NextEra Energy Partners: Strong Financials Coupled With Promising Market Bring Benefits

Summary

- NextEra Energy Partners is a leading player in the renewable energy sector, owning a diverse portfolio of renewable generation assets and tapping into the rapidly growing renewable energy market.

- NEP's strategy focuses on securing long-term contracts to stabilize their cash structure, with a portfolio representing a total capacity of 9,438 net megawatts of clean energy projects across 30 states in the U.S.

- Despite economic uncertainties, NEP has maintained a strong financial position with a healthy balance sheet and a plan to generate a 12-15% growth per year in limited partner distributions.

brandedhorse/iStock via Getty Images

Introduction

NextEra Energy Partners (NYSE:NEP) is a limited partnership focused on acquiring, managing, and owning clean energy projects with stable long-term cash flows. As of the end of 2022, NEP holds a 46.2% limited partner interest in NEP OpCo, giving it ownership of a diverse portfolio of renewable generation assets such as wind, solar, storage, and natural gas pipeline projects. Additionally, NEP has the advantage of tapping into the rapidly expanding renewable energy market in Florida, which is currently the fastest growing state for renewables in the United States. With a robust balance sheet, NextEra Energy Partners is well-positioned for continued growth in the years ahead.

NEP business outlook

In recent years, developed countries have made significant investments in renewable energies. However, the Russian invasion of Ukraine and subsequent energy supply chain shortfalls have highlighted the importance of transitioning to alternative energy sources. The growth in renewable energy can largely be attributed to its increasing cost competitiveness, which is driven primarily by government incentives, Renewable Portfolio Standards (RPS), advancements in technology, declining installation costs, and the impact of environmental regulations on other forms of energy generation. To support the development of renewable energy projects, federal, state, and local governments in the United States have implemented various incentives. These incentives include accelerated depreciation, tax credits, and grants that help reduce the costs associated with developing such projects. Additionally, these incentives create demand for renewable energy assets through RPS programs. RPS also provide incentives for utilities to contract with renewable energy providers for their generated power. As a result of these initiatives, there has been a surge in demand for renewable energies and considerable improvement in clean energy technologies in recent years.

As of the end of 2022, NextEra Energy (NEE) owns 617,882 NEP common units. Additionally, NEE Equity holds approximately 53.8% of NEP OpCo's common units and 100% of NEP OpCo's Class B partnership interests. These Class B partnership interests can be exchanged for NEP common units or cash. NEP management's strategy is focused on securing long-term contracts to stabilize their cash structure. As part of this strategy, the company has invested in a diverse portfolio of contracted clean energy projects across 30 states in the U.S. This portfolio represents a total capacity of 9,438 net megawatts (MW). The MW reflects NEP's net ownership in the renewable energy project capacity based on their respective ownership interests. It is important to note that as of the end of 2022, NEP's net MW includes 61 MW of solar generating capacity and 32 MW of battery storage capacity. These capacities are currently under construction and are expected to be operational by the end of the third quarter of this year. All of NEP's contracted projects are focused on solar, wind, and battery storage technologies, with expiration dates extending beyond 2040. Additionally, NEP has ownership interests in natural gas pipeline assets located in Texas and Pennsylvania, with some contracts expiring after 2027. Consequently, NEP is well-positioned to generate consistent cash flows due to their long-term contractual agreements.

NEP financial outlook

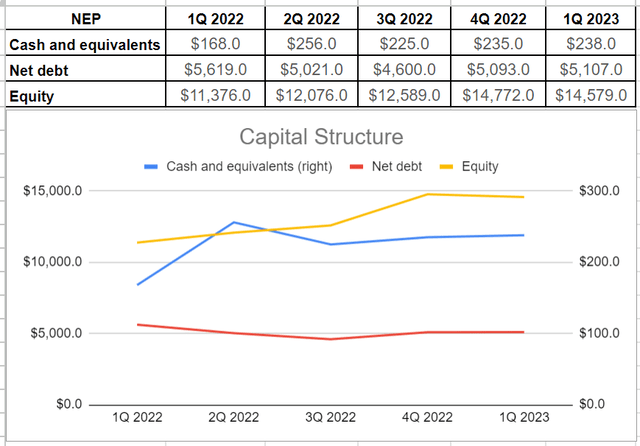

During the first quarter of 2023, NextEra Energy Partners achieved impressive financial results. Their adjusted EBITDA reached $447 million, marking an 8.5% increase compared to the same period in 2022. This growth can be attributed to the acquisition of 1,200 net megawatts of new projects in 2022. Additionally, NEP entered into a new agreement with NextEra Energy Resources to acquire approximately 690 megawatts of long-term contracted operating wind and solar projects in early 2023. This strategic move is expected to generate higher cash available for distribution yield. The acquisition portfolio cost NEP $708 million but is projected to bring in approximately $72 million of cash available for distribution and $110-130 million of adjusted EBITDA. Furthermore, NEP successfully completed the buyout of 50% of the STX Midstream convertible equity portfolio financing and plans to buyout an additional 15% of the NEP Renewables II convertible equity portfolio financing by year-end. As of the end of the first quarter of 2023, NEP's net debt level stood slightly above $5 billion, which is comfortably below its equity level of $14.5 billion. This healthy financial position bodes well for NEP's future prospects and growth opportunities (see Figure 1).

Figure 1 - NEP's capital structures (in millions)

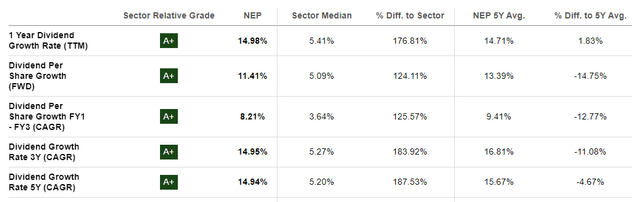

The management's plan to generate a 12-15% growth per year in limited partner distributions per unit until at least 2026 is supported by their strong balance sheet. As a result, it is anticipated that NEP will distribute an annualized rate of $3.64 to $3.74 per common unit by the end of the fourth quarter of 2023. Furthermore, the combination of projects is expected to contribute $2.2 billion to $2.4 billion of adjusted EBITDA and $770 million to $860 million of CAFD by the year-end. NextEra Energy Partners has maintained a dividend growth rate of approximately 15% in TTM, and the management intends to continue this rate. Given the economic uncertainty caused by the COVID-19 outbreak and increasing interest rates in various countries to combat inflation, NEP's ability to pay distributions at a faster rate than inflation is advantageous for unitholders as it helps them maintain their purchasing power (see Figure 2).

Figure 2 – NEP’s dividend growth

The market outlook

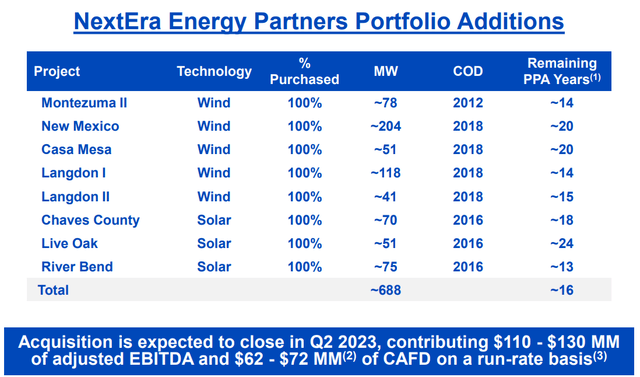

On 24 April 2023, the NEP entered into a purchase and sale agreement with three subsidiaries of NextEra Energy Resources (NEER), to acquire interests in a portfolio of wind and solar generation facilities for a total purchase price of about $566 million. The assets that are included are five wind facilities in California, New Mexico, and North Dakota, and three solar facilities in New Mexico, Georgia, and Alabama (see Figure 3). Two important questions come up to my mind here: 1) Is the market outlook for solar and wind energy still strong as they were before? 2) Are NEP’s wind investments in California, New Mexico, and North Dakota, and its solar investments in New Mexico, Georgia, and Alabama beneficial?

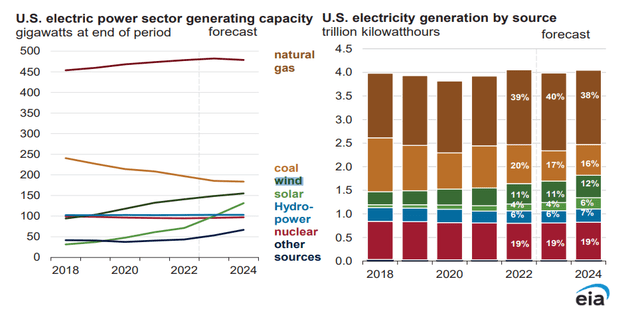

According to EIA’s short-term energy outlook, the U.S. electric sector added an estimated 14 gigawatts of solar generation capacity and about 8 gigawatts of wind capacity during the 12 months ending May 2023. Solar energy has been the leading source of new generating capacity in the U.S. in the first half of 2023. U.S. solar and U.S. wind generation this summer is estimated to be 24% and 7%, higher than in the summer of 2022. Figure 4 shows that U.S. wind and solar electric power generating capacity is expected to increase further in 2024. As a result, the share of wind electric power in U.S. total electricity generation is projected to increase from 11% in 2022 and 2023 to 12% in 2024. Also, the share of solar electric power in U.S. total electricity generation is projected to increase from 4% in 2022 and 2023 to 6% in 2024. Thus, the future of wind and solar energy is bright and is improving.

Now, let’s go to the second question. North Dakota is among the six states with the largest share of its electricity generated by wind energy. North Dakotas' wind power generation more than doubled since 2015. Alabama's solar power generation increased significantly in the past few years. Georgia's solar potential is among the highest in the Southeast. In 2022, wind accounted for 7% of California's total in-state electricity generation. In 2022, wind energy supplied 35% of New Mexico’s total in-state generation, 100% more than two years ago. Also, Solar energy supplied almost 7% of New Mexico's in-state generation in 2022. We can see that NEP’s portfolio additions are not irrational at all, and the company’s management has been clever to grab the existing opportunities. NEP’s solar and wind investments in the mentioned states can be very beneficial for the company.

Figure 3 – NextEra Energy Partners portfolio additions

Figure 4 – U.S. electric power sector generating capacity and electric generation by source

Why I might be wrong?

NEP has a limited number of customers. Thus, if they become unwilling or unable to fulfill their contractual obligations, or decide to terminate their agreements with NEP, the company’s cash generation ability can get hurt in a significant way. Also, the company may not be able to extend to renew its current contract, especially its natural gas transportation contracts, at favorable terms. For now, government policies and regulations are supporting solar and wind power generation. However, we cannot be sure that these policies will continue. Government laws and policies that are providing incentives and subsidies for clean energy could be changed, negatively affecting NEP’s business strategy. Another important risk is connected to the macroeconomic situation of the United States. Possible financial instabilities as a result of hiked interest rates can decrease the commercial energy demand, and also, can hurt the current path of renewable energy developments.

Conclusion

NextEra Energy Partners is a global leader in wind and solar energy production. With the rapidly expanding market for clean energy, NEP's robust financial position positions it well to capitalize on the growing demand, ultimately benefiting its unitholders. Taking into account NEP's strong financials and positive market outlook, I am confident in assigning a "buy" rating to NEP units.

As always, I welcome your thoughts and opinions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.