Triumph Group: Upside Catalyst Expected From Achieving FY25 Target

Summary

- Triumph Group plans to double its EBITDA from FY22 to FY25, driven by increased volumes, improved contract pricing, and the exit of loss-making programs.

- The Systems and Support segment is expected to grow, fueled by the recovery of commercial travel, while the Commercial Aero backlog provides visibility for near-term growth.

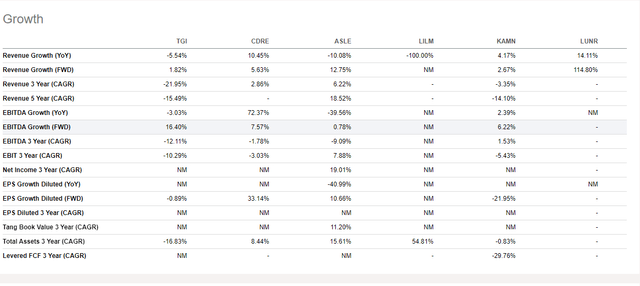

- TGI stock deserves to trade at a premium to peers, given it is expected to grow much faster than peers.

Thomas Barwick

Summary

Overall, Triumph (NYSE:TGI) equity story is still strong with a new initiation of FY24 guidance and board refresh that should continue to steer the ship towards the right direction. I recommend a buy rating.

Outlook

From FY22 to FY25, TGI plans to double the company's EBITDA, which would mean an increase from the current level of $155 million in core EBITDA to $310 million. This would mean growth of 42% year over year compared to the midpoint of the FY24 guidance. While this goal may seem ambitious at first, I believe it is achievable thanks to the operating leverage TGI will experience from increased volumes and improved pricing upon contract renewals, as well as the exit of loss-making programs via divestitures and the end of G280 and B747 operations.

Systems and Support

As narrowbody volumes with Military begin to improve, Systems and Support revenue grew 23% organically in FQ4. I anticipate that commercial aero growth will be the primary driver of the segment's growth, with support from the continuous travel recovery fueling demand for commercial AM and OE. Since the quarterly fluctuations in military AM are more difficult to model due to their lumpiness, I would expect more volatile movements compared to the past few quarters. The segment's volume growth should be accompanied by rising margins, and I see no reason why it couldn't eventually double its total EBITDA as set by management. One major factor fueling this expansion will be the greater contribution of MRO and spare parts compared to OEM, as well as price increases resulting from recontracting.

Commercial Aero Backlog analysis

The order book for commercial aircraft is booming, increasing by 13% to $1.6 billion. Based on fiscal year revenue, this should last for two years or more, giving the company and its investors' confidence in its near-term growth prospects. The $1.6 billion is a very reliable indicator of future sales because the book to bill ratio is still positive at 1.2x, indicating that demand is still higher than TGI's capacity to translate into slates. TGI is actively pursuing work on military platforms in both the original equipment and maintenance, repair, and overhaul (OE and MRO) space, which gives me hope for the future quality of growth.

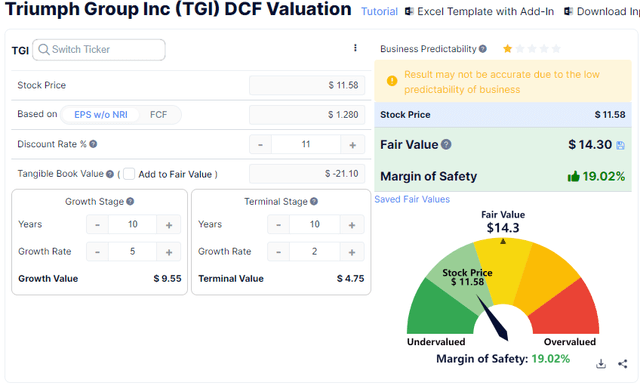

Valuation

Based on TGI historical performance, which I find as fairly conservative, I believe the stock would be worth around $14.30, which represents an attractive upside. Notice that I have used 11% as my discount rate to take into account the uncertainties due to the macro situation, as such the upside could be higher if cost of capital goes down.

Given the last of the divestitures is now closed, it is much easier and cleaner to value the exiting running business.

To give a better sense of valuation, I also did a comparative analysis to TGI peers. Focusing on forward EBITDA multiple and adjusted for growth, I believe TGI deserves to trade at a premium to peers.

Risks

TGI faces several notable risks that have the potential to impact its operations and financial performance. Firstly, a higher interest rate on refinanced maturities poses a significant challenge as it restricts the company's ability to achieve positive FCF. Moreover, the global demand for commercial aircraft and air travel represents another key risk for TGI . Fluctuations in this demand can adversely affect the company's revenue streams, especially since it operates within the aerospace industry. Any decline in global demand for commercial aircraft and air travel may result in reduced orders for TGI products and services, potentially impacting its profitability and market position.

Conclusion

In conclusion, TGI shows strong potential for growth and improvement. The company's new FY24 guidance and board refresh are expected to steer it in the right direction. TGI aims to double its total company EBITDA from FY22 to FY25, driven by higher volumes, better pricing on contract renewals, and the exit of loss-making programs. The Systems and Support segment is projected to experience growth, supported by the recovery of commercial travel. The Commercial Aero backlog is healthy, providing visibility for near-term growth. TGI's valuation suggests an attractive upside, with a potential stock worth of around $14.30. Comparatively, TGI deserves to trade at a premium to its peers. Overall, considering these factors, a buy rating is recommended for TGI.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.