Alibaba: The Crackdown Is Over (Rating Upgrade)

Summary

- Alibaba's stock has struggled to break out of its trading range between $80 and $90, but recent developments in China's economy and the resolution of Ant Group's fine could provide a boost.

- Alibaba is ramping up its buybacks, with the company revealing it bought back more stock between April 1 and May 17 than in the entire preceding quarter.

- Despite the potential for U.S./China tensions to negatively impact Alibaba shareholders, the company's valuation and positive catalysts make it a bargain compared to other options in the market.

Jack Ma Michael Loccisano

Alibaba Group Holding (NYSE:BABA) has been trading in a set range for a long time. Bouncing between $80 and $90 for months, it has struggled to break out. On Friday, the stock rallied 8%, after the long-anticipated Ant Group fine came in less than expected. It was a big move, but it only took the stock to the upper end of the range it had been trading in for most of the year. No new highs were set.

The question on investors' minds is whether Alibaba can finally break out of the range it's been trading in and really deliver some alpha. Alibaba has low valuation multiples combined with strong earnings growth, but it has had these virtues for some time without much movement in the stock price. Those holding the stock over the last year have had their patience consistently tested.

Today, that may be about to change. There are many catalysts in China's economy that have the potential to lift Alibaba and other Chinese stocks. Companies (including Alibaba) are ramping up their buybacks, retail sales are growing at 12.7%, and China's government is taking measures to stimulate consumption. Taken together, these developments point to a future for Chinese ADRs that is better than their recent past.

That doesn't guarantee that Alibaba stock will go up, of course. It's never 100% certain how the markets will react to news about a particular company, or about the economy as a whole. However, we now have more good news items for Alibaba coming out at once than at any other time in recent memory.

When I last wrote about Alibaba, I rated the stock a buy based on its cheap valuation and admirable competitive position. Since then, BABA has risen 6.5%. The stock price is now higher than it was at the time my last article was published, but the company's prospects look even better now than they did then. Accordingly, I'm upgrading my rating to 'strong buy,' despite the slightly higher stock price. In the ensuing paragraphs, I'll explain why I chose to do so.

The Ant Group IPO

One of the biggest reasons I'm becoming more bullish on Alibaba is because the prospects of an Ant Group IPO occurring have gotten better.

On Friday, China finalized its $984 million Ant Group fine. Although a company being fined is in itself a bad thing, this particular fine signaled positive things for Alibaba. First, the fine was smaller than what was anticipated. Second, China's central bank commented that the fine concluded its probe into the company, meaning that no further fines or regulatory actions are likely coming. Finally, the resolution of the fine is the final step that Ant Group (which Alibaba owns 33% of) must conclude before pursuing an IPO.

The cancellation of Ant Group's IPO was the impetus for the many years-long downtrends that Alibaba stock embarked on in 2020. Investors believed at the time that the cancellation signaled hostility from China's government. They were proven right, as the move was quickly followed by several similar ones, such as the imposition of a $2.8 billion fine, and the forced sharing of payment methods with Tencent (OTCPK:TCEHY).

To some extent, the selloff following the cancellation of the Ant Group IPO was justified, as it did come with a significant hit to BABA's fundamentals. In the year following the IPO's cancellation, Alibaba's earnings declined. Those bearish on BABA in late 2020 were proven right.

Now, however, with China softening its stance on Ant Group, there is hope that Alibaba may turn things around. Not only will an IPO create benefits for Alibaba (e.g., cash inflows from selling shares), it being allowed at all signals a more dovish stance from the CCP, which could make life easier for the company in the years ahead.

Buybacks

Another reason why I'm getting more bullish on Alibaba is because it is ramping up its buybacks. BABA has had a $25 billion buyback program authorized for over a year now. Until recently, it hadn't been actually doing much with the buyback room it had given itself. In some quarters, stock-based compensation actually ran ahead of buybacks!

That's beginning to change. In its most recent earnings call, BABA revealed that it bought back $2.3 billion worth of stock between April 1 and May 17. That's more than the $1.9 billion worth of shares repurchased in the entire preceding quarter. This data suggests that BABA's management is becoming more willing to use authorized buyback space. Also, Tencent is currently doing a large buyback program, as are other Chinese companies. This suggests that buybacks are 'in vogue' among Chinese companies, are not being opposed by the Chinese Communist Party ("CCP"), and that Alibaba will be free to use its authorized buyback program within a reasonable timeframe.

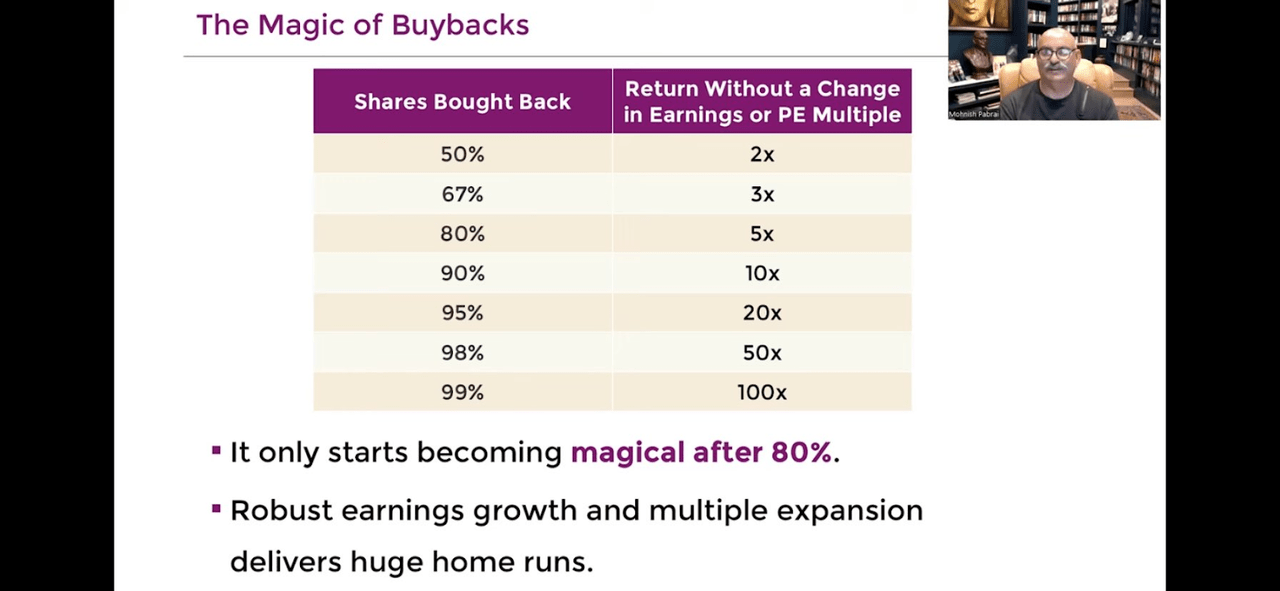

Buybacks have the potential to increase a stock's price as well as its intrinsic value. As Mohnish Pabrai showed in a recent talk, if you assume no multiple expansion or change in P/E multiple, then a buyback will move a stock's price according to the table shown below:

Returns from buybacks (Mohnish Pabrai)

Currently, Alibaba has $75 billion in cash and short-term investments (e.g., treasuries) on its balance sheet. It did $25 billion in free cash flow last year. It has a $232 billion market cap. Therefore, Alibaba's balance sheet liquidity plus two years' worth of free cash flow would be enough to push BABA's stock price up 100% according to Pabrai's table.

Now, this is simplifying a bit, because in reality, the stock price would be progressively moving upward while the shares were being bought, assuming the supply and demand from other shareholders were unchanged. To get numbers exactly like the ones Pabrai shows in his table, you need to buy at progressively higher prices. Still, the fact that BABA could buy back half its float in two years IF the price didn't change is telling. It suggests that the stock is priced cheaply compared to its fundamentals and that it wouldn't take much to ignite a rally.

Valuation

A final reason why I'm getting more bullish on BABA is the reason I've always been bullish on it:

The stock is cheap.

This fact has been the crux of my commentary on Alibaba ever since I started covering it, but it is even more the case now than before. Alibaba's stock has declined in price this year, yet its earnings grew 6.5% and its free cash flow grew 78%. So, you're now paying much less per dollar of earnings when you buy a BABA share, compared to at the start of the year.

How cheap is Alibaba stock exactly?

According to Seeking Alpha Quant, it trades at:

11.5 times adjusted earnings.

23 times GAAP earnings.

1.9 times sales.

8 times operating cash flow.

9.86 times free cash flow.

This compares pretty well to North American tech stocks. According to the Wall Street Journal, the NASDAQ-100 has a 31 P/E ratio, so BABA is much cheaper than U.S. tech. Additionally, the company has $9.18 in free cash flow per share in the trailing 12-month period. That gives a 10% free cash flow yield using Friday's closing price of $90.55, making BABA one of the few big tech companies that beats the 10-year treasury on potential yield.

On a related note, the 10-year is currently at a 4.08% yield. If you assume that Alibaba's cash flows never grow again, then its $9.18 in FCF per share yields a fair value estimate of $225, discounted at the treasury yield. If you add a 6% risk premium, taking the discount rate to 10%, then you get a $91.8 fair value estimate. So, there's some upside even if we assume no growth and a large amount of risk.

The Big Risk to Watch Out For

On a concluding note, there is one big risk that every investor in Alibaba stock has to keep in mind:

U.S./China tensions. The U.S. and China are currently at odds over Taiwan and computer chips, among other issues. China wants to integrate Taiwan with itself, the U.S. wants the Island to remain de facto independent. China wants to build its own computer chip supply chain, while the U.S. does not want China to have advanced chip-making capabilities. The differences between the U.S. and China on these issues are pretty stark. The fact that Janet Yellen met with He Lifeng recently was taken as a sign of thawing relations, but it coincided with yet another crackdown on exports of DUV lithography machines to China. Obviously, the U.S. and China still don't see eye to eye.

This situation poses certain risks to Alibaba investors. First, an invasion of Taiwan would likely rattle investor confidence, triggering worries about wholesale commerce bans like those imposed on Russia during the invasion of Ukraine. Second, continued bans on sales of chip exports to China could dampen Alibaba's own chip ambitions-which are key to the success of its cloud business. Third and finally, the diplomatic wrangling over these issues can be a source of volatility in itself. So, there is potential for U.S./China tensions to negatively impact Alibaba shareholders. But when we look at BABA's valuation and many positive catalysts, we can see clearly that it's a bargain compared to much of what's out there in the markets today.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.