A Tobacco Industry Match-Up: Altria Is The Best

Summary

- The tobacco industry is known to offer high dividend yields and low valuation ratios.

- Aside from strong cash flows and low prices, several other factors look desirable in the industry from an investment standpoint: Including ROIC, buybacks, and financing.

- But how do you pick a stock from the offering, and what stock offers the best balance between the metrics? Here's my take.

mariusFM77

The contest

The tobacco industry is known for offering investors many attributes that are considered favourable. These include high dividend yields, high profit margins, high returns on capital, and relatively low P/E ratios because of low anticipated growth and some investors opting to stay out of the area entirely.

If you've studied the tobacco industry over the years as I have, you may have wondered what attribute to favour over the other. Should you pick the tobacco stock with the highest dividend yield? Or the one with the highest return on capital? Or perhaps favour buybacks? Should you buy the cheapest over the others?

With this analysis, I will give you my answer to this based on a ranking system inspired by Joel Greenblatt's "Magic Formula" for value investing. With the "Magic Formula", Greenblatt ranked stocks based on two metrics: Their P/E and their return on assets (ROA). The highest ranking stocks would be the ones with the lowest P/E and the highest return on assets.

Instead of ranking based on only two metrics, I will be ranking each tobacco stock based on the following metrics:

- PFCF - Price-to-free cash flow.

- Dividend yield.

- Buyback yield.

- Return on invested capital (ROIC).

- Debt coverage (Debt-to-earnings).

Once a "winner" of the contest has been found, I will do a deeper dive on the particular stock in the second section of this analysis.

The "contestants" are:

- Altria Group, Inc. (NYSE:MO). Known for its very high dividend yield. Generally more exposed to traditional tobacco products (combustibles) than peers. Placed in the premium segment through Marlboro.

- Imperial Brands PLC (OTCQX:IMBBY). This British producer is the smallest of the "Big Four" tobacco makers. Also quite exposed to legacy tobacco with a very high dividend yield. Mostly placed in the discount segment.

- Philip Morris International, Inc. (PM). One of the most internationally exposed tobacco companies. Known to be a leader in non-combustibles and a fast grower in the industry.

- British American Tobacco p.l.c. (BTI). Alongside Philip Morris, this is the most internationally exposed "Big Four" member. Equally known for its high dividend yield and occasional buybacks.

- Japan Tobacco (OTCPK:JAPAF). Japan Tobacco is the maker of "Camel" outside the US and also owns a very diverse portfolio of other brands. It has enormous dominance in Japan. Operates in several other industries, including real estate.

- Vector Group (VGR). As with Japan Tobacco this one's a little different from the others in that it has one leg in tobacco through Liggett Group and the other leg in real estate through Douglas Elliman etc. It operates in the discount segment.

- Universal Corporation (UVV). Not strictly a tobacco business but one that is highly tied to the industry. Universal is a tobacco leaf merchant that provides tobacco companies with tobacco for their products.

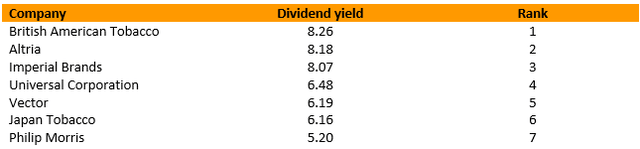

PFCF ranking

The first metric I will be ranking on is a valuation (price) ratio. I'm using PFCF - price to free cash flow - rather than the traditional earnings multiple (P/E). This is because most tobacco companies are strong cash flowers and earnings may be misleading based on a number of accounting factors.

The ranking turns out as follows:

Analyst's presentation, data from Gurufocus.com

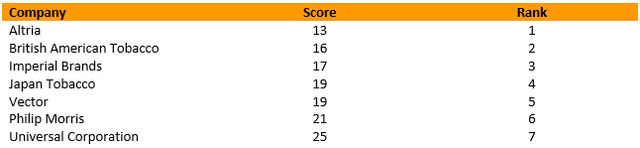

Dividend yield ranking

This metric is pretty self-explaining. It measures the dividend yield of the "contestant".

Here again British American Tobacco leads. It looks as though you have three tiers of dividend yield: One with ultra-high dividends (British American Tobacco, Altria and Imperial Brand), one middle tier with Universal Corporation and Vector, and one with Japan Tobacco and Philip Morris:

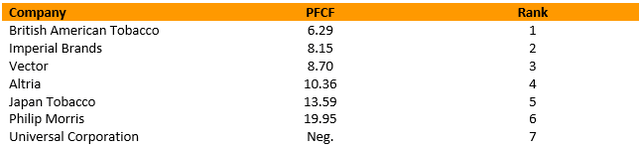

Buyback ranking

For this metric, I will be measuring the buyback yield to supplement the dividend yield. I will only be looking at active share repurchase programs, and as it turns out, only Imperial Brands and Altria are actively buying back at the moment. The full value of the buyback program is measured against current market capitalization:

Analyst's presentation, data from company presentations

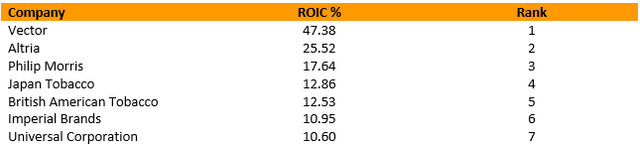

ROIC ranking

This metric measures the company's profitability. It accounts for both the return made from equity and debt borrowings. This is why I use ROIC instead of return on assets (ROA) or return on equity (ROE):

Analyst's presentation, data from Gurufocus.com

Debt coverage ranking

This metric measures the company's long-term debt versus its earnings for 2022 (debt-to-earnings). I wanted to include it as it's one thing to be profitable and another for the stock to be cheap. But you also want a business that is conservatively financed:

Analyst's presentation, data from Seeking Alpha

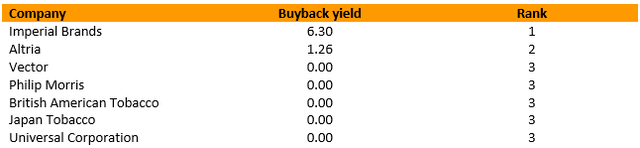

And the winner is...

- Altria!

Based on an equal weighing of the factors price-to-free cash flow, dividend yield, buyback yield, return on invested capital, and each tobacco company's ability to cover debts, Altria Group, Inc. appears the most attractive. I think that what can be said about Altria is that even though it doesn't lead on any one metric, it offers a strong scoring in each category and thereby a good balance. The "runners-up" are British American Tobacco and Imperial Brands.

The least favourable is Universal Corporation.

The full ranking is as follows:

A closer look on Altria

Altria's business

Since Altria has "won" the tobacco contest, I will be taking a closer look on Altria.

Altria is most known for owning the rights to make and sell Marlboro in the US, but its operating companies include five in total:

The largest operating company is Philip Morris USA, the maker of Marlboro in the US. NJOY is the most recent addition to Altria's operating segment. This is Altria's push to really move into e-vapor products as NJOY holds the only pod based e-vapor product with market authorization from the FDA. Going forward, Altria will try to leverage their sales and distribution organization to increase NJOY sales.

Aside from the operating companies, Altria has a joint venture with Japan Tobacco called Horizon Innovations, the so-called service companies named Altria Client Services and Altria Group Distribution Company, and certain strategic investments.

My prior analysis, updated valuation & risk assessment

In May 2023, I rated Altria a "Buy". My buy thesis then was centered around a "sum of the parts" analysis where I looked at Altria's ownership of a 10 % stake of Budweiser (BUD) in particular. I concluded then that the Budweiser asset alone was worth around $12 per share - a significant portion of the stock price. On top of this, Altria owns the largest US brand of cigarettes, Marlboro, with annual 2022 sales of more than 75 billion cigarettes. On top of this, Altria owns a stake of Canadian cannabis maker Cronos (CRON), cigar maker John Middleton and an alternatives product portfolio.

Since my last analysis, the stock has moved up from $44.51 to $45.98 (3.3 %) while having also paid its most recent quarterly dividend of $0.94 (~2 %).

It's hard to say exactly what is a fair value for the Altria stock, but whatever number you come up with I believe should be derived from a dividend discount model. This is because the investment case is so clearly based on Altria's ability to return cash to shareholders in the form of its 8%+ dividend yield and its current $1 billion buyback program. If you consider both dividends and buybacks a direct cash return eligible for consideration under the dividend discount model, the total current cash returns to be valued is $8,424 million per year (2022). This again translates to $4.72 per share. The question then is how those cash flows (or cash returns) will develop over time. Altria has said themselves that they expect mid-single digit dividend growth annually. Altria is a "Dividend King", so I expect them to strongly go for this target pretty much whatever it takes. Buybacks should help the dividend growth as shares are retired allowing for greater per-share distributions on the remaining shares. If we assume that dividends (and buybacks) will grow at a 5 % rate for the first 10 years - with an assumed dividend growth of 2 % thereafter - discounted at a rate of 9 % (somewhat in line with the general market movement) each share of Altria comes out at a value of ~$79. The model used here is that of the "H Model" which assumes an initial high dividend growth and a perpetual low growth stage after that. With the stock currently trading at ~$46, the model would suggest quite substantial undervaluation.

There are of course risks associated with buying Altria stock (and any tobacco stock, for that matter). I see the risks in Altria as being mainly centered around its ability to transition to alternative non-combustible products such as nicotine pouches and e-vapor. It's an undisputable fact that cigarette sales are declining and have been for a long time with the amount of US smokers relative to population declining. Altria will probably be able to keep raising prices on cigarettes to offset the decline (price elasticity), but even so, in the very long term, I see no way around transitioning to smoke free products. Another significant risk and one that is outside the control of management is regulatory risk. This includes everything from further restrictions on marketing to taxes and litigation resulting from such areas.

Final thoughts

The tobacco industry offers the contrarian investor many opportunities to pick stocks that have favourable attributes. The right weighing of these attributes is for the individual investor to decide. One important factor that I have intentionally left out in this analysis and contest is growth. It's hard to measure expected growth, and particularly hard against fundamentals such as dividend yield that can be accurately stated (at least looking backwards). Another important metric is the profit margin which could've also been added in.

I have provided one way to measure the companies against each other based on fundamentals that I consider to be important. Other metrics could be right for you - or perhaps a weighing of the metrics so that, for instance, return on capital weighs more than debt coverage.

As the numbers change, so could the ranking and thereby the most favourable investment at the moment. Presently, I consider Altria to be the most desirable tobacco stock based on the ranking system.

When taking a closer look on Altria, I believe the fundamentals support its first-place spot. Altria has a diversified business within tobacco, including a very strong combustible business based on Marlboro but also a focus on transitioning to alternatives through NJOY, Horizon Innovations etc. I believe a valuation based on Altria's ability to dispense cash to shareholders show considerable undervaluation by the market at its present price.

Do you agree or disagree with this analysis? Let me know in the comments below.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, PM, IMBBY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (12)