BT Group: Valuation Is Not Attractive At This Price

Summary

- The BT Group's valuation is not attractive at the current price.

- BT Group's operational performance is improving, especially in monetizing its fiber Digital Infrastructure, and the company is well-positioned to capitalize on rising fiber demand and improve its FCF outlook for the medium term.

- Potential competitive pricing pressure and the equity markets' short-term focus limit the stock upside, in my opinion.

xijian

Summary

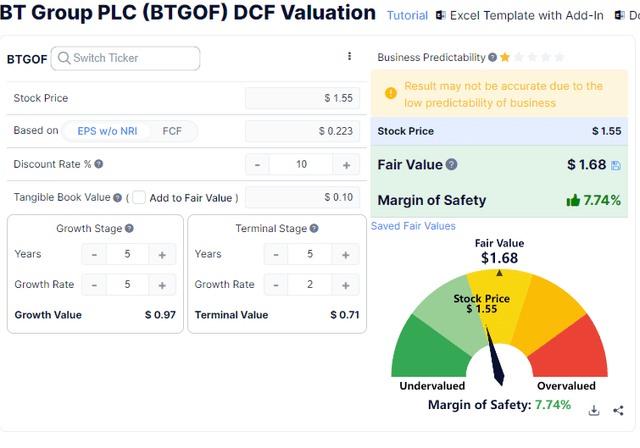

I recommend a hold rating for BT Group (OTCPK:BTGOF) as the valuation is not attractive at the current price. My DCF model suggests a target price of $1.68, which is only 8% above the current share price.

Business description

In the United Kingdom, BT Group is one of the many telecom providers. It controls the largest U.K. fixed-line network, known as Openreach. Managed IT network services, fixed voice and data services, mobility, TV and connection services, and broadband internet access are all part of the company's offerings. Copper and fiber optic lines connect BT's exchanges to customers' homes and businesses. The company caters to both private and public sector clients, including large corporations, SMEs, start-ups, wholesale customers, retail locations, offices, and residences. In terms of segments, BT Group has 47% revenue in Consumer, 24% in Enterprise, 16% in Global, and the remaining in Openreach. Among these, Openreach carries the highest portion of EBITDA, 43.5%.

Industry

BT Group operates in a very attractive industry, which I expect to continue growing at a rapid rate, and BT Group to benefit from it. According to The Business Research Company, the 5G services global market is set to grow at 56% from CY22 to CY26, from $95 billion to $561.5 billion. I believe this growth is plausible due to companies stabilizing their output after catering to the demand that grew exponentially during the COVID-19 pandemic in 2020

The industry that BT Group competes in is not a new industry, rather, there are already other competitors. According to Gartner Peer Insights, BT Group competes with Tata Communications Network Services, Vodafone, AT&T, Verizon, Lumen, GTT Communications Network Services, Colt Network Services, and Orange.

Thesis updates

The outstanding operational performance highlighted by BT's 4Q23 results beat is a result of the company's efforts to monetize its fiber Digital Infrastructure. The market appears to be fixated on the company's elevated spending and reduced Normalized FCF estimate for FY24, but I think the company is actually in a strong position to make these changes. In my opinion, this indicates that BT is making an effort to capitalize on rising fibre demand and improve its FCF outlook for the middle term. Strong fiber adoption and significant staff reductions (therefore higher margins) are two of the new metrics for FY28–30. This increases my assurance in BT's ability to generate FCF of GBP3 billion by FY30, which was originally guided. Revenue and EBITDA are still predicted to rise in FY24. I like the fact that management is going hard on reinvesting into capex, which is currently expected to be GBP5-5.1bn in FY24 - as it means higher future growth. Although I agree that the equity markets are short-term focused, I believe investors will be able to look past the temporary dip in FCF.

Financial analysis

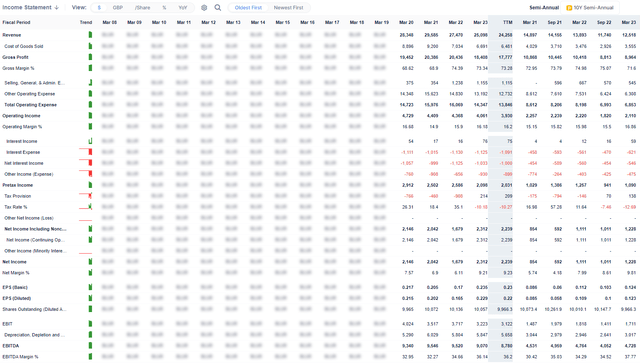

BT Group is not a fast-growing software company, rather it grows topline slowly at low-single digits historically. I expect growth to slightly tick up as BT Group capitalize on the fibre trend (the results of investing in CAPEX today). Revenue growth from here should stem from ARPU growth and increase in number of subscribers.

BT Group EBITDA margin has historically been stable at the low 30% to mid 30% range, but has recently broken that trend to reach the high 30% range. I expect EBITDA margin to continuously slowly expand moving forward as BT Group raise prices down the road, which has high incremental margin given that the cost of laying the fiber cables are already front loaded today.

Gurufocus

I expect BT Group to have an advantage in terms of reinvesting profits into growth (laying fiber cables) because of its better profitability, relative to peers. In particular, I would note that BT Group has one of the leading gross margin in the telecom industry, which indicates that BT Group has good pricing power.

BT Group current has GBP3.9 billion in cash and ~GBP24 billion in total debt, which sums up to ~GPB20 billion in net debt. The net debt to EBITDA ratio has increased outside of its range relative to the past (range between ~1+x) to the current 2.7x. I believe this is justified as BT Group needs financial capacity to invest in fiber cables upfront. As BT Group gains more subscribers, EBITDA should increase, thereby deleveraging the ratio. There should be no issue with BT Group’s balance sheet strength.

Valuation

As per my expectations that BT Group should see growth accelerate higher than its historical range, I assume growth to tick up to 5% in the growth stage, follow by historical growth in the terminal stage. Lastly, I assumed 10% discount rate to account for the increase in equity risk premium. My DCF model suggests an 8% upside. I believe this upside is not attractive enough for investors to go long. Hence, I recommend a hold rating.

Risk

If competitors in the UK keep up their aggressive price cuts and promotions, BT may be obliged to respond by raising prices across the board or lowering prices on its premium brand, sending BT Consumer into a period of tough performing periods.

Conclusion

In conclusion, I recommend a hold rating for BTGOF due to its unattractive valuation at the current price. While the industry is expected to grow rapidly, with BT Group benefiting from it, the target price based on my DCF model suggests only an 8% upside. BT Group faces competition from other telecom providers, and its operational performance is improving, particularly in monetizing its fiber Digital Infrastructure. Despite elevated spending and reduced FCF estimates for FY24, I believe the company is well-positioned to capitalize on rising fiber demand and improve its FCF outlook for the medium term. However, the equity markets' short-term focus and potential competitive pricing pressure pose risks. Considering these factors, I believe the upside is not compelling enough for investors to take a long position, hence the hold rating.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.