Blackstone Secured Lending: A Superior 11% Yield

Summary

- The Blackstone Secured Lending Fund currently yields 11.4%, making it a high-yield option for income-seeking investors.

- BXSL benefits from the size, expertise, and quality of its external manager, Blackstone Credit, which contributes to its well-managed business development operations.

- BXSL focuses on investing in secured debt instruments, particularly first-lien senior secured and unitranche loans, offering a top-tier portfolio with a defensive nature and favorable risk profile.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Andrii Yalanskyi/iStock via Getty Images

Introduction

It's time to talk about a high-yield investment - a very high yield in this case. The Blackstone Secured Lending Fund (NYSE:BXSL) currently yields 11.4%, which is one of the highest yields on my radar.

While I prefer to buy dividend growth stocks with much lower yields, there is a group of investors that desire some very high-yielding stocks for a wide variety of reasons.

Although it needs to be said that buying very high yields comes with significant risks, I believe that Blackstone Secured Lending is one of the best-run business development companies on the market, which offers opportunities for income-seeking investors.

In this article, I'll give you the details.

However, before we start, I want to make one thing very clear: buying a yield this high comes with risks. As much as I like BXSL, do not go overweight in this stock or any of its peers. Funding a pension gap or any other financial gap should not be done by going all-in on risky assets.

Benefitting From Size, Expertise, And Quality

With a market cap of $4.5 billion, BXSL is one of the biggest business development companies. Formed in 2018, it operates as a closed-end management investment company regulated under the Investment Company Act of 1940.

This company is externally managed by Blackstone Credit BDC Advisors LLC, which is a subsidiary of Blackstone Alternative Credit Advisors LP.

I believe this is good news, as Blackstone (BX) is one of the world's biggest asset managers with a huge talent pool and other benefits.

- In this case, the Adviser is responsible for originating, researching, and structuring investments, as well as monitoring the portfolio.

- BXSL also benefits from the resources and scale of Blackstone Credit, including access to transaction flow, direct origination channels, syndicate deals, and a trading platform.

Bear in mind that Blackstone has close to $1 trillion in assets under management. Blackstone Credit managed roughly $250 billion - as of December 31, 2022.

In return for these services, the Adviser receives a management fee based on the average value of BXSL's gross assets. This is comparable to ETFs, where the managing company also receives a fee.

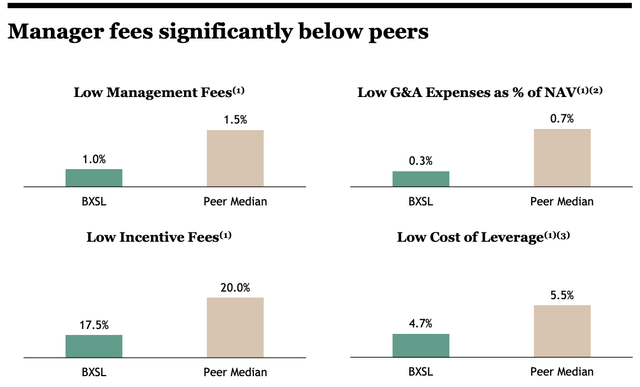

The good news is that BXSL has relatively low fees. The company beats its median peer when it comes to management fees, G&A expenses, incentive fees, and costs of leverage. While the differences aren't huge, these benefits add up over time.

Blackstone Secured Lending Fund

Having said that, BXSL primarily invests in secured debt instruments, with at least 80% of its total assets allocated to these investments.

Its portfolio mainly consists of first-lien senior secured and unitranche loans. The company focuses on investments in financially stable companies and does not primarily target distressed issuers, which tremendously helps when it comes to the quality of its loans, but more on that later.

A Top-Tier Portfolio

While an 11% yield indicates that risks are elevated (they are somewhat), we're dealing with a company that knows how to properly invest in debt.

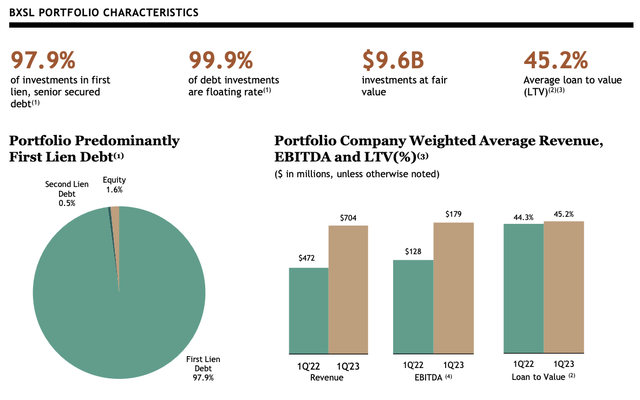

In its first-quarter earnings call, the company highlighted the defensive nature of its portfolio by emphasizing that the majority of investments, up to 98%, are first-lien senior secured loans.

Blackstone Secured Lending Fund

Furthermore, over 95% of these loans are extended to companies owned by private equity firms or other financial sponsors who have access to additional equity capital.

It also helps that the portfolio is highly equitized, with an average loan-to-value of 45%.

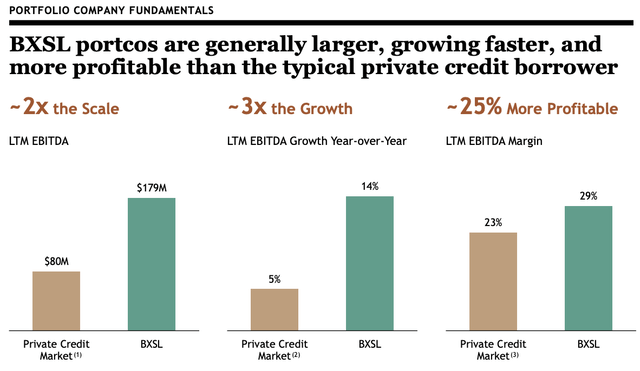

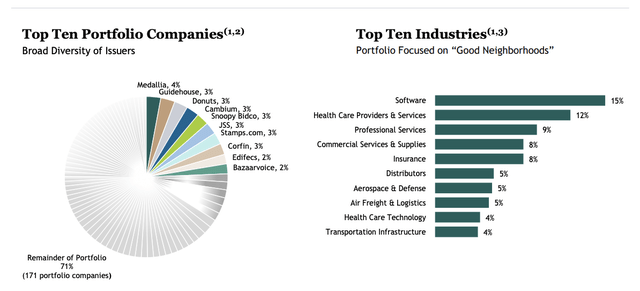

When it comes to the size of the average company in its portfolio of 181 companies with a weighted average weighting of 2%, the company mainly looks for companies in the upper end of the middle market, which BXSL believes offer compelling value opportunities.

According to the company, larger companies have shown significant growth rates compared to smaller companies since 2022, with substantially lower default rates since 2018.

Blackstone Secured Lending Fund

Additionally, less than 2% of BXSL's portfolio is allocated to companies earning less than 30 million of EBITDA, which historically have higher covenant default rates.

Comparing BXSL's portfolio to the Lincoln database, the last 12-month average interest coverage of 2.1x is slightly higher than the market average of 1.8x.

But wait, there is more. BXSL also places importance on investing in better companies in better sectors to drive sustained returns over time.

This includes key sectors with low default rates and low capital expenditure requirements, such as software, healthcare providers and services, and professional services, which collectively account for over 35% of the investment portfolio.

Blackstone Secured Lending Fund

With all of this in mind, at the end of the first quarter, BXSL had a total portfolio investment of $9.6 billion. The weighted average yield on its loans was 11.4%.

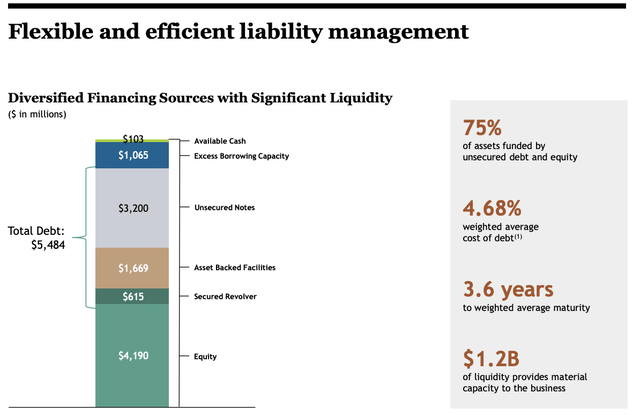

The company's outstanding debt stood at $5.5 billion, with a weighted average cost of 4.68%. The spread between floating-rate assets and low-cost fixed-rate liabilities helped offset the impact of rising rates on the average cost of debt.

Based on that context, BXSL has an attractive and diverse liability profile. 58% of the drawn debt consisted of unsecured bonds, with an average fixed rate of less than 3%.

This debt profile helped BXSL navigate the Federal Reserve's policy rate increases since the beginning of 2022.

Blackstone Secured Lending Fund

Adding to that:

- The company had $1.2 billion in liquidity at the end of the first quarter.

- The debt-to-equity ratio decreased to 1.31x from 1.34x in the previous quarter.

- The company maintained three investment-grade corporate credit ratings.

- BXSL has a low level of near-term debt maturities, with only 6% of commitments maturing within the next two years and a weighted average maturity of 3.6 years.

A Juicy Yield

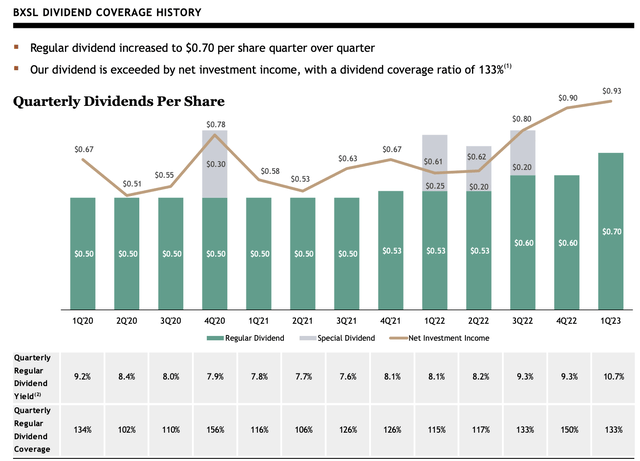

BXSL doesn't have a long dividend history. However, the data we do have shows a resilient picture.

In 1Q20, the company distributed $0.50 per share per quarter. Even during the first wave of lockdowns, that dividend was protected by net investment income.

Blackstone Secured Lending Fund

In 4Q21, the company started hiking its dividend. The most recent hike was announced on June 21, when the company hiked by 10% to $0.77 per share per quarter. This translates to an 11.4% yield.

While this isn't the highest BDC yield on the market, the company makes the case that it has the highest yield among companies with significant first-lien exposure.

We believe this represents the highest dividend yield for any listed BDC with as much of its portfolio invested in first lien senior secured assets.

Outperformance & Valuation

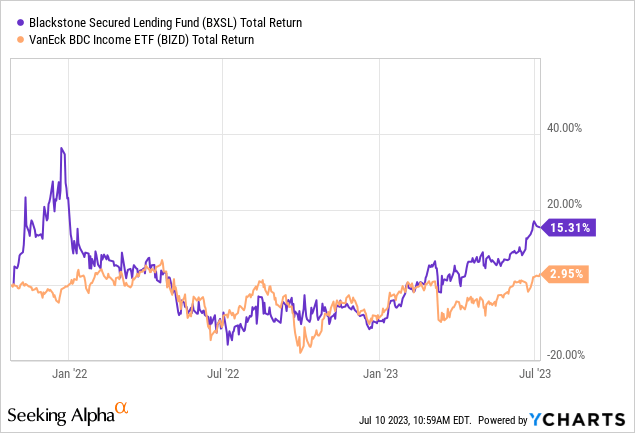

Since its IPO in 2021, the company has returned 15%, outperforming the VanEck Vectors BDC Income ETF (BIZD) by a wide margin. Note that BXSL is the fourth-largest holding of that ETF with a 4.6% weighting.

Given the company's fantastic management, high-quality debt, and ability to withstand economic headwinds, I believe that BXSL will remain an outperformer on a long-term basis.

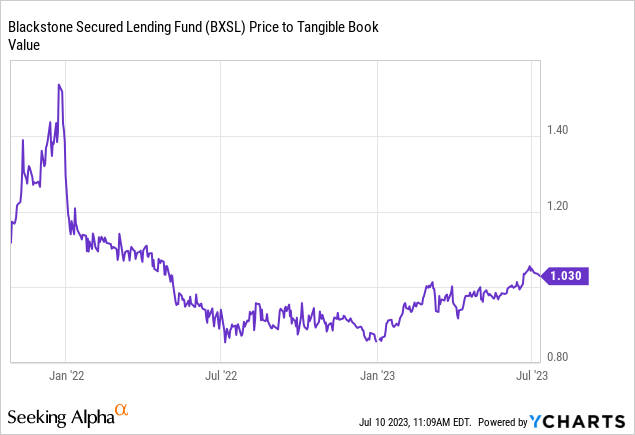

With regard to the company's valuation, we're dealing with a fair valuation.

How fair?

Well, the company is trading at the value of its tangible book. That's as fair as it gets.

Hence, the consensus target price is $27.50, which is less than 3% above the current price.

At this point, I also want to add again that as much as I like BXSL's portfolio, the company could suffer in a scenario of mass defaults. I'm not saying that could happen, but if the Fed tightens too far, it could trigger a series of defaults.

BXSL is still one of the healthiest BDCs on the market, but it's not immune against steep recessions.

So, whatever you do, do not go overweight in BDCs. Keep your position small. Only use BDCs to add some income to your portfolio.

Let high-quality dividend growth stocks do the heavy lifting!

Takeaway

The Blackstone Secured Lending Fund offers an enticing 11.4% yield, making it a high-yield option for income-seeking investors.

Managed by Blackstone, a renowned asset manager, BXSL benefits from its expertise, platform, and scale.

The company focuses on financially stable companies, reducing the risk associated with its loans.

Moreover, its emphasis on better sectors and larger companies contributes to sustained returns.

While BXSL has demonstrated resilience and outperformed its peers, it's important to be cautious and avoid overweighting in BDCs.

Therefore, investors should maintain a small position in BDCs and rely on high-quality dividend-growth stocks for long-term portfolio growth.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)

In your view - which one do you like better as a long term investment: BXSL vs OCSL? Thanks