Summit Materials: Good Medium To Long-Term Growth Prospects

Summary

- Summit Materials Inc's revenue growth is expected to benefit from price increases and strong demand in non-residential and public infrastructure markets, offsetting a decline in residential volume.

- The company has managed to offset inflation and supply chain issues through price increases, and its long-term outlook is favorable due to improving business portfolio mix and cost-saving measures.

- Valuation is reasonable.

fotografiche/iStock via Getty Images

Investment Thesis

Summit Materials, Inc’s (NYSE:SUM) revenue growth should benefit from carryover price increases and incremental price increases moving forward. In addition, the company should also benefit from good demand in heavy non-residential and public infrastructure markets driven by secular trends. I expect the strength in heavy non-residential and public infrastructure markets, and price increases should help the company offset the decline in the residential volume. In the medium to long term, gradual recovery of the residential market due to pent-up demand and the long-term growth opportunities from secular demand trends and associated government infrastructure funding should help revenue growth.

On the margin front, while inflation and supply chain issues continue to remain near-term headwinds, the company should be able to fully offset it through price increases. The longer-term outlook looks favorable as well. In the medium to longer-term margins should recover with the help of improving business portfolio mix and cost-saving measures. Coming to the valuation, the company is trading at a discount to its peers and its FY24 forward P/E valuation also looks attractive when compared to historical averages. This combined with good medium to long-term growth prospects, makes the company a buy.

Revenue Analysis and Outlook

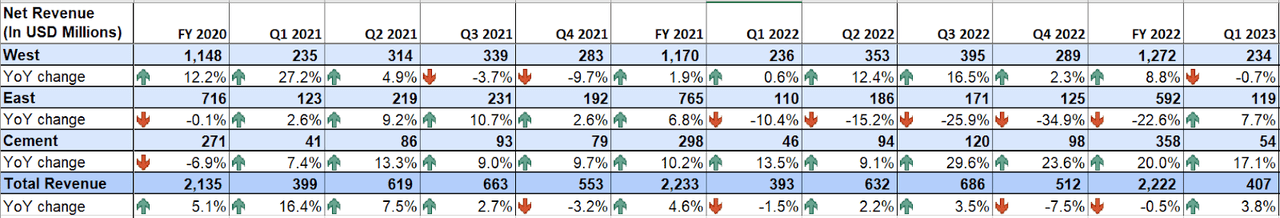

Post-pandemic, Summit Material’s revenue growth benefited from good demand across all of its end markets. However, sales growth was impacted in FY2022 due to demand softening in the residential market in response to rising interest rates. Moreover, the divestiture of a few businesses in order to optimize the business portfolio also impacted the sales growth last year.

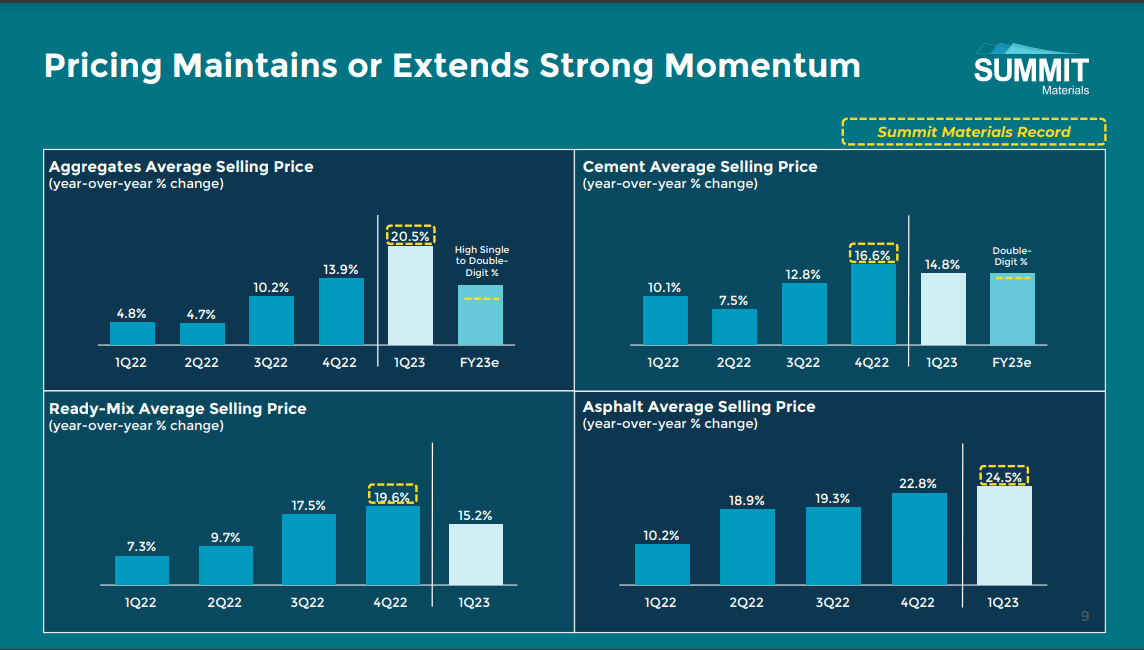

In the first quarter of 2023, sales growth continued to face headwinds from lower demand in the residential markets, leading to volume declines. However, the company was able to offset the residential slowdown through price increases and good strength in the public infrastructure market from IIJA funding. This resulted in a 3.8% YoY growth in revenue to $407 million. With respect to volume and pricing dynamics, the growth reflects 20.6, 14.8, 15.3, and 20.8 percentage YoY price increases in aggregates, cement, ready-mix concrete, and asphalt respectively. This was partially offset by a 3.4, 1.2, and 19.3 percentage YoY decline in volume for aggregates, cement, and ready-mix concrete respectively, while asphalt saw a 38.7 percentage increase in volume for asphalt, aiding growth along with price increases.

SUM’s Historical Sales (Company Data, GS Analytics Research)

Looking forward, I believe the company should be able to post revenue growth benefiting from price increases and good demand on the infrastructure side. This should also help the company offset near-term headwinds from continued softness in residential markets. In the medium to long term, a recovery in the residential market as the interest rate cycle eventually reverses, and the tailwind from federal funding in infrastructure space should help revenue growth.

In an inflationary environment, the company has been relying on price increases to protect its margins. SUM took price increases across all of its products in the second half of fiscal 2022. The company took additional pricing at the beginning of January and anticipates multiple price increases moving forward. The carryover impact of previous price increases and potential price increases ahead should help the company's revenue growth.

Summit Material's Pricing Momentum (Q1 2023 Earning Presentation)

In addition, the company should also benefit from good demand in public infrastructure (comprising ~36% of total revenue) and non-residential markets (comprising ~32% of the total revenue), especially on the heavy side. The U.S. Government has increased its focus on aging and overloaded infrastructure and is providing various infrastructure stimulus for modern, upgraded, and safe infrastructure in the country. So, the outlook for infrastructure is well supported by various federal funding, especially the Department of Transportation's (DoT) Infrastructure Investment and Job Act (IIJA). This funding is majorly targeting the repair and rebuild work where SUM has good exposure.

Talking about IIJA funding, during the first quarter earnings call, the company’s CEO Anne Noonan commented,

... I would say, overall, very positive on our state funding just as a base of funding across all of our states. We remain very positive on that. But we are starting to see the IIJA flow through. And if you look at [ARPUs] data, they have estimated that 50% of those funds are going to repair and rebuild, which is Summit specialty, right? So we are starting to see those, and we saw that in our Q1 volumes, frankly. The other thing I would point you to is we look at our backlogs. So our backlogs with respect to our public end market, if we look at the asphalt, it's at 21% or 23% and our construction is at 53%. Our aggregates are up 20%. So our backlogs have improved year-on-year. And then specific to our North Texas market, in Q1, that is 50% of our public revenue, and it was up 40% in activity, so with respect to public funding.

So we're starting to see those dollars fall through. And I would expect more as we go through the second half of the year. And then as we go into 2024, we've talked before that the first year of funding is about 25% federal funding. The second is 40%. But these projects tend to be 9 to 12 months in duration with somewhat more balanced towards the repair and rebuild at the front end. So we are starting to see the dollars flow through. We're very positive. We're seeing it in our backlogs. We're seeing it in actual numbers on our asphalt volumes. So that is an area where we feel pretty good about what's in the guide right now.”

So, this implies that the IIJA provides a good medium to long-term growth opportunity for the company and should continue to support sales growth moving forward. In addition to public infrastructure, the heavy non-residential market (which includes manufacturing and distribution projects) is also experiencing good strength in demand. This is due to the increasing need to reshore manufacturing in the U.S. The post-pandemic supply chain issues have forced industries to reshore manufacturing in the U.S. and become self-sufficient. To further incentivize it, the U.S. government also put the CHIPS and Science Act in place. This is helping in increasing demand for manufacturing construction. While the heavy non-residential side is experiencing good demand, the company is anticipating softness in the light non-residential side (lodging, offices, small retail shops, and education facilities) due to the potential ramifications of tightening credit standards. The light non-residential market also follows the residential sector (as more houses and communities require more retail shops or educational facilities to be built), which currently is facing softness due to rising interest rates. However, I believe this should be more than offset by the strength in the heavy non-residential sector.

Speaking of the residential market (comprising ~32% of the total revenue), since the beginning of fiscal 2022, it has been seeing a decline as a result of lower end-market demand due to rising interest rates. In an inflationary environment with rising interest rates, buying a new house becomes challenging for consumers as EMIs have increased. This is a near-term concern for the company’s sales growth. However, I believe the company should also be able to offset this slowdown through the strength in the industrial and non-residential sectors, and the impact of price increases. Moreover, if we look at housing starts, which is a key indicator of new residential construction, in May 2023 there was a sequential as well as year-over-year increase in total New Privately‐Owned Housing Units Started. Further, in the initial guidance for FY23, management expected a 30% YoY decline in volume in the residential market but this guidance was updated to a 25% YoY decline in volume during the first quarter earnings release, suggesting constructions are improving in the residential market. I also believe there is a lot of pent-up demand in the residential market which should help the sector's gradual recovery in the coming year once the interest rate cycle turns. Further, given the much better-than-expected housing starts numbers in May, I expect management to further improve their outlook for residential end markets on their next earning release.

So, in a nutshell, while there are near-term headwinds due to declining residential volume, the company should be able to offset them through price increases, and good demand in the non-residential and public infrastructure end markets driven by secular trends. This should result in a YoY increase in revenue in FY23, with an acceleration in growth expected beyond FY23 due to long-term secular demand trends in the non-residential and public infrastructure sector along with pent-up demand in the residential sector which should unleash once the interest rate cycle turns. So, I am optimistic about the long-term growth of the company.

Margin Analysis and Outlook

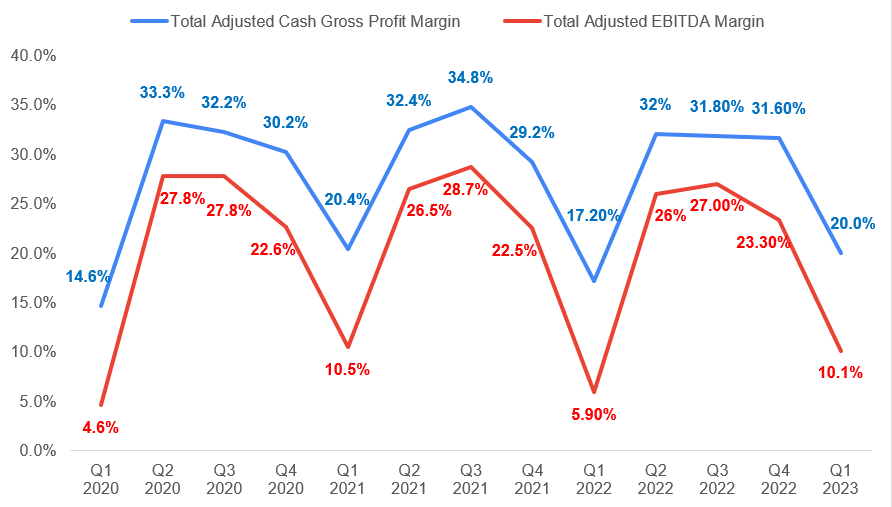

In FY 2022, the company's margin growth was negatively impacted by inflationary input costs, including labor, fuel, and energy costs. Additionally, the company faced significant challenges stemming from supply chain issues, further weighing on margin growth.

However, in the first quarter of 2023, despite the persisting inflationary pressures and supply chain challenges, the company was able to counter these headwinds through price increases and the strategic divestiture of underperforming businesses to optimize its portfolio. As a result, the company witnessed a 280 basis point YoY increase in its adjusted cash gross profit margin, reaching 20%. Moreover, the adjusted EBITDA margin also experienced a notable improvement, with a 420 basis point YoY increase to 10.1%.

It is worth noting that the company's margins follow a seasonal pattern, whereby the first quarter tends to be the least profitable. This is due to weather-related conditions, such as extended periods of rainy and cold weather that occur at the beginning of the year, resulting in operational challenges and lower revenue generation.

SUM’s Adjusted Cash Gross Profit Margin and Adjusted EBITDA Margin (Company Data, GS Analytics Research)

Looking ahead, while inflationary input costs remain elevated year-over-year and the company is projecting mid-to-high single-digit inflation for the full year 2023, I believe, the company should be able to mitigate these cost headwinds through strong price increases which we have seen in the recent quarters.

Beyond 2023, I believe the company should be able to continue improving its margins. Over the past year, the company has strategically divested lower-performing businesses and improved its business mix. I expect this focus on improving the business mix to continue in the coming years.

The company is also actively driving cost savings across its operations. For example, through the identification of common operational pain points and implementation of improvement initiatives such as modernizing long-term mine planning, optimizing yield, conducting maintenance splices, debottlenecking plants, and utilizing automation more efficiently, the company has gained efficiencies. In the first quarter, the quarries involved in these continuous improvement events experienced an average 7% increase in overall equipment effectiveness and more than a 9% increase in tons per hour compared to baseline levels. This translates to approximately $3 million in productivity savings for the quarter. The company intends to continue identifying such pain points and driving additional cost savings, which will contribute to margin recovery. Furthermore, the installation of a new innovative waste fuel technology in the company's Davenport facility will reduce fossil fuel consumption by at least 50% and help achieve carbon reduction goals. Simultaneously, it will lead to cost savings by replacing coal and pet coke with alternative fuels, further supporting long-term margin growth.

In summary, I hold an optimistic outlook for the company's medium to long-term margin growth prospects.

Valuation and Conclusion

The company is currently trading at a 26.72x FY23 consensus EPS estimate of $1.34 and a 22.4x FY24 consensus EPS estimate of $1.61. Over the last 5-year, the stock has traded at an average forward P/E of 25.6x. So, on a forward basis (FY24 EPS), the stock is reasonably priced. Furthermore, compared to its peers, the company appears relatively attractive at its current levels.

Peers | FY 23 P/E (FWD) | FY 24 P/E (FWD) |

Martin Marietta Materials, Inc. (MLM) | 27.52x | 24.14x |

Vulcan Materials Co (VMC) | 33.20x | 27.91x |

Summit Materials, Inc. (SUM) | 26.72x | 22.30x |

I believe the company possesses strong long-term growth prospects. These prospects are supported by factors such as price increases, secular demand trends in the heavy non-residential and public infrastructure segment, pent-up demand in the residential market, cost savings initiatives, and improvements in the business mix. While the company has seen some pressure on the residential construction side, I believe the interest rate is likely to peak sometime this year and, as we see the interest rate cycle turn over the next couple of years, this market should also recover accelerating revenue and margin growth. The company’s good growth prospects combined with a reasonable valuation on a forward basis make me positive about the stock and hence, I have a buy rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Saloni V.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)