DocuSign: Untapped Potential

Summary

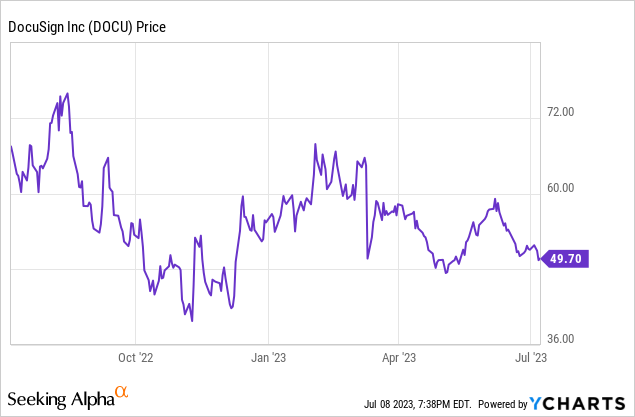

- Despite a 12% drop in share price this year, DocuSign remains a promising investment due to a massive $50 billion TAM and secular tailwinds toward digitization.

- Revenue growth may be slowing down to the low teens, but DOCU is generating rich near-30% pro forma operating margins.

- Demand for digital signature products will only grow as companies seek to automate processes and enable remote work.

- We can attribute a chunk of the current revenue slowdown to a tough macro environment in which large process-changing IT projects are being deferred.

Sundry Photography

Even though we are well beyond the irrational pandemic-era market, investment logic in the tech sector has seen a similar reversion back to that time. Regard for fundamentals and valuation is limited (despite high interest rates), and investors are back to betting almost exclusively on stories - particularly anything having to do with AI.

Against this backdrop, DocuSign (NASDAQ:DOCU) has been a notable laggard in the software sector this year, with its share price down -12% - even though most small/mid-cap tech stocks have seen massive double-digit rebounds this year. Investors have panned the company's slowing growth rates, almost entirely ignoring DocuSign's huge market opportunity plus its rich profit margins. It's a great time, in my view, for investors to reassess the bull case in this stock.

I remain incredibly bullish on DocuSign as one of the core holdings in my tech portfolio this year. The company continues to issue conservative expectations, but always manages to come out on top while also displaying massive profitability gains. Taking a step back and assessing the broader landscape, it's also difficult to imagine a world in which paper-based contracts and processes don't get replaced by technology like DocuSign's, and DocuSign is already the clear leader in e-sign.

As a refresher for investors who are newer to this stock, here are all the key reasons to be bullish on DocuSign:

- Clear leader in a mission-critical technology product. Despite the fact that pandemic tailwinds are "over" for DocuSign, remote work has only shown us how reliant we are on digital to facilitate basically everything. Today, many swaths of industry remain stuck in legacy processes; and giant sectors like real estate and healthcare remain ripe for technology disruption. In other words, DocuSign still benefits from a huge greenfield market for its electronic agreements products. DocuSign is also designated as an industry Leader by Gartner, arguably the most influential software reviewer.

- $50 billion TAM. DocuSign addresses a $25 billion market opportunity in pure e-sign and an additional $25 billion opportunity for add-ons, which means the company's current ~$3 billion revenue scale has only achieved single-digit penetration into this overall market.

- Customer diversification. DocuSign is a truly "horizontal" software product that is applicable to customers of any industry, without any functional changes needed to its product. At the time of its IPO in 2018, DocuSign had only ~400k customers; today, that number has more than tripled to more than 1.3 million, reflecting the strength of DocuSign's go-to-market expansion.

- High gross margin profile. DocuSign has 80%+ pro forma gross margins, among the highest in the enterprise software sector and allowing for significant operating leverage at scale.

Valuation also remains a core reason to stay invested in DocuSign. At current share prices just shy of $50, DocuSign trades at a market cap of $10.06 billion. After we net off the $1.41 billion of cash and $724.0 million of debt on DocuSign's most recent balance sheet, DocuSign's resulting enterprise value is $9.37 billion.

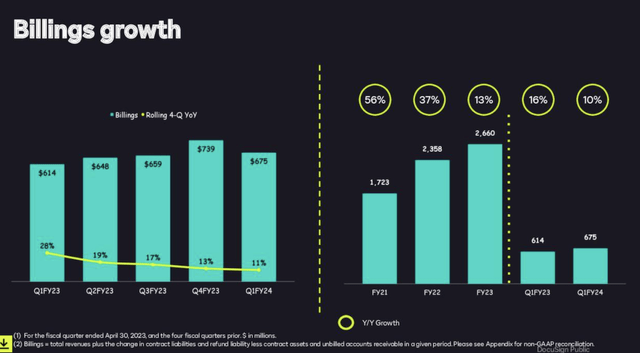

Meanwhile, for the current fiscal year FY24, DocuSign has guided to $2.71-$2.73 billion in revenue, representing 8% y/y growth. Of note is the slight increase in the company's billings guidance for the year to $2.74-$2.76 billion (roughly $30 million, or 1% higher, on both ends of the range from an original guidance range that suggested only 2% y/y growth).

DocuSign guidance (Docusign earnings deck)

Against the midpoint of the company's revenue guidance for the year, DocuSign trades at just 3.4x EV/FY24 revenue - which, in my view, dramatically undervalues a company with a significant TAM and pro forma operating margins nearing 30%. Yes, DocuSign might be in a current growth funk as the company deals with tough macro conditions that are prompting extra scrutiny on large capital IT expenses, but that's no reason to lose faith in the company for the long term.

My year-end price target for DocuSign is $67, a price target that represents 4.7x EV/FY24 revenue and ~34% upside from current levels. Stay long here and hold on for the rebound.

Q1 download

Let's now dig through DocuSign's latest quarterly results in greater detail. The Q1 earnings summary is shown below:

DocuSign Q1 results (Docusign earnings deck)

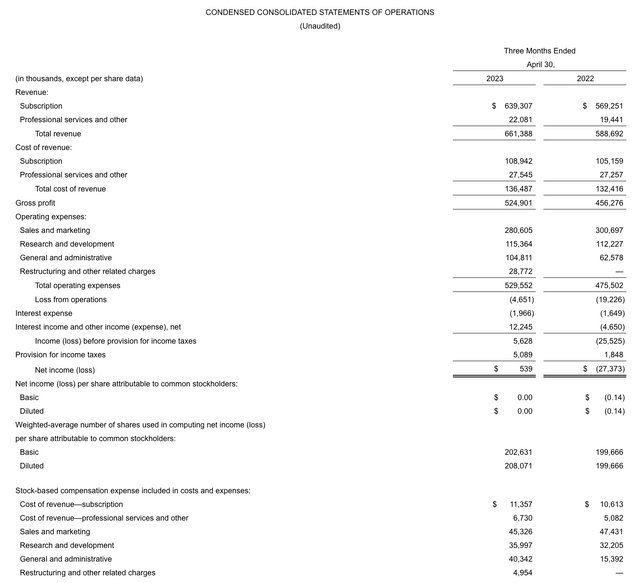

DocuSign's revenue grew 12% y/y to $661.4 million, beating Wall Street's expectations of $641.7 million (+9% y/y) by a respectable three-point margin.

We do note that investors' concerns of deceleration are valid (though it's the relatively modest magnitude of deceleration that makes DocuSign's bargain-basement valuation unwarranted). Revenue decelerated two points from 14% y/y growth in Q4, and billings growth of 10% y/y decelerated three points from Q4 and seven points from Q3, indicating that further revenue slowdown is likely. Still - it's hard to believe that with 10% billings growth in Q1, and arguably most macro impacts already factored into current results, that DocuSign will really land the year at just 3% y/y billings growth overall.

DocuSign billings (Docusign earnings deck)

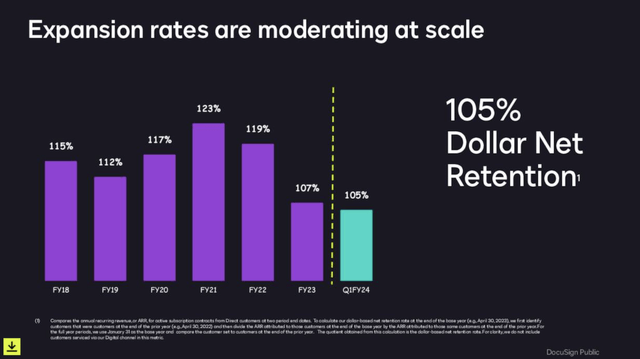

The company is noting a slowdown in net expansion rates, which slimmed down to 105% in the first quarter - two points weaker than 107% for the entirety of FY23.

DocuSign net expansion rates (Docusign earnings deck)

Allan Thygesen, DocuSign's CEO, noted that macro malaise is leading to smaller deal sizes and elongating sales cycles. Per his prepared remarks on the Q1 earnings call:

Turning to our go-to-market execution in the first quarter. We're pleased with how our field team navigated the distractions in Q1 as we rebalanced our approach. However, we are seeing more moderate pipeline and cautious customer behavior, coupled with smaller deal sizes and lower volumes. We recognize it's a dynamic competitive environment across multiple categories. We're confident in our premium positioning, especially in complex and high-value use cases.

As we've stated, international expansion remains a largely untapped opportunity for us. We're making investments not only with market-specific product innovation like identity verification, but also in stronger local market presence to strengthen our footprint. We recently released funding to further invest in Germany and Japan. And in Japan, note, we just went live with our first CLM customer this past quarter."

Underneath this backdrop, however, digital self-service customers (which tend to be smaller deals) are seeing improved conversion rates. DocuSign also managed to add 45k net-new customers in the quarter, landing the company total at 1.40 million customers in its base.

Where investors shouldn't ignore DocuSign's progress, however, is in profitability. The company cut 10% of its workforce earlier this year, and the efficiency is playing out in much richer operating margins.

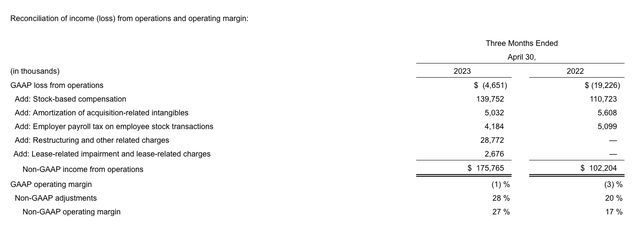

DocuSign margins (Docusign earnings deck)

Pro forma operating margins hit 27% in Q1, ten points richer y/y. We note as well that on top of 12% revenue growth, DocuSign is just on the cusp of being a "Rule of 40" software stock - which makes its ~3x revenue multiple even more difficult to defend.

Key takeaways

A massive TAM, secular tailwinds toward digitization, rich operating margins, and an undemanding valuation - there are plenty of reasons to remain bullish on DocuSign while the rest of the market is turning the other way. Stay long here.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DOCU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.