LightPath Technologies, Inc. A Direct Beneficiary Of China's Germanium Export Restrictions

Summary

- On July 4, 2023, China announced major export restrictions on gallium and germanium. These rare minerals are used in many advanced economy applications, notably in high technology.

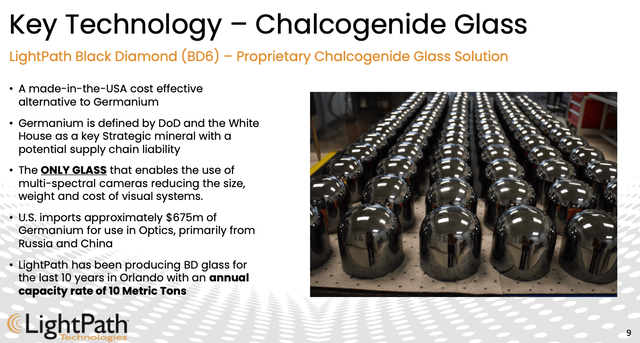

- LightPath Technologies is a direct beneficiary of China's major policy shift in that its Chalcogenide Glass (referred to as BD6) is a good substitute product within the optics segment.

- LightPath has 10 million metric tons of U.S. manufacturing capacity, at its Florida facility, where it manufactures BD6.

- This idea was discussed in more depth with members of my private investing community, Second Wind Capital . Learn More »

pixinoo/iStock via Getty Images

On July 4, 2023, as a retaliation measure against the U.S., over its restrictions on A.I. semiconductors and related technologies within the advanced computing eco-system, China put in motion strict export controls on gallium and germanium. In case you haven't noticed, we're moving closer to a new Cold War, not in the military sense, rather a technological arms race. And if you've been closely following the news cycle, this story has been widely covered and is a hot topic. As economic tension increase, Treasury Secretary, Janet Yellen, just got back from a trip to China, where she was dispatched, on behalf of the White House, to bring down the temperature, in the global theatre.

As a small cap value and special situation investor, I'm constantly questing for interesting opportunities and surveying the investment landscape. Although these discovery missions, at times can be quixotic, after being at this game both formally and informally, for the north of twenty years, I've gotten fairly adept at finding new opportunities.

Today, I write to share a new micro-cap idea and highlight a company that is a direct beneficiary of China's Germanium export restrictions. The company is LightPath Technologies Inc (NASDAQ:LPTH) and I will explain how they directly benefit from China's major policy shift.

Brief Background on Germanium

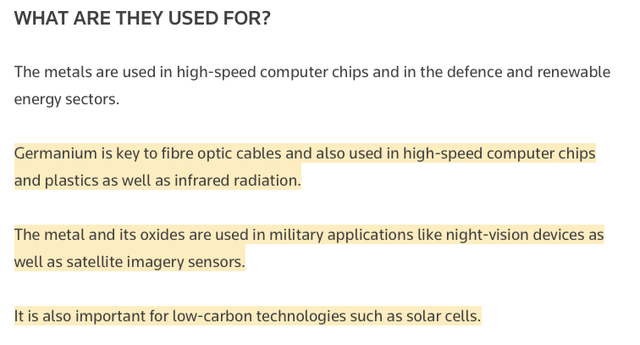

Essentially, China produces approximately 60% of the world's germanium. Germanium is used as a vital component in a lot of high-end/ advanced economy applications.

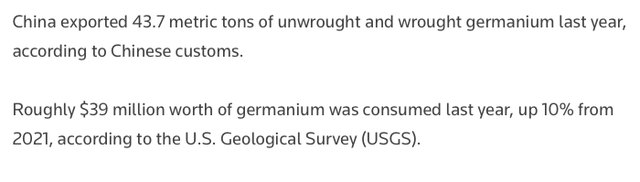

Per a recent Reuters article:

In 2022, China exported 43.7 metrics tons of germanium.

Germanium is used in these applications:

LightPath has a proprietary technology that is a substitute for germanium, Chalcogenide Glass, that can be used in optics. The optics market accounts for about 25% of germanium end demand.

The company has annual capacity of 10 Metric tons, at its Florida manufacturing facility. There are only two small players, that might have total capacity of 1 metric tons, each, that can make a similar product.

(Source: LightPath April 2023 investor deck)

Incidentally, LightPath and the DoD have been working on this well in advance and have more or less anticipated this move, by China.

Enclosed below is an excerpt from LPTH's Q1 FY 2023 conference call, which took place on May 11, 2023:

Please note the references to germanium:

To achieve significant growth and the market share in such an established market while commanding a premium, LightPath is leveraging its unique and exclusive materials for infrared imaging as an entry point into new programs and to become a supply of choice for infrared optics in the aerospace and defense industry.

The advantages our materials provide are twofold. First, it is an alternative to using germanium for infrared optics. The DoD and White House identify germanium as a strategic vulnerability within the supply chain. With most of the germanium originating from China and Russia, it is of strategic importance to have alternatives. We have been working with the DoD and various government agencies to accelerate the qualification of our new materials. Most of this work is funded directly by those agencies.

Secondly, our materials provide additional advantages over germanium, primarily in complex imaging systems. A good example of that is our own Mantis camera, which could not be made possible if we were to use only germanium. While new defense contracts can take a significant amount of time to come to fruition, we're seeing very positive lead indicators because the success of this strategy, as well as some faster wins as evident in our backlog.

(Source: LPTH's Q1 FY 2023 Conference Call - May 11, 2023)

The Business

Please note, LPTH's fiscal year ends on June 30th.

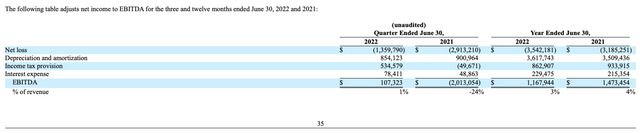

Over the past few years, and through the first nine months of FY 2023, the company has more or less been Adj. EBITDA breakeven.

Full Year FY 2021 and FY 2022

Nine months ended March 31, 2023

Q3 FY 2023 was marred by orders getting pushed into Q4 FY 2023 largely due to timing and the ongoing Florida manufacturing capacity expansion initiative. Q3 FY 2023 gross margins were solid, at 34%, despite the dis-economies of scale from lower revenue.

From a year-over-year basis, LPTH backlog is growing at a healthy clip.

Related to LightPath's Chalcogenide Glass technology is MANTIS camera.

Per the LPTH Q3 FY 2023 Conference Call

So far, we have seen strong interest and reception in the market to the unique capabilities of an imaging solution like Mantis. Those include a number of applications in the defense space, as well as commercial uses, such as sorting, plastic and recycling, fire detection, and more. It is clear to us that the need for such an imaging solution exists. And then some applications and customers were simply waiting for such a solution to appear at the right price point.

Instead of a $100,000 cryogenically cooled camera, that was the only option until now, we are now offering a solution for an order of magnitude less.

Over the last few months, our camera has been tested and evaluated in a number of applications, and has especially received significant attention with some groups inside Department of Defense. We're very encouraged by this and believe it will lead to significant OEM business of customized solutions.

Also, in addition to working with customers on their applications, we developed some unique technologies around it for which we have been applying for patents. In the last few weeks, we have applied for more patents than the company has in the last 10 years combined, representing a significant buildup of unique IP.

Valuation

LPTH has 37.3 million shares outstanding, or a $61 million market capitalization, with shares closing at $1.62, as of July 10, 2023. As of March 31, 2023, the company has $10 million of cash and about $14 million of net working capital. The company is more or less Adj. EBITDA breakeven and benefits from a growing backlog. It is really hard to value a company that is Adj. EBITDA breakeven and only has a $61 million market capitalization. You can't exactly apply an enterprise value to Adj. EBITDA number nor can you calculate a P/E ratio. The value of the business is related to how well management can grow its backlog, increase gross margins, move up in the value stack, and monetize its IP portfolio, in the form of products serving the defense, industrial, and commercial markets. Moreover, management needs to prove they can deftly take advantage of its BD6 technology and U.S. manufacturing footprint.

Additionally, in January 2023, the company did a secondary raise, selling 9.1 million shares, priced at $1.10 per share. The deal proceeds were earmarked for capacity expansion and working capital needs to support the commercialization of its programs.

From my perspective, there now appears to be some upside optionally tied to the company's stock, as Mr. Market works out the potential of LPTH's BD6 technology and tries to synthesize what its 10 metric tons of U.S. manufacturing capacity means, in a germanium-constrained world.

Risks

This is a $61 million market capitalization company. The stock is relatively thinly traded outside of quarterly earnings release periods. The company's 90-day average daily trading volume is only 130K shares. That said, on July 5, 2023, LPTH traded 7.2 million shares, as perhaps a few forward thinking market participants worked out China's germanium export restrictions and how LightPath could be poised to benefit.

Other risks include standard execution risks, such as blocking and tackling, as again, the company only has $10 million of cash.

Putting It All Together

Today's note was written to introduce LightPath Technologies to my small cap readership. Secondly, as germanium continues to trend in the news, given China's recently announced and significant export restrictions, this is an apt time to highlight LightPath, as an under the radar and promising micro-cap stock. I would venture to guess semiconductor manufacturers are racing to secure and stockpile germanium. Lo and behold, when this happens, and the way markets work, at least according to Adam Smith's invisible hand, is that germanium prices could materially increase, in both the near and intermediate term. If germanium prices rise materially, this should be a major catalyst for the adoption of Chalcogenide Glass (referred to as BD6), as a substitute, in both the defense and other market verticals, again though, within optics.

Now that we have a catalyst, LPTH also benefits from its healthy balance sheet, breakeven Adj. EBITDA profile, and growing backlog. Moreover, the company's MANTIS infrared camera is a promising display of LightPath's IP and patent portfolio. As a small cap value investor, if you can get comfortable with the risk and volatility, there is a lot to like here.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Second Wind Capital is a value oriented investment service with a strong recent track record of exceptional outperformance. The focus is mostly small cap value and special situation equities. From January 1, 2020 - December 31, 2022, the flagship account has compounded at 43.7% per year.

This article was written by

I actively invest my own capital and for a few family members.

Favorite quotes:

“When you are inspired by some great purpose, some extraordinary project, all your thoughts break their bonds: Your mind transcends limitations, your consciousness expands in every direction, and you find yourself in a new, great and wonderful world. Dormant forces, faculties and talents become alive, and you discover yourself to be a greater person by far than you ever dreamed yourself to be.” (Author - Patanjali)

“Tentative efforts lead to tentative outcomes. Therefore, give yourself fully to your endeavors. Decide to construct your character through excellent actions and determine to pay the price of a worthy goal. The trials you encounter will introduce you to your strengths. Remain steadfast...and one day you will build something that endures: something worthy of your potential.” (Author - Epictetus)

"Hope sees the invisible, feels the intangible, and achieves the impossible." (Author - Unknown)

"When I stand before God at the end of my life, I would hope that I would not have a single bit of talent left, and could say, 'I used everything you gave me." (Author - Erma Bombeck)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LPTH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.