Merck: The Market Lacks Conviction To Take It Higher

Summary

- Merck's recent $10.8B acquisition of Prometheus Biosciences is expected to negatively impact earnings per share by approximately $0.25 in the first 12 months.

- Despite a projected 6.5% YoY decline in adjusted EPS, Merck's earnings growth is not expected to be structurally affected, with positive growth expected in FY24.

- MRK's expensive valuation could discourage buyers from having the confidence in taking it higher, as MRK sold off after it took out its all-time highs in May.

- MRK also trades well above its pharma peers' median, suggesting that optimism over its earnings growth could have been reflected in its current valuation.

- I don't see any particularly enticing opportunity to buy MRK at the current levels.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Sundry Photography

Investors of Biopharma leader Merck & Co., Inc. (NYSE:MRK) didn't cheer the completion of its recent $10.8B acquisition of Prometheus Biosciences, which I first discussed in April. MRK has remained close to the lows in June, as its premium valuation needs to be carefully assessed.

The company expects to provide a more detailed outlook at its upcoming Q2 earnings release on August 1, discussing the near-term impact on its earnings drivers. According to the company's prelim update, the acquisition is "expected to negatively impact earnings per share by approximately $0.25 in the first 12 months following the transaction's close."

As such, I believe the impact is likely not that significant, as Merck is expected to report an adjusted EPS of $7 based on the revised consensus estimates. Although it represents a 6.5% decline YoY, it's not likely to be structural to Merck's earnings growth. Accordingly, Merck's adjusted EPS is projected to return to positive growth in FY24 with a 21.8% increase.

With Merck not facing an impending patent cliff on its well-diversified portfolio, Merck Bulls could argue that it justifies MRK's premium valuation. Moreover, with Merck's robust balance sheet boasting a net debt/forward EBITDA ratio of just 0.32x for FY23, the company has significant flexibility to capitalize on business development opportunities to expand its pipeline.

While Merck's wide-moat business model is underpinned by its success in Keytruda, it also has a robust vaccines portfolio bolstering its competitive edge. With its industry-leading production scale, Merck is expected to continue delivering robust profitability and operating leverage.

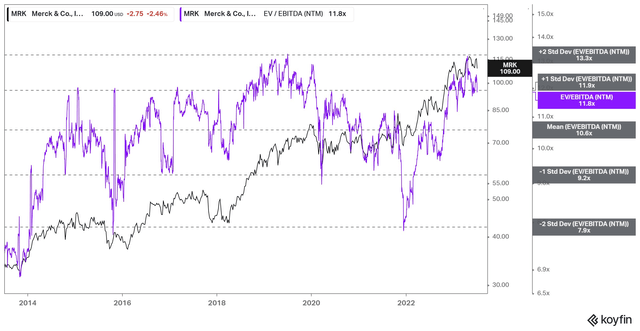

MRK forward EBITDA multiples trend (koyfin)

However, it's also critical to consider whether the current valuation in MRK justifies the growth inflection that analysts anticipate next year. I assessed that while the company promulgated a negative impact on this year's earnings due to its recent acquisition, investors weren't unduly concerned.

Despite that, MRK last traded at a forward EBITDA multiple of nearly 12x, well above its 10Y average of 10.6x. On an adjusted P/E basis, MRK's forward adjusted P/E of 15.8x is also well above its Pharma peers' median of 11.5x (according to S&P Cap IQ data), suggesting no valuation dislocation despite the recent pullback.

Hence, I assessed that unless you have high-conviction in MRK's thesis, I don't view the current opportunity as particularly enticing from a risk/reward perspective.

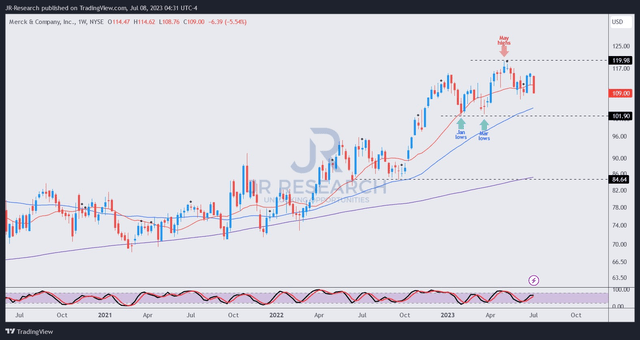

MRK price chart (weekly) (TradingView)

MRK's price action suggests that the recent pullback is close to re-testing its June lows. However, the critical support zone to watch remains MRK's $100 level, bolstered by dip buyers in January and March.

I see MRK's May highs particularly troubling, indicating that holders weren't willing to support a decisive breakout into higher levels, as MRK took out its all-time highs. As such, the lack of decisive breakout buying momentum indicates that perhaps the market was concerned about MRK's relatively expensive valuation.

With that in mind, I urge investors to consider holding back adding more positions at the current levels, considering its relatively well-balanced risk/reward, without convincing technical buy triggers.

However, if MRK could retrace further toward the $100 region and hold its support zone robustly, it could open up another opportunity for dip buyers to add with more confidence considering an improved risk/reward profile.

Rating: Maintain Hold.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore (NUS). NUS is also ranked among the top ten universities globally. I currently hold the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)