Revisiting The MFA Preferreds With A Comparison To PennyMac Preferreds

Summary

- The article provides an update on the MFA Financial, 6.50% Series C Fix/Float Cumulative Redeemable Preferred Stock, originally reviewed earlier this year.

- It compares the advantages and disadvantages of investing in MFA.PC to the PennyMac Mortgage Investment Trust 6.75% RED PFD C, both of which are issued by mREITs.

- The key differences between the two are that the MFA coupon floats while the PMT one does not, and the PMT issues have a longer time before a potential Call.

- While the 8% yields are attractive, there are other mREIT preferreds that should also be reviewed before deciding which, if any, to hold.

- Looking for more investing ideas like this one? Get them exclusively at Hoya Capital Income Builder. Learn More »

Phiwath Jittamas

(This article was co-produced with Hoya Capital Real Estate)

Introduction

With the banking crisis hopefully in the rearview mirror, it seemed logical to do an update on my MFA Preferreds Offer Investors Different Options article. While MFA Financial has two Preferreds, this time I focus on the MFA Financial, 6.50% Series C Fix/Float Cumulative Redeemable Preferred Stock (NYSE:MFA.PC) and then compare the pros/cons of investing in the PennyMac Mortgage Investment Trust 6.75% RED PFD C (NYSE:PMT.PC). Both are issued by mREITs; the difference is that the MFA coupon floats whereas the PMT one does not. As a note, I own PMT.PC, which is another reason I admit choosing that preferred as I benefit from reviewing what I own too. Per my understanding of mREITs, they come in three basic flavors:

- Residential mortgages only

- Commercial mortgages only

- Combination of both

MFA Financial review

Seeking Alpha describes this mREIT as:

MFA Financial, Inc., together with its subsidiaries, operates as a real estate investment trust in the United States. The company invests in residential mortgage assets, including non-agency mortgage-backed securities, agency MBS, and credit risk transfer securities; residential whole loans, including purchased performing loans, purchased credit deteriorated, and non-performing loans; and mortgage servicing rights related assets. MFA Financial, Inc. was incorporated in 1997 and is based in New York, New York.

This is how MFA Financial defines themselves:

We are a specialty finance company that invests in and finances residential mortgage assets. Our targeted investments include principally the following:

- Residential whole loans, including Purchased Performing Loans, Purchased Credit Deteriorated and Purchased Non-performing Loans. Through certain of our subsidiaries, we also originate and service business purpose loans for real estate investors. We also own residential real estate (or REO), which is typically acquired as a result of the foreclosure or other liquidation of delinquent whole loans in connection with our loan investment activities;

- Residential mortgage securities, including CRT securities; and

- MSR-related assets, which include term notes backed directly or indirectly by MSRs.

Our principal business objective is to deliver shareholder value through the generation of distributable income and through asset performance linked to residential mortgage credit fundamentals. We selectively invest in residential mortgage assets with a focus on credit analysis, projected prepayment rates, interest rate sensitivity and expected return. We are an internally-managed real estate investment trust (or REIT).

Source: mfafinancial.com/overview

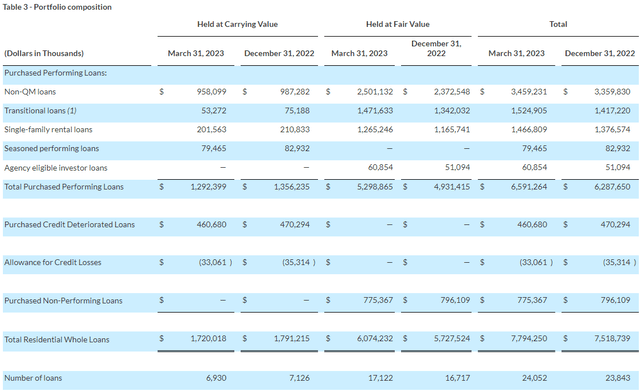

The latest quarterly statement shows the portfolio composition as of 3/31/23 and 12/31/22.

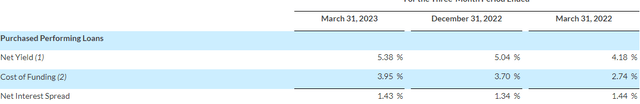

They also provided how their Net Interest spread has moved over the past year, an important data point during a period of rapidly increasing rates.

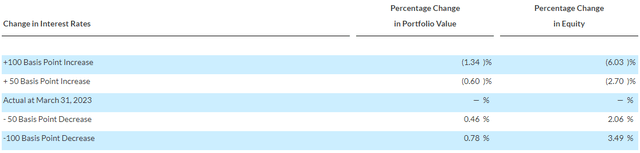

Also important, they shared how future changes in rates would affect both the portfolio and the equity values.

mfafinancial.com rate movement

Preferred review

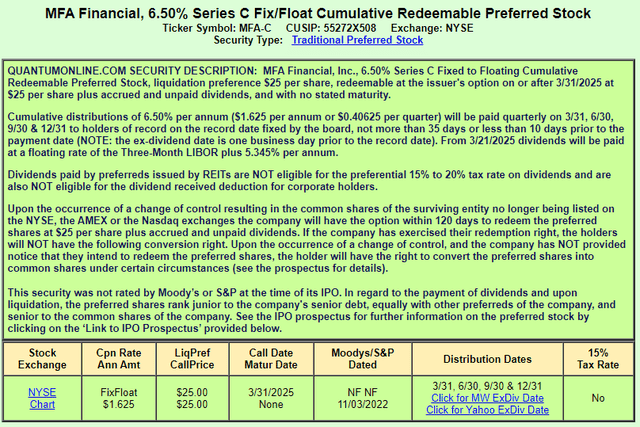

seekingalpha.com homepage QuantumOnline.com MFA.PC

This preferred can first be called on 3/31/25. If not called, the coupon becomes 3-mo SOFR + 5.345%. SOFR replaces LIBOR as of 6/30/23 and currently is just over 5%. Unless that drops back to pre-2022 levels, the odds of being called are high if MFA can issue a new preferred with a lower fixed/floating coupon.

PennyMac Mortgage Investment Trust review

Seeking Alpha describes this mREIT as:

PennyMac Mortgage Investment Trust, a specialty finance company, primarily invests in mortgage-related assets in the United States. It operates through four segments: Credit Sensitive Strategies, Interest Rate Sensitive Strategies, Correspondent Production, and Corporate. The company’s Credit Sensitive Strategies segment invests in credit risk transfer (CRT) agreements, CRT securities, distressed loans, real estate, and non-agency subordinated bonds. Its Interest Rate Sensitive Strategies segment engages in investing in mortgage servicing rights, excess servicing spreads, and agency and senior non-agency mortgage-backed securities (MBS), as well as related interest rate hedging activities. The company’s Correspondent Production segment is involved in purchasing, pooling, and reselling newly originated prime credit residential loans directly or in the form of MBS.

This is how PennyMac Mortgage describes themselves:

PennyMac Mortgage Investment Trust is a specialty finance company that invests primarily in residential mortgage loans and mortgage-related assets.

As a real estate investment trust (REIT), our objective is to provide attractive risk-adjusted returns to our shareholders over the long-term, primarily through dividends and secondarily through capital appreciation. Our investment focus is on mortgage-related assets that we create through our industry-leading correspondent production activities, including mortgage servicing rights (MSRs). In correspondent production, we acquire, pool and securitize or sell newly originated prime credit quality loans.

Source: pmt.pennymac.com

A recent press release explained the impact of the current environment on PMT's operations.

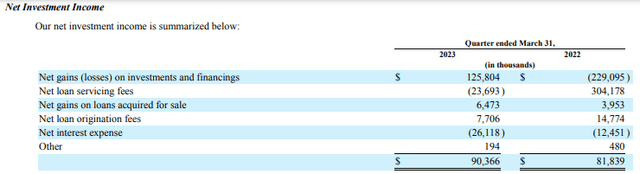

Compared to Q1'22, Net Investment Income was up about 10%.

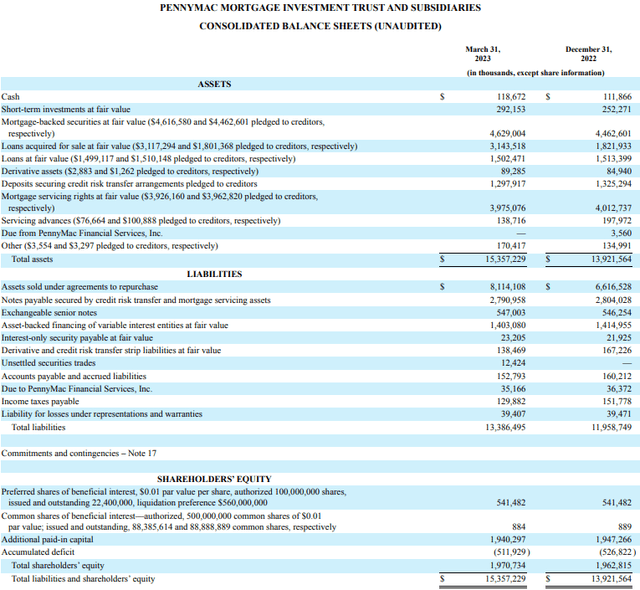

The Balance Sheet looks like this.

d18rn0p25nwr6d.cloudfront.net 10Q

I looked at several documents for PMT and failed to find how their Net Interest Rate spread had changed.

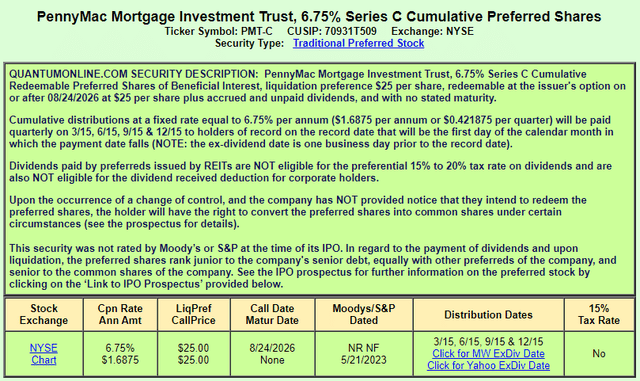

Preferred review

seekingalpha.com homepage QuantumOnline.com PMT.PC

Unlike MFA.PC, investors know what their coupon will be until the issue is called, which becomes possible on 8/24/26.

Side-by-side review

Here are how the two issuers and their preferred stocks compare.

| Factor | MFA | PMT |

| Issuer EPS payout ratio | 100% | 100% |

| Issuer Book Value | $15.96 | $15.15 |

| BV/common price | 70% | 89% |

| PFD Coupon | 6.5% | 6.75% |

| PFD Current Yield | 8.2% | 8.9% |

| PFD YTC | 21.2% | 16.8% |

| PFD Call date | 3/31/25 | 8/24/26 |

PFD Floating rate rule | 3-mo SOFR*+5.345% | NA |

* According to the recent 10-Q filing, the SOFR rate will replace the originally used LIBOR and that should now be the case as the deadline was 6/30/23.

The YTC for both are attractive but what's the odds of that occurring? MFA also has MFA.PB with a higher 7.5% coupon and is callable but hasn't been. PMT has two callables in 2024 with higher coupons; they would be called first. PMT.PC currently provides a higher yield and almost 1.5 years more in call protection compared to MFA.PC.

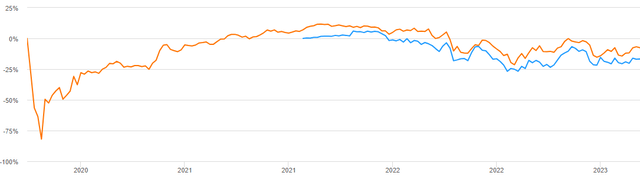

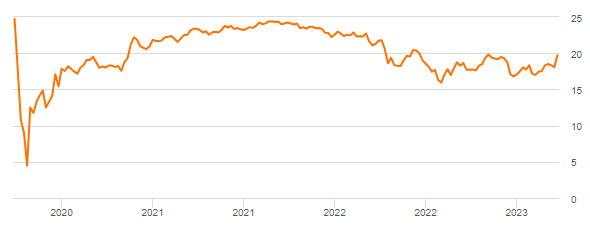

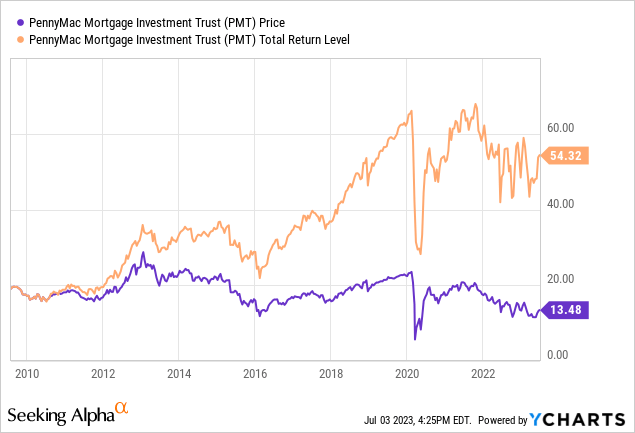

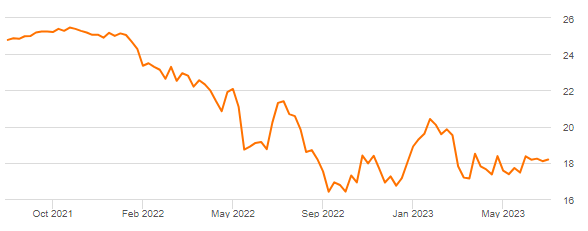

Normally, I would adjust the next chart to reflect and match the data for both but I though how MFA.PC performed when the COVID effect hit was important.

Since PMT.PC was issued, both show a negative total return below 14%.

Portfolio strategy

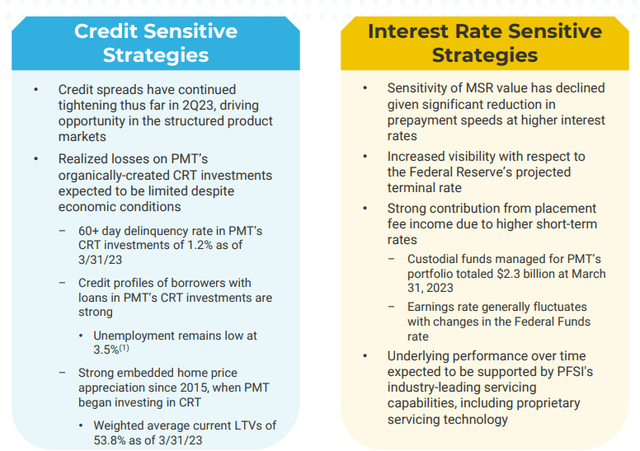

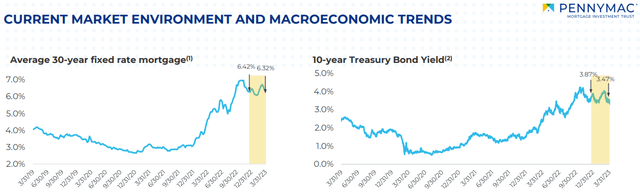

PennyMac provides these two charts.

As shown in the MFA data previously, while mortgage rates have climbed, so has the cost of financing that portfolio; thus, the importance of tracking the Net Interest Spread. There is uncertainty when the FOMC will stop raising and then start cutting the Federal Funds Rate. Most mREITs use interest-rate swaps to dampen the effect on their Net Interest Spread but that relies on guessing where rates are going.

As a disclaimer, I am not an expert on mREITs and depend on others to help me make those investment allocations. I recommend for reading the Mortgage REITs: High-Yield Risk And Opportunity as a great review of the sector in greater detail.

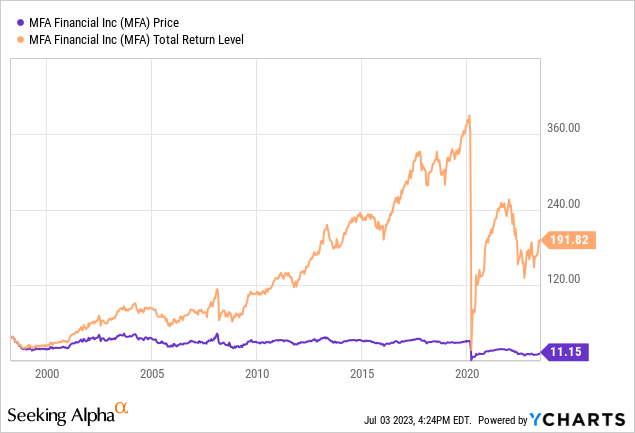

As with any preferred stock, the ability of the Issuer to keep making paying payments is critical, especially if the preferred does not have to be redeemed, as is the case with both here. One important feature is both are cumulative, meaning common stock dividends stop when a preferred payment is missed and cannot restart until preferred holders are made whole. Neither issuer can afford that; just look at what happened to the price of MFA and PMT during March 2020! I think the 8+% yields currently offered are attractive but without reviewing what other mREITs preferreds yield, I will give both of these a Hold rating.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research - including reports that are never published elsewhere - across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

This article was written by

I have both a BS and MBA in Finance. I have been individual investor since the early 1980s and have a seven-figure portfolio. I was a data analyst for a pension manager for thirty years until I retired July of 2019. My initial articles related to my experience in prepping for and being in retirement. Now I will comment on our holdings in our various accounts. Most holdings are in CEFs, ETFs, some BDCs and a few REITs. I write Put options for income generation. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PMT.PC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)