Ares Capital: Rising Rates Make Up For Activity Slowdown (Rating Upgrade)

Summary

- The BDC sector is not in the most upbeat shape, but Ares Capital is well positioned.

- Investment activity is slowing down as evidenced by falling gross funding and gross commitment data along with management commentary indicating a dearth of investment opportunities.

- But rising rates are a more powerful tailwind for Ares Capital's floating-rate-dominated investment portfolio. Further rate hikes are likely to provide further propulsion, increasing investment yields.

- The quality of the portfolio is steadily improving as the mix and incidence of the highest investment grade companies increase. An increasing weighted average EBITDA also signals portfolio resiliency.

- I anticipate increasing net investment income to lead to a jump in NAVs in Q2 FY23, driving upsides in the valuations and stock prices.

Ares Capital is riding the rising rates

graphixel/E+ via Getty Images

Thesis Review

In my last article on Ares Capital (NASDAQ:ARCC), I held a 'neutral/hold' stance primarily because the BDC sector dynamics were expected to be deteriorating. 3 months later, the stock has generated a total return of +8.74% vs the S&P500's total return of +7.69%, leading to an alpha of +1.05%. This is a missed opportunity but I am not beating myself up about it because it is by no means a major miss. An example of what I consider a major miss is my first article on Palantir (PLTR).

Now, as I review my thesis, I find that although my expectation of a slowdown in the BDC sector was correct, this is being more than compensated by powerful macro tailwinds. This prompts me to change my stance from a 'neutral/hold' to a 'buy' on Ares Capital.

Investment activity is slowing down

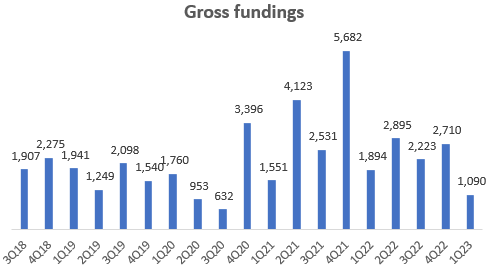

Gross fundings of new investments saw a sharp downtick from $2.71 billion to $1.09 billion in Q1 FY23:

Gross Fundings (USD mn) (Company Filings, Author's Analysis)

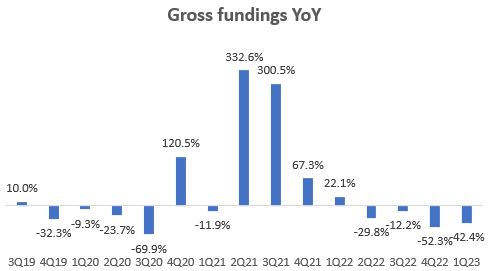

The YoY trend has been declining for the last 4 quarters; however, it is important to note that before Q1 FY23, the past 3 quarters show a YoY declines following very high growth rates of above 50% in the prior year.

Gross Fundings YoY (Company Filings, Author's Analysis)

I would assign more weight to Q1 FY23's figure as it is an early indication of a structural decline, even from more normalized funding activity levels. Management's narrative agrees with these numbers as they described a "relatively slow transaction environment" in the Q1 FY23 earnings call.

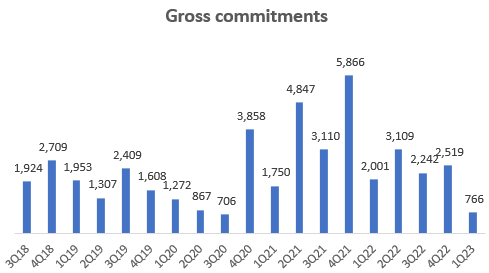

Commitments are a slightly leading indicator of future investment fundings. Gross commitments have fallen off a steeper cliff from a consistent run-rate of more than $2bn in FY22 to $766 million, similar to the pandemic-stricken 2020 year.

Gross Commitments (USD mn) (Company Filings, Author's Analysis)

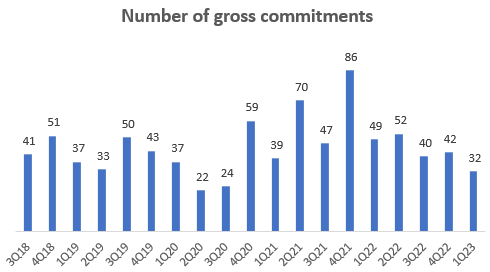

The headwind aggregate gross commitments figure is a result of a double-whammy composed of both a fall in the number of gross commitments from 42 to 32:

Number of Gross Commitments (Company Filings, Author's Analysis)

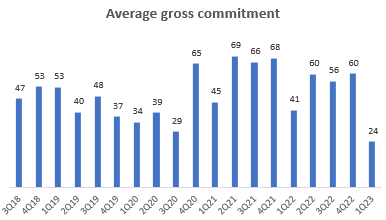

And a sharp 41.4% YoY decline in the average gross commitment value from $41mn to $24mn:

Average Gross Commitment (USD mn) (Company Filings, Author's Analysis)

Management has admitted that:

...our selectivity rate on new transactions in the first quarter is one of the lowest in 5 years.

- CEO Robert Kipp deVeer in the Q1 FY23 earnings call

The numbers and narratives clearly paint a lackluster outlook for new investment activity for Ares Capital.

But rising rates are a more powerful tailwind

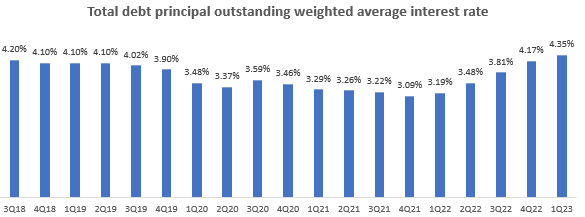

69% of Ares Capital's investments are geared to floating rate loan terms. Thus, as interest rates have risen, so has the weighted average interest rate on the issued loans:

Total Debt Principal Outstanding Weighted Average Interest Rate (Company Filings, Author's Analysis)

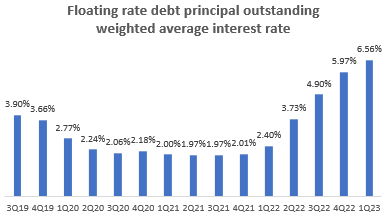

The rise in the overall weighted average interest rate is driven mainly by sharp rises in floating rate increases:

Floating Rate Debt Principal Outstanding Weighted Average Interest Rate (Company Filings, Author's Analysis)

Ultimately, this lever is contributing to an increase in investment yield for Ares Capital's investment portfolio:

Weighted Average Yield on Total Investments at Fair Value (Company Filings, Author's Analysis)

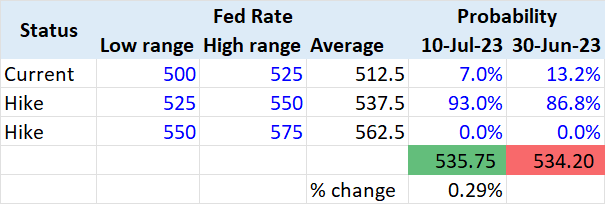

I believe Ares Capital is due for further upside ahead in Q2 FY23 due to the expectations of higher rates following the 26 July 2023 Fed meeting. According to the CME Group's FedWatch tool, the probability-weighted expectation implies a 0.29% higher federal funds rate following a strong beat in June 2023's private payrolls data:

Fed Rate Hike Probabilities (CME FedWatch Tool, Author's Analysis)

The quality of the portfolio is steadily improving

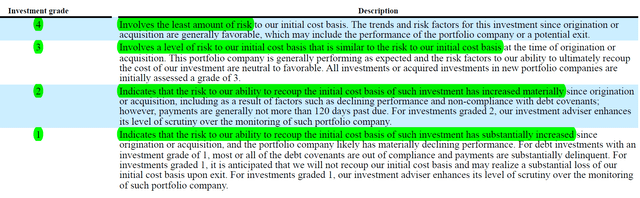

Grade 4 represents an investment class that involves the least amount of risk:

Ares Capital Investment Grade Classifications (Company Filings)

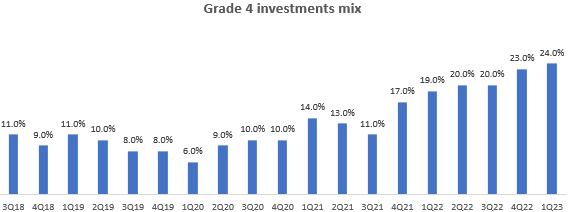

Ares Capital's composition of highest investment grade companies in its overall portfolio is seeing steady improvement both on an aggregate investment value level:

Grade 4 Investments Mix (Company Filings, Author's Analysis)

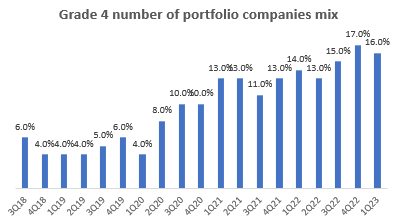

And also in terms of company representation:

Grade 4 Number of Companies Mix (Company Filings, Author's Analysis)

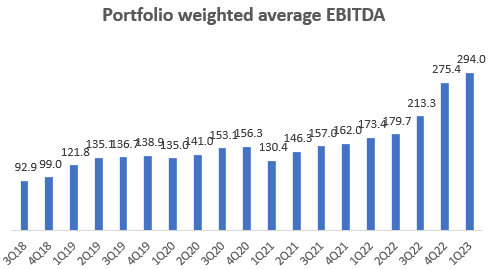

Management noted that larger companies are showing faster growth in the current, challenging operating environment:

Companies in our portfolio with EBITDA in excess of $50 million are growing faster than companies with less than $50 million of EBITDA

- Co-President & Co-Head of Ares Credit Group Mitchell Goldstein in the Q1 FY23 earnings call

Larger size is generally associated with higher resiliency, which is especially important during challenging economic times. Given this context, it is pleasing to see Ares Capital's weighted average EBITDA show meaningful sequential improvements over the last few quarters:

Portfolio Weighted Average EBITDA (Company Filings, Author's Analysis)

Valuation

BDC companies such as Ares Capital are marked to fair value every quarter. The net asset value (NAV) per share stood at $18.45 as at the end of Q1 FY23. The current share price is $19.08, implying a premium of only 3.4%. I believe we are due for an appreciation in the net asset value in Q2 FY23, driven by higher net investment income arising from a likely rate hike.

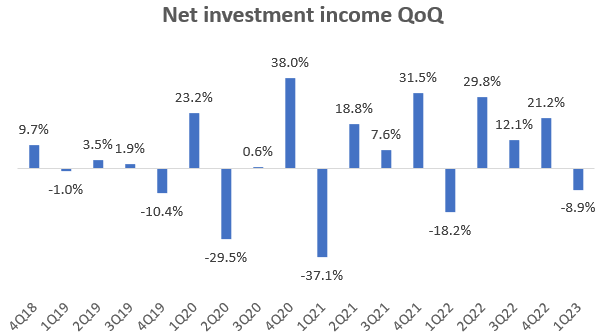

Net Investment Income QoQ (Company Filings, Author's Analysis)

Q1s tend to be seasonally weak for Ares Capital, yet the sequential decline of -8.9% was considerably lower than the prior 2 Q1s. I think this indicates favorable momentum. Looking at the magnitude of the Q2 QoQ rebounds, I suspect that the upside is higher than the premium to NAV margin of 3.4%. Therefore, I anticipate further upside in the stock:

The most important risk and monitorable

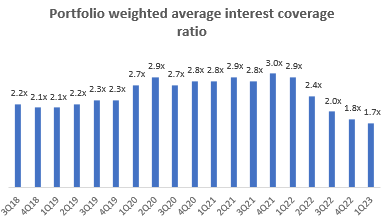

Despite the rising rate tailwinds and a greater incidence of quality companies in its portfolio, a challenging environment for middle-market companies in the BDC sector is leading to a compression in Ares Capital's weighted average interest coverage ratio:

Portfolio Weighted Average Interest Coverage Ratio (Company Filings, Author's Analysis)

I believe this is the most important risk and monitorable for Ares Capital. I note that management has suggested that 1.7x would be a bottom:

...running the forward LIBOR curve through our model, it [interest coverage ratio] does bottom out at 1.7x.

- Partner & Co-Head of US Direct Lending, Kort Schnabel in the Q1 FY23 earnings call

However, as this driver is a factor outside management's control, I would not place too much weight on management's guess. The weighted average interest coverage ratio is a key number I will be tracking in the Q2 FY23 earnings release. Any further deterioration in this figure towards 1.0x may trigger increased accruals and investment impairments similar to what is plaguing Medical Properties Trust (MPW) currently.

Takeaway

The data shows that my earlier anticipation of sectoral weakness in BDCs is true; investment activity has dried up and investment commitment stats suggest that the outlook remains on the bleak side. However, more than compensating for these headwinds is the uplifting effect of rising rates, which is sharply pushing up the yields on Ares Capital's floating-rate-dominated investment portfolio. Within the portfolio, the mix of higher grade investments is also increasing steadily.

Given the structural drivers ahead, I believe we are likely to see further upside in the company's net asset value in the Q2 FY23 results, which may contribute to further upside to the valuations and the stock. On the risks side, weighted average interest coverage ratios are near a local low in the current environment; this is a key metric to monitor in the next quarterly release.

Rating Revision: 'Buy'

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ARCC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)