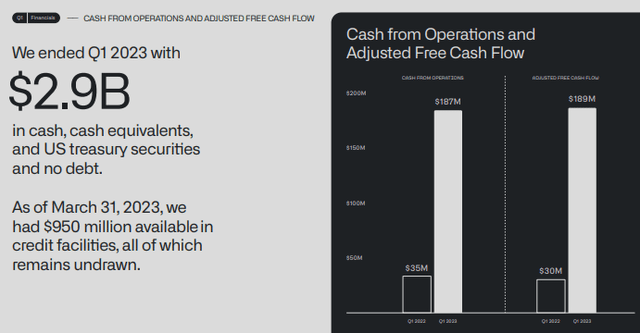

PLTR ended the quarter with $2.9 billion in net cash - interest earned on that cash undoubtedly will continue to help net margins.

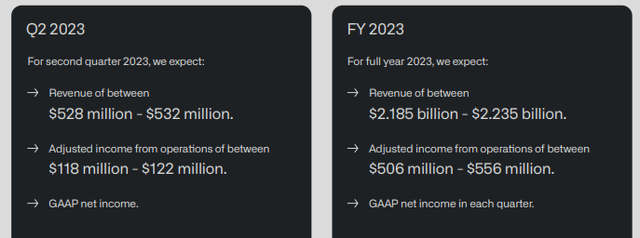

Looking ahead, PLTR has guided for the second quarter to see 12.5% YOY growth to $532 million, and for the year to see 17% YOY growth to $2.235 billion (a slight increase from prior guidance of $2.23 billion). PLTR expects to generate $556 million of adjusted operating income, up from the prior guidance of $531 million.

These are strong financial results. Yes, revenue growth has decelerated meaningfully from the 30+% growth rates shown during the pandemic. But the stock is no longer selling for 30x sales, and lower valuations have changed the expectations. It is impressive that PLTR is able to sustain such robust revenue growth in spite of the tough macro environment, and simply incredible that the company is able to expand profit margins on top of that.

Yet I am of the view that it was not the financial results that have driven the latest rally. On the conference call, management fully embraced investor enthusiasm for AI, stating that “larger enduring value is more likely to emerge from the application and workflow layer,” in which PLTR is the clear leader. Like Microsoft (MSFT), PLTR has shown an aggressive growth mentality, with managing stating that “when you're ahead of the market, you need to take territory.” Whereas the hype for AI has reached a boiling point this year, the reality is that implementing AI may not be so trivial for every unique business need. PLTR views itself as being well positioned to capitalize on growing interest in AI because it can close the gap between demand and implementation.

Is PLTR Stock A Buy, Sell, or Hold?

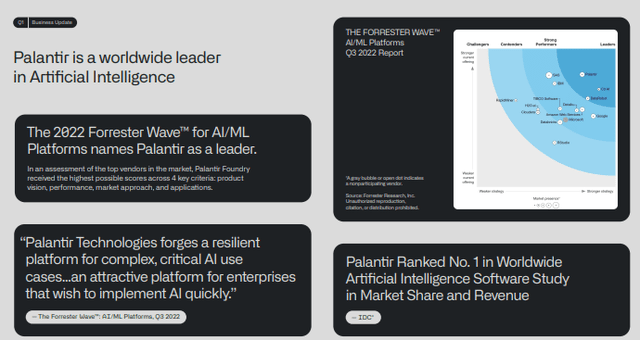

With that in mind, it may become easier to understand why PLTR stock has performed so strongly as of late. I view PLTR as being the ultimate AI consultant. There have been many reports about how providers of AI have no moat, I am of the view that PLTR has a great moat in being the preeminent implementer of AI for customers. Even prior to this year’s AI hype, PLTR was recognized as the worldwide leader in artificial intelligence.

Some readers may be wondering if that leadership has been displaced by Microsoft’s partner in OpenAI or any of the other tech titans. The opposite is true: all of this AI hype has likely only driven increased demand in PLTR’s expertise. If the average person is suddenly interested in how they can use AI, then you can bet that enterprise companies are also thinking critically on how they can use AI to drive operational efficiencies as well.

PLTR has introduced its Artificial Intelligence Platform to help customers employ large language models.

Management noted that they have already seen “unprecedented demand” for AIP and I suspect that this should lead to accelerating growth in coming years. Consensus estimates are factoring in such acceleration, but I wouldn’t rule out a return to 30% growth rates.

With PLTR now poised to deliver GAAP profitability, traditional and growth investors alike now can start comparing the stock’s valuation to stocks outside of the tech sector. Yes, the stock’s 15x sales multiple represents some premium to peers, but this is a company which can arguably drive 30% net margins over the long term. Based on 25% revenue growth, 30% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see PLTR trading at 11.3x sales over the next several years, suggesting solid upside. Yes, my revenue growth assumption is higher than consensus estimates, but I reiterate my view that recent AI hype may be the catalyst to help revenue growth accelerate coming out of this tough macro environment. There is arguably significant upside to my target as much of the broader market trades at PEG ratios well in excess of 1.5x and one can make the argument that PLTR deserves a significant premium due to the high margin business model. That said, the vicious rally since my last coverage has reduced the multiple expansion potential in the near term, and I must downgrade my bullishness from "strong buy" to "buy."

What are the key risks? From the get-go, PLTR has been a company full of promise, but management has arguably shown a history of over-promising and under-delivering. It is possible that revenue growth does not accelerate and the recent push for GAAP profitability is merely meant to offset such deceleration. In that case, my fair value estimate would decline considerably due to its heavy reliance on top-line growth. It is also possible that the tech titans find a way to make it easier for companies to implement AI for unique use cases, which would make PLTR’s business model somewhat obsolete. I find such a result unlikely as of the current moment, but AI is new waters and it is not clear what the future will hold. The stock is not nearly as cheap as it was just several months ago but I do not view it to be in a bubble (unlike some other AI stocks) and see considerable upside if my thesis of accelerating growth comes to fruition. I reiterate my buy rating for the stock especially for long-term growth investors.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)

Buying on dip seems worth it.

Thanks for this follow up. I missed your first article.

if one missed the pltr can one play the weakness in the tdoc or is that flawed logic thank you again