Does The New Napco Dividend Policy Make Sense?

Summary

- Napco Securities has initiated a quarterly dividend policy, with the first payment made on May 22nd. The company will pay $0.0625 per share, amounting to a $2.3 million dividend payout to shareholders.

- Despite fluctuations in Free Cash Flows (FCF), Napco's dividend is considered sustainable due to a strong recovery in cash flow generation and a significant net cash position of over $50 million.

- Napco's future growth prospects, including a target of $300 million in revenues by 2026, suggest the potential for sustainable dividend increases.

ATHVisions/E+ via Getty Images

Last quarterly report Napco Security Technologies (NASDAQ:NSSC) surprised investors by initiating a quarterly dividend. Napco has been a great outperformer in the past five years and tripled in price, surpassing $1.2 billion in market cap. Napco certainly is a growth stock and investors should question if a dividend policy makes sense or if reinvestment in growth would make more sense. In this article, I'll dive into that question.

Napco 5 year chart (Google)

The dividend policy

With its third-quarter earnings release, Napco announced initiating a quarterly dividend policy. Napco will now pay $0.0625 per share, with the first payment on May 22nd. At 36,7 million shares, this is a $2.3 million dividend payout to shareholders.

CEO Richard Soloway said the following about the dividend:

We are excited to initiate our dividend program as the Company evolves and continues its strong growth patterns. NAPCO has created tremendous shareholder value over the years and the dividend program is another way for us to continue to do so in the future. We believe that it is important to balance our capital allocation priorities, including investing in growth opportunities, maintaining a strong balance sheet, and returning capital to shareholders.

Is the dividend sustainable?

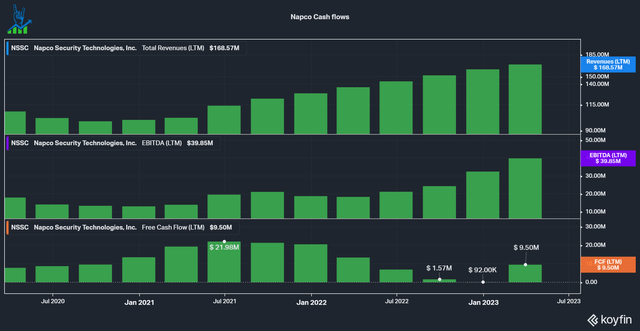

Historically dividend growers have outperformed the general market. Let's look at the financials and see if Napco can grow and sustain its dividend over the next years. Many people measure the health of a dividend by its payout net income payout ratio. I believe that only cash flow matters because, in the end, that's how you pay it out. The chart below shows that Napco has been growing revenues and EBITDA well over the last five years, but Free Cash Flows are pretty lumpy. In July 2021, FCF peaked at $21.98 million and dropped to $92 thousand in January 2023. This means that Napco couldn't have paid its dividend out of its FCF in the last two quarters. Fortunately, this is not a concern and Napco is not a cyclical business. In my previous article, I covered the reason for the absence of FCF to summarize it: Napco saw a chip shortage in critical components and had to stock up its inventory. This led to $30 million in changes in inventories, which depleted FCF for a period. These issues are abiding now, as seen by the strong recovery in Cash flow generation. Over the last 12 months, Napco generated $9.5 million, a 24% dividend payout ratio.

Napco cash flows (Koyfin)

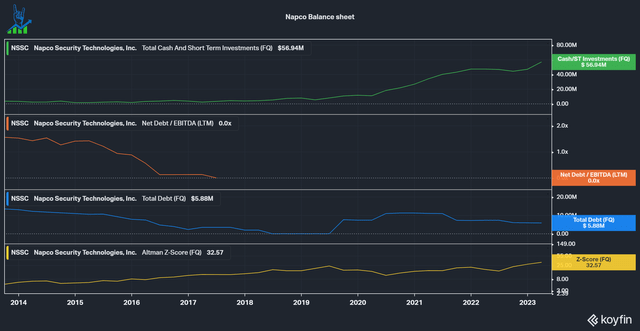

If we look at Napco's balance sheet, we can see one of the major reasons they initiated the dividend: The business is gushing cash. Even during the last year, when inventories bloated, they managed to keep the cash position stable, only dropping by $3 million. Napco has over $50 million in net cash (the $5.88 million in debt are all leases and no long-term debt. I include leases, but some people do not). Compared to a market cap of $1.2 billion, that's a very sizable cash position for an asset-light company.

Napco's stellar balance sheet (Koyfin)

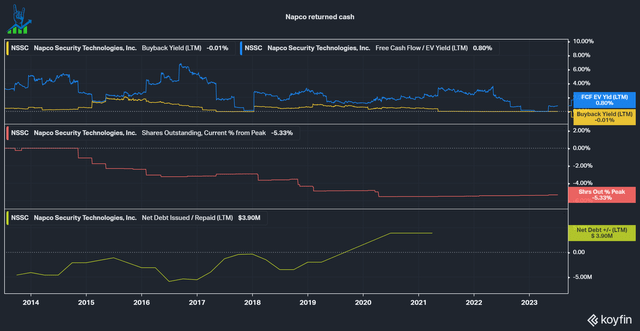

We can see below that the company did some share repurchases over the last decade, reducing shares by 5%, but it wasn't a major part of the stock's success. The company also made no acquisitions and grew organically. Buybacks are done opportunistically if the price is cheap and Napco knows the stock is not a bargain. Mindlessly buying back stock is never a good option, so returning cash to owners via a quarterly dividend is reasonable.

Napco returned cash (Koyfin)

Can the dividend grow?

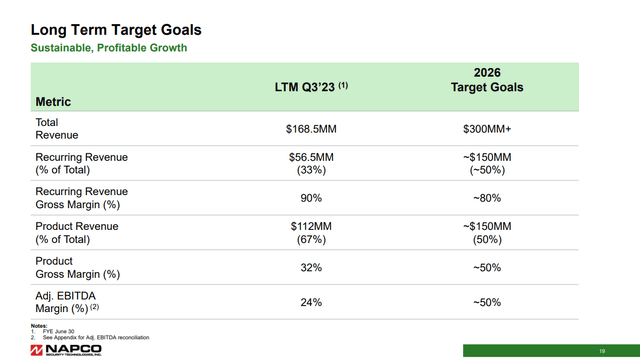

It is important to judge if the company is likely to grow in the future. Only then can we expect sustainable dividend increases. By sustainable, I mean a stable dividend payout ratio; dividend growth should be driven by cash flow growth, not the payout ratio. Napco has set goals for 2026 to reach $300 million in revenues and to increase the proportion of recurring revenues from 1/3 to 1/2. This and the recovery of the product margins should elevate the AEBITDA margin to 50%. EBITDA/FCF conversion was volatile in the past, but I would expect around 50%, leaving us at a 25% FCF margin. At $300 million in revenue, this would be $75 million in FCF by 2026. The same 25% payout ratio would leave $18.75 million for dividends, an eightfold increase. Napco did not disappoint in the past, showcased by 21% sales and 26% recurring revenue growth last quarter, and I believe they have a good chance to meet these goals.

Long term goal (Napco Investor Presentation)

Napco is a buy

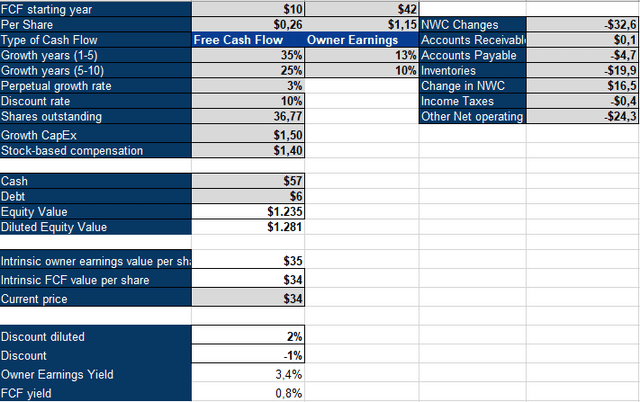

To value Napco, I'm using an inverse DCF model. I use a 10% discount rate and a 3% perpetual growth rate; I also calculate Owner Earnings besides normal Free cash flows. I believe that Owner Earnings are a better representation of the cash flows to owners than normal free cash flow, which several factors can easily distort:

- Stock-based compensation is paid out in shares and replaces cash expenses, but it is a cost to shareholders.

- Often not all of the CapEx spend is going towards maintaining the business, but rather to grow it. These investments could be cut, returned to owners, and thus added back to Owner Earnings.

- Changes in Net working capital can distort cash flows, so I adjust them out.

Owner Earnings = FCF - SBC + Growth Capex +/- NWC changes

Below we can see that the current price implies a 13% growth rate in owner earnings for the next five years, followed by five years of 10% growth. Given the shift to a recurring revenue model and the upside from normalizing manufacturing margins, I see Napco as undervalued and continue buying shares.

Napco Inverse DCF Model (Authors Model)

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NSSC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advise.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

I read the entire article without knowing what business the company actually does. I didn't know if they made shoes or sold ice cream or dug ditches.

Articles like this should have 2 or 3 sentences that mention the actual product.