Why KeyCorp Is A Pre-Earnings Buy This July

Summary

- I think KeyCorp is a promising investment despite the ongoing skepticism surrounding regional banks following Silicon Valley Bank's failure.

- I'll argue that KeyCorp's risk of collapse is low, its valuation could be incredibly low compared to its intrinsic value, and high interest rates could present an opportunity for the bank.

- My plan is to heavily invest in KeyCorp before its next earnings call, believing that the presentation of the upcoming quarterly data will be a strong positive catalyst for the stock.

Landscape and nature photographer based in Upstate, New York

As the quarterly results loom closer, I've begun to delve into trades that could yield near-term payoffs. The focus, however, remains on stocks I would be glad to hold in my portfolio, even if the Q2 2023 figures aren't as stellar. Overall, I'm looking for stocks which present a high likelihood of surging right after the release of the upcoming report. One sector receiving my particular attention is regional banks, where I am hunting for stocks excessively punished in the aftermath of Silicon Valley Bank's failure and its consequent fallout.

One stock I find particularly appealing is KeyCorp (NYSE:KEY). This is the 23rd largest bank in the United States in terms of managed assets, amounting to $198 billion at the end of Q1 2023. Established in Albany, New York, KeyCorp's history spans nearly 200 years, with its operations primarily centered in the northern USA.

The balance sheet data is extremely compelling. Despite this, the stock continues to be under pressure, chiefly due to skepticism surrounding the resilience of regional banks. I believe there are three reasons why it is an opportune time to buy this stock:

The risk of a KeyCorp collapse is low, albeit not non-existent;

If the company successfully navigates this delicate period, its valuation would be incredibly low compared to the intrinsic value of the firm;

High interest rates could present an opportunity, not just a threat, for KeyCorp.

The next earnings call is scheduled for July 20th and I am planning on buying the stock heavily before that day arrives.

Intrinsic value excluding the 'SVB-moment’ risk

The current valuation of KeyCorp stands at $9 billion. Let's momentarily disregard the rising interest rates and all the consequences thereof: the unrealized losses on bonds purchased when the Fed rates were quite low, the potential for panic-induced crashes among account holders, and the percentage of deposits not covered by the FDIC or collateralized. Essentially, let's momentarily put aside the 'SVB scenario.' When we focus on the data that emerges from the balance sheet, KeyCorp's current valuation is remarkably low. Here are a few metrics to help understand how undervalued the stock price is compared to its intrinsic value.

Anno | Total Revenue | Net income | FCF | Book value | Dividend per share |

2016 | 6.75B | 791M | 1.41B | $12.58 | $0.29 |

2017 | 7.32B | 1.30B | 1.55B | $13.09 | $0.38 |

2018 | 7.60B | 1.87B | 1.08B | $13.87 | $0.57 |

2019 | 7.60B | 1.71B | 2.43B | $15.49 | $0.71 |

2020 | 7.25B | 1.34B | 2.74B | $16.48 | $0.74 |

2021 | 7.40B | 2.63B | 1.08B | $16.71 | $0.75 |

2022 | 8.03B | 1.91B | 1.44B | $11.74 | $0.79 |

TTM | 8.68B | 1.78B | 4.50B | $12.64 | $0.80 |

Every valuation method points in the same direction. Between 2017 and 2019, the stocks consistently fluctuated within the $17-20 range, with net earnings virtually identical to the current figures and free cash flow incomparable to today's. Meanwhile, the annual dividend more than doubled, and KeyCorp's assets increased from $139 billion in 2018 to $197 billion at the close of the last quarter.

The most astonishing element is the book value. Historically, the stock has always been priced 10-40% above the book value per share. At the moment, however, the shares are valued 31% less than their book value.

Stock Valuation sans Collapse Risk

Considering all of this, my estimate is that in the absence of an 'SVB scenario' risk, the shares would currently be priced at $22-24. Unquestionably not less than $20, which was the stock price before the infamous March 10th, when Silicon Valley Bank declared insolvency.

During those months, Wall Street was still pricing in the possibility that interest rates would stop rising in the summer and probably start to fall by the end of 2023. Today, we know that rates will continue to rise over the summer and will not decrease by the end of the year, which should contribute to an increase in KeyCorp's net interest income and that of American banks in general.

The Risk of an SVB Moment

Having ascertained that the potential upside is considerably high, let's assess the likelihood that KeyCorp ends up like UBS, First Republic Bank, and Silicon Valley Bank. This risk assessment, of course, cannot be precise: the risk is not linked to KeyCorp's core business but to the chance that a spark could trigger a customer panic, causing mass withdrawals. Panic, in itself, is unpredictable.

At the same time, I have solid grounds to believe that KeyCorp won't find itself in this predicament. First off, because the percentage of deposits not insured by the FDIC is relatively low compared to the banks that collapsed earlier this year. Here is a representation of the percentage of uninsured deposits based on end-of-2022 balance sheets.

Signature Bank | 90% |

Silicon Valley Bank | 88% |

Citigroup (C) | 85% |

First Republic | 68% |

JPMorgan (JPM) | 59% |

KeyCorp | 47% |

Goldman Sachs (GS) | 33% |

Updating KeyCorp's data to Q1 2023 and factoring in collateralized deposits, the percentage of deposits not covered by the FDIC and not collateralized drops to 34%.

We also need to consider measures introduced by the Federal Reserve to enable banks to quickly secure funding in the event of a deposit flight, particularly the Bank Term Funding Program, which allows fast loans using U.S. Treasuries in the portfolio as collateral - assessed at face value.

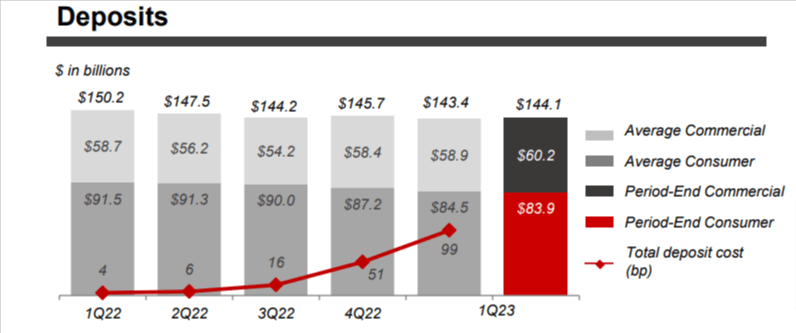

Moreover, the first quarter of the year reported a minimal change (-2%) in deposits at KeyCorp compared to Q4 2024.

KeyCorp - Q1 '23 Earnings Presentation

The only deposit-related issue is the increase in the percentage of interest-paying accounts. Currently, 29% of deposited funds generate interest, with management expecting a peak in the low-40s for this economic cycle. This certainly affects the net interest margin but doesn't impact KeyCorp's solidity.

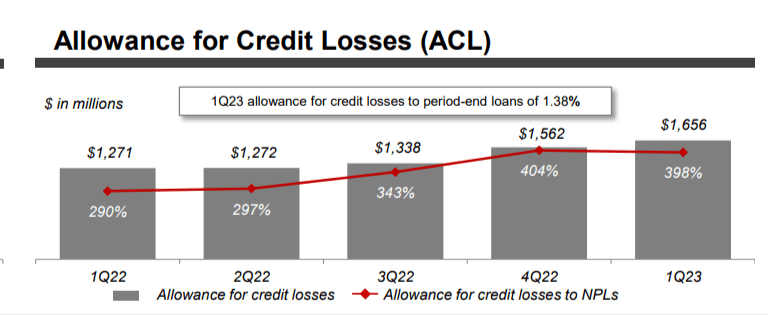

It's crucial to note that provisions for credit losses have historically been very conservative, far surpassing non-performing loans (NPLs). At the end of the first quarter, allowances for credit losses were 398% higher than impaired loans.

KeyCorp - Q1 '23 Earnings Presentation

Opportunities and strengths

Frankly, I consider all the points not touched upon so far to be secondary for the analysis and only contribute to establishing where within the $17-25 range KeyCorp shares would be if fears of an 'SVB moment' never arose. My rating wouldn't change based on the shift of the points mentioned henceforth.

The most notable strengths are:

The possibility of a scenario where the Fed rates will be 'higher for longer,' which according to the Q1 2023 presentation should bring about $1B of additional net interest income by the first quarter of 2025;

The growth of the Laurel Road business unit, catering to healthcare professionals, which increased its customer base by 30% in 2022. This could potentially become an interesting spin-off idea in the future;

KeyCorp has demonstrated consistency in increasing the dividend paid to shareholders year over year, even though I prefer to focus on the general capacity of the business to produce cash flows for investors.

Threats and weaknesses

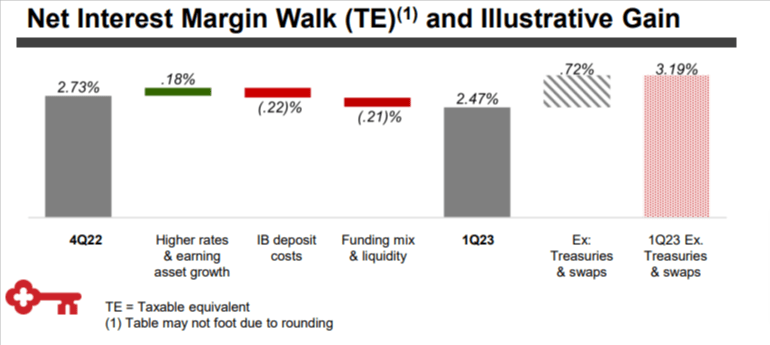

Excluding the risk of customer flight, the real issue that might bother shareholders is the pressure on margins. The net interest margin fell by 26 basis points in Q1 2023 compared to Q4 2022, with KeyCorp focusing on deposit acquisition rather than maintaining high margins. Margin pressure mainly came from an increase in interest-paying deposits and a change in the company's funding mix, as shown in the graph below. As a result, Q1 '23 net interest income was 10% lower than in Q4 '22.

KeyCorp - Q1 '23 Earnings Presentation

On June 12, management also stated that Q2 '23 net interest income would drop a further 12%, rather than the previously forecasted 4-5%. I can't say how much of bad news this is, as in my opinion, the stock suffered in the market more than this news would have justified.

Lastly, one must consider unrealized losses, a situation that is continuously improving. KeyCorp has $22B of Treasuries and swaps maturing by the end of 2024, so with each passing month, it becomes less likely that unrealized losses could cause panic. Additionally, with each passing month, the bank can reinvest funds at today's high yields: this is a significant opportunity to increase net interest income.

Final thoughts and conclusions

My rational estimate of the probability of KeyCorp ending up like First Republic Bank is not higher than 10%. At the same time, I expect that if this doesn't happen, the stock would double in value within the next 2-3 years. Also, I expect that the presentation of the upcoming quarterly data will be a strong positive catalyst for the stock, with the only strongly negative news - the drop in NII - already fully absorbed by the markets. Likely, KeyCorp will report significant balance sheet consolidation, easing fears of the bank's failure and helping investors regain confidence in the stock.

Given all this, I am entirely willing to accept the risk of insolvency to expose my investment to the potential upside.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KEY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)