BST And BSTZ: 9%-11% Tech Yields, Outperforming In 2023

Summary

- BST yields 9.36% and BSTZ yields 11.09% - both pay monthly.

- Both funds have heavy tech exposure and use covered calls to generate income. Both funds have outperformed in 2023.

- One of them is selling at a 14% discount.

- Looking for more investing ideas like this one? Get them exclusively at Hidden Dividend Stocks Plus. Learn More »

da-kuk

After getting stomped in 2022, tech is back in the market's good graces - it's leading all others so far in 2023, rising 38%. As we've mentioned in previous articles, that's a mixed blessing for retail income investors due to tech's very low dividend yield.

However, there are certain tech-based funds that offer you an attractive yield, such as BlackRock Science And Technology Trust (NYSE:BST) and/or its sister fund, BlackRock Science and Technology Trust II (BSTZ). These are both closed-end funds.

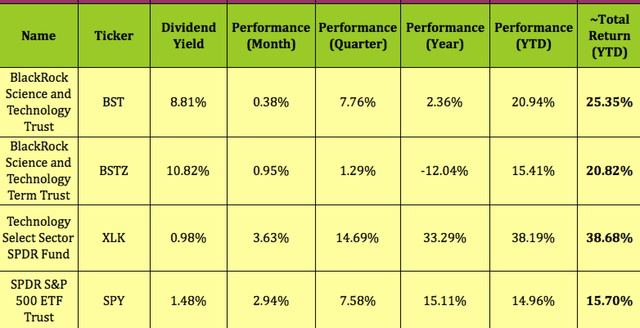

Like tech, both funds were down in 2022, but they've come alive in 2023, with BST up ~21% and BST up 15.4%. Add in six months of dividends and the year-to-date total returns look even better, at ~25% and ~21% respectively, vs. 15.7% for the S&P 500.

That's not nearly as strong of a return as the broad tech sector has thus far, at 38.7%, but it does provide attractive income for passive income investors.

Hidden Dividend Stocks Plus

Fund Profiles:

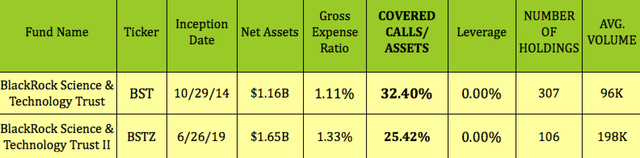

BST is a perpetual CEF which began operations in October 2014 with the investment objectives of providing income and total return through a combination of current income, current gains and long-term capital appreciation.

Under normal market conditions, BST will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market cap range. BST's management sells covered call options on a portion of the common stocks in its portfolio. (BST site)

BSTZ is a limited-term CEF. BSTZ began operations in June 2019 with the investment objectives of providing total return and income through a combination of current income, current gains and long-term capital appreciation.

BSTZ normally invests at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market cap range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology. BSTZ's management also sells covered calls on part of its portfolio. (BSTZ site)

BSTZ is the newer of the two funds - it IPOd in 2019. It has a larger asset base, of $1.65B, with ~2X the average volume for BST.

BST has 32.4% of its assets exposed to covered calls, vs. 25.42% for BSTZ. BST has 307 holdings, vs. 106 for BSTZ. At 1.33%, BSTZ's expense ratio is a bit higher than BST's 1.11% figure. Neither fund uses leverage.

Hidden Dividend Stocks Plus

Dividends:

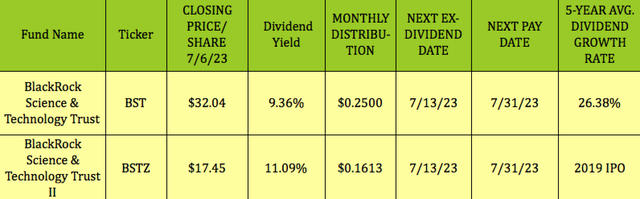

At its 7/6/23 closing price of $32.04, BST yielded 9.36%, vs. 11.09% for BSTZ. Both funds go ex-dividend on 7/13/23, with a 7/31/23 pay date.

BST has an impressive five-year dividend growth rate of 26.38%, mainly due to its 100%-plus growth in 2021, when it paid $4.26, vs. $2.05 in 2020. BSTZ recently cut its dividend in March '23 from $.1920 to $.1613.

Hidden Dividend Stocks Plus

Taxes:

BST - 28% of 2022 distributions came from return on Capital, with the balance coming from prior net realized gains. BST had -$20.29/share in investment operations in 2022. Coupled with its $3.00 in distributions, NAV declined from $52.40 to $29.11 in 2022, a stark contrast vs. 2021, when its NAV increased from $51.94 to $52.40/share, even after paying $4.27 in distributions.

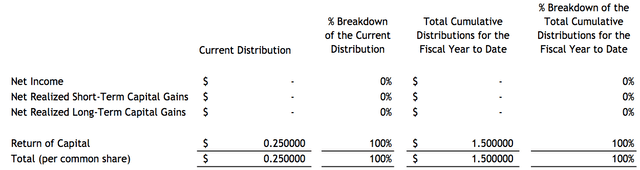

So far in January -June 2023, BST's distributions are estimated to be 100% return of capital:

BST site

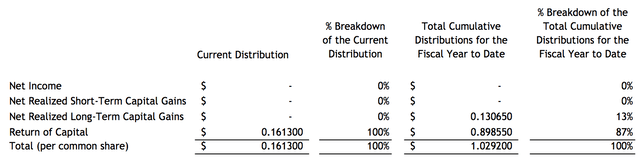

It's a slightly different story for BSTZ, with 87% of its 2023 distributions estimated to be return on capital, and 13% coming from long-term capital gains:

BSTZ site

Holdings:

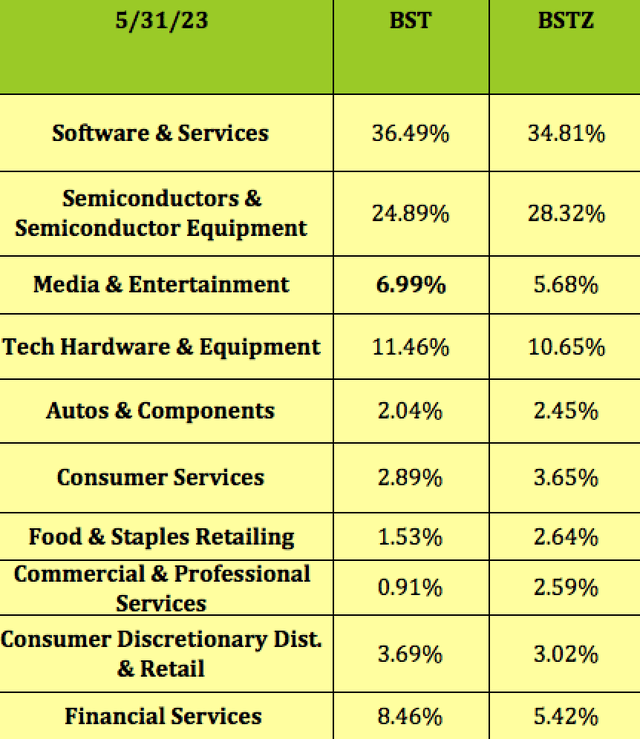

The largest differences in the two funds' sector exposures are in semis and financial services, with BSTZ holding a larger position in semis, and a smaller position in financial services:

Hidden Dividend Stocks Plus

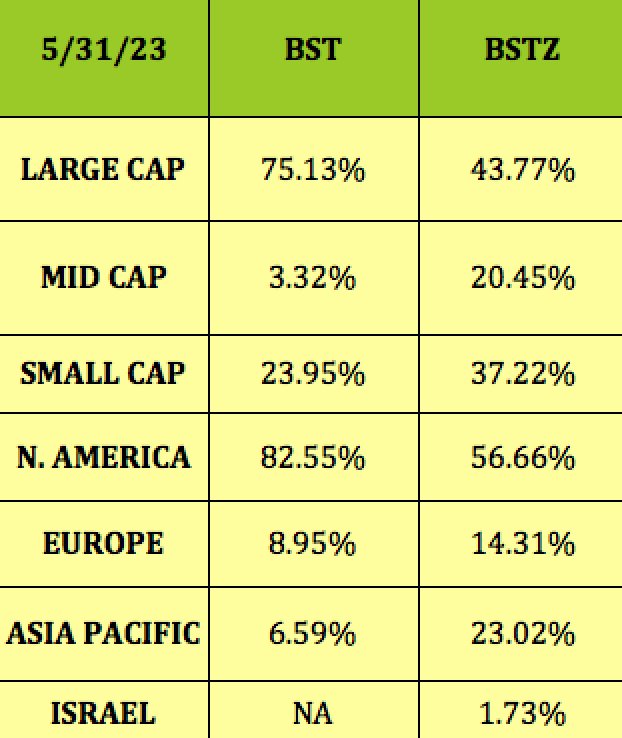

The major difference between these two funds lies in their market cap and regional exposures. BSTZ's bias toward rapid and sustainable growth potential gives it a much lower large cap exposure than BST, with much higher exposure to mid-caps and small caps.

BST has 82.5% exposure to US companies, vs. 56.7% for BSTX, which has much higher exposures in Europe and Asia:

Hidden Dividend Stocks Plus

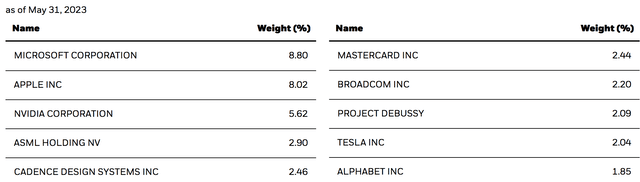

BST's top 10 holdings include many big cap familiar tech names, including Apple (AAPL) and Microsoft (MSFT), which form 16.8% of its portfolio. The top 10 holdings comprise 38.42% of the portfolio:

BST site

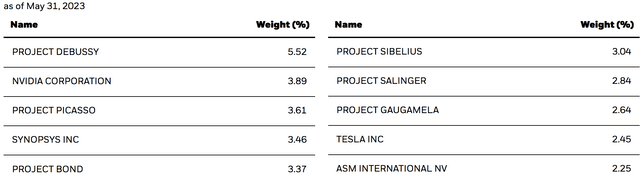

BSTZ's top 10 includes Nvidia (NVDA), at 3.89%, and Tesla (TSLA), 2.45%, but heavily favors lesser-known tech names, forming ~33% of its portfolio.

BSTZ site

Long-Term Performance:

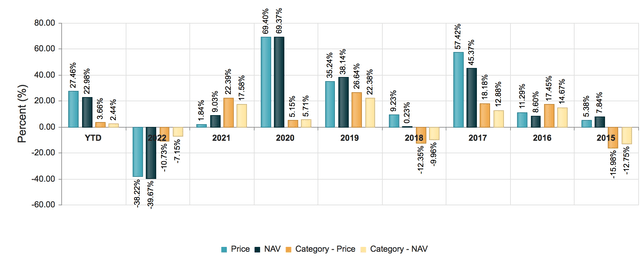

BST lagged the Morningstar Equity CEF sector in 2021 and 2022, but outperformed it on a price and NAV basis in 2017 - 2020, and in 2015, and has outperformed it so far in 2023. As of 5/31/23, BST had an NAV total return of 281% since its inception.

BST site

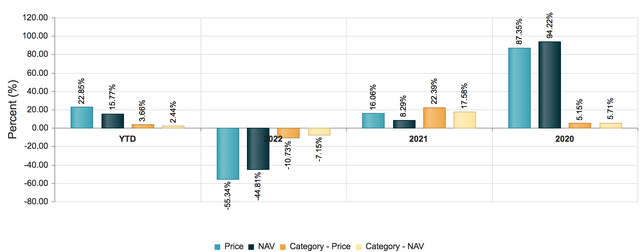

BSTZ has a much shorter history - it underperformed in 2021-2022, and outperformed in 2020. It also has outperformed so far in 2023. As of 5/31/23, BSTZ had an NAV total return of 40% since its inception.

BSTZ site

Valuations:

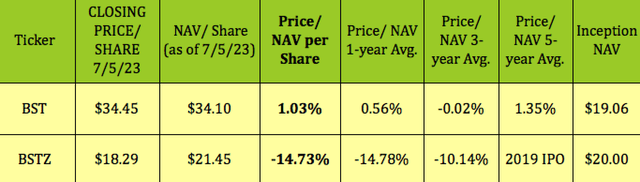

Buying CEFs at a deeper than historical discount can be a useful strategy due to mean reversion. At its 7/5/23 closing price of $34.45, BST was selling at a 1% premium to NAV/share, which is higher than its 1- and 3-year average prices to NAV, and slightly lower than its five-year average.

At $18.29, BSTZ was selling at a 14.73% discount to its 7/5/23 NAV/Share, which is a much deeper discount than its three-year 10.14% average discount.

Hidden Dividend Stocks Plus

Parting Thoughts:

BST has a long track record of positive returns, and an attractive yield. Try to buy it a lower premium on a market down day. BSTZ has a higher yield, and a deep discount, but is more volatile.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations. Our portfolio's average yield is over 9%.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of high yield income vehicles, and there's currently a 20% off sale on our service.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

"Hidden Dividend Stocks Plus", a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world's markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BST, BSTZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

Thank you