Vonovia: Recent Disposals Improved The Picture Significantly (Cash Flow Model View)

Summary

- Vonovia is one of my highest conviction investments accounting for no less than 7.5% of my portfolio.

- My local real estate private equity background gives me confidence that the German residential market will be just fine long-term.

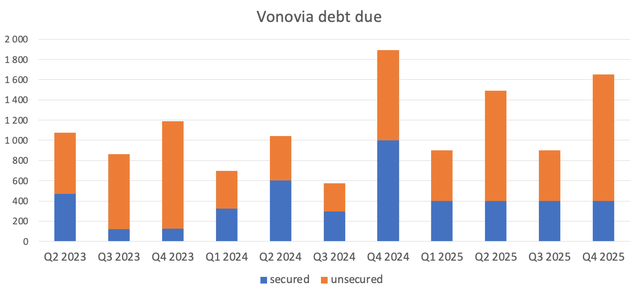

- In the meantime, a detailed cash flow model presented in the article confirms that the company is in stable condition, with all debt maturities covered until Q4 2024.

- This idea was discussed in more depth with members of my private investing community, High Yield Landlord. Learn More »

Makhbubakhon Ismatova

Dear readers/followers,

Those of you that have been following me for a while know, that I'm very bullish on Vonovia (OTCPK:VONOY) (OTCPK:VNNVF). And I'm putting my money where my mouth is as the stock now accounts for 7.5% of my overall portfolio.

Because this is such a large holding for me, I have done an unusually high amount of due diligence to make sure that I understand the risks properly. I've done this due diligence on top of an already deep understanding for the German residential market which I attained over 5 years of working for a major real estate private equity firm in the region. My background as well as research has made my conviction in this stock very high.

I have published a number of articles on the stock, including my latest article in High Yield Landlord which goes into a lot of detail, summarizing recent events and exploring the true discount to NAV that the stock trades at. I encourage you to check it out if you haven't already.

The bears essentially have two arguments, (1) the NAV is overstated and the true discount is therefore much smaller than it seems and (2) management will not be able to manage debt maturities as they come due, cost of debt will rise and since regulated rents will only increase gradually, the company will continue to get squeezed for as long as interest rates remain high.

With regards to the first argument, there has been a lot of research published on Seeking Alpha and elsewhere. The fact is that Vonovia keeps their properties on the books at 2,400 EUR / sqm.

If you don't know anything about construction or are not familiar with the market, let me tell you that building a comparable condo building here in Europe will cost an absolute minimum of 2,000 EUR / sqm in construction costs alone. Add to that soft cost such as architect fees, project documentation preparation, permits and you easily spend another 300-500 EUR / sqm.

These are the bare minimums that a developer would expect to spend these days and exclude the cost of land, the cost of financing and of course any profit that the developer would have to make in order to go ahead with the project.

For comparison, we can look at two condo projects in Prague which I've worked on directly. You might say that Prague is different from Germany, and you'd be right. Construction costs in Prague are about 20-30% lower compared to Germany, yet the total budget for the building below was 3,400 EUR / sqm. Excluding the cost of land, construction alone cost about 2,700 EUR / sqm. Well above what Vonovia reports.

Best of Realty 2019 - Prague

Another condo project in an average location in a wider city center, which is still under construction is expected to cost around 3,600 EUR / sqm and 3,000 EUR / sqm excluding land. Also way above Vonovia's book value.

Sure, Vonovia's buildings aren't brand new, in fact some are quite old (though the company is doing a good job refurbishing them), but even after a standard 20% deduction for second-hand space, the reported fair value is below replacement costs.

Over the next couple of quarters I expect the reported BV of assets to come down slightly (perhaps to around 2,200-2,300 EUR / sqm), but since we're buying the stock at a huge discount to reported NAV, I'm really not too worried about it, especially in light of the ever increasing undersupply in the market.

The main goal of this article is to expand on the second bear argument and provide you with some evidence that Vonovia is NOT going bankrupt.

The argument is predicated on the fact that interest rates stay high for a long time. Though that is not my base case, I will focus on this bearish scenario for the rest of the article.

Management has made it clear that their playbook will remain the same for as long as interest rates remain at elevated levels. They will try to sell properties near book value and use the proceeds to repay any maturing unsecured debt (bonds). All secured debt (bank loans) will be refinanced.

They have already done a good job during the first quarter of this year, announcing two major disposals with total proceeds of EUR 1.56 Billion.

To see how much more work management has left to do, we need a forecast of the company's cash flows. Lucky for you, I have done just that.

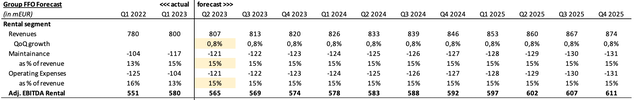

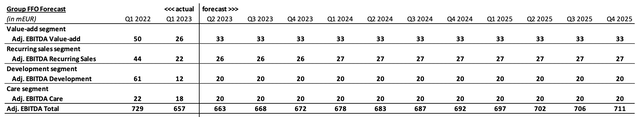

Vonovia generates money in five segments - rental, value-add, recurring sales, development, and care. The rental segment is by far the biggest and easiest to forecast.

The business model is incredibly stable with near perfect occupancy and collections and the regulated nature of rent in Germany makes for highly visible rent increases of 3-4% each year. Simply put, regulated rents result in rent growth being lower in good times, but higher in bad times. Because of this, we can confidently forecast 3.2% annual rent increases going forward.

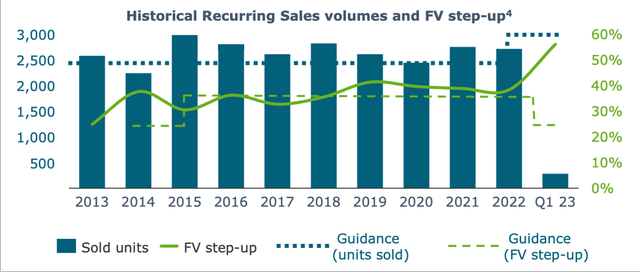

The remaining four segments are more unpredictable and rely quite heavily on investment volume which is why value-add, recurring sales and development all saw significant declines in revenue between Q4 2022 and Q1 2023. Going forward, I remain conservative and assume that revenues will stay near this lower level.

Note that in the model there are multiple assumptions behind the high level numbers below. Most of them are based on guidance, historical performance, and my own judgement. But I will not bore you with details here.

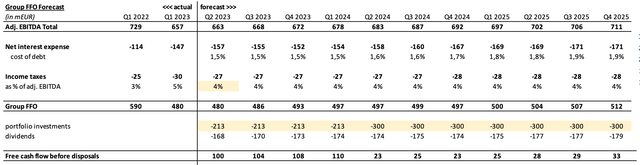

Author's proprietary model

Recurring sales, for example, are forecasted in line with guidance for 2023 which calls for a relatively high number of sales (3,500), but at a significantly lower fair value step-up (aka profit) of only 25%. Forecast beyond 2023 is based on a normalized number of units sold, but at a still conservative 30% FV step-up (vs 47% in Q4 2022 and 56% in Q1 2023).

Continuing with our calculation, we take the total group adjusted EBITDA from all five segments and deduct net interest expense and taxes. Note that net interest expense assumes that all unsecured debt is repaid and all secured debt is refinanced at a rate 4% higher than the current debt. This is why the total cost of debt increases from 1.5% currently to 1.9% by 2025.

Further subtracting portfolio investment in line with guidance for 2023 and closer to normalized level beyond 2023 and subtracting dividends at 70% of Group FFO (with a 50% scrip ratio in line with history) results in free cash flow before disposal that Vonovia can use to repay any maturing bond issues.

Author's proprietary model

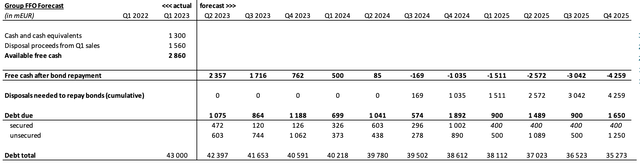

Of course, in addition to cash flow, the company can also use the liquidity it already has which comprises of approx. EUR 1.3 Billion in cash and EUR 1.56 Billion in disposal proceeds.

Author's proprietary model

As a result, we see that even under conservative assumptions the company will have enough liquidity to cover all bond repayments until Q4 2024. Beyond that point further disposal will be needed to continue with management strategy if a high interest rate environment persists.

To conclude, Vonovia is not completely out of the woods yet, but disposals announced during the first quarter of the year gave a really strong indication that it is indeed possible to sell assets at reasonable prices even in this tough environment. I think the risk-reward really makes sense here, especially if you (like me) think that the German residential market will be just fine long-term.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

![]()

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

This article was written by

Disclaimer: I am not a financial advisor and none of the content I provide on this website is financial advice. Content is provided for illustrative and educational purposes only. Always do your own research before investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VONOY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.