SQQQ: Eyeing A Tech-Led Dip As Q3 Is Off To A Soft Start

Summary

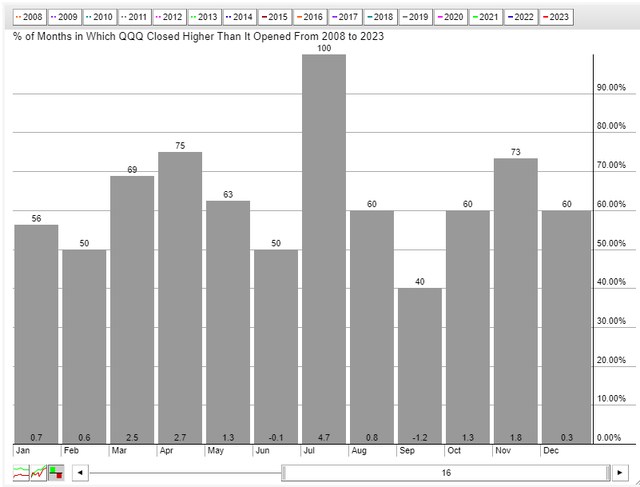

- The Invesco QQQ Nasdaq 100 ETF was down by 1.1% last week, but has been up in each of the previous 15 Julys.

- The ProShares UltraPro Short QQQ ETF seeks a return that is -3x the return of its index for a single day, making it a risky but potentially profitable short-term investment.

- Despite bullish tendencies for QQQ through August, a short-term buy rating on SQQQ is suggested due to a possible correction to the 200-day moving average on QQQ.

- Ahead of the Q2 earnings season and amid some exhaustion signals on QQQ, I outline key price levels to watch on QQQ that can help direct SQQQ investors.

primeimages/iStock via Getty Images

It was a rough start to the month for the Nasdaq 100. The Invesco QQQ Nasdaq 100 ETF (QQQ) was lower by 1.1% last week as we await crucial Q2 earnings reports from the domestic mega caps. On the bulls' side, though, is simply the month of July. QQQ has been up in each of the previous 15 Julys. Hence, being short now comes at your own risk.

Still, I am willing to buck this trend via a long idea on the ProShares UltraPro Short QQQ ETF (NASDAQ:SQQQ).

Is the QQQ 15-year Bullish Streak in Jeopardy?

According to the issuer, SQQQ seeks a return that is -3x the return of its index (target) for a single day, as measured from one NAV calculation to the next. Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return and ProShares' returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks, such as SQQQ. Investors should monitor their holdings as frequently as daily.

Of course, with any leveraged ETF, it is imperative that we recognize the perils of owning such products over long timeframes. Gains can be significant over short periods, but keep in mind that leveraged ETFs should only be considered as short-term tactical investment options, and not as suitable long-term holdings. You can learn more about the risks of leveraged ETFs from industry regulators such as the SEC (additional resources are provided at the conclusion of this article): Updated Investor Bulletin: Leveraged and Inverse ETFs.

During periods of sideways trading, leveraged exchange-traded products (ETPs) will experience negative compounding returns. If, for instance, QQQ exhibits back-and-forth movements, then volatility without a clear upward trend adversely affects the performance of SQQQ. Here is an illustration of how negative compounding returns occur in a leveraged ETF: Suppose an index starts at 100, and the leveraged product also begins at 100. If the index falls by 10% to 90, the 3x short product increases to 130. However, if a subsequent 10% rally happens, the index jumps to 99 (a 1% loss from the initial value). In contrast, the 3x short fund declines to $91 (.7*130), reflecting a 9% decrease over the entire holding period.

With those risks in mind, let’s focus on SQQQ. The fund with $4.8 billion assets under management features a high 0.95% annual expense ratio and pays quarterly dividends at an annual rate of 3.2%. Volume is high with this ETF – around 100 million shares traded daily, and its 30-day median bid/ask spread is just five basis points. With strong tradability but at a high cost, the ETF can be effective in hedge a long portfolio against a broad market decline, particularly in large-cap tech stocks.

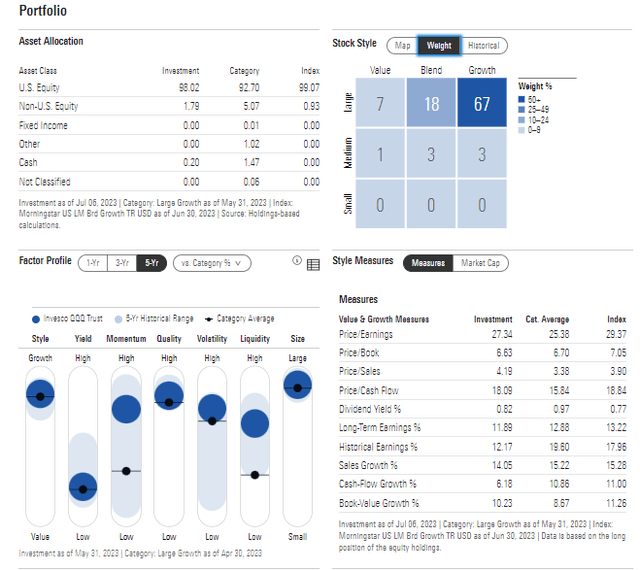

Let’s x-ray the QQQ ETF since this is for all intents and purposes what SQQQ inversely follows. QQQ is a large-cap growth fund with more than 67% of its net assets in the upper-right quadrant of the Morningstar Style Box. Factor-wise, there is very little of the value style in QQQ while mid-cap exposure is likewise modest. With a low yield and high momentum, QQQ has performed very strongly so far in 2023 despite the modest retreat to kick off the second half.

The Nasdaq 100 is also quite expensive at more than 27 times earnings, per Morningstar. Of course, much of the S&P 500’s growth comes from the major companies housed within QQQ. More broadly, I caution investors not to put much emphasis on the valuation when trading a leveraged inverse product such as SQQQ since valuation doesn't matter much over short stretches.

QQQ: Portfolio & Factor Profiles

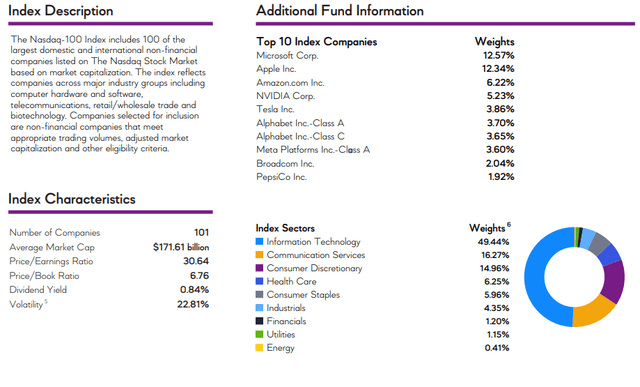

SQQQ has high exposure to Apple and Microsoft in addition to many of the other well-known mega-cap stocks. The index the fund tracks has 101 positions with a very high average market cap with implied volatility above that of the S&P 500. The goings on within the Information Technology sector matter quite a bit considering the Nasdaq 100 is nearly 15% exposed to that market niche.

SQQQ: Portfolio Exposure

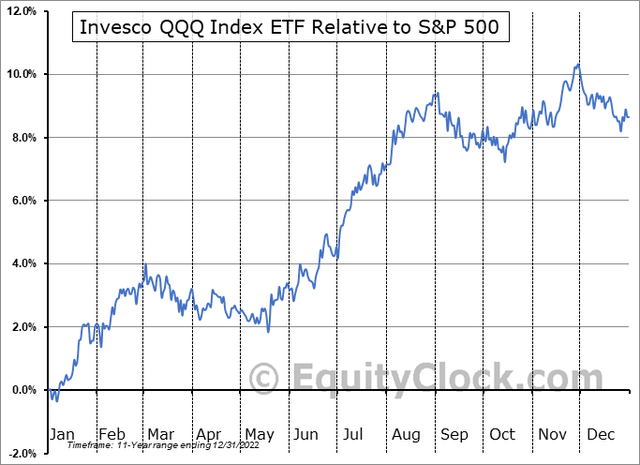

Seasonally, mid-July through August tends to be a bullish period for the index upon which SQQQ inversely tracks relative to the S&P 500, according to data from Equity Clock. That suggests being long SQQQ is not a wise play at the moment, but buying the ETP in advance of September may be more opportune.

QQQ vs SPX: Bullish Trends Through August

The Technical Take

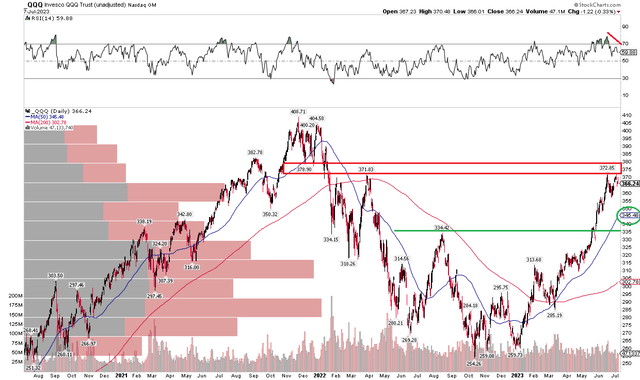

With a high expense ratio and tight tracking to the richly valued and seasonally strong Nasdaq 100, how does SQQQ look technically? Again, I assert focusing on trends in QQQ is more important. So, notice in the chart below that QQQ has encountered resistance.

Shares rallied up to the high from April last year, and have since pulled back, or at least paused. What tips me off to a possible turn lower in the Qs is that the RSI momentum indicator at the top of the graph had a lower high last week. While this is not technically a bearish divergence (since the price did not make a new high), there are signs of tech-investor exhaustion in my view. I expect a pullback this quarter.

A decline to the rising 200-day moving average would make sense, and a potential retest of the August 2022 peak seems plausible given the massive run-up so far this year. I would exit an SQQQ long position if QQQ closed above $373 – that makes the risk/reward situation rather good in my opinion.

QQQ: Shares Hit Resistance After A Stellar Run, Eyeing A Pullback

The Bottom Line

Despite bullish seasonal tendencies for QQQ now through August, I have a short-term buy rating on SQQQ as a correction to at least the 200-day moving average on QQQ appears quite possible over the coming weeks.

1) The Lowdown on Leveraged and Inverse Exchange-Traded Products (FINRA)

2) Leveraged and Inverse ETFs: Specialized Products with Extra Risks for Buy-and-Hold Investors (SEC)

3) FINRA's Reminder on sales practices for Leveraged and Inverse ETFs (FINRA)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.