SM Energy: Interesting Only For Acquisition Potential

Summary

- SM Energy, a $3.8 billion market cap company, pays a 1.9% dividend.

- The company’s reserves are only 38% higher-valued oil, 1Q23 production was 43% oil. SM Energy produces from the Midland sub-basin and the south Texas Eagle Ford and Austin Chalk.

- The company's Denver headquarters reflect its Colorado roots. However, it's now more geographically removed from operations than its competitors.

- This idea was discussed in more depth with members of my private investing community, Econ-Based Energy Investing. Learn More »

Jasmin Pawlowicz

SM Energy Company (NYSE:SM) is a mid-cap oil and gas producer probably best positioned as an acquisition candidate. For long-term energy investors, I rank SM Energy as sell.

With only a 1.9% dividend, SM Energy will not appeal to dividend investors. Those seeking capital appreciation in energy stocks will want to consider other companies as SM Energy has significant debt paydown obligations and its production leans more heavily (57%) toward lower-valued natural gas and natural gas liquids. The company's Eagle Ford/Austin Chalk natural gas will be competing with more natural gas from the Permian Basin. Permian Basin associated gas is a byproduct whose price sometimes actually goes negative.

However, speculators who think SM Energy might be the next PDC Energy (which was acquired by multinational Chevron (CVX)) or that it becomes another South Texas company getting consolidated may want to consider buying the company's stock.

1Q23 Results and 2Q23 Guidance

For the first quarter of 2023, SM Energy reported net income of $198.6 million, or $1.62/share. Production of 146,400 barrels of oil equivalent (BOE) was 43% oil.

In terms of production:

- Oil was 62,700 BPD, most (about 80%) from the Midland basin.

- Natural gas was 358,100 MCF/D, roughly evenly split between Midland (45%) and South Texas (55%).

- Natural gas liquids were 23,800 BPD, all from the Austin Chalk/South Texas.

On a BOE basis, 51% came from the Midland Basin (mostly oil) and 49% from South Texas (mostly gas and natural gas liquids).

The third quarter average realized price pre-hedge was $43.31/BOE and post-hedge was $43.70/BOE.

Cash from operations was $331.6 million. Capital spending was $241 million.

Adjusted EBITDAX was $401.4 million.

The company repurchased more than 1.4 million shares of its own common stock in 1Q23. (According to its 2Q23 update, it has since purchased an additional 2.6 million shares in 2Q23. Total share repurchases in the $500 million share repurchase authorization are 5.3 million shares since the program's beginning in September 2022.)

For 2Q23 through 4Q23:

- 30% of oil was hedged at $75.29/barrel.

- Slightly less than 30% of natural gas was hedged at $4.03/MMBTU.

Originally, for the second quarter of 2023, the company expected to make $305 million in capital expenditures, drill 17 wells (10 in South Texas, seven in the Midland basin), and produce about 147,000 BOE/D, 42-43% oil and 59-60% liquids (oil and natural gas liquids).

In the 2Q23 update, SM Energy announced 2Q23 production is expected to be slightly higher than originally estimated (4% above the midpoint) and to be 42% oil. Capital expenditures for the original plan are lower: Some of the additional capital freed up will be used to add another rig in the Midland Basin during 4Q23.

SM Energy recently purchased oily assets in the Midland sub-basin. These Dawson and Martin County assets comprise 23,000 acres, 1250 BOE/D net production, 90% oil. Purchase price was +$93 million.

For full-year 2023, production also is expected to be slightly higher than originally estimated and to be higher in oil content, at 43-44%.

Oil and Gas Prices

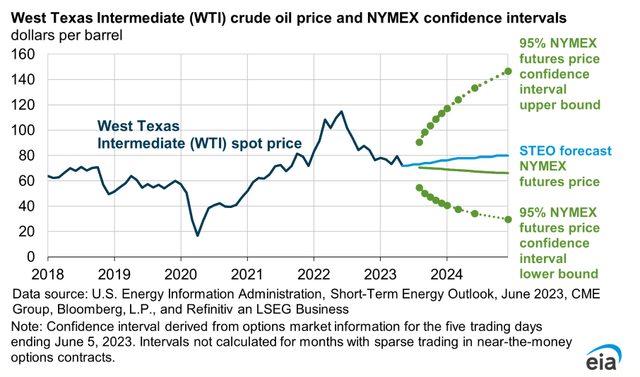

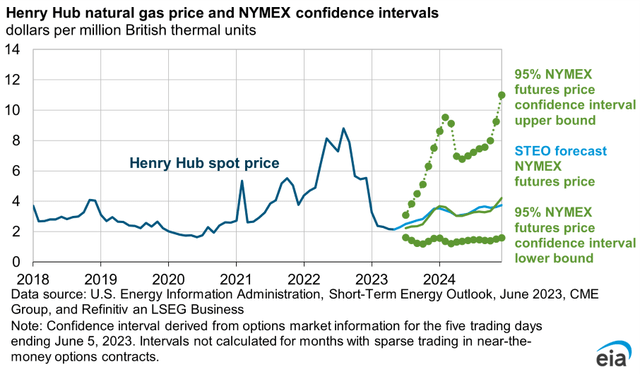

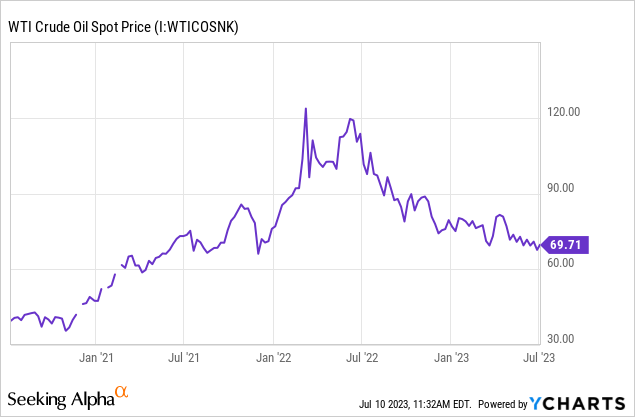

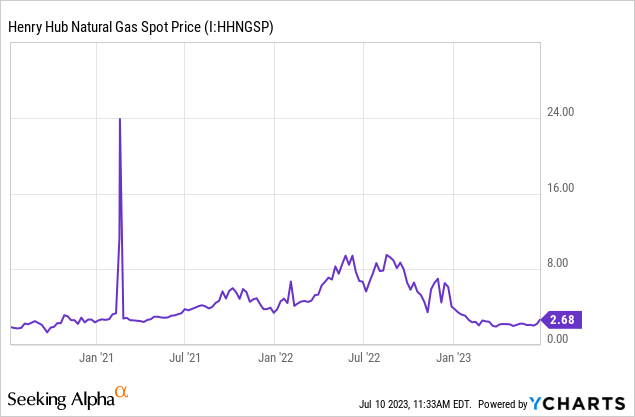

July 10, 2023, oil price for West Texas Intermediate - WTI - crude oil at Cushing, Okla., for August 2023 delivery was $73.65/barrel. Natural gas price for August 2023 delivery at Henry Hub, Louisiana was $2.68/million British Thermal Units (MMBTU).

Supply and demand factors point to somewhat higher oil prices and seasonally higher natural gas prices for the second half of 2023.

The EIA's 5-95 confidence interval charts for both oil and gas prices through the end of 2024 are shown below. The oil price range by year-end 2024 is $30-$140/barrel. The gas price range fluctuates seasonally.

Reserves

With one italicized exception, the following statistics do not include oily assets in the Midland sub-basin that SM Energy recently purchased, mentioned above.

On Dec. 31, 2022, SM Energy owned proved reserves of 537 million BOE, of which 59% were proved developed and 41% were proved undeveloped.

The company has 88,000 acres in Midland (now 111,000 with the acquisition) and 155,000 acres in South Texas.

Of the total, 206 million barrels, or 38%, are oil/condensate, 98 million barrels or 18%, are natural gas liquids, and 233 million BOEs (1.40 trillion cubic feet), or 44%, are natural gas.

The GAAP standardized measure of discounted future net cash flows on Dec. 31, 2022, was $10.0 billion. This compares to $7.0 billion for year-end 2021 and primarily reflects higher 2022 prices used in the calculation: $94/bbl vs. $67/bbl for oil (2022 vs. 2021) and $6.40/MMBTU vs. $3.60/MMBTU (2022 vs. 2021) for natural gas.

SM Energy also reports a non-GAAP PV-10 value of proved reserves of $12.15 billion for year-end 2022 (compared to $8.16 billion at year-end 2021).

SM Energy has a relatively low percentage of oil compared to its peers (most are 50%-60% in reserves and production.) Investors should note the company classifies its lower-valued condensate as oil. While that's technically correct, condensate's price is discounted since it is lighter (has a higher API gravity) than standard WTI.

Competitors

SM Energy is headquartered in Denver, Colorado.

Because it operates in South Texas and in the Midland sub-basin of the Permian, it competes with virtually every domestic E&P company exploring in those areas or in the Delaware sub-basin (or the Central Basin Platform) of the Permian. Competitors I have reviewed for the public Seeking Alpha site (I also reviewed many others for EBEI Investing Group subscribers) within recent months include APA Corp. (APA), Battalion Oil (BATL), Ring Energy (REI), SilverBow Resources (SBOW), and Vital Energy (VTLE).

SM Energy also has significant competition from private companies.

Competition extends throughout its business, from hiring executives and expert professionals to competing for takeaway capacity and service contractors, to selling oil and gas.

Governance

On July 1, 2023, Institutional Shareholder Services ranked SM Energy's overall governance as an excellent 1, with sub-scores of audit (1), board (1), shareholder rights (1), and compensation (2).

Insiders own 1.7% of the stock. On June 15, 2023, 7.1% of floated stock was shorted.

SM Energy's beta is extremely high at 4.4, representing considerably more volatility than the overall market. This is symptomatic of the upheaval in oil supply, demand, and prices in the last two years.

A company-specific issue is that for a company whose major operations and reserves are in Texas, the Denver headquarters puts it far from the oilfield action compared to competitors in Midland and Houston.

On March 30, 2023, much of SM Energy's stock was held by institutions, some of which represent index fund investments that match the overall market. The four largest institutional holders were BlackRock (16.9%), Vanguard (12.9%), State Street (5.6%), and Dimensional Fund Advisors (3.5%).

BlackRock and State Street are signatories to the Net Zero Asset Managers Initiative, a group that, as of Dec. 31, 2022, manages $59 trillion in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner. It's worth noting some energy analysts and professionals suggest attempts to attain net zero could impoverish the globe's population, including a reduction in food supply.

A similar net zero group for insurance companies has seen many of its thirty original signatories pull away.

Even Larry Fink of BlackRock is now shying away from using the term "ESG," albeit only the acronym and not the policy itself.

SM Energy's Financial and Stock Highlights

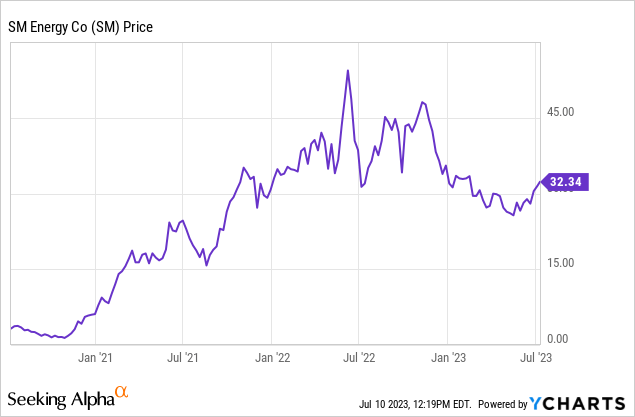

With a July 10, 2023, price of $32.31/share, SM Energy's market capitalization is $3.8 billion.

The company's 52-week price range is $24.66-$48.55 per share, so the most recent price is 67% of the one-year high. The one-year target price is $40.18/share: the price is 80% of that level.

Trailing twelve months' earnings per share is $10.19 for an excellent trailing price/earnings ratio of 3.2.The averages of analysts' estimated 2023 and 2024 earnings per share - EPS - are $5.41 and $6.48, respectively, giving the company a favorable forward P/E ratio range of 5.0-6.0.

Trailing twelve months' - TTM - operating cash flow was $1.68 billion and levered free cash flow was $253 million.

TTM return on assets and equity are an excellent 19.4% and 47.2%, respectively.

SM Energy pays a dividend of $0.60/share or 1.9%. As noted, it also has a $500 million share repurchase program underway.

On March 31, 2023, SM Energy had $2.64 billion in liabilities, including $1.57 billion in non-current senior notes and $5.87 billion in assets giving it a liability-to-asset ratio of 45%.

Mean analyst rating is a 2.3, or "buy," leaning toward "hold" from twenty analysts.

Notes on Valuation

The company's book value per share of $26.80 is below its current market price, indicating somewhat positive investor sentiment.

The ratio of enterprise value to EBITDA is 2.1, well below the range of 10.0 or less that suggests a bargain, thus a considerable bargain by this measure.

SM Energy's SEC PV-10 reserve value at year-end 2022 was $12.15 billion; GAAP measurement of reserves at year-end 2022 was $10.0 billion; 1Q23 asset value (March 31, 2023) was $5.87 billion; current market capitalization is $3.8 billion; and current enterprise value is $4.9 billion.

SM Energy's market capitalization per unit of production is lower than its peers at $26,200/flowing BOE and $61,100 per flowing barrel of oil. Due to its high gas, NGL, and condensate content, it's not unusual for South Texas production to be discounted. On an overall basis as well, only 38% of SM Energy's reserves are higher-valued oil, and even that includes some condensate.

Positive and Negative Risks

Investors should consider their US oil, gas (particularly), and NGL price expectations as the factors most likely to affect SM Energy.

The biggest political risk to SM Energy is from the US administration's anti-hydrocarbon stance and the effect on operations.

Although it is moderating, inflation has increased costs throughout global supply chains, including for oil and gas production.

Recommendations for SM Energy

I recommend SM Energy only to short-term traders. It also may interest speculative traders who believe SM Energy could be an acquisition candidate, as PDC Energy was.

Due to high year-end 2022 prices relative to current prices, and especially for gas (44% of the company's reserves), investors should expect a lower year-end 2023 reserve value.

I do not recommend SM Energy to dividend hunters (1.9% dividend) or those seeking capital appreciation as the company's production is only 42% oil and its reserves are only 38% oil. Natural gas and natural gas liquids make up the rest; they have value, but not nearly as much.

The company's Denver headquarters is more remote than those of its competitors in Houston or Midland. This could slow decision-making on many projects and issues.

Other Midland and Permian basin oil and gas producers present more relative upside, so I am ranking SM Energy as "sell." Although the whole sector will benefit from good oil and gas demand, in the Midland sub-basin of the Permian I prefer Vital Energy and large ConocoPhillips (COP), among others. In South Texas, I prefer ConocoPhillips and Marathon Oil (MRO) among others.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

I hope you enjoyed this piece. I run a Marketplace service, Econ-Based Energy Investing, featuring my best ideas from the energy space, a group of over 400 public companies. Each month I offer:

*3 different portfolios for your consideration, summarized in 3 articles, with portfolio tables available 24/7 to subscribers

*3 additional in-depth articles = 6 EBEI-only articles;

*3 public SA articles, for a total of 9 energy-related articles monthly;

*EBEI-only chat room;

*my experience from decades in the industry.

Econ-Based Energy Investing is designed to help investors deal with energy sector volatility. Interested? Start here with an initial discount.

This article was written by

Do you want to understand and invest in volatile energy markets? We bring fundamentals-based insights to oil, gas, utilities, renewables, and gasoline companies for real-world investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COP, CVX, VTLE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.