ARK Innovation ETF: Cathie Wood's Casino

Summary

- Cathie Wood's ARK Innovation ETF is currently performing well, with a nearly 45% return in 2023.

- The ETF's top holdings include Tesla, Coinbase Global, Roku, Zoom Video, and UiPath.

- I would advise caution when investing in ARK Innovation ETF due to the high-risk nature of the portfolio.

DNY59

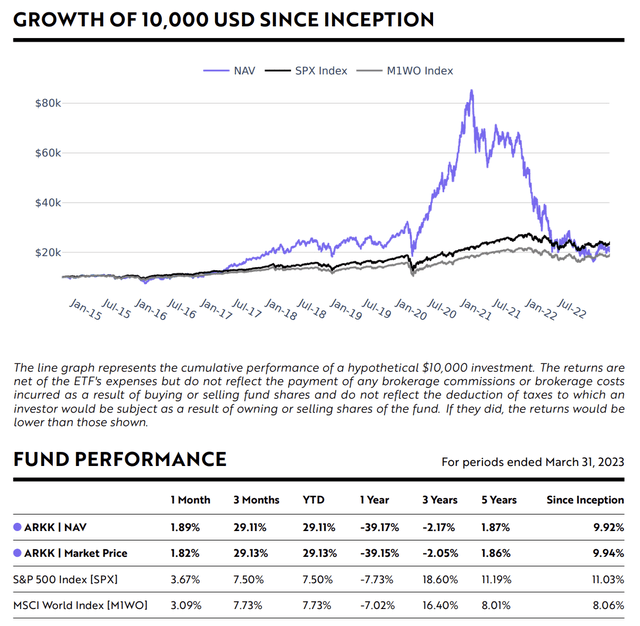

Portfolio manager Cathie Wood and her ARK ETFs are perhaps one of the most divisive topics when it comes to investing. One look at the chart of her ARK Innovation ETF (NYSEARCA:ARKK) quickly shows you why. The ETF put up enormous returns, especially during the pandemic, only to give back much of its gains. Since the end March, the stock just slightly trails the performance of the S&P 500, but the way it got there certainly was volatile. Year to date, though, the ETF is once again hot.

To get a better sense of the ETF, let's take a look at its current top holdings.

Tesla (TSLA) - 12.73% Weighting

It probably shouldn't be surprising that the most divisive ETF's top holding is one of the most divisive stocks run by one of the most divisive CEOs. Whether you love him or hate him, TSLA CEO Elon Musk has grown the electric vehicle maker into one of the largest and most powerful companies in the world.

And despite his flaws, Musk has proven doubters wrong and helped grow the company into once what seemed like a ridiculous valuation. He's done some really smart things, and the TSLA Supercharger network appears to be one of its main advantages.

That said, between the distraction of running Twitter into the ground, perhaps too much inventory on lots, and a still high valuation, I'm more neutral on the name.

Coinbase Global (COIN) - 7.98% Weighting

While TSLA may be divisive, COIN is downright controversial. The stock of the cryptocurrency exchange has had a huge year, increasing over 130%. However, its actual results have been mixed. Its Q1 revenue fell -34% year over year, but the company did rein in expenses to become EBITDA positive.

Meanwhile, last month, the SEC sued COIN for operating as an unregistered securities broker. For her part, Wood bought more COIN shares after the news and told CNBC that: "Actually, I'm betting on the checks and balances inherent in our government," and that she is happy that the legislative and judicial branches are "studying and getting involved in this topic. I think it's great."

Credit Wood for having conviction, but this is not an area I'd personally play in given a lot of uncertainty surrounding the legal issues. Legal outcomes have historically just been difficult to predict.

Roku (ROKU) - 7.02% Weighting

Streaming company ROKU has been putting up some pretty ugly numbers of late, although Woods is clearly looking for a turnaround. I'm not so sure.

The company's platform business has been a big disappointment, which it has blamed on a weak scatter market, which is fair. However, the streaming market is changing, and companies are done with looking to acquire subscribers at any cost and have shifted their focus to profitability, which isn't great for a ROKU, which has often been a lead-gen platform for these services.

At the same time, as streamers look towards profits, they may find that ROKU's revenue-share agreements don't make sense given a lack of value in the ecosystem that Roku provides versus the cost of doing business with them. To me, ROKU has become the equivalent of the counter person asking for a 20% tip for handing you your bag of takeout food. Cable companies had to spend billions in capex building pipes to the home, so it made sense they got their cut. ROKU provides one of many ways to get streaming TV.

For more on ROKU, see my most-recent write-up on the name.

Zoom Video (ZM) - 6.87% Weighting

The posterchild of work from home during the pandemic, ZM saw a ton of pull-forward demand as a result. The company is still growing, as evidenced by its 5% constant currency growth in Q1 and 13% increase in enterprise revenue growth. Meanwhile, the stock is fairly cheap, trading at a EV/S multiple under 3x 2024 revenue estimates of $4.7 billion.

However, investors are a bit worried about enterprise renewals, especially as many companies have revolted against work from home and want to see their employees in their offices. ZM's reported number of 215,900 enterprise customers fell short of expectations calling for 218,000 enterprise clients, adding some fuel to this fire.

With an attractive valuation and trailing 12-month net dollar retention above 110% (112%), ZM is one of ARKK's more attractive top-5 investments in my view.

UiPath (PATH) - 5.95% Weighting

PATH rounds out the top-5 holding for ARKK, and it has had a strong year up over 35% year to date. Originally dubbed a robotic process automation (RPA) firm, the company is now calling itself an AI-powered automation firm.

Notably, much of PATH's revenue still come from its on-prem legacy offerings. Growth has significantly slowed for the past few years, going from 81% in 2020, to 47% in 2021, to under 19% in 2022. It was 18.2% in Q1, which was an acceleration from the 6.5% revenue growth in Q4.

The stock trades at around 5x fiscal 2025 (ending January) revenue of $1.5 billion, and it is expected to continue to grow revenue in the high teens over the next few years. The company has a strong market share, and its net dollar retention of 127% (excluding fx) is very strong, although it only added about 50 new customers in the quarter bringing the total to 10,850.

I have mixed feeling on PATH, but don't mind the investment.

Other Investments

ARKK also has several other holdings I've written about, including DraftKings (DKNG) found here; Twilio (TWLO); found here; Teladoc (TDOC), found here; and Roblox (RBLX), found here.

Conclusion

ARKK is a volatile ETF that is currently on the upswing with a nearly 45% return in 2023. Wood is a momentum and growth investor that seems to care little about valuation. She is outspoken and is invested in many of the most divisive stocks out there. She uses a go-go strategy that tends to be boom or bust depending on the market.

Looking through her top holdings, I'd be careful investing with her. This is a gambling person's type of portfolio, so know what you're getting into. I personally wouldn't invest in most of the names in the ETF due to valuation, legal, and other issues. Wood's portfolio can be very successful in the right market environment, but it can also perform very bad when the momentum leaves the market. I'd rate the ETF a "Sell," but can understand if investors want to gamble a little on the ETF.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)