111, Inc. Turns Profitable

Summary

- The Covid lockdown headwinds could only temporarily dent the relentless progress the company is making, growing revenue, expanding gross margin, and producing substantial operating leverage.

- We can't think of any even half plausible reason why this relentless progress should not continue, at most marginally less vigorous.

- Yet the share price is lingering at rock-bottom valuations, despite even a take-out offer 50% above the current share price.

- The share price lingering could very well continue for quite some time, but it will likely correct at some point and it's not hard to predict its direction.

- Looking for more investing ideas like this one? Get them exclusively at SHU Growth Portfolio. Learn More »

Aliseenko

A year ago, we directed investors' attention to 111, Inc.'s (NASDAQ:YI) inexorable drive to profitability. A year later, the company chalked up its first (non-GAAP) operating profit.

There is progress all around, apart from the share price, which is roughly stuck where it was a year ago.

FinViz

This strikes us as non-sensical, especially in light of the $3.62 buyout process by company insiders that is still ongoing and the very modest valuation of the shares. The company is benefiting from secular tailwinds like the digitization of healthcare.

Main products

- 1 Drugstore (B2C)

- 1 Clinic (digital hospital)

- 1 Drug Mall (B2B platform)

- 1 Health

- Private label products

- Services

Of these, the B2B platform is no doubt the most significant (certainly in revenue terms), it is a platform that is the largest virtual pharmacy network in China with 440K pharmacies and over 550 global pharma companies, as well as distributors, wholesalers, clinics, doctors practices and physicians.

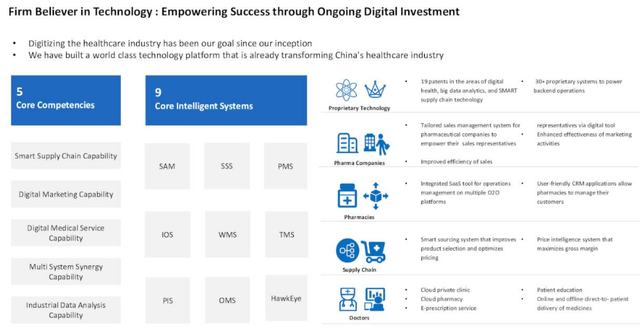

The company offers services to pharma companies like drug commercialization tools, digital marketing, and market insights.

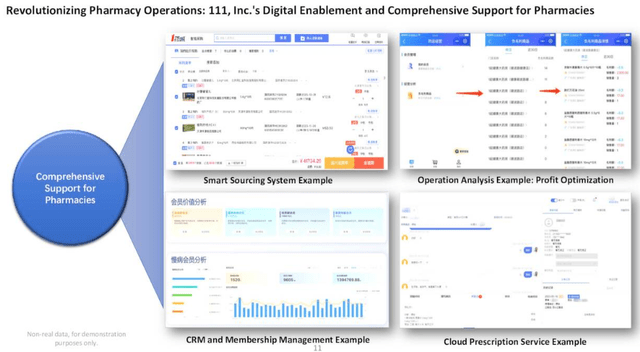

Services offered to pharmacies are cheaper medicines directly sourced from over 550 pharma companies and suppliers, streamlined processes improving operational efficiency through systems like automated ordering systems and efficient logistics, but we're scraping the surface here.

1 Health

1 Health is a digital franchise for small and medium-sized pharmacy chains, from the Q1CC:

All participating pharmacies can use our platform to better manage their product selection, procurement and inventory management, as well as accessing our distribution tools through our digital SaaS services, including smart sourcing, digital marketing, O2O, and CRM.

Private label products

The company already has 70+ (and rapidly expanding) private-label products which are especially interesting for small and medium-sized pharmacy chains (which can't afford their own).

These consist of medicines, health supplements, medical devices, etc. and come with services like CRM, big data, and health management database attached.

Yi's online and offline digital platform and nationwide distribution capabilities, ensure that these products will improve gross profit and improve downstream customer stickiness significantly.

Services

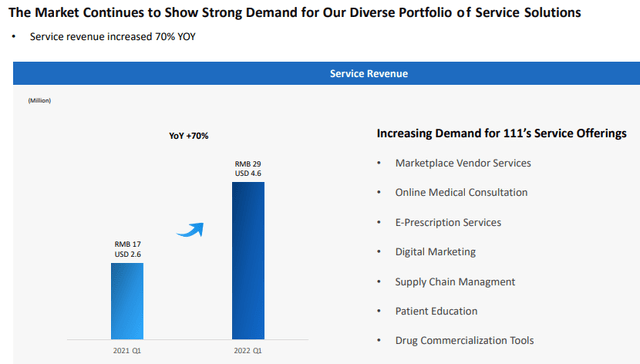

The company offers a host of services that were neatly categorized in a slide from a year ago and remain useful:

It keeps on adding services, in Q1 there were:

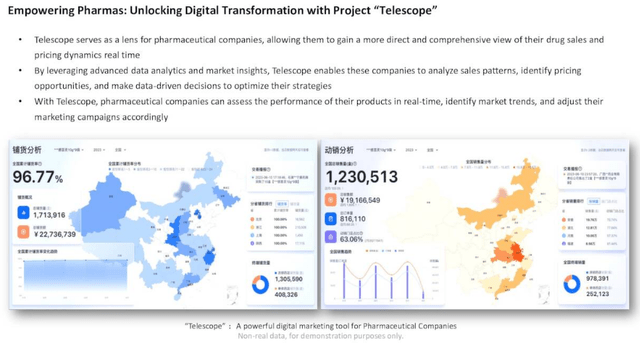

- Telescope

- Sanofi's Allegra is the first product that has been sold directly on the company's B2C platform (YI has 500+ pharma companies selling on its B2B platform)

Telescope offers pharma companies (Q1CC):

advanced data analytics and market insights, Telescope enables these companies to analyze sales patterns, identify pricing opportunities, and make data-driven decisions to optimize their strategies. With Telescope, pharmaceutical companies can assess the performance of their product in real time, identify market trends, and adjust their marketing campaigns accordingly.

We also like the use of the B2C platform for Sanofi's Allegra, showing that although the B2C platform is a tiny part of revenue (albeit producing higher gross margins) facing big competitors, there is life in the platform yet.

Competitive strength

- B2B, 500 pharma direct sourcing

- Network of 440K virtual pharmacies

- 1 Health virtual franchise of 20K pharmacies

- Digital platform offering a host of services

- A relentless focus on digitization and continuous improvement, it's just as much a technology company as an online drug wholesaler.

The company is pretty uniquely positioned, from the Q1/22CC:

Our strength is in the fact that we want to use technology to drive efficiency and we believe that digitization is the future. So, as far as the traditional – we have 14,000 distributors in our space and we'll have some of the giant state-owned distributors. We very much doubt that those traditional players can match our capabilities. Even for the newcomers who are copying our model, I think we have something very, very unique.

Looking over all players in this space, no one is attempting to get through to the consumers for the B2B players. And no one has the full capability of servicing the – pretty much all the key stakeholders in this industry.

That is, it doesn't compete head-on with the big B2C players, nor with the big wholesalers/distributors, but it uses technology to drive efficiency through the whole value chain and become indispensable for its customers. So far they're doing a pretty good job.

The company has a partnership with Tencent jointly providing technology-based services to customers (pharmacies as well as pharma companies)

Finances

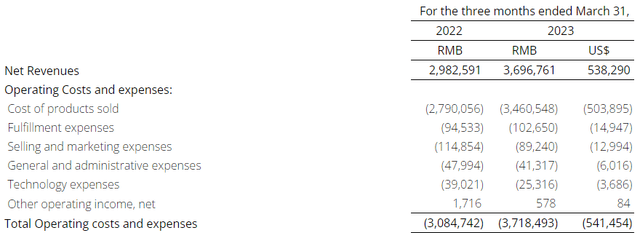

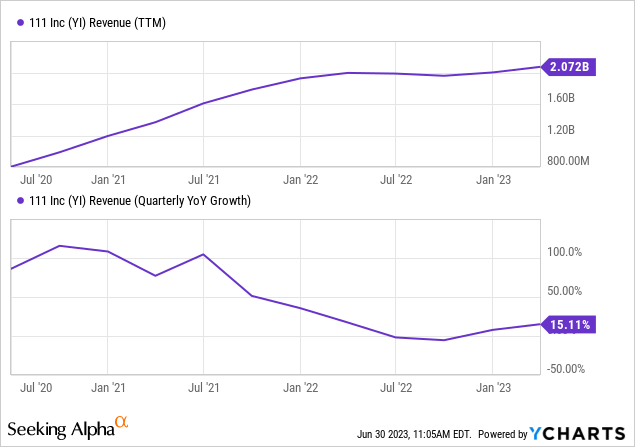

Growth has stalled a little during the harsh pandemic lockdowns which affected Shanghai, where the main operations of the company are located, disproportionately, but growth is back with revenue growing 24% (in yuan) and B2B, which produces the bulk of the revenues growing by 25%.

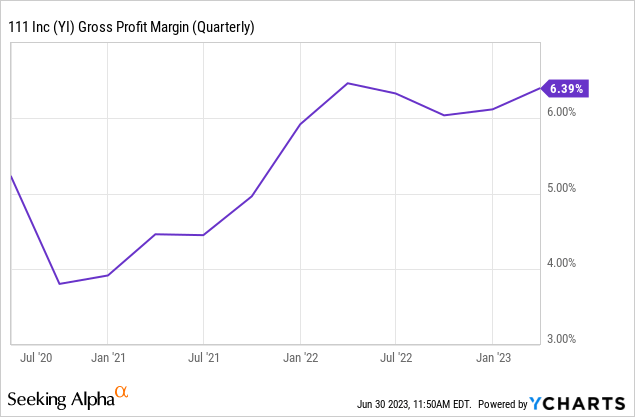

Gross margins are on what seems to be an inexorably rising trend, only halted temporarily by the Chinese pandemic lockdowns last year:

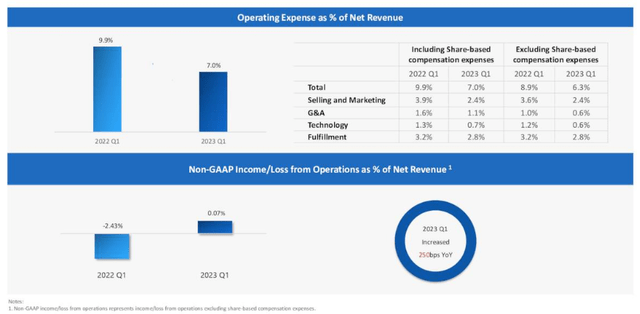

On top of rising gross margins, there is a remarkable operational improvement:

Not only are the main OpEx categories declining in terms of percentage of revenue, but (apart from fulfillment) they're also actually declining in yuan to a remarkable extent:

Fulfillment costs have increased as they added their own warehouses (now 11, on top of a number of joint-venture warehouses). Nevertheless, one can conclude that there is really considerable operating leverage. This isn't all that surprising, for two reasons:

- The company really is mostly a technology company, with its platforms producing considerable scale and scope efficiencies.

- Management is almost maniacal about efficiency throughout the whole value chain and uses digitization as its main tool.

They have focus areas for additional improvements and efficiency gains:

- Optimizing its product assortment

- Reducing procurement cost

- Intelligent pricing

- Smart supply chains

- Driving operation efficiency

- Building out 1 Health

- Digitization

It's not all tech, management has even established an in-house, multi-disciplined advisory department dedicated to driving strategic improvement (Q1CC):

This department plays a pivotal role in analyzing customers' needs, enabling us to refine our product assortment to better align with market demand. By closely monitoring market trends and leveraging customer insights, we can intelligently adjust pricing to ensure competitiveness while maximizing profitability.

Management is confident it can bring down OpEx to 5% of revenue on RMB20B of sales, and 4% of revenue on RMB30B of sales which could give them a net profit rate approaching 5%. They're not there yet, but given their track record, there is little reason for doubt.

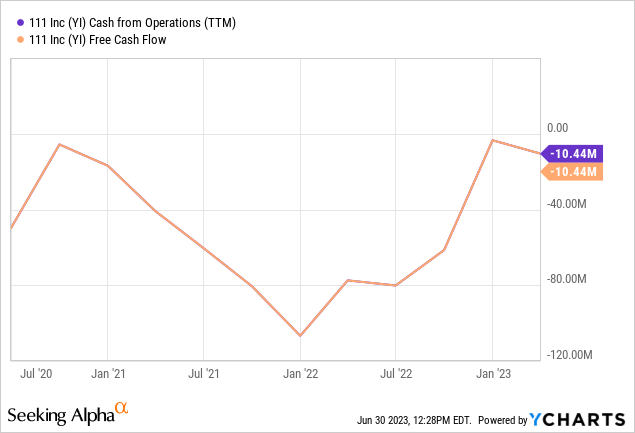

Growth + gross margin expansion + operating leverage does wonders for cash flow:

Q1 cash flow would have been positive if not for a number of one-time costs

In any case, the company has a considerable cash amount (RB878.8M, some $128M), although there is this (Q1CC):

when pharmacy technology proposed listing on the stock market was not completed before June 30, 2023, certain PRC investors would be entitled to require us to redeem all or part of their equity for an amount up to RMB1.71 billion. As of today, certain investors have agreed not to exercise their rights before June 30, 2024, to redeem their investment, totalling RMB726 million.

They're working with the remainder of these investors. In any case, this will not affect their business and management believes it has the resources to deal with the demands.

Last September, company insiders made an unsolicited bid for taking it private for $3.62 per ADS, and management argued during the Q1CC that the process is still ongoing.

Valuation

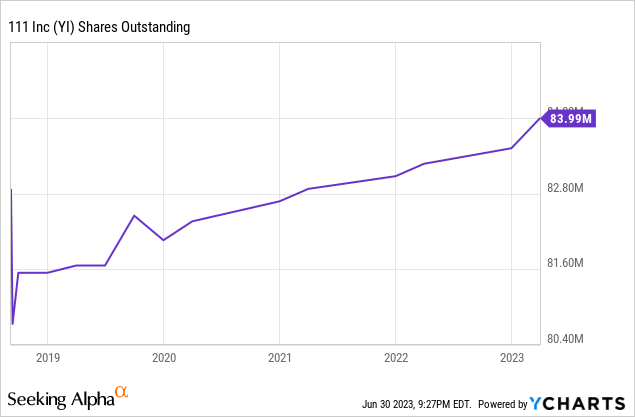

Dilution hasn't been serious:

There were 5.36M options (at the end of 2022, the last quarter with available data) and 1.79M RSUs, and another 31.5M options from the employee ownership plan.

These are options and RSUs on ordinary shares, not ADS so we have to divide that by 2, that is 19.32M additional ADS for a fully diluted ADS count of 103.3M shares or a market cap (at $2.5 per share) of $258.3M.

The cash ($128M) doesn't entirely cancel out the mezzanine equity ($155.9M) so the EV is $286M. In Q1 alone revenue was $538.3M, we struggle to believe how cheap the shares are.

Even the take-out price on offer of $3.62 seems way too low, perhaps that's why the process is taking so long.

Conclusion

The company posted its first (non-GAAP) operating profit in Q1 but anyone even remotely familiar with YI could have seen this coming years ago.

It has used the digitization of healthcare to entrench itself in its position as the biggest digital B2B drug distributor and is becoming increasingly indispensable for pharma and pharmacies alike.

It is using the ongoing digitization of healthcare to increase efficiencies and the added relentless drive to squeeze costs has produced steadily rising gross margins and a surprising amount of operating leverage, cementing its competitive advantage in the process as it shares some of the benefits with its customers.

Just as two years ago investors could have foreseen today's first operating profit, investors can see a profitable and cash-generating company going forward.

We struggle to see any significant risk that could alter this picture, the only thing that we can muster is perhaps progress could be slower going forward, but we doubt that as many of the necessary investments (for instance in fulfillment centers) are largely in the rearview mirror and the company will automatically benefit from scaling up.

We could (and have) argued similar lines in the past yet the share price lingers at unreasonably low levels, the company is valued as if it is an offline wholesaler.

We can't explain the share price rot, apart from being China-related as more Chinese tech companies suffer from the same investor disinterest. But for YI this is even more curious considering the $3.62 take-out offer and the relentless growth and improvement.

So while we rate the shares a strong buy, investors might very well have to be quite patient.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

If you are interested in similarly small, high-growth potential stocks you could join us at our marketplace service SHU Growth Portfolio, where we maintain a portfolio and a watchlist of similar stocks.

We add real-time buy and sell signals on these, as well as other trading opportunities which we provide in our active chat community. We look at companies with a defensible competitive advantage and the opportunity and/or business models which have the potential to generate considerable operational leverage.

This article was written by

I'm a retired academic with three decades of experience in the financial markets.

Providing a marketplace service Shareholdersunite Portfolio

Finding the next Roku while navigating the high-risk, high reward landscape.

Looking to find small companies with multi-bagger potential whilst mitigating the risks through a portfolio approach.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of YI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.