This Is How To Use AI To Revolutionize Investment Management

Summary

- The shift to index investing has largely eliminated specific-company risk, but has increased market risk due to investors' herding behavior.

- The investment management industry has not created tools for the public to manage market risk, with most financial advisors focusing on asset gathering rather than predicting market direction.

- The industry is evolving towards applying trend techniques to entire portfolios rather than individual asset classes, with machine learning models being applied to the most stationary behavior to maximize returns on invested capital.

Pgiam/iStock via Getty Images

If you can't describe what you are doing as a process, you don't know what you're doing.

- W. Edwards Deming

The markets have undergone a dramatic shift in the past two decades. The shift to index investing has largely eliminated specific-company risk, as John Bogle intended. In addition, investors have been able to capture upside index returns, or upside beta, cheaply and easily. This is the principal achievement of John Bogle's life and his Vanguard Group, which on average, charge only 0.08% in fees on their almost $8 trillion in AUM.

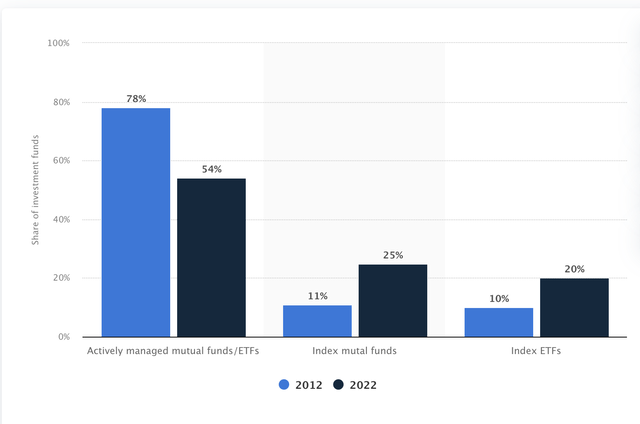

According to Statisa.com, "While passively-managed index funds only constituted 21 percent of the total assets managed by investment companies in the United States in 2012, this share had increased to 45 percent by 2022."

Distribution of active and passive investment funds in the United States in 2012 and 2022, by type (Statista.com)

However, market risk, also known as systematic risk, has remained. The shift to index investing may have even increased market risk, as investors are no longer influenced by fundamental research on individual companies which used to make up core holdings, and instead, engage in herding behavior as they invest and withdraw money from index investments.

Conventional advisors in the traditional asset management industry have increasingly started to practice a form of indexing-lite. As I wrote in April of 2020:

Most investors do not have a process for dealing with market direction. First, they have been brainwashed by the investment management industry into believing that picking market direction is impossible.

Most financial advisors really view themselves as hand holders or therapists. They believe that it is their job, rather than to divine market direction, to patronizingly tell investors to stay invested no matter what the valuation of the market, so that they can cynically continue to collect their fees.

If the public keeps holding index funds at any price, the management companies keep earning fees. It's completely cynical.

Most financial "advisors" are really broker types who enjoy rubbing elbows with the affluent, schmoozing clients on the phone, and taking them to dinner. They are asset gatherers. Very few have a fanatical devotion to data, statistical analysis, and algorithmic techniques to predict market direction.

And if they were fanatical about creating algorithms, most would be very bad at the job their firms pay them for - which is gathering assets. They would most likely be fired. So it's a self-selection problem. Most financial "advisors" are people-person broker-types who do not have the capability to predict market direction.

Their utility to their firms is as salesmen, not as market experts. If that's how their firms view them, why would you view them differently?

So we have an interesting dilemma on our hands:

- Investors, en masse, have exchanged individual company risk for market risk.

- The investment management industry has not created tools for the public to manage market risk.

- Indeed, the investment management industry has completely abdicated responsibility for doing so, throwing up their hands and declaring the task impossible.

- The business model, as we have seen, is hand-holding therapy, not true investment management.

- Market risk is recognized, but rarely managed.

It is important to use precise terms to understand the behavior underlying market risk, or systematic risk. Market risk is driven by herding behavior, or the herding effect. The herding effect in financial markets is strong. As we have seen, Keynes famously referred to the herding effect as animal spirits-literally the natural tendency of market participants to act like a herd of animals influenced by fear and by greed.

Algorithmically modeling the herding effect is key for index investors, who wish to capture upside moves in the market, while avoiding bear markets.

In addition, the natural herding effect of investors is strengthened by Federal Reserve gambits to inject and to withdraw liquidity from the financial system. Heavy-handed central bank moves to inject and to withdraw liquidity often overwhelm the effect of economic fundamentals on the financial markets.

Market participants focus on explicit Federal Reserve policy decisions. However, day-to-day open market operations, in which the Federal Reserve buys and sells bonds on the open market, are just as important.

These open market operations also create trends, or serial autocorrelation, in the direction of asset classes. Trading by the Fed itself in the bond market further strengthens the herding effect. The Fed literally moves asset prices through heavy-handed buying and selling through the central bank's own trading desk.

In addition, popular narratives around technological progress and societal change also fuel the herding effect.

We can see examples of this in the internet bubble of the 1990s and subsequent bust in 2000, the great financial crisis of 2008-2009, and the current focus on society-changing advances in AI.

These popular narratives can create multi-year booms and subsequent busts, further strengthening the herding effect in financial markets.

Over time, the interplay of these variables creates a massive herding effect.

For index investors, understanding whether the herding effect is creating a bull or a bear market determines the winners and the losers of the game.

The three most important factors for capturing the herding effect and predicting market direction are:

1. Trend.

2. Trend.

3. And Trend.

It may seem humorous, but capturing the trend of the market in a mathematically accurate way is a very serious game - and if you are an index investor, it is a game you cannot afford to lose. Other than a medical doctor, bad market analysis can hurt you more than the provision of any other specialized service. One should not trust this sort of analysis to human intuition, or reasoning. It is too important. Stick with data. Two Sigma has convincingly proven in their exhaustive factor analysis that trend following is one of the most robust factors.

Algorithmic methods can often sniff out important statistical footprints which allow us to identify when the herding effect is causing financial markets to rise or to fall.

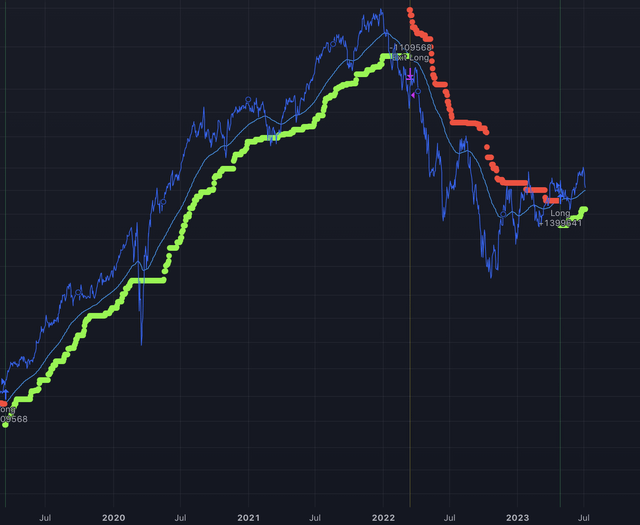

The Zomma Directional Algorithm is designed to capitalize on trends that emerge from the investment flows caused by herding behavior.

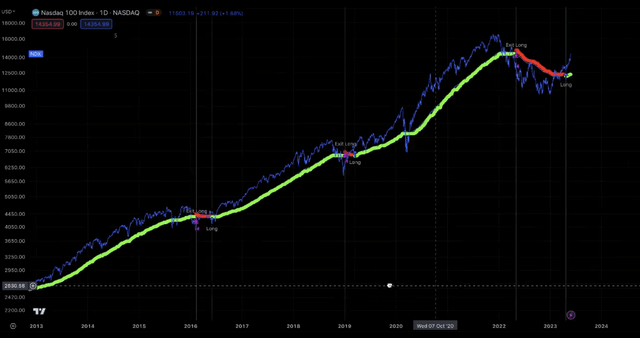

Here's how to understand the visualization:

1. When line turns green, it signals a buy.

2. When the line turns red, it signals a sell and a move to cash.

Note: The algorithm is not designed to create short signals.

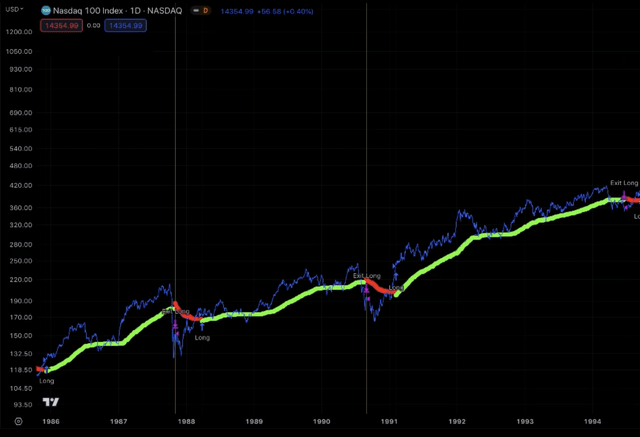

The algorithm takes advantage of trends created by the flow of investment dollars created by the herding effect. Let's take a look at the trend of the Nasdaq-100 since 1986.

From 1986 to 1994

Nasdaq-100 from 1986 to 1994 (www.ZommaEngine.com)

From 1994 to 2006

Nasdaq-100 from 1994 to 2006 (Zomma Engine)

From 2006 to 2011

Nasdaq-100 from 2006 to 2011 (Zomma Engine)

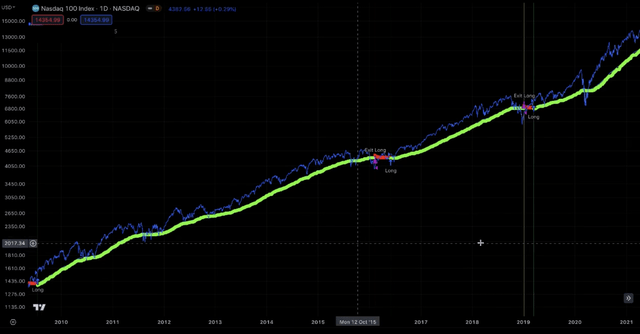

From 2011 to 2021

Nasdaq-100 from 2011 to 2021 (Zomma Engine)

From 2013 to 2023

Nasdaq-100 from 2013 to 2023 (Zomma Engine)

The trend effect is remarkably strong in the Nasdaq-100 index. Increasing indexation, Federal Reserve gambits, and popular narratives surrounding technology have dramatically increased the power of the herding effect starting in the mid 1990s.

However, it is important that we understand the intellectual history of the investment management industry's approach to market risk to gain a more complete perspective.

Unsurprisingly, whereas the business approach that the investment management industry has taken to market direction for retail investors is the patronizing, faux-intellectual, hand-holding therapy, the business approach that the investment management industry has taken to institutional investors has been a serious intellectual effort.

Sovereign wealth funds scoff at the notion that hand-holding is called for. They demand something more old-fashioned - performance.

There are two approaches that have been embraced by the industry in recent years, but I will advocate that investors should choose a third hybrid model:

1. Institutions have embraced risk-parity and complex asset allocation models.

2. Then there has been a push to embrace dynamic allocations to asset classes based upon trend.

3. I advocate that investors should embrace an approach which applies machine learning/AI techniques to trend following entire portfolios, rather than to individual asset classes.

Risk-Parity

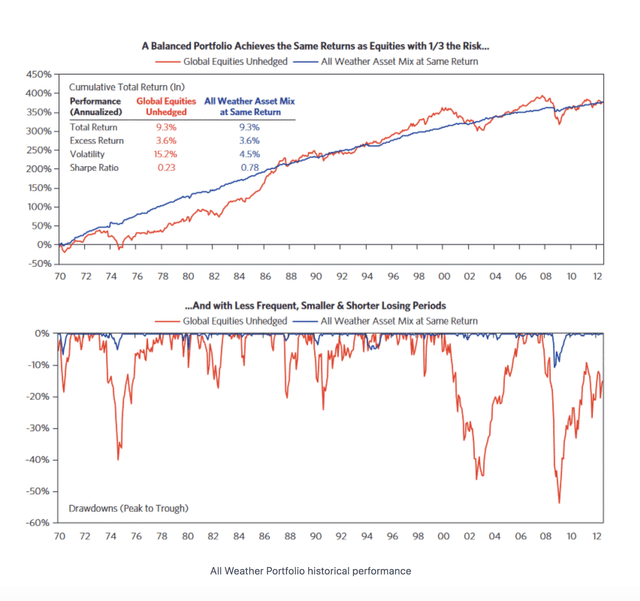

Institutions have fully embraced the risk-parity paradigm created by Bridgewater associates and implemented in its "All Weather" fund.

Risk-parity is an investment strategy that aims to allocate risk, rather than capital, equally across different asset classes. The premise of risk-parity is that conventional portfolios, such as the 60/40 equity/bond split, are capital-allocated, meaning they risk a disproportional amount of capital on equities which are more volatile.

Risk-parity, in contrast, attempts to equalize the risk contribution of each asset class by leveraging less risky assets (like bonds) to match the expected risk of more volatile ones (like equities). Theoretically, this results in a less volatile and more diversified portfolio.

Simply put, different asset classes, such as equities, bonds, and commodities have drawdowns at different times. Moreover, some asset classes are inversely correlated to others during different market regimes. Combining multiple asset classes together can overcome market risk by allocating to multiple, hopefully non-correlated, or less correlated markets in an effort to reduce volatility and risk.

Rather than focusing on trend, risk-parity focuses on asset allocation in an effort to equalize the volatility of each asset class in the portfolio.

Bob Prince, Bridgewater (www.https://www.quantifiedstrategies.com/)

In an uncertain future, the various asset classes in risk-parity have the potential to provide a return during periods of economic growth, contraction, inflation, and deflation.

However, there are three main industry critiques of risk-parity (these critiques have been over-whelmed by the tremendous support for the strategy and the allocation of billions in institutional assets to Bridgewater Associates, which has made it the largest hedge fund by AUM in the world):

1. The performance of the strategy, until recently, has benefited from a historical bull market in bonds.

2. Correlations between asset classes can change over time.

3. During market crashes, everything can become correlated, or sell off at the same time during a panic.

The recent Federal Reserve interest rate tightening cycle has been unkind to the All Weather fund's performance. However, in all fairness to Bridgewater, the strategy has had solid performance, with relatively low volatility, for many years.

The intellectual history of the investment management industry's approach to market risk has continued to evolve.

Dynamic Asset Allocation Based Upon Trend

Famously, Mebane Faber published his Global Tactical Asset Allocation framework in 2006, which famously applied a systematic trend following strategy to a multi-asset class portfolio. Gone were static allocations, and instead, dynamic "tactical" allocations to different asset classes based upon their trend were introduced.

Then, in 2016, Michael Gayed won the Charles H. Dow Award for his paper "Leverage for the Long Run", which further examined the notion of using moving averages, or trend techniques, to reduce market risk and to boost returns. Gayed advocated using the 200-day moving average as an indicator of trend in equities, but the main advocate of using the 200-day moving average, for decades, has been the legendary Paul Tudor Jones. Jones is the real deal. My father invested with him in the 1980s, and his performance during the 1987 crash was spectacularly good - close to a 100% gain for the year. I believe that Gayed was given credit for formalizing what Jones has advocated for many years.

Applying Machine Learning Trend Algorithms to Entire Portfolios

I will advocate that investors embrace a further evolution in the investment management industry's approach to the problem of market direction.

Mathematically, it is clear to me that the industry will evolve to applying trend techniques to entire portfolios, rather than to individual asset classes.

Here is why:

- Financial markets are noisy and non-stationary (their behavior changes over time). Therefore, it is difficult for machine learning models to make accurate predictions of individual asset classes. This means that machine learning algorithms (or AI) often perform well on the historical data but cannot generalize well to new, unseen data.

- Therefore, the behavior of a portfolio itself (rather than its individual component asset classes) is less noisy than its individual components. Intuitively, this makes sense, because in a multi-asset class framework, it is more likely for an individual asset class to undergo a regime change, than for all asset classes to undergo a regime change simultaneously.

- Investment management businesses, correctly so, want their investments in machine learning to have the maximal payoff relative to the R&D costs incurred. This means applying computational power to the most stationary behavior (portfolios, rather than their individual asset class components) in order to maximize returns on invested capital.

- This also means that ongoing, marginal costs, of continual adjustment to machine learning models is minimized.

Bottom line - if an investment management business is going to allocate massive amounts of capital to R&D, wise practitioners of machine learning, or AI, are going to conclude that machine learning models should be applied to entire portfolios rather than to individual asset classes, so that the money is not wasted, or continually spent, because the individual asset class behavior is non-stationary.

That is the direction that the industry is going in - combining asset allocation with algorithmic trend techniques, or trend following applied to entire portfolios. It is incredibly advantageous to apply trend techniques to entire portfolios, because they add further risk management, drawdown reduction, and synthetic alpha creation to the benefits of diverse asset allocation. Imagine stacking statistical advantages together. That is the benefit that combining asset allocation with algorithmic trend following techniques provides.

As an example, we can see the algorithm applied to a 50/50 portfolio of the S&P 500 and the 20+ Year U.S. Treasury index. Notice that applying an algorithm to the portfolio itself allowed the portfolio to move to cash when a Federal Reserve tightening cycle caused both bonds and equities to fall rapidly. This is a direct, rational answer to the risk of asset classes falling together during severe market dislocations.

The intellectual history of the investment management industry's response to the problem of market direction is constantly evolving.

Being part of that wider conversation means rejecting the industry-wide pose of the patronizing, faux-intellectual, hand-holding therapist towards retail investors and demanding that investment management firms roll up their proverbial sleeves to do real data-driven work (is there any other kind?) and to supply the fruits of these labors to the public, rather than merely to other institutions.

Just as importantly, one must understand how to maximize the financial returns to large enterprises of massive investments in machine learning by insisting that these investments are applied to areas where stable, stationary, smooth patterns are highly likely to persist over time.

The current Wild-West frontier atmosphere of widespread adoption of machine learning/AI has a multitude of researchers who are competent and clever at the individual tasks of creating AI models.

However, firms are realizing that they do not need individual tasks - they need solutions. What is lacking at many of the largest investment management firms is the wisdom to understand where to allocate these precious R&D dollars.

In my twenty year career of creating algorithms for some of the largest trading firms in the world, I have championed the notion that the key to creating robust, sustained performance from machine learning algorithms is to focus on structural sources of alpha, which can be sustained for decades. If the source of alpha is truly structural, which is rare, it can persist. The persistence of the performance is what makes it valuable to an institution. Therefore, the key task (and the most value-added) is to first identify structural sources of alpha, then to apply vast computational resources to mining it.

The open secret of the burgeoning machine learning sub-industry in finance (which will eventually swallow the entire financial industry) is that the creation of all algorithms/machine learning/AI is incredibly expensive. Therefore, the key to maximizing the return on that investment is to find a structural mine of alpha that can be harvested for years to come. The longer the source of alpha persists, the greater the return on the investment in R&D.

The best machine learning executives recognize this and firmly link R&D investments in AI to the identification of robust sources of structural alpha and long-term organizational goals to create durable competitive advantages.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.