Yext: Not Worth The Wait (Ratings Downgrade)

Summary

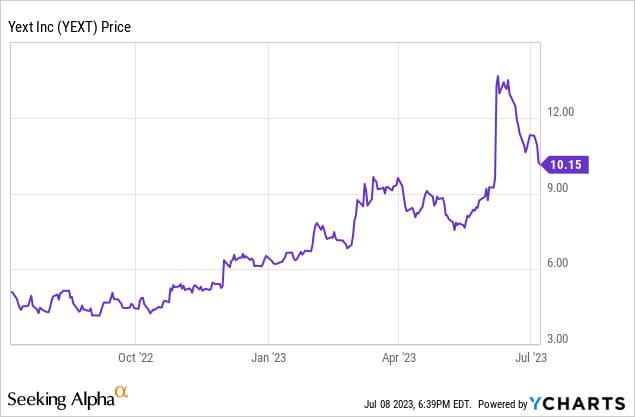

- Yext, a "knowledge management" software company, has seen its shares rise by more than 60% this year.

- Despite a new CEO, cost cuts, and innovation in AI, Yext's projected revenue growth for FY24 is just 1-2%.

- Churn rates are higher than peer software companies.

- Though cheap at ~3x forward revenue, without any meaningful growth catalysts, Yext looks more like a value trap.

Alena Kravchenko/iStock Editorial via Getty Images

Amid rampant market volatility, the strategy I've been recommending remains constant: focus on careful stock selection, especially on "growth at a reasonable price" stocks that can do well no matter which way the overall market heads.

Unfortunately, many names in this space end up being value traps, and I think Yext (NYSE:YEXT) has become one of those stocks. The self-labeled "knowledge software" company, which was originally known for helping multi-location businesses update their customer-facing details on the web, has seen its shares skyrocket more than 60% year to date. The question for investors now is: can the rally keep going?

To be fair, Yext has had a lot of things going for it this year that have sparked enthusiasm. The company has tapped a new CEO, revamped its sales/go-to-market teams, improved profitability via cost cuts, and perhaps the biggest contributor to the stock's rally to date - Yext has long been an innovator in the AI space, with the company long having leveraged AI and natural language processing to power search and chat features on its platform.

At the same time, however, Yext is facing top-line stagnation. In my view, the main draw to Yext at the moment is its cheap valuation. At current share prices just north of $10, Yext trades at a market cap of $1.26 billion. After we net off the $216.9 million of cash on the company's most recent balance sheet, Yext's resulting enterprise value is $1.04 billion.

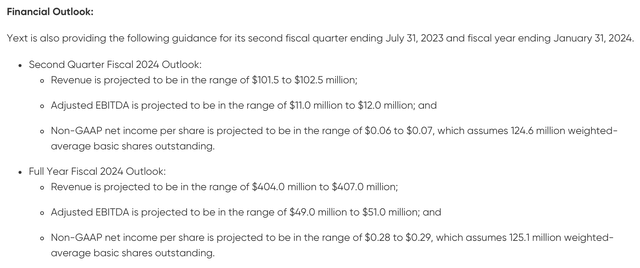

For the current fiscal year FY24 (the fiscal year for Yext ending in January 2024), the company has guided to $404-$407 million in revenue, representing just 1-2% y/y growth.

Yext Q1 results (Yext Q1 earnings release)

This puts Yext's valuation at 2.6x EV/FY24 revenue - cheap in a vacuum, of course, but for a company with unproven execution and limited prospects for growth, I'm not confident there is substantial upside remaining - especially after Yext's recent rally.

Here are the key fundamental risks to be wary of for Yext:

- Growth has stalled. Yext is barely managing to eke out growth anymore, and in the tech space, lack of growth creates a vicious cycle where customers start to lose faith and churn (software requires support, ongoing maintenance, and feature updates - none of which companies want to invest in if they think the vendor is in trouble of sinking).

- High churn rates. Yext's focus on smaller and mid-market customers has led to high churn rates (holding down growth). Yext's net revenue retention rates index far lower than peer software companies.

- Cost cuts can only go so far. We appreciate Yext's ferocity at cutting costs, but on a stagnant revenue base this can only go so far - especially when cuts are being made to the company's revenue-producing sales teams.

- Founder exit. Howard Lerman's resignation as CEO in 2022, as well as the concurrent exit of longtime CFO Steve Cakebread (a former Salesforce executive and well-known in the tech community), indicate in my opinion a lack of faith in the direction of the business.

In light of Yext's higher valuation notched over the past month, coupled with its inability to re-spur growth, I'm downgrading Yext to bearish. In my view, it's best to stay on the sidelines here until Yext stock comes back down.

Q1 download

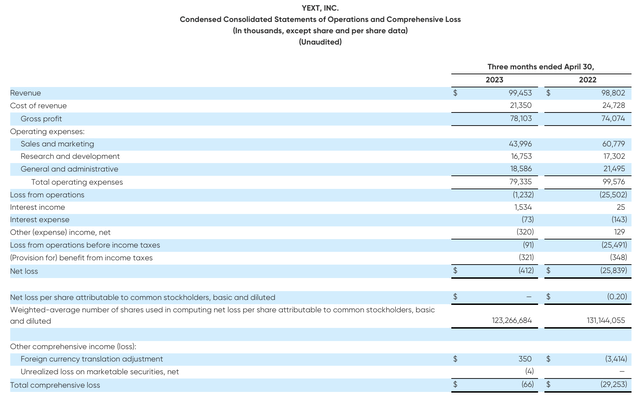

Let's now go through Yext's latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Yext Q1 results (Yext Q1 earnings release)

Yext's revenue grew just 1% y/y to $99.5 million, slightly edging out over Wall Street's expectations of $98.6 million (flat y/y), and roughly in line with Q4's flat y/y growth rate.

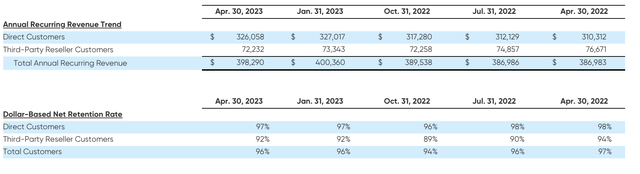

Several key metrics, however, are worth pointing out. First: Yext saw a sequential reduction in ARR to $398.3 million - still up 3% y/y, but shedding $2.1 million of ARR versus Q4.

Yext key metrics (Yext Q1 earnings release)

Additionally, as shown in the chart above, the company's dollar-based net retention rate was 96% in the quarter - reflecting 4% net churn in the business, whereas most competing software companies report net upsell.

Michael Walrath, Yext's CEO, noted that it will take several quarters for the company's new go-to-market strategy fully bear fruit. Per his remarks on the Q1 earnings call:

Our go-to-market executive team has been in place for six months and we're pleased with the progress we are making. While the full transformation of our go-to-market will take a couple more quarters, we are beginning to see increases in pipeline production and conversions, particularly with smaller enterprise customers.

Our mid-market team benefits from shorter sales cycles and less complex integrations and the uptake is a good indicator of how our value proposition is landing with customers. So while it is still early, we believe this momentum will eventually carry over to the larger enterprises as well."

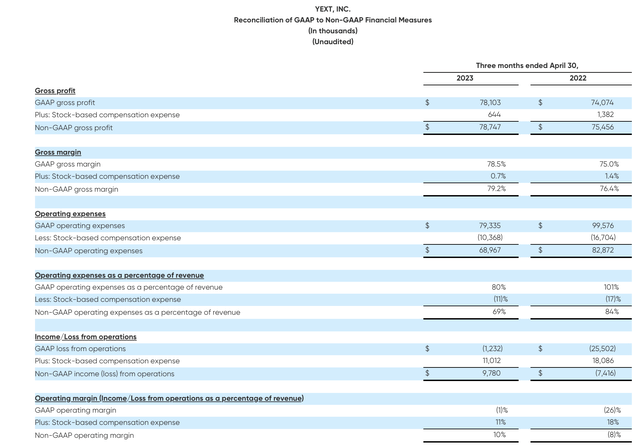

The main bright side was on profitability. Yext's pro forma gross margins saw a respectable 280bps y/y expansion to 79.2%, driven by a more favorable revenue mix toward software and away from professional services, as Yext has succeeded in pawning off implementation work to third-party partners. The company expects to see gross margins in a similar range throughout the remainder of the year.

Yext Q1 margins (Yext Q1 earnings release)

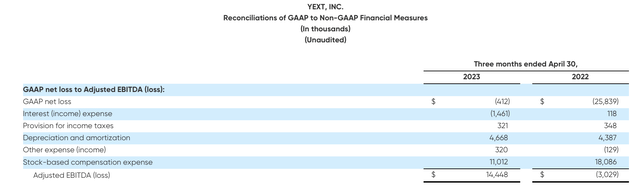

Pro forma operating margins, meanwhile, jumped substantially by 18 points y/y to 10%, driven by a fifteen-point reduction in sales and marketing expenses as a percentage of revenue. And as shown in the table below, Yext's adjusted EBITDA also jumped to $14.4 million (a 14% margin) from a loss of -$3.0 million in the year-ago Q1.

Yext adjusted EBITDA (Yext Q1 earnings release)

Key takeaways

With an uncertain growth trajectory and elevated churn rates, I'm not keen on investing in Yext unless it's ultra cheap - and at a 2.6x forward revenue multiple, Yext isn't cheap enough just yet to justify a bet. Keep an eye on this stock on your watchlist, but don't jump in yet.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)