Great Lakes Dredge & Dock: The Only Thing Keeping This A Viable Prospect

Summary

- Great Lakes Dredge & Dock has seen a significant decline in revenue, profits, and cash flows, with shares dropping 13.8% since last year.

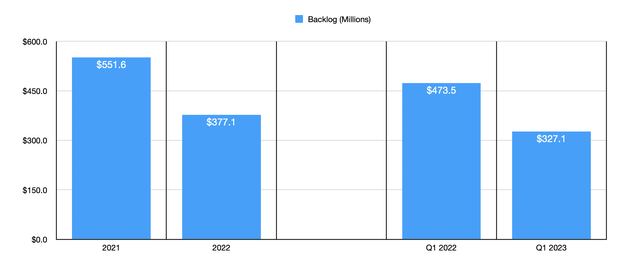

- The company's backlog, or future projects, has also decreased from $551.6 million at the end of 2021 to $327.1 million in the first quarter of 2023.

- Despite the downturn, funding from the US Army Corps of Engineers and bids on offshore wind projects could provide a boost, leading to a more neutral rating for the company.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

gece33/iStock via Getty Images

One company that just cannot seem to catch a break is Great Lakes Dredge & Dock (NASDAQ:GLDD). As its name suggests, the company is involved in the business of providing dredging services. Its work spans government projects, projects for private industry, and even touches on newer industries like the offshore wind market. Some of its work also includes coastal restoration and land reclamation, trench digging for pipelines, and more. Shares have taken a beating over the past several months, but this decline was not necessarily unwarranted. Revenue, profits, and cash flows have all taken a hit. What's more, backlog for the company continues to decline. In most circumstances, I would rate a company like this rather bearishly. But there's only one catalyst for the firm that is still keeping me optimistic to the point of granting it a more neutral rating. But if the picture continues as it has, even that will eventually have to change.

Tough times

Back in September of last year, I found myself very interested in Great Lakes Dredge & Dock. I really like companies that have unique operating models. And what could be more unique in this day and age than a company that makes most of its money off of dredging services? At that time, I acknowledged that financial performance for the firm had been lackluster and I was dismayed by the continued decline in backlog that the business was seeing. Having said that, I felt as though it's decision to focus more on the offshore wind turbine market was promising and the stock looked quite cheap at the time. At the end of the day, this led me to rate the business a ‘hold’ to reflect my view that shares should generate performance that would more or less match the broader market for the foreseeable future. But that, sadly, was not destined to be. While the S&P 500 is up 12.9% since the publication of that article, shares of Great Lakes Dredge & Dock have plummeted 13.8%.

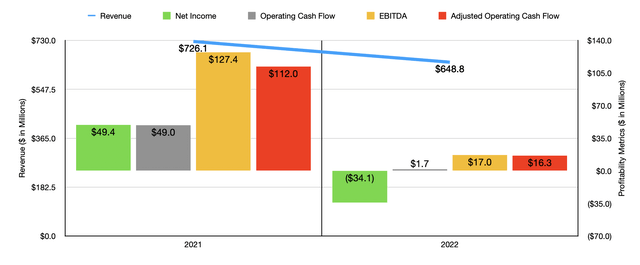

As a value investor, I can be incredibly critical of the market. I have seen many instances where a company has seen its share price drop unjustifiably. This, unfortunately, is not one of those instances. The decline for the company was more than warranted. Consider how the company finished its 2022 fiscal year. Revenue for that time came in at $648.8 million. That's 10.6% below the $726.1 million the company generated for 2021. Most of the operating parts of the company took a beating during this time. The most significant was the domestic capital portion of the firm. This involves domestic dredging operations. Revenue fell from $397 million to $342.5 million. This decrease, about 13.7% in all, was driven largely by lower revenue earned from deepening projects throughout states like Alabama, Massachusetts, Florida, and South Carolina. The only bright spot for the company during this time involved its coastal protection business. Management attributed the $22.9 million, or 13.5%, increase to greater revenue earned on projects in Virginia, North Carolina, and New York.

On the bottom line, the picture for the company was even worse. Net income went from $49.4 million to negative $34.1 million. Operating cash flow went from $49 million to only $1.7 million. If we adjust for changes in working capital, we would see that the number declined from $112 million to $16.3 million. And finally, EBITDA for the business plunged from $127.4 million to $17 million. If these declines seem disproportional compared to the drop in revenue, keep in mind that this is an asset intensive enterprise. And when you see any sort of asset intensive enterprise report a weakening in revenue, you almost always see a much larger impact on the bottom line because of the nature of fixed costs.

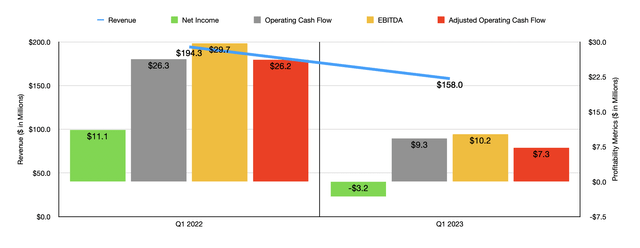

The weakness for the company has continued into 2023. Revenue of $158 million in the first quarter of the year came in significantly lower than the $194.3 million reported at the same time last year. The firm went from generating a profit of $11.1 million to generating a loss of $3.2 million. Operating cash flow plunged from $26.3 million to $9.3 million, while the adjusted figure for this dropped from $26.2 million to $7.3 million. And finally, EBITDA for the business plunged from $29.7 million to only $10.2 million.

These changes alone are cause for concern. But to add salt to the wound, leading indicators for the company look anything but great. The most important leading indicator for a company like this would be its backlog. This is the value of future projects that have been booked with the company. At the end of 2021, the firm had $551.6 million worth of backlog. This fell to $377.1 million by the end of 2022. By the end of the first quarter of this year, the figure had fallen further to $327.1 million. That's materially lower than the $473.5 million reported for the first quarter of 2022. To be very clear, management has warned investors that backlog may not be indicative of future revenues. In part, this is because some of the projects that the company does do not get booked a long time in advance. In addition to this, the vast majority of the company's backlog, about 77% as of the end of 2022, involved the federal government in the US as a client. And technically, this relationship allows the government to cancel or alter its projects without repercussion.

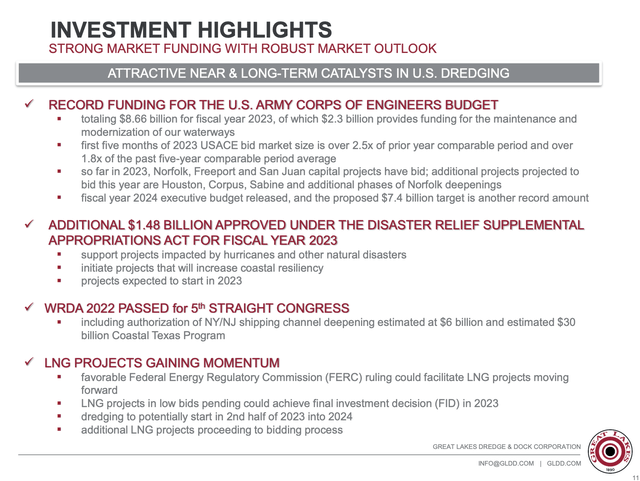

Given these changes that have occurred, I was very tempted to downgrade the company entirely. But there is one reason why I think the picture could be about to change. According to the latest investor presentation provided by management, there is a great deal of funding that could come the firm's way. For the 2023 fiscal year, for instance, the US Army Corps of Engineers received total funding of $8.66 billion. Of this, $2.3 billion has been earmarked for funding for the maintenance and modernization of waterways in the country. The budget is expected to be even larger next year. On top of this, there is an additional $1.48 billion in funding that has been approved under the Disaster Relief Supplemental Appropriations Act For the 2023 fiscal year. There are other initiatives as well that could result in billions of dollars coming the company's way over the years.

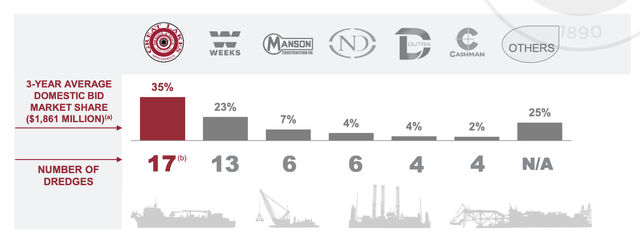

Obviously, there is no guarantee that any of this will turn out in the firm's favor. After all, the company is part of a competitive bidding process. The good news, however, is that at least when it comes to the domestic market, the company has won about a 35% market share, if we average out the market opportunity over the past three years. Not only that, the firm continues to place bids on offshore wind projects centered around the eastern seaboard. Naturally, all of this is speculative. But it does create a very binary sort of scenario.

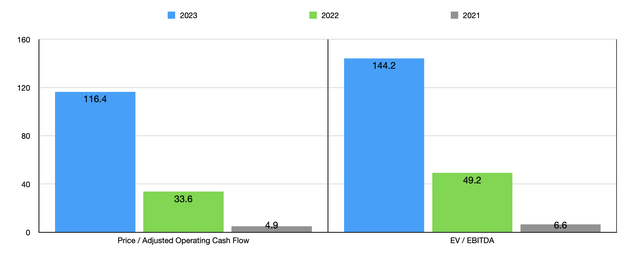

Truthfully, some of these projects must come through or else Great Lakes Dredge & Dock will find itself in a world of pain. I say this because, at the moment, shares of the enterprise do look very expensive on a forward basis. My own estimates suggest that the company may generate adjusted operating cash flow this year of only $4.7 million, while EBITDA may be as little as $5.8 million. As you can see in the chart above, this would make the stock very expensive on an absolute basis. Even if we assume that results stabilize to what the company experienced in 2022, the stock would look pricey on an absolute basis. Though it may be only a bit pricey relative to similar firms. As you can see in the table below where I compared the company to five similar enterprises, three of the four firms with positive results ended up being cheaper than it when it comes to the price to operating cash flow approach. And when it comes to the EV to EBITDA approach, four of the five were cheaper.

| Company | Price / Operating Cash Flow | EV / EBITDA |

Great Lakes Dredge & Dock Corporation | 33.6 | 49.2 |

| Bowman Consulting Group (BWMN) | 29.2 | 26.1 |

| Sterling Infrastructure (STRL) | 7.4 | 9.1 |

| Argan (AGX) | 64.5 | 5.6 |

| Concrete Pumping Holdings (BBCP) | 5.1 | 6.9 |

| Emeren Group (SOL) | N/A | 136.1 |

Takeaway

From what I can see, the picture for Great Lakes Dredge & Dock is anything but great. Normally, I would be very tempted to downgrade the company. And in truth, I do believe that only those who are comfortable with a speculative prospect should consider dabbling around with the company at this time. But for those who don't mind a binary scenario, I do think a more neutral stance is warranted. If the company can win some sizable contracts, upside from here could be appealing. Because of this, and keeping in mind that this is a speculative play no matter what, I would argue that a soft ‘hold’ rating is alright at the moment.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.