PGJ: Keeping The Faith In This Oversold Chinese Consumer Tech Play

Summary

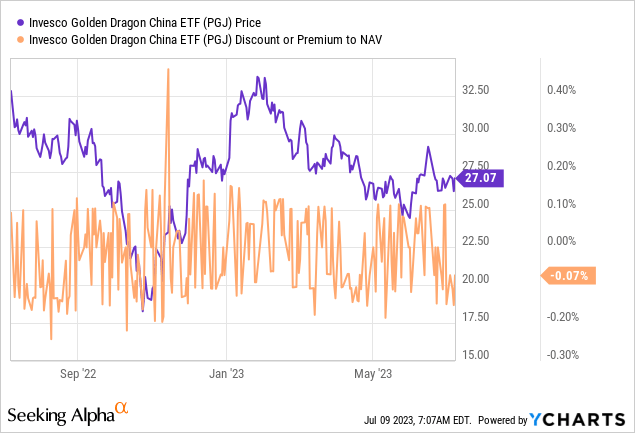

- The consumer tech-heavy Invesco Golden Dragon China ETF has extended its underperformance in recent months.

- While the broader Chinese economy has slowed, the consumer remains in good shape – with or without stimulus.

- Given its exposure to the right parts of the Chinese economy, PGJ remains a worthy growth-oriented portfolio addition.

AerialPerspective Works

For the most part, Chinese economic data has offered few positives this year. Manufacturing PMI remained well below 50 for the third consecutive month (implying contraction), youth unemployment is running at multi-year highs, and local government balance sheet constraints are limiting stimulus on the fiscal side. Hence, investor sentiment has understandably been fragile on Chinese equities; in tandem, stocks have retraced much of the gains made since the reopening last year.

However, the bearishness on the broader economy has also extended to Chinese internet names, the key component of the Invesco Golden Dragon China ETF (NASDAQ:PGJ) portfolio. Given many of these companies are not only well-capitalized but also generating solid cash flows amid a more favorable regulatory (note the conclusion of the fintech crackdown last week) and consumer backdrop, the consumer tech selloff seems unjustified. Alongside an expansionary services PMI and recent e-commerce data indicating solid online consumption trends, oversold tech stocks like Baidu (BIDU), Alibaba (BABA), and Tencent (OTCPK:TCEHY) look poised to lead a recovery in the coming months. Meanwhile, efforts by Chinese tech companies on the generative artificial intelligence ('AI') front remain underappreciated relative to their US counterparts, so investors looking for AI optionality will also find a lot to like here.

Fund Overview – Reasonably Priced Exposure to Chinese Consumer Tech

The Invesco Golden Dragon China ETF, which tracks (pre-expenses) the performance of a basket of US exchange-listed Chinese depositary receipts ('ADRs') per the NASDAQ Golden Dragon China Index, has seen its net assets further decline to $179m (down from ~204m when I last covered PGJ) amid Chinese equities' underperformance. The ETF maintains a relatively high 0.7% expense ratio (mainly from the 0.5% management fee), though it remains a cost-effective option when benchmarked against actively managed funds.

The fund's sector allocation remains largely consistent with prior reporting, led by consumer discretionary at 54.5% (vs. 53.0% prior). Communication services have ceded further share of the portfolio at 23.4% (down from 25.0%), along with information technology at 6.1% (down from 7.2% prior). Meanwhile, the biggest gainer was industrials at 6.3% (up from 5.3% prior), now the third-largest allocation. The top five sectors continue to account for an outsized share of the total portfolio at 93.9%, so investors should be mindful of the sector concentration risk.

Jan-23 | Apr-23 | Jul-23 | |

Consumer Discretionary | 53.9% | 53.0% | 54.5% |

Communication Services | 25.2% | 25.0% | 23.4% |

Industrials | 4.2% | 5.3% | 6.3% |

Information Technology | 7.1% | 7.2% | 6.1% |

Real Estate | 3.6% | 4.1% | 3.6% |

Financials | 3.9% | 3.1% | 3.4% |

Consumer Staples | 0.3% | 0.6% | 1.3% |

Health Care | 1.9% | 1.7% | 1.2% |

Others (Including Cash) | 0.1% | 0.0% | 0.2% |

Total | 100.0% | 100.0% | 100.0% |

Source: Invesco Golden Dragon China ETF

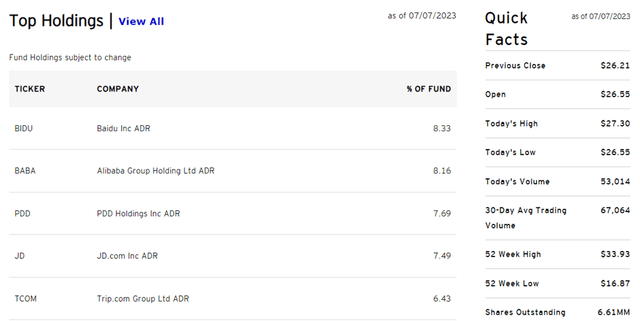

Following Alibaba's retracement post-April, the fund's top holding is now internet-related services and artificial intelligence company Baidu at 8.3% (up from 7.7% prior). Online travel agency Trip.com (TCOM) has also been bumped down in favor of e-commerce company PDD Holdings (PDD) and e-commerce platform JD.com (JD). The consumer tech-focused top ten list also contributes an outsized ~59% of the portfolio, so even though the 10% cap on single-stock allocation remains intact, PGJ is a highly concentrated fund.

Positive Chinese E-Commerce Readthroughs Ahead of This Month's Politburo Meeting

Stimulus talks in China have ramped up in recent weeks, and if the recent release of the China Macroeconomy Forum's mid-year report (by key Beijing advisor Liu Yuanchun) is any indication, major consumer stimulus could be in the pipeline. Specifically, the think tank called for an RMB3tn stimulus plan (partly funded via digital yuan issuance subject to a one-year validity period) to boost consumption and household income. Whether the government ultimately moves forward with this proposal at this month's Politburo meeting is another question; either way, more stimulus for a Chinese consumer that seems to be already doing well points to upside for PGJ's consumer tech-heavy portfolio. Even if the government opts for private sector reforms instead without large-scale stimulus, the strong NBS and Caixin services PMI report (both well above 50 in June) means activity in the services sector should continue to improve through the year.

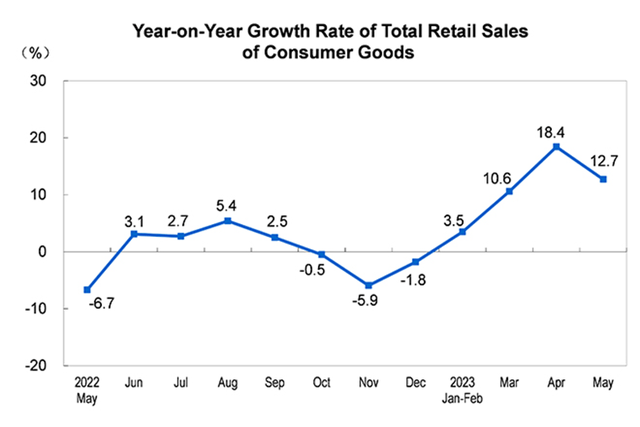

Despite the bearish news flow about the Chinese retail sales print last month, a closer look suggests a notable divergence between offline and online sales growth. Relative to the +12.7% YoY headline retail sales print for the month, China's e-commerce sales growth (excluding virtual goods and services) far outpaced offline at +16.9% YoY. The readthroughs appear favorable for key PGJ holdings BABA and PDD, with China's online clothing sales leading the way at +14.6% YoY over the Jan-May period. E-commerce penetration also reached >30%, extending the offline to online migration runway accelerated during COVID. A top-line boost, in addition to the efficiency/cost-cutting efforts at the major Chinese tech companies over the last year, bodes well for the profitability and cash flow outlook going forward.

Addressing the Washington Tail Risk

Amid heightened US-China tensions, concerns about semiconductor restrictions hampering the development of the Chinese tech sector have rightly been top of mind. But Beijing is biting back – ahead of treasury secretary Yellen's visit last week, China threatened to retaliate via restrictions on exporting gallium and germanium, key inputs into the semiconductor manufacturing process. The catch is that this restriction will only come into effect from August, an extended implementation deadline that gives Washington time to negotiate a mutually beneficial outcome.

So while Beijing leveraging its commodity reserves represents an escalation of sorts, it also signals a potential roadblock to further tit-for-tats with Washington. Given China is also the leading global producer of numerous other critical raw materials and has access to key supply chains via foreign direct investments (e.g., nickel in Indonesia), a full US-China decoupling is far from a given here. Going forward, Washington's reaction to this new round of escalation will be key – any retreat from ongoing threats to further tighten China's access to leading-edge semiconductors bodes well for the PGJ portfolio companies' long-term AI optionality.

Keeping the Faith in This Oversold Chinese Consumer Tech Play

The selloff in Chinese equities has only worsened this year, and the PGJ fund hasn't been spared. While some de-rating is justified given the weak economic data, I suspect investor sentiment has turned too bearish on PGJ's consumer tech holdings. Unlike the rest of the economy, services and online consumption have continued to rise YoY, supporting the cash generation and profitability of China's leading internet companies. And as last week's regulatory retreat showed, oversold tech plays like Alibaba and Tencent could still re-rate significantly if sentiment turns.

With stimulus on the horizon and regulators increasingly unwinding their restrictive stance on the private sector, the PGJ portfolio screens very cheaply at ~16x fwd P/E. The upcoming Q2 2023 results present a potential catalyst, along with optionality from successful future AI launches (e.g., generative AI and autonomous vehicles) by the large Chinese internet companies.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.