TSI: Time To Buy Mortgages

Summary

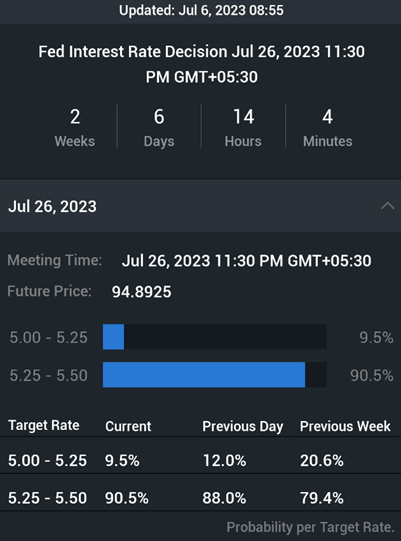

- The market is pricing a 90% probability of another rate hike in the upcoming July meeting due to strong economic data.

- Peak rates are expected in 2023, creating opportunities in Treasuries and MBS, with JP Morgan Research recommending Agency MBS bonds as a top fixed income investment.

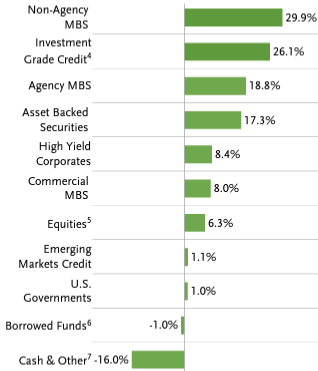

- TCW Strategic Income Fund, a multi-asset class closed-end fund, has non-Agency MBS bonds as its largest holding, with over 29% of the fund's portfolio being MBS bonds.

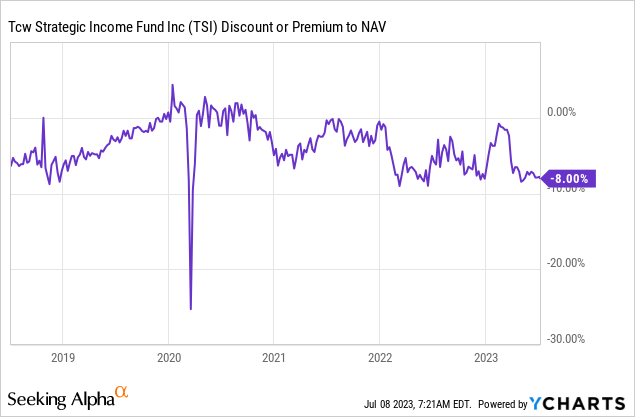

- The CEF is currently trading at a historical wide discount to net asset value.

skynesher/E+ via Getty Images

Thesis

In the past week we have seen rates up again, with the market now pricing an above 90% probability for another hike during the upcoming July meeting:

Hike Probability (CME)

Data came in very strong, which prompted the latest re-pricing. Is this the last hike or are we going to see more? The Fed is saying they are data dependent, but at the same time cognizant about not over-tightening. In all fairness we had been of the opinion the prior hike was the last one, and we are going to watch the Fed in a 'wait and see' mode. It did not happen that way due to much stronger than expected economic indicators. Irrespective, the 5% to 6% band is very much the top in our mind. If we could have the foresight and ring a bell at the top we would most certainly be quite wealthy by now.

As we have said before, timing the market is impossible, but 2023 will see peak rates. Peak rates translate into attractive opportunities in Treasuries and MBS. Because one cannot call a top, it is best to dollar cost average into opportunities as the year progresses. To that end, we made a couple of MBS related calls:

- BKT: It Is Time To Buy Agency MBS Bonds (CEF Structure)

- SPMB: It Is Probably Time To Start Buying Agencies (ETF Structure)

- VMBS: Agency Mortgages, A Top Idea From JPMorgan (ETF Structure)

This was done in correlation with new JP Morgan Research, which determined Agency MBS bonds as a top fixed income recommendation:

Recession remained our base case," Bob Michele, chief investment officer and head of the Global Fixed Income, Currency & Commodities Group at J.P. Morgan Asset Management, said in a note. "While the central banks are committed to bringing inflation down to 2% and willing to sacrifice the economy to get to that level, the group appreciated that it is taking longer to work through several years of accumulated policy stimulus." Nevertheless, leading indicators continue to see a recession as the most likely outcome.

Taking into consideration the outlook for more central bank rate hikes and the inverted yield curve, "agency mortgage-backed were our top pick," Michele said. "While the technicals of Fed balance sheet runoff, FDIC selling, and lower bank demand are challenging, valuations are at their cheapest level since the height of the global financial crisis.

TCW Strategic Income Fund (NYSE:TSI) is a multi-asset class closed-end fund managed by TCW Investment Management Company. The vehicle has been in the market for over 30 years, and counts MBS bond as its largest sleeve.

Holdings

The fund has non-Agency MBS bonds as its largest holding:

Holdings (Fund Fact Sheet)

As a reminder, non-Agency MBS securities are different than Agency ones:

As a quick reminder, non-agency RMBS are securitized bonds backed by residential mortgages from across the U.S. They differ from the Agency RMBS market because these securities do not have the implicit guarantee of the federal government (i.e., Fannie and Freddie). From a practical standpoint, the majority of the non-agency RMBS market consists of seasoned pools that are priced at a discount. Lastly, they provide fixed income investors access to an improving housing market and a healing consumer with less interest rate risk since the majority of the asset class is floating rate.

However, a large proportion of said non-Agency MBSs are senior tranches rated AAA:

Ratings (Fund Fact Sheet)

In effect over 65% of the fund's portfolio is investment grade, with the rest allocated mainly to 'BB' credits, although 'CCC' assets do have a very large sleeve here.

Premium / Discount to NAV

The fund moved to a discount to NAV once rates started moving higher in 2022:

As we can see from the above graph the fund has a beta to the yield curve from a discount perspective. Once the market started pricing peak rates in the beginning of 2023 the fund moved to an almost flat discount to NAV. That initial move has now fully reverted.

Conclusion

TSI is a fixed income closed end fund. The vehicle has been in the market for over 30 years, and currently does not employ any leverage. The fund has non-Agency MBS bonds as its largest holding at 29.9% of the portfolio. Despite the lack of a government guarantee, most MBS bonds here are senior tranches rated AAA on their own. This translates into investors benefiting from the subordination of other tranches and the loan to value embedded in the pledged homes. The fund's discount to NAV has a beta to rates, and we expect the -8% gap to NAV to close by mid next year. Expect a total return in excess of 16% here in the next 12 months, driven by the fund's discount to NAV reverting, its carry (currently 5.3%), and the capital gains to be expected from the MBS collateral pool as rates move down (1% rate decrease considered on the duration profile). While not as exciting as the equity asset class, rates driven fixed income is at cyclical lows at the moment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.