GUT: Pay A Dollar For 50 Cents

Summary

- The Gabelli Utility Trust (GUT) fund is trading at a 113% premium to its net asset value (NAV), despite only delivering a 6.7% average annual return over 10 years.

- The fund is liquidating its NAV to maintain an unsustainable 18.5% distribution yield, making a future distribution cut almost certain.

- Investors are advised to consider alternative utility-focused closed-end funds, such as the Cohen & Steers Infrastructure Fund, which offers a more sustainable 8.0% distribution yield.

tirc83/iStock via Getty Images

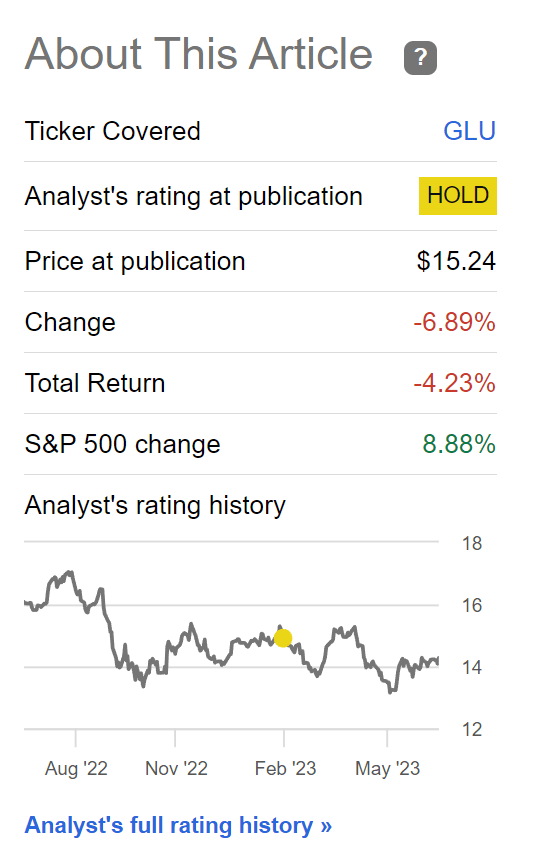

A few months ago, I wrote a cautious article on the Gabelli Global Utility & Income Trust (GLU), warning that with poor returns and a high distribution yield, the GLU CEF is a classic example of an amortizing 'return of principal' fund. Since my article, the GLU fund has delivered -4.2% total returns, lagging far behind the market and justifying my caution (Figure 1).

Figure 1 - GLU fund has underperformed as expected (Seeking Alpha)

Recently, I upgraded my view on the utility sector due to better relative valuations. Therefore, I wanted to revisit the Gabelli funds, to see if there are any trading opportunities there.

However, while browsing through the Gabelli website, I came across the Gabelli Utility Trust (NYSE:GUT), and I felt compelled to write an article on the fund, as it trades at a 113% premium to NAV.

Although the GUT fund's performance has been solid, with 10Yr average annual return on NAV of 6.7%, it simply is not enough to fund its 18.5% of NAV distribution yield. Every month, the GUT fund must liquidate NAV to fund its distribution, which makes future distributions even more unsustainable.

While I cannot predict when the GUT fund will cut its distribution, it is a near certainty that the fund's distribution will be cut in the future. Either that, or the fund will run out of NAV to distribute. I rate the GUT fund a strong sell.

Fund Overview

The Gabelli Utility Trust is a closed-end fund ("CEF") focused on utilities and other utility-like infrastructure assets. The GUT fund was spun out of the flagship Gabelli Equity Trust in 1999.

The GUT fund is lead managed by Mario Gabelli, an award-winning fund manager and founder of Gabelli Asset Management ("GAMCO"). Mr. Gabelli was inducted to Barron's 'All Century Team' in 2000 and has won numerous fund manager of the year awards over the decades he has been in the business.

The GUT fund currently has $314 million in net assets and charged a 1.54% net expense ratio after fee waivers in 2022, according to the fund's annual report.

Portfolio Holdings

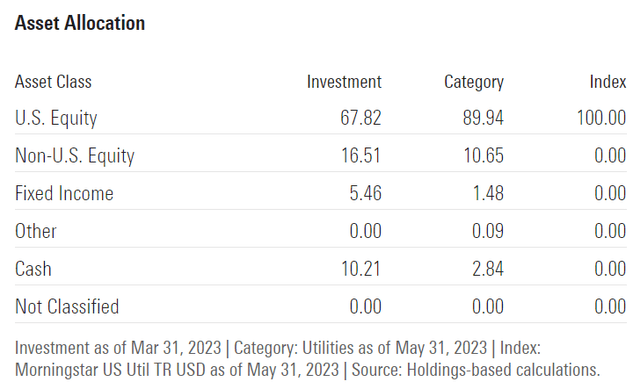

Figure 2 show the asset allocation of the GUT fund as of March 31, 2023. The GUT fund has about 2/3 of its assets invested in domestic U.S. equities, and 16.5% invested in foreign equities. It also has a high cash holding of 10.2%.

Figure 2 - GUT asset allocation (morningstar.com)

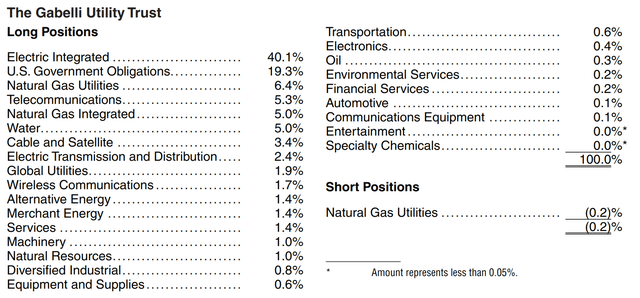

Sector-wise, the GUT fund is primarily invested in Electric Utilities and other infrastructure assets as designed. Figure 3 shows the sector allocation of the fund as of December 31, 2022.

Figure 3 - GUT sector allocation (GUT 2022 annual report)

Overall, I see nothing unusual about the fund's holdings, it looks like a well-diversified utilities fund.

Returns

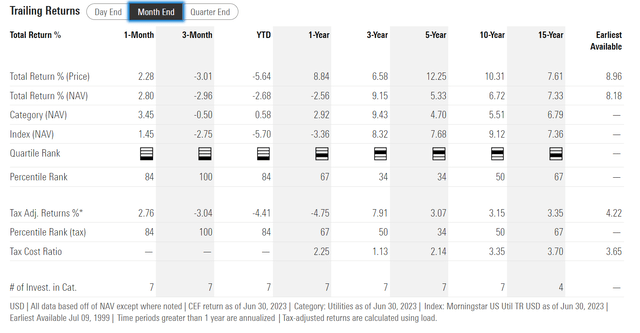

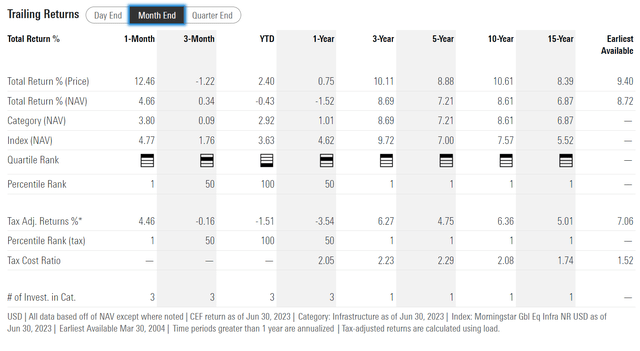

NAV returns for the GUT fund has also been solid, if unspectacular. The GUT fund has delivered 3/5/10/15Yr average annual returns on NAV of 9.2%/5.3%/6.7%/7.3% respectively to June 30, 2023 (Figure 4).

Figure 4 - GUT historical returns (morningstar.com)

Distribution & Yield

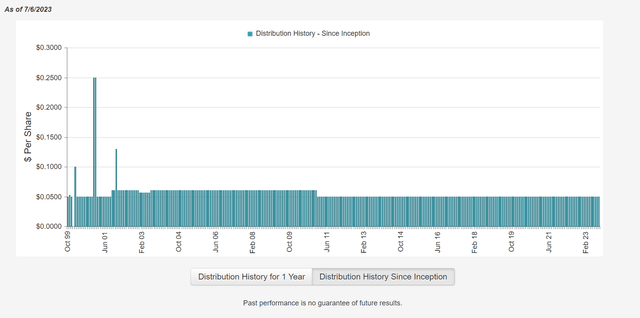

However, where I start to have concerns is with respect to GUT's distribution. Specifically, the GUT fund pays a monthly distribution of $0.05 that has been set in place since 2010, with a forward yield of 8.7% on market price. There was a period in the early 2000s when the fund paid $0.06 / month, according to CEFconnect.com (Figure 5). But $0.05 / month appears to be Mr. Gabelli's promise to unitholders.

Figure 5 - GUT pays a $0.05 monthly distribution (cefconnect.com)

What is concerning is that based on the GUT fund's latest net asset value ("NAV") of $3.25 / share, the fund is yielding an incredible 18.5%.

The problem is, if you recall from Figure 4 above, the GUT fund only earns returns of ~7% on NAV on average over 15 years. How can the fund pay out an 18.5% of NAV yield?

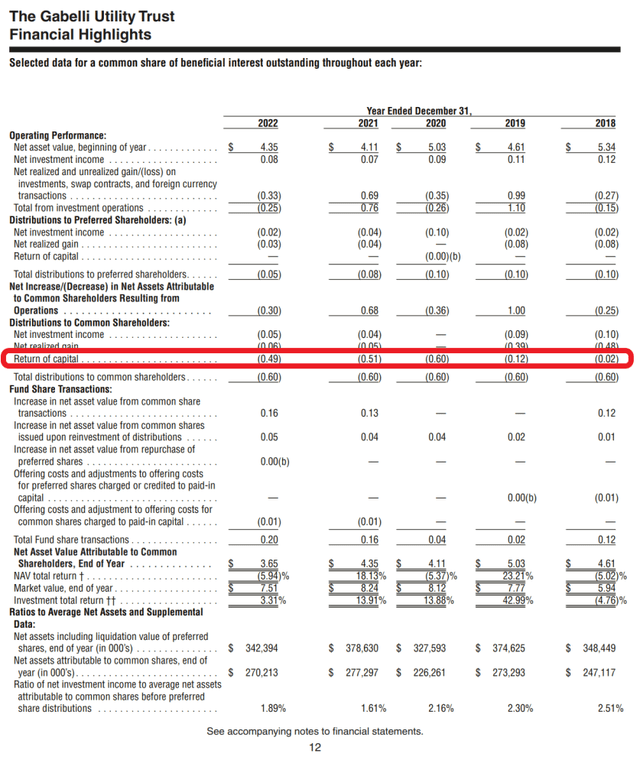

The answer is via NAV amortizing return of capital ("ROC") (Figure 6).

Figure 6 - GUT's distribution is funded from ROC (GUT 2022 annual report)

As the GUT fund ran out of realized gains in 2019, the fund has switched to fund its $0.60 / year distribution with $0.60 in ROC in 2020, $0.51 in 2021, and $0.49 in 2022. Essentially, investors are just getting their own capital returned to them via the distribution.

The GUT fund is a classic case of 'return of principal' funds that I have been warning against, ad nauseam.

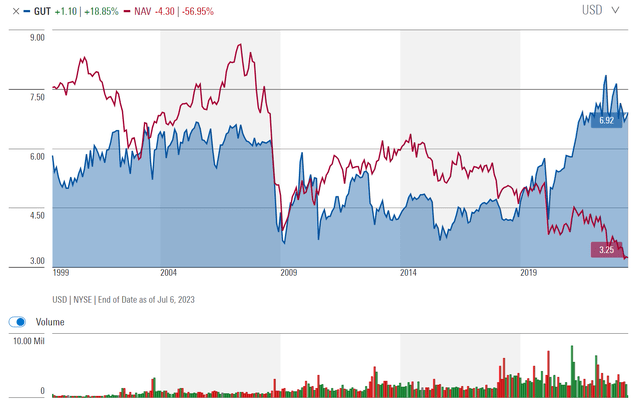

How To Buy $0.50 of Assets For $1

Although the GUT fund's NAV has been in a straight-line decline since 2014, investors have been 'rewarding' the fund with an ever-increasing market price, presumably because the GUT fund has maintained its promise to pay $0.05 / month in distributions (Figure 7).

Figure 7 - Large divergence between GUT's NAV and market price (morningstar.com)

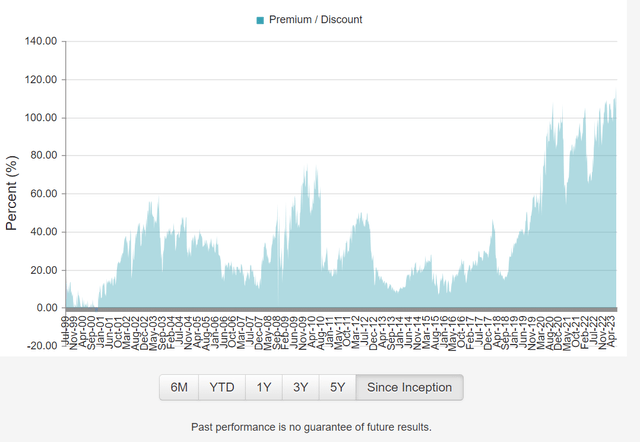

This has led the GUT fund to trade at an eye-watering 113% premium to NAV (Figure 8).

Figure 8 - GUT fund trades at 113% premium to NAV (cefconnect.com)

Essentially, investors are paying over $1 for liquid assets that are worth $0.50. The GUT fund may be the most overvalued CEF on the market today!

What Explains GUT's Premium?

Part of the reason I believe why investors are willing to pay such a high premium for the GUT fund is due to Mr. Gabelli's reputation. Who wouldn't want to invest with a silver-haired maestro that has almost 60 years of investing experience?

Another reason is that the GUT fund has been consistently paying its $0.05 / month distribution through thick and thin, giving unitholders a sense of 'stability'.

Finally, the GUT fund does periodic 'rights offerings', allowing unitholders to subscribe for new shares at a 'discount' to market price (but still a huge premium to NAV!). For example, in February 2022, the GUT fund conducted a rights offering where unitholders could subscribe for shares at $5.50 / share plus 7 'rights', a 30% discount to the fund's then market price of ~$7.00.

But the GUT fund's NAV was actually just $4.27 in March 2022, so investors were actually paying a ~30% premium to NAV for the 'privilege' of getting their own money paid back through the fund's distribution.

Trade GUT for UTF

While the GUT fund can maintain its distribution for months, if not years as long as it has assets to liquidate or can sell new shares to the market, at some point, the fund reaches a tipping point where it simply cannot continue to pay out the same distribution rate.

For example, at 2022's net investment income ("NII") rate of $0.08 / share and a distribution rate of $0.60 / share, the GUT fund needs to deplete NAV by ~$0.50 / year. Given the fund's $3.25 / unit in NAV, the current distribution rate may continue for a few more years. But inevitably, NAV will go to zero at the current pace, and the game will end.

For investors currently invested in GUT, I suggest they consider alternative utility-focused CEFs to switch into that pay similar monthly distribution yields. For example, the Cohen & Steers Infrastructure Fund (UTF) pays an 8.0% distribution yield, but is trading at NAV. With long-term average annual returns of 8.6% over 10 years, the UTF's distribution appears much more sustainable (Figure 9). I wrote a recent update on the UTF fund here.

Figure 9 - UTF historical returns (morningstar.com)

Conclusion

The Gabelli Utility Trust is a utility and infrastructure asset focused CEF that pays an attractive 8.7% forward yield. However, if investors look underneath the hood, they will realize that the fund is trading at an incredible 113% of NAV, which means the actual yield on NAV is 18.5%.

With solid, but unspectacular 10Yr average annual returns on NAV of 6.7%, the GUT is liquidating its NAV to fund its unsustainable yield. Current investors in GUT are advised to jump ship before fund inevitably announces a distribution cut that will bring GUT's premium to NAV back to earth.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.