U.S. Stocks Continue To Lead Major Asset Classes In 2023

Summary

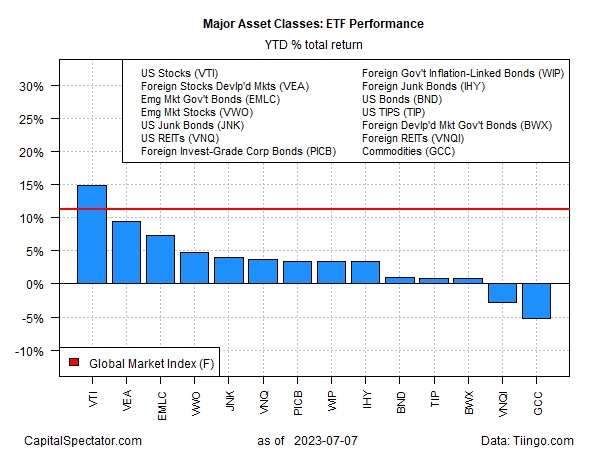

- American shares eased last week, but the US stock market remains the clear leader for the major asset classes this year, based on a set of proxy ETFs through Friday’s close (July 7).

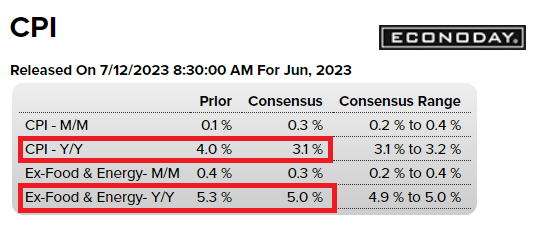

- Markets and the appetite for risk will be stress-tested anew this week when new US consumer inflation data is published on Wednesday, July 12.

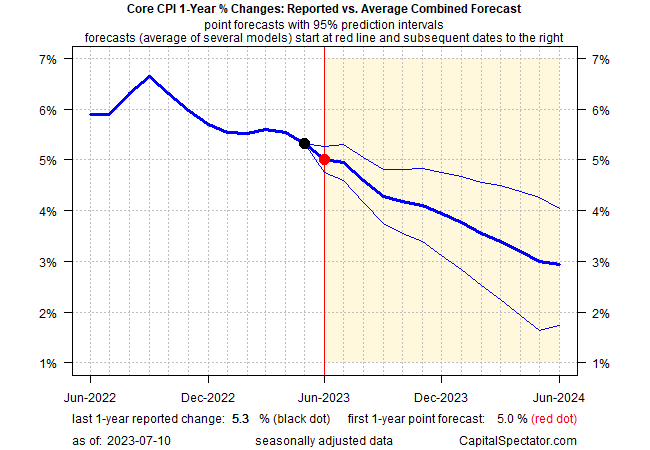

- By some accounts, the inflation-has-peaked forecast suggests US bonds are looking attractively priced after more than a year of flat to negative performances.

William_Potter

American shares eased last week, but the US stock market remains the clear leader for the major asset classes this year, based on a set of proxy ETFs through Friday's close (July 7).

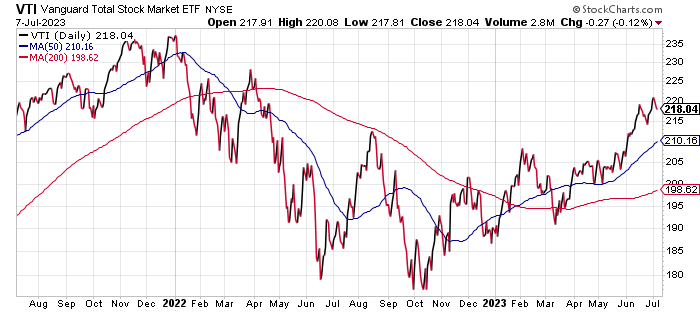

Vanguard Total US Stock Market Index Fund (VTI) fell 1.0% last week. Despite the modest pullback, the ETF remains close to a 15-month high following a rally off the October bottom. Year-to-date, VTI is up a strong 15.0%.

StockCharts

The Global Market Index (GMI.F) is up more than 10% this year. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

Tingo Econoday Capital Spectator

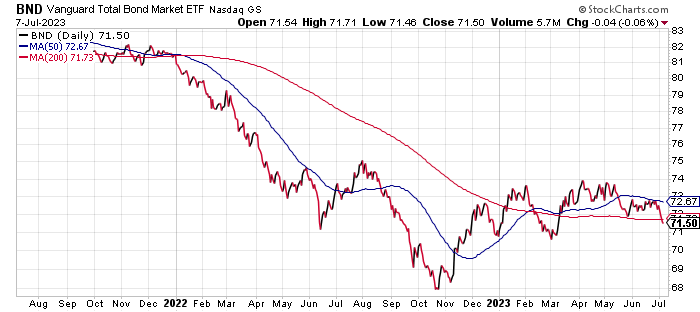

By some accounts, the inflation-has-peaked forecast suggests US bonds are looking attractively priced after more than a year of flat to negative performances. Although Vanguard Total US Bond Market Index Fund (BND) is up 1.0% this year, the ETF is still a long way from recovering from 2022's steep haircut.

StockCharts

"Right now you're getting good income out of fixed income," says Katie Nixon, chief investment officer for wealth management at Northern Trust. Rates are not only attractive on an absolute level, but also on a "real" basis in terms of comparing yields to the outlook for inflation in the years ahead, she tells Morningstar.com.

This week's CPI report will offer an early reality check on that reasoning.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by