First Horizon's Financial Journey Amid Merger Chaos

Summary

- First Horizon Corporation reported a Q1 2023 net income available to common shareholders (NIAC) of $243 million, a decrease from Q4 2022's $258 million, following the failed merger with TD Bank Group.

- The bank could utilize the Federal Reserve's Bank Term Funding Program (BTFP) and discount window to bolster its financial position and enhance liquidity amid wider instability in the banking sector.

- Despite challenges and uncertainties, First Horizon remains confident in its robust financial foundation and operational resilience, maintaining its disciplined approach to capital and expense management while fostering growth.

da-kuk

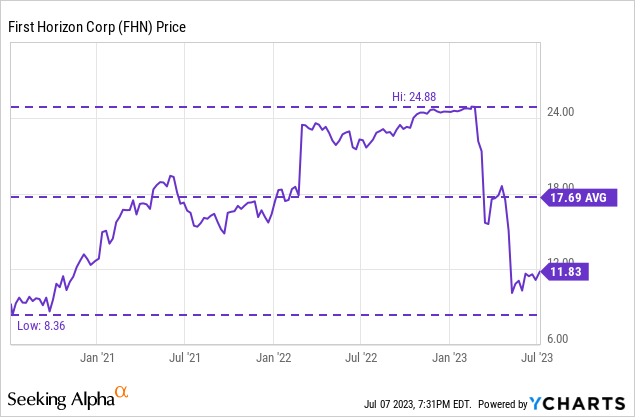

First Horizon Corporation (NYSE:FHN), the Memphis-based regional financial services powerhouse, has always been a quiet bank that has gone about its business in a responsible and solid way, but it's recently been getting a lot of attention due to its failed merger with TD Bank. When news of the failed merger broke, the stock capitulated, but things are now looking better for the firm as investors begin to get a better understanding of why the deal fell through. It's been a tough time for regional banks, but the experienced management team has somehow retained most of its deposits and is cranking out decent income so far. Today we will take a look at what investors can expect in the banking industry going forward and discuss why First Horizon is worth keeping on your watchlist.

Surprisingly Solid Earnings

First Horizon delivered a net income available to common shareholders (NIAC) of $243 million, or $0.43 per share, which was a dip from Q4 2022's NIAC of $258 million, or $0.45 per share. The after-tax notable items, costing $16 million, or $0.03 per share, undeniably played their part in this decrease.

When we set aside these exceptional items, the adjusted Q1 2023 NIAC slides to $259 million, or $0.45 per share, down from $293 million, or $0.51 per share in Q4 2022.

The main takeaway for investors was the fact that deposits only fell by 3.2% compared to the fourth quarter of 2022. But when we consider what's been going on in the banking industry, this is actually a massive win for the company. This will likely be the main focus for investors in the upcoming July 19 earnings call. Investors will want to see this number as close to zero as possible. I would say a double-digit decline would be cause for concern, but I would also say that it is unlikely, largely because of the actions the Federal Reserve took to address deposit flight at regional banks.

Navigating Stormy Seas: Regional Banks Amid Turbulence

The upheavals involving Silicon Valley Bank (SVB) and Signature Bank in March 2023 have certainly stirred the waters in the banking sector. However, it's amid such uncertainty that First Horizon can potentially find opportunities for stability. The Fed's introduction of the Bank Term Funding Program (BTFP) and the increase of the per-account deposit insurance cap have apparently cooled investors' fears and stabilized deposits at regional banks.

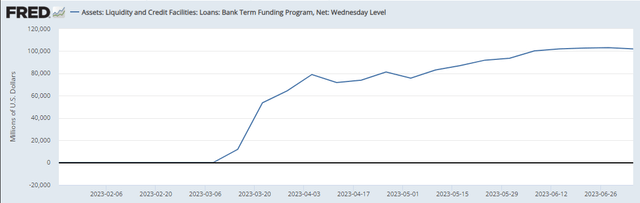

The BTFP, essentially a safety net for banks battling significant unrealized losses on government bonds, has seen an uptake of more than $100 billion since March, which really gives you an idea of how bad things were in the banking space.

The adjustments to the discount window policy, specifically with respect to the full-face value of collateral, have also been helpful. This assistance will likely come at a significant cost down the road for regional banks in the form of regulations. Compliance is already a massive spend for most banks, and there will likely be more rules on the horizon to address the banks' exposure to fluctuations in bond pricing to prevent a recurrence of the Silicon Valley Bank situation. With this in mind, it is important to note that the journey for First Horizon and its peers is far from over.

Going into a possible recession, banks will want to get in front of labor costs and cut down on investment to beef up the balance sheets as they weather an economic downturn. Apart from workforce management, it is likely that we will see a pickup and consolidation activity in the space as banks look to benefit from economies of scale and reduce their exposure to credit risk. It is expected that companies with exposure to risky markets will likely get left out of these mergers, but this shouldn't apply to First Horizon due to its strong financial position and sound way of doing business.

Charting the Course Ahead

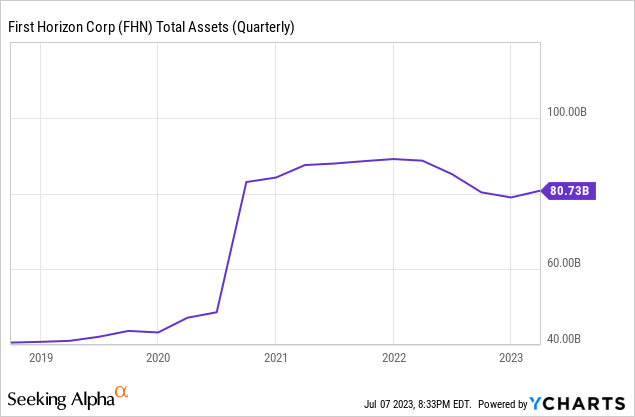

Despite these challenges, First Horizon remains confident in its robust financial foundation, backed by $80.7 billion in assets as of March 31, 2023.

The bank maintains a prominent presence in 12 states, predominantly across the southern U.S., and continues to provide a diverse range of commercial, private banking, consumer, small business, wealth and trust management, retail brokerage, capital markets, fixed income, and mortgage banking services.

Some of the bank's resilience comes from these two factors. Its presence in the South ties with migration trends that support commercial real estate and housing prices, which are major risk factors during economic downturns.

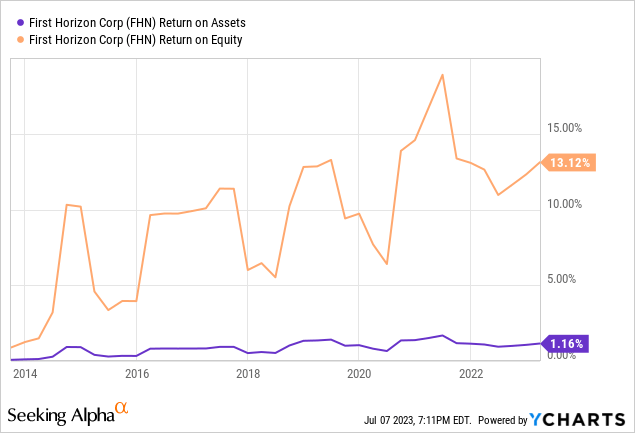

Like many banks these days, the return on assets is stable but low. The low yield is certainly acceptable for shareholders in normal circumstances, but it would be ideal if the company had strong yields that would allow it to entice customers to keep deposits in place by offering attractive interest rates. The recent success of the Apple (AAPL) bank accounts shows how important interest rates can be when combined with the right brand. Apple offered a high-yield savings account with roughly 4% interest and was able to draw nearly $1 billion in business in just four days. It is easier than ever to open a new bank account, so a resurgence in deposit flight from regional banks is always a risk investors should pay attention to.

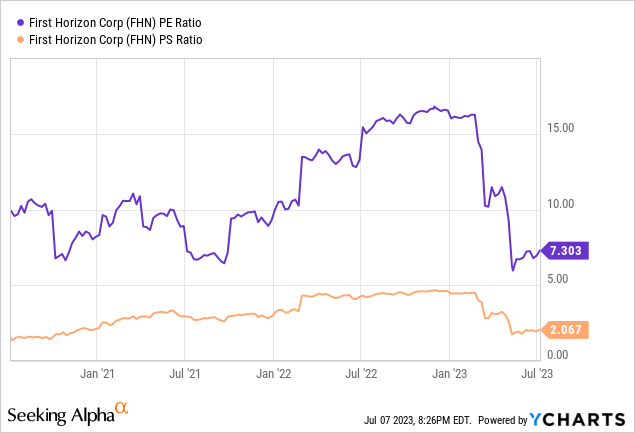

But if this risk is somehow avoided, then we have what could be a very compelling opportunity. First Horizon trades at just $7.30 for each dollar of the company's earnings, which is extremely attractive. It is not a given that a recession will occur, but it is likely that when the Fed does begin hunting rates, the rate cuts will likely be aggressive, which would greatly improve the situation and valuations of First Horizon (holding the regulatory environment constant).

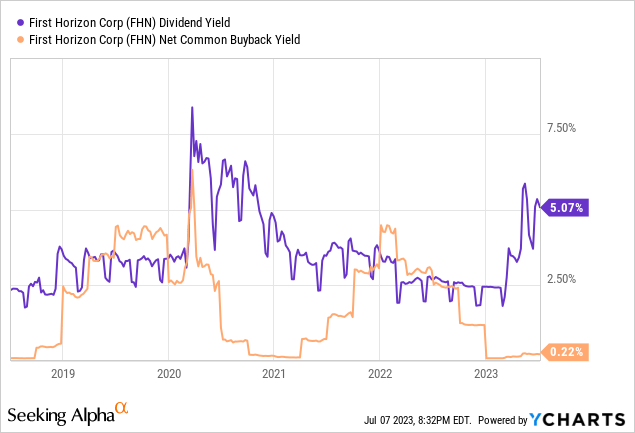

The company also offers what has now become an attractive dividend of roughly 5% due to the massive selloff. It is important to note that in the event of an economic downturn, this dividend would likely be cut or shelved in an effort to cut costs. Nevertheless, the company has built up a great reputation of returning cash to shareholders.

The Takeaway

As we look at the near future, it becomes clear that First Horizon is sailing through uncharted waters. Yet, in the face of adversity, the bank's resilience has been its compass. Despite the fallout from the failed TD Bank merger, the shadow of Silicon Valley Bank's collapse, and an unpredictable macroeconomic landscape, First Horizon remains firmly rooted in its strong capital position, diverse revenue sources, and commitment to driving growth.

Even as storm clouds gather, this bank's narrative is far from a tale of woe. Instead, it offers a lesson in adaptation, reminding investors that even in turbulent times, there are opportunities to be seized. Indeed, the bank's ability to pivot in response to the unfolding saga, leveraging facilities like the Bank Term Funding Program and the Federal Reserve's discount window, could transform the turbulent landscape from a crisis into an opportunity as the weaker names are weeded out.

However, it is important to remain balanced about the risks on the horizon. The onus will be on First Horizon to maintain its strategic agility, capitalizing on opportunities while continuing to effectively manage its expenses. All eyes will be on the bank's leadership, as this is no easy feat.

As we look forward to the rest of 2023, First Horizon's journey is not merely its own. It represents the trials and tribulations of regional banks navigating the aftermath of sector shakeups and regulatory uncertainties. It is a story that the investment world watches with bated breath, and one that could very well redefine what resilience means in the banking industry. So, as First Horizon charts its course, we will be here, compass in hand, ready to navigate through the financial currents alongside it. After all, that's what makes the ever-evolving narrative of the financial sector an intriguing watch. I rate the First Horizon as a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.